The Role of Government

Chapter 4

McGraw-Hill/Irwin

Copyright © 2010 by the McGraw-Hill Companies, Inc. All rights reserved.

Government’s Role

• When markets fail government intervention

may be needed

– Under what circumstances do markets fail?

– How can government intervention help?

– How much government intervention is desirable?

4-2

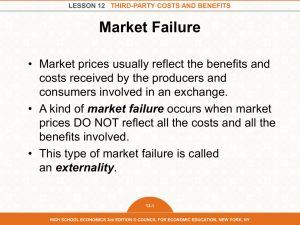

Market Failure

• Ideally, the market mechanism leads to an

optimal mix of output

• Optimal mix of output: The most desirable

combination of output attainable with existing

resources, technology and social values

4-3

Market Failure

• The market mechanism uses market prices

and sales to signal desired outputs (or resource

allocations)

• Market failure: An imperfection in the

market mechanism that prevents optimal

outcomes

4-4

Market Failure

• When there is market failure the forces of

supply and demand don’t lead to the optimal

point on the production possibilities curve

• There is a basis for government intervention to

push market outcomes closer to the ideal

4-5

Computers (units per time period)

Market Failure

Production

possibilities

X (Optimal mix)

M (Market mix)

All Other Goods (units per time period)

4-6

Causes of Market Failure

• The four specific sources of market failure are:

–

–

–

–

Public goods

Externalities

Market power

Equity

4-7

Public Goods

• Private good: A good or service whose

consumption by one person excludes

consumption by others

• Public good: A good or service whose

consumption by one person does not exclude

consumption by others

4-8

The Free-Rider Dilemma

• The communal nature of public goods may

cause some consumers to try for a free ride

• Free rider: An individual who reaps direct

benefits from someone else’s purchase

(consumption) of a public good

4-9

Underproduction of Public Goods

• If public goods were marketed like private

goods, everyone would wait for someone else

to pay

• Consequently, the market under-produces

public goods and over-produces private goods

• Need government intervention to remedy

4-10

Externalities

• Externalities: Costs (or benefits) of a market

activity borne by a third party; the difference

between the social and private costs (benefits)

of a market activity

• When externalities are present, market prices

are not a valid measure of a good’s value to

society

4-11

External Costs and Benefits

Social Demand Market Demand Externalities

– Subtract external costs, a negative impact

– Add external benefits, a positive impact

• The optimal production mix is where the social

demand curve intersects the supply curve

4-12

Externalities

Price (per pack)

Market supply

EM

EO

External cost

per pack

Market

demand

Optimal

output

Market

output

qO

Social demand

qM

Quantity of Cigarettes (packs per year)

4-13

External Costs and Benefits

• The market fails by:

– Over-producing goods that have external costs

– Under-producing goods that have external benefits

• To move toward the optimal mix, we need

government intervention

4-14

Market Power

• The market may fail when the response to

price signals is flawed, rather than the signals

themselves

• Market power: The ability to alter the market

price of a good or service

4-15

Restricted Supply

• Market power gives a producer the ability to

maximize profits rather than produce the

optimal mix of output

• Monopoly: A firm that produces the entire

market supply of a particular good or service

4-16

Antitrust Policy

• Government intervention is necessary to

prevent or dismantle concentrations of market

power

• Antitrust: Government intervention to alter

market structure or prevent abuse of market

power

4-17

Natural Monopoly

• A monopoly structure may be desirable

• Natural monopoly: An industry in which one

firm can achieve economies of scale over the

entire range of market supply

• Government may need to regulate the behavior

of a natural monopoly

4-18

Inequity

• The marketplace distribution of goods and

services is not necessarily “fair”

