The consumer will be unable to use bill pay.

advertisement

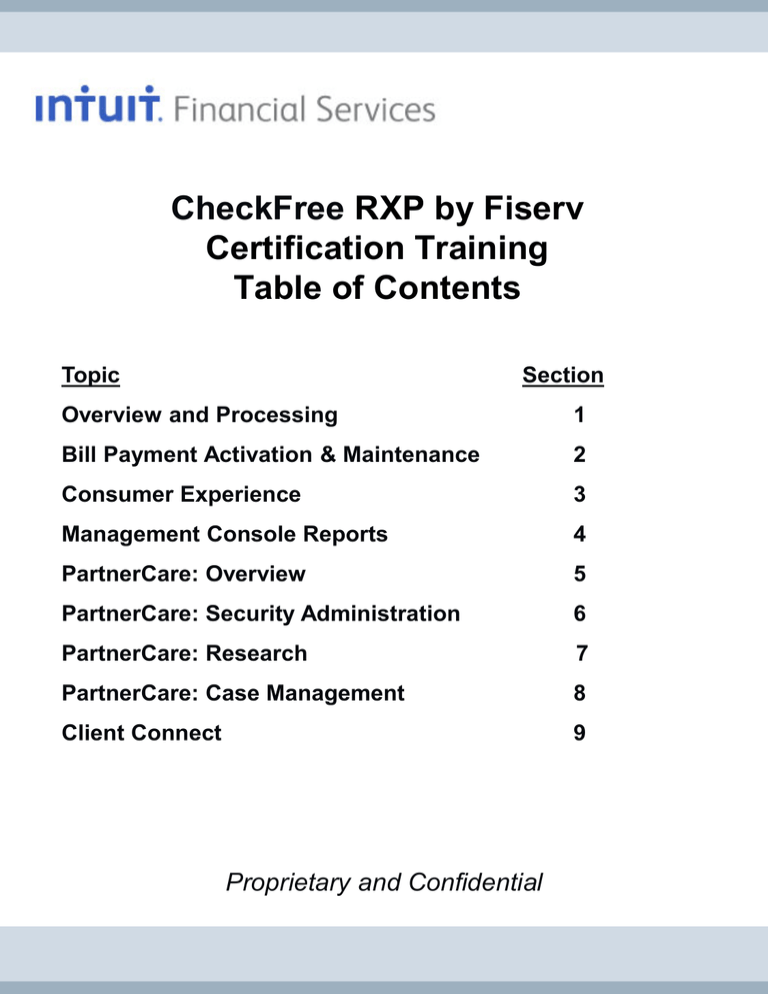

CheckFree RXP by Fiserv Certification Training Table of Contents Topic Section Overview and Processing 1 Bill Payment Activation & Maintenance 2 Consumer Experience 3 Management Console Reports 4 PartnerCare: Overview 5 PartnerCare: Security Administration 6 PartnerCare: Research 7 PartnerCare: Case Management 8 Client Connect 9 Proprietary and Confidential Bill Pay Certification Course Objectives By the end of this course, you will learn how to use and manage bill pay in order to launch and run an effective bill pay program at the financial institution. Specifically, you will learn: Fiserv's terms and processing details how consumers opt to begin using bill pay and the approval process for the financial institution (if applicable) the features and functionality of the bill pay front end the reporting available in Management Console how to support bill pay with PartnerCare the additional reporting available via Fiserv's Client Connect site Section 1: Overview and Processing Page 2 Section 1: Overview and Processing Intuit Financial Services University Bill Pay Certification Training Bill Pay Certification Section Objectives By the end of this section you will learn: the technical requirements needed to access bill pay the key terms for bill pay Fiserv's payment processing details (remittance methods, debit returns procedures, etc.) Section 1: Overview and Processing Page 4 Bill Pay Certification Technical Requirements • The screens of Bill Pay are designed to support a resolution of 1024 x 768 pixels or higher. • You must enable Java in your browser. • You must enable cookies in your browser. • You must have 128-bit encryption in your browser. (Note: All current browsers are 128-bit encrypted.) • A list of support browsers and operating systems are found on the Client Site (www.diclientsite.com) under the “Client Support” Troubleshooting Browsers Supported section. Section 1: Overview and Processing Page 5 Bill Pay Certification General Terms to Know • Bill Payment Processor – Intuit Financial Services' partner for bill pay • Fiserv – Intuit Financial Services' partner that provides this bill pay service to financial institutions • CheckFree RXP– the name of Fiserv's bill pay service • Consumers – your bill pay customers or members • Host – the financial institution's core processing system or data processing vendor (DPV) Section 1: Overview and Processing Page 6 Bill Pay Certification CheckFree RXP Terms to Know • Sponsor – the financial institution • Subscriber – the bill payment consumer • Partner Care Rep/Admin – the financial institution employee with PartnerCare access • eReg record – file that contains a consumer’s profile information used to activate and maintain Bill Pay for the consumer • Biller/Payee – the company or person that the consumer is paying through bill pay • Electronic Bill/e-Bill – an electronic version of the consumer’s statement/bill with the biller • Automatic Payments – a payment set up by the consumer with specific payment instructions to be applied to all payments for a specific biller • Single Payment – a single, one-time payment that requires the consumer to enter an amount and a due date • Bill Reminders – periodic bill payment alerts that notify the consumer when a bill is due Section 1: Overview and Processing Page 7 Bill Pay Certification Bill Pay Tools Front End • Fiserv's consumer interface for bill pay that allows the consumer to schedule bill payments online. PartnerCare • Fiserv's administrative system that allows the financial institution to access bill pay processing information in order to research/troubleshoot consumers' bill pay issues. Management Console • Intuit Financial Services’ administrative system that allows the financial institution to maintain consumer's bill pay e-Reg records and generate reports regarding bill pay. Client Connect • Fiserv's secure client extranet that allows the financial institution to access additional information, documentation, and reporting on CheckFree RXP bill pay. Section 1: Overview and Processing Page 8 Bill Pay Certification Reasons to Use Bill Pay Of all relationship deepening features, online bill pay has the greatest effect on retention. Studies have shown that bill pay consumers are 50 percent less likely to leave their financial institution. Therefore, let your consumers know about the following: • On Time & Secure Payment Guarantees - Fiserv covers any latepayment related charges (up to $50.00) should a payment arrive after its due date, as long as the consumer scheduled the transaction in accordance with Fiserv’s terms and conditions. • Pay closer to the due date - With certain billers, the