Lecture: Course Wrap-up

advertisement

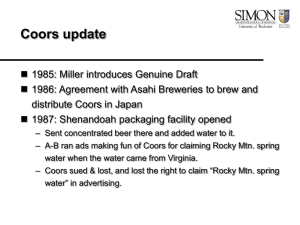

STR 421 Economics of Competitive Strategy: Course Wrap-up Michael Raith Spring 2007 1 The key question Efficient markets: successful strategies quickly attract imitators How, then, can companies achieve and maintain above-normal returns? – Why do some companies consistently make more profits than others? 2 Part I: Obtaining and sustaining a competitive advantage 1. Competition and markets 2. Value creation and competitive advantage 3. Horizontal and vertical scope of the firm 3 The Bertrand trap A game you don’t want to be in Assumptions: 1. Homogeneous goods 2. No capacity constraints 3. One-shot game Prediction: competition drives prices toward MC With fixed costs, firms make losses 4 Sellers offering goods of different quality Sellers compete by offering consumer surplus bids B-P. – PS #2, FMA and network effects What matters for winning is not benefit or cost but the difference: Dell, RTE cereal: brands vs. private labels Prices reflect costs, benefits, and competitive bidding Firms with a competitive advantage often have some freedom in choosing prices: Dell, Dupont 5 Three ways out of the Bertrand trap 1. Limit industry capacity: Dupont 2. Cooperate on prices: American Airlines, RTE cereal, Infant formula 3. Differentiate = be different – Differentiation relaxes price competition – CCS, Dell, Enterprise, ValuJet 6 Five forces analysis – Taking a snapshot of an industry What’s going on in the industry in general? Who appropriates value created? Firms in industry or others? – Extreme cases: Metal cans vs. RTE cereal Don’t forget about complementors = 6th force; e.g. Enterprise: dealers Dig deep: Why does the industry look the way it does? – Product differentiation, role of advertising/R&D, first-mover advantages, ability to collude, etc. – A useful analysis already requires considerable knowledge of how markets work 7 Limitations of Five Forces 1. No conclusive answer to question “Should we enter this industry?” entry decision must focus on competitive advantage 2. Only snapshot; industry may look different in a few years 8 Industry dynamics – What determines market structure in the long run? Good strategic decisions must anticipate likely changes in the market, and market structure, in the future – Coors, Birds Eye, Dupont, RTE cereal, EMI Predictions about market growth and entry are related: Dupont Forces towards a more concentrated market: 1. Economies of scale (look at MES/market size): Dupont 2. Intense price competition: Metal cans, PCs, opposite: PS #1, “Restaurants” 3. Escalation of spending on endogenous fixed or sunk costs: Beer, RTE cereal, CT scanners (as market matures) 9 Part I: Obtaining and sustaining a competitive advantage 1. Industry analysis 2. Value creation and competitive advantage 3. Horizontal and vertical scope of the firm 10 Positioning: horizontal and vertical product differentiation Firms are vertically differentiated when they offer different quality/cost combinations. – Brands vs. private labels in frozen food and cereal, Delta vs. ValuJet – “Cost” vs. “benefit/differentiation” strategy Firms are horizontally differentiated when they – target particular groups of customers: Dell, Enterprise – offer products with attributes that appeal to some customers but not others: (light-bodied) Coors, Honey Nut Cheerios 11 Activities and strategic fit Check how a firm’s activities fit with the market environment (“external fit”) and one another (“internal/strategic fit”) Same market can support different strategies and sets of activities: Dell vs. Compaq A successful strategy is supported by all activities of the firm – CCS: e.g. one-month inventory – Dell: all activities tailored to particular subset of business customers – Enterprise: HR policies Most choices involve some tradeoff. – Why aren’t other firms doing the same? 12 The “productivity frontier” in practice: assessing competitive advantage To assess your or rival’s competitive position, look at – Cost drivers: what factors determine costs? Beer: transport costs Dupont: scale and experience RTE cereal: ingredients, packaging – Benefit drivers: what factors contribute to buyer’s valuation? Coors: mystique, freshness CCS: quick response EMI: technology, service 13 Quantitative cost/quality comparison Simple: compare $/unit, not % of sales or costs – Coors – PS #3, ValuJet vs. Delta Fancier: use own cost/quality position, and cost and benefit drivers, to estimate rivals’ cost/quality positions. – Dell 14 Sources of a sustainable advantage: 1. Impediments to imitation a) Regulatory restrictions b) Patents: EMI? c) Superior access to inputs or customers or complementors: Enterprise, Dupont d) Strategic fit: CCS, Dell, Enterprise, ValuJet e) Experience/organizational learning: Dupont 15 Sources of a sustainable advantage: 2. First/early-mover advantages PS #2, “First-mover advantage?”; PS #3, Capacity choice game Three conditions: 1. Being first/early mover 2. First move (e.g. entry) is a credible commitment Second movers not deterred if first