• Taxes and transfers are the principal tools for

redistributing income

• Transfer Payments: Payments to individuals

for which no current goods or services are

exchanged

4-19

Merit Goods

• Merit good: A good or service society deems

everyone is entitled to some minimal quantity

of

• Government steps in to provide merit goods

when market outcomes are inadequate

4-20

Macro Instability

• Micro market failures imply we are at the

wrong point on the production-possibilities

curve or inequitably distributing output

• The marketplace also experiences bouts of

unemployment and inflation, which require

government intervention at the macro level

4-21

Macro Instability

• Unemployment: The inability of labor-force

participants to find jobs

• Inflation: An increase in the average level of

prices of goods and services

4-22

Macro Instability

• The goal of macro intervention is to foster

economic growth

– Achieve full employment

– Maintain stable prices

– Increase production capacity

4-23

Growth of Government

• Potential micro and macro market failures

justify government intervention

• The public sector has increased dramatically

– In 1902 the U.S. government employed fewer than

350,000 people and spent only $650 million

– Today the federal government employs nearly 4

million people and spends about $4 trillion a year

4-24

Federal Growth

• Although the absolute size of government has

grown, the relative size of government – direct

expenditures on government purchases as a

share of total output – has declined

• Virtually all recent growth in overall federal

expenditures has come from increased income

transfers, not purchases of goods and services

4-25

Government Growth

Source: U.S. Bureau of Economic Analysis

During World War II the public sector purchased nearly half of total U.S.

output. Since the early 1950s the public-sector share of total output has been

closer to 20 percent.

4-26

State and Local Growth

• The share of public-sector spending attributed

to different levels of government has changed

– State and local spending dominated until World

War II, when the federal share overtook it

– In the 1960s state and local spending caught up

– Today state and local governments buy much more

output and employ many more people

4-27

Taxation

• The opportunity cost of government spending

is the private-sector output sacrificed

• The primary function of taxes is to transfer

command over resources (purchasing power)

from the private sector to the public sector

4-28

Federal Taxes

• Federal government revenue sources include

–

–

–

–

Income taxes

Social security taxes

Corporate taxes

Excise taxes

4-29

Income Taxes

• Individual income taxes are the largest single

source of federal government revenue

• Progressive tax: A tax system in which tax

rates rise as incomes rise

• People with high incomes pay more taxes and

pay a larger fraction of their income in taxes

4-30

Social Security Taxes

• Current workers transfer a portion of earnings

to retirees through mandatory deductions

• The social security tax is proportional up to a

certain income ceiling and regressive after that

– Proportional tax: A tax that levies the same rate

on every dollar of income

– Regressive tax: A tax system in which tax rates

fall as income rises

4-31

Corporate Taxes

• The federal government taxes the profits of

corporations as well as consumer incomes

• Corporate taxes are a relatively small source of

revenue

4-32

Excise Taxes

• Excise taxes are imposed on certain goods and

services, including such things as liquor,

gasoline, and cigarettes

• Excise taxes discourage production and

consumption of these goods

4-33

Federal Taxes

Source: Office of Management and Budget, FY2010 data

4-34

State and Local Revenues

• In general, cities depend heavily on property

taxes and state governments rely heavily on

sales taxes

• State and local taxes tend to be regressive

4-35

Government Failure

• The goal of government intervention is to

change the mix of output

• Government failure: Government

intervention that fails to improve economic

outcomes

4-36

Perceptions of Waste

• Government waste is when the public sector

isn’t producing as many services as it could

with given resources

• Such inefficiency implies production inside the

production-possibilities curve

4-37

Opportunity Cost

• The issue of government waste encompasses

two distinct questions:

– Efficiency: Are we getting as much as we could

from the resources we allocate to government?

– Opportunity cost: Are we giving up too many

private-sector goods in order to get those services?

4-38

Cost-Benefit Analysis

• Additional public-sector activity is desirable

only if the benefits from that activity exceed

the opportunity costs

• The value (benefits) of public services must be

estimated because they don’t have (reliable)

market prices

4-39

Ballot-Box Economics

• Voting mechanisms substitute for the market

mechanism in allocating resources to the

public sector and deciding how to use them

• We do not know what the real demand for

public goods is, and votes alone do not reflect

the intensity of individual demands

4-40

Public Choice Theory

• Public choice: Theory of public-sector

behavior emphasizing rational self-interest of

decision-makers and voters

• A central tenet of public-choice theory is that

bureaucrats are just as selfish (utility

maximizing) as everyone else

4-41

The Role of Government

End of Chapter 4

McGraw-Hill/Irwin

Copyright © 2010 by the McGraw-Hill Companies, Inc. All rights reserved.