consumer can schedule a same day or next day payment (depending on the biller’s relationship with Fiserv and the consumer’s risk level). • Only have to remember one set of login credentials – If consumers pay their bills via the financial institution's Internet Banking site, they only have to remember one user ID and password. • Save time and money – Consumers can stop spending money on stamps and time running back and forth to their mailbox. With bill payment, consumers can pay all of their bills in a few simple clicks without having to get up from their computer. Section 1: Overview and Processing Page 9 Bill Pay Certification Restrictions on Use Weekends/Holidays - Payments are only processed on days when the Federal Reserve is open for business. Therefore the system will not allow for a single payment's due date to be scheduled for a weekend or holiday. (Important: Recurring payments that fall on a weekend or holiday will process on the previous business day.) Payment Amount Limits - The amount of bill payment transactions must be at least $1.00 but not greater than $99,999.99 (per transaction). Restricted Payments - Tax payments, court ordered payments, and payments made outside of the U.S. and its territories (APO, FPO, Guam, and U.S. Virgin Islands) are restricted. Section 1: Overview and Processing Page 10 Bill Pay Certification Payment Method Selection Each time a bill payment is processed, Fiserv evaluates the consumer as well as the payment to determine the level of risk on Fiserv's part in remitting the payment on behalf of the consumer. • Each consumer is evaluated every four months based on their payment history. Positive payment history (no debit returns) results in a lower risk level for the consumer and translates into a higher rate of electronic payments. The consumer's initial risk level is set by the consumer's FICO soft credit score pulled upon the consumer opting-in to bill pay. • Each payment is evaluated via a patented process. Some possible criteria used by Fiserv are: • Is the biller set up to receive electronic payments? • Does the biller have a reversibility agreement with Fiserv? • What is the dollar amount of the payment? Depending on the assessed risk of the consumer and payment, Fiserv will uses one of the following three types payment options to remit money to billers: • Electronic • Single Check • Draft Check Section 1: Overview and Processing Page 11 Bill Pay Certification Risk Based Remittance Methods If Fiserv determines that the consumer/payment is low risk , then Fiserv will send the payment via one of the following methods: Electronic – an electronic payment sent through the Federal Reserve with the consumer's biller account number listed Single Check – a paper check drawn against Fiserv's corporate checking account These payment methods are considered risk based on Fiserv's part because Fiserv releases the credit to the biller without knowing whether or not the consumer has the available funds in their account to cover the debit. After Fiserv sends the payment to the biller, Fiserv debits the consumer's bank account (via ACH) on the payment date that the consumer specified (i.e. the date that the payment is expected to arrive at the biller). This transaction is seen in the consumer's account history as "Online Pmt“ and includes the payee’s name as well as Fiserv’s ACH ID 9500000000 (this is not customizable). Section 1: Overview and Processing Page 12 Bill Pay Certification Non-Risk Based Remittance Method If Fiserv determines that the consumer/payment is high risk , then Fiserv will send the payment via: Draft Check – a paper check drawn against the consumer's DDA/checking account at the financial institution This payment method is not considered risk based on Fiserv's part because Fiserv is not drawing money from one of Fiserv’s accounts. Instead, Fiserv sends a check to the payee that is drawn against the consumer’s bank account. When the payee deposits the draft check, the consumer's bank account is debited. This transaction is seen in the consumer's account history as "DDA Regular Check" with a link to the check image (if the financial institution has check imaging). Section 1: Overview and Processing Page 13 Bill Pay Certification Process Date Because the remittance method is not determined until a payment begins to process, it is recommended that consumers login and schedule their payments at least 4 business days in advance of the due date. Scenario: The consumer has a bill that is due on Friday. Therefore the consumer should login to bill payment by midnight Eastern on Monday and set up the single payment to be due on Friday. MON TUES WED THUR FRI Here is a behind-the-scenes look at what happens when a bill is processed: 1. On Tuesday night / Wednesday morning Fiserv starts the processing procedure for that bill. a. Single checks or draft checks are sent to the post office on Wednesday morning. b. Electronic payments are sent out Wednesday night /Thursday morning. 