Well, I`ll Get Around to It

advertisement

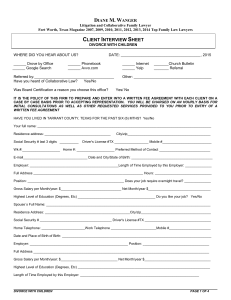

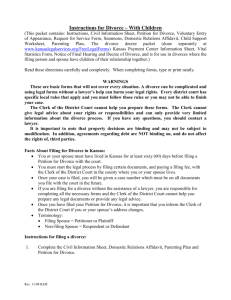

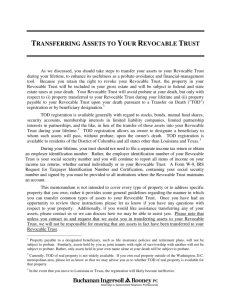

Well , I’ll Get Around to it . . . WHO NEEDS AN ESTATE PLAN? EVERYONE! PURPOSE OF PLANNING Lifetime issues Family issues Wealth protection Tax avoidance WHAT DOES AN ESTATE PLAN INCLUDE? Will Statement of Disposition of Tangible Personal Property Revocable Trust Life Insurance/ Irrevocable Trust Durable General Power of Attorney Durable Health Care Power of Attorney Organ Donation / Cremation and Funeral Instructions Beneficiary Designations Re-titling of Assets WHERE THERE IS NO WILL No named beneficiaries No named guardian No named personal representative No testamentary trust THE WILL The will is the instrument that directs how your assets are to be distributed after your death. Personal representatives Q-tip trust Family trust GUARDIANS For people with minor children, this is the most important reason for establishing an estate plan. REVOCABLE OR “LIVING TRUST” Trust Agreement Pour-Over Will WILL VS. REVOCABLE TRUST Tax planning Organize now or later Administration BENEFICIARIES THIS IS A BIG ISSUE Children Charities Other family members IF YOU HAVE A REVOCABLE TRUST . . . Is it funded? GENERAL DURABLE POWER OF ATTORNEY This document handles your financial matters. Date of Document When does it become effective GENERAL DURABLE HEALTH CARE POWER OF ATTORNEY You appoint someone to make health care decisions for you when you are unable Includes the “living will” Cremation/burial instruction STATEMENT OF DISPOSITION OF TANGIBLE PERSONAL PROPERTY BENEFICIARY DESIGNATIONS Properly designating beneficiaries of Retirement Plans at death is an important part of the estate planning process For many, this is the largest asset Children as beneficiaries LIFE INSURANCE Liquidity – taxes, succession planning Creating estates Replace income A lot of insurance Not enough insurance IRREVOCABLE TRUSTS for Life Insurance TITLING OF ASSETS TENANTS IN COMMON JOINT TENANTS BENEFICIARY DESIGNATIONS IRAs LIFE INSURANCE 401(k)s WHAT IS A PROBATE? The purpose of probate is to transfer assets and deal with the creditors of the decedent. DIVORCE Ownership of real property by a husband and a wife as joint tenants changes to ownership as tenants in common if the couple is divorced. After a divorce if one marriage partner dies before changing the title to the property, the decedent’s interest in the property automatically passes to his or her heirs rather than to the former spouse. DIVORCE (continued) A divorce terminates the right of a former spouse to inherit under the will. A divorce or dissolution of marriage revokes bequests and devises to a former spouse – but not the will itself. A divorce revokes the appointment of the former spouse as an executor or trustee under the will. Watch out for insurance beneficiaries! MINOR CHILDREN Appointment of a guardian Establishment of a trust – minor children cannot inherit outright DISABLED CHILD Supplemental Needs Trust THE FIRST RULE IN ESTATE TAX PLANNING: Fully utilize the Unified Credit UNIFIED CREDIT 2014 $5,250,000 ENTITY CHOICES… LIMITING LIABILITY Entity Choice Liability insurance ENTITIES THAT LIMIT LIABILITY Corporations Limited Liability Companies LIABILITY INSURANCE • Look at your umbrella • Pays for the lawyer FACTORS TO CONSIDER IN CHOOSING ENTITY TYPE Tax considerations Operational flexibility/compliance Ease of liquidity Future fundings C CORPORATIONS • annual compliance • double taxation • most familiarity S CORP • special election • • •US •Tax flow through limited to 75 shareholders/ residents liability even if no cash from corp. LLCs • • Flow through fewer formalities/operational flexibility • operating agreement • • managers transfer of appreciable assets to members FOR MORE INFORMATION REGARDING PLANNING, CONTACT: Cristy J. Carbón-Gaul 505-899-5696 cristy@carbon-gaul.com