mover might exit/ back down => Sunk costs important 3. Entry unprofitable for second mover. Depends on Market size => not too large! Intensity of competition 16 Types of first-mover advantages a) Scale economies: Look at MES/ size of relevant market – Dupont b) Geographic or positional preemption: – CCS as last-resort canner, Coors in 70s (location), Enterprise, RTE cereal c) Reputation for quality: – CCS, Infant formula – Building reputation/brand image through advertising: Are buyers responsive? Beer, RTE cereal: yes; PCs: not much, Frozen food: initially yes, later less so 17 Types of first-mover advantages (cont’d) d) Switching costs: how difficult is it for buyers to switch? – Metal cans: no; Instant messaging: yes – What exactly is the nature of switching costs? CT scanners e) Network effects: where do they come from? How strong? – Direct: Instant messaging – Indirect: Choice Hotels (guests and affiliated hotels) – With new products, network effects often difficult to predict f) Learning effects: are there any? How big? – Dupont yes, Metal cans no 18 Strategies are commitment-intensive Strategic decisions are often hard to reverse, due to sunk costs, inertia etc. – Coors’ regional vs. national strategy Even firms with well-designed strategies can be adversely affected by changes in market : Compaq, Birds Eye Anticipate, don’t react – Monitor/anticipate developments in the market: Dell, Enterprise: luck or foresight? – Try to anticipate others’ moves – Extreme examples: Coors vs. Dupont 19 Part I: Obtaining and sustaining a competitive advantage 1. Industry analysis 2. Competitive positioning and competitive advantage 3. Horizontal and vertical scope of the firm – How broadly should a firm choose its activities beyond its core business? 20 Good and bad reasons to expand scope Most expansion efforts fail! Two main reasons: 1. Agency problems: growth objective 2. Firms overestimate generality of their capabilities Think of narrow focus/ outsourcing as default – Independent partners/suppliers have better incentives, are – …better able to realize economies of scale: Birds Eye Two key questions: 1. What are the synergies/economies of scope? 2. Can they be realized by contract, or is integration only solution? 21 Look for economies of scope Efficient use of resources: – – – Choice Hotels’ reservation system and umbrella branding; GE in sales and service for CT scanners and other products Wal-Mart: products with different seasonal structures Benefits of co-location: soft-drink bottlers and metal cans Coordination/quality control: Coors into everything (!?), Birds Eye Pricing of complementary products/double marginalization: Coors into cans in 1970s? Benefits of bundling for buyers: cross-selling at Choice Hotels, Wal-Mart: toys and clothes 22 What about contractual solutions? No need for integration if contracting is easy – Reservation systems in car rental, airlines – Output-based contracts for pea farmers etc. Maybe integrate if contracting seems too difficult – Holdup problems: Soft drink bottlers and can-making facilities; Birds Eye and cold stores How big are relationship-specific investments? How much uncertainty about future? – Problems with performance measurement: cross-selling efforts at Choice Hotels 23 Part II: Strategic interaction Any major strategic decision you make will likely provoke some kind of response from competitors Use insights from game-theoretic models to anticipate your competitors’ capabilities and moves – – – – American Airlines: will competitors go along? Dupont: how will others respond to expansion plans? Instant messaging: what is logic of the game being played? ValuJet: how will/should Delta respond to entry? 24 Price dynamics: Logic of cooperative pricing Oligopoly pricing is a Prisoners’ Dilemma situation Cooperative pricing requires long enough time horizon Key questions – How easy is it for firms to tacitly agree on prices? – How tempting is it for a firm to cut price? – How effectively can deviations be detected and punished? Industry’s ability to cooperate on prices often matters more than a firm’s relative performance in industry – Shrimp game, airline vs. cereal industry 25 Price dynamics: industry factors and facilitating practices Ability to cooperate depends on industry factors. – Airlines: transparency vs. asymmetries and excess capacity – Infant formula, RTE cereal: several conducive factors Firms can also facilitate cooperative pricing in a variety of ways. – American Airlines: establish price leadership, increase transparency, standardize products, spatial pricing rules – PS #3, HMOs Keep antitrust restrictions in mind! Price-fixing agreements prohibited for good reasons. 26 Strategic commitments Key idea: limit your own options in the future to influence your rival’s behavior to your advantage Basic ingredient of any first-mover advantage Commitment is simple in theory, but hard in practice – Moving first is not a commitment – How costly is it to change your mind later? If not much, you’re not committed 27 Commitment tactics Sunk costs: sinking costs