2. The funds are received by the biller on Friday. 3. Fiserv takes the money out of the consumer’s account on Friday. (NOTE: If the payment was sent via draft check, the consumer will be debited once the biller deposits the check.) Canceling: If the consumer needs to cancel this payment, it must be done by midnight Eastern on Monday via the front end of bill payment or by midnight Eastern on Tuesday via PartnerCare. (This scenario varies for same day and next day payments.) Section 1: Overview and Processing Page 14 Bill Pay Certification Debit Return Process If Fiserv sent a payment to the payee electronically or via single check, Fiserv will debit the consumer’s account for the amount of the payment on the payment’s due date. If that debit is returned, Fiserv will begin their collection process. NOTE: The collection process varies depending on the payee type (reversible vs. non-reversible) and the return code (insufficient/uncollected funds vs. some other return reason). Please refer to the resource page for sample copies of Fiserv’s debit return/collection letters and emails. (In the case of more than one rejected debit, Fiserv sends one email per rejected debit, while it mails a single letter referencing all rejected debits.) Fiserv may assess a service fee for each attempted debit that is returned. These fees will be billed to the financial institution, or Fiserv can be responsible for passing these charges on to the consumer. This decision is made during implementations. If the charges are passed on to the consumer, they will be assessed 5-7 days after the debit return. This charge shows up in the consumer's account history as a “Payment Services” (not customizable). Details on Fiserv service fees can be found in the financial institution's contract. Section 1: Overview and Processing Page 15 Bill Pay Certification Non-Reversible Payees – Return Reason Codes: R01 (Insufficient Funds) or R09 (Uncollected Funds) If the first debit attempt is returned for reason code R01 (Insufficient Funds) or R09 (Uncollected Funds): 1. The consumer will receive “NSF1” letter and “ENSF1” email which informs the consumer that their debit was returned and that a second attempt to debit the account will be made. 2. Fiserv debits the consumer’s account a second time. If the second debit attempt is returned: 3. The consumer will receive “NSF2” letter and “ENSF2” email which informs the consumer that their debit was returned and Fiserv has sent the debt to the Collections team. 4. Fiserv freezes/ suspends the consumer’s account . NOTE: The consumer will be unable to use bill payment. 5. The consumer will receive “FOZ” letter and “EFOZ” email which informs the consumer that their payments have been paid but they will be unable to use bill pay as their account will be placed in a frozen status. The consumer is instructed on how to submit their money to Fiserv as well as how to contact Fiserv to unfreeze the account. 6. Fiserv will send the debt to their Collections team which will attempt a third debit. If the third debit attempt is returned: 7. The consumer will receive “COL1” letter and “ECOL1” email as a first collections request . Then “COL2” letter and “ECOL2” email is sent as a second collections request. These letters/emails request payment to be made and warn the consumer that Fiserv will send their info to a law firm if payment resolution is not made. If Fiserv does not receive payment through their Collections team: 8. The consumer will receive: “CNCL” letter and “ECNCL” email as the final collections request before the situation is turned over to a law firm. This letter informs the consumer that their bill payment service has been cancelled. Section 1: Overview and Processing Page 16 Bill Pay Certification Non-Reversible Payees – Return Reason Codes: Other than R01 or R09 If the first debit attempt is returned for a reason other than R01 (Insufficient Funds) or R09 (Uncollected Funds): 1. Fiserv freezes/ suspends the consumer’s account. NOTE: The consumer will be unable to use bill pay. 2. The consumer will receive “FOZ” letter and “EFOZ” email which informs the consumer that their payments have been paid but they will be unable to use bill pay as their account will be placed in a frozen status. The consumer is instructed on how to submit their money to Fiserv as well as how to contact Fiserv to unfreeze the account. 3. Fiserv will send the debt to their Collections team. 4. The consumer will receive “COL1” letter and “ECOL1” email as a first collections request . Then “COL2” letter and “ECOL2” email is sent as a second collections request. These letters/emails request payment to be made and warn the consumer that Fiserv will send their info to a law firm if payment resolution is not made. If Fiserv does not receive payment through their Collections team: 5. The consumer will receive: “CNCL” letter and “ECNCL” email as the final collections request before the situation is turned over to a law firm. This letter informs the consumer that their bill payment service has been cancelled. Section 1: Overview and Processing Page 17 Bill Pay Certification Reversible Payees – Return Reason Codes: R01 (Insufficient Funds) or R09 (Uncollected Funds) If the first debit attempt is returned for reason code R01 (Insufficient Funds) or R09 (Uncollected Funds): 1. The consumer will receive “NSF1” letter and “ENSF1” email which informs the consumer that their debit was returned and that a second attempt to debit the account will be made. 2. Fiserv debits the consumer’s account a second time. If the second debit attempt is returned: 3. Fiserv reverses the payment(s) with the payee(s). 4. The consumer will receive “RMNSF2” letter and “ERNSF” email which informs the consumer that the payment(s) have been reversed by the payee and their payment(s) have not been paid. The consumer can continue to use bill payment. NOTE: The consumer can continue to use bill payment, however they will have an outstanding payment with the biller. Once a consumer has incurred a debit return, their status is changed to “High Risk” and all subsequent payments are sent via draft check for the next four months. After that time, Fiserv pulls a new soft credit score and resets the risk limits for that consumer. Section 1: Overview and Processing Page 18 Bill Pay Certification Reversible Payees – Return Reason Codes: Other than R01 or R09 If the first debit attempt is returned for a reason other than R01 (Insufficient Funds) or R09 (Uncollected Funds): 1. Fiserv reverses the payment(s) with the payee(s). 2. Fiserv freezes/suspends the consumer’s bill payment service. NOTE: The consumer will be unable to use bill payment and will have an outstanding payment with the biller. 3. The consumer will receive “RMFOZ” letter and “ERFOZ” email which informs the consumer that their bill payment service has been frozen and that their payment(s) have been reversed by the payee(s) and their payment(s) have not been paid. The consumer is instructed to contact Fiserv to unfreeze the account. Section 1: Overview and Processing Page 19 Bill Pay Certification Frozen Status Consumers in a frozen account status are able to view their e-bills. This feature will not apply to bill payment accounts that have been frozen due to fraudulent activity. Section 1: Overview and Processing Page 20 Bill Pay Certification OFAC Screening Fiserv’s ACH Support Department, within Customer Operations, is responsible for their OFAC screening process. The names and addresses of 100% of all payment recipients are compared to the Specially Designated Nationals & Blocked Persons List (SDN), published by the Office of Foreign Assets Control (OFAC). The most up-to-date SDN List is downloaded every day, directly from the U.S. Treasury’s web-site. You may read more about Fiserv’s OFAC screening on the Intuit Financial Services' Client Site: https://www.diclientsite.com/prodserv/bill_pay_checkfree.html Section 1: Overview and Processing Page 21 Bill Pay Certification Practical Applications – Processing Payments 1. How does Fiserv determine how a payment is going to be sent? 2. How many days does the consumer need to leave for processing? 3. For payments that are sent either electronically or via single check, when does the money come out of the consumer's account and when is the Biller paid? 4. When can the consumer cancel a payment and how? 5. When would a consumer have a debit return but still be able to use bill pay? (Questions continue on next page.) Section 1: Overview and Processing Page 22 Bill Pay Certification Practical Applications – Processing Payments 6. Today is Feb 1st and the consumer has a bill that is due on the Feb 13th. When is the last day this bill can be set up in order for the Biller to be paid on time (not considering next day or same day payments)? February Sun Mon Tues Wed Thurs Fri Sat 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 22 23 24 FED. HOLIDAY 18 19 20 21 25 26 27 28 Section 1: Overview and Processing Page 23 Bill Pay Certification Section Objectives - RECAP In this section, you learned: the technical requirements needed to access bill pay the key terms for bill pay Fiserv's payment processing details (remittance methods, debit returns procedures, etc.) Section 1: Overview and Processing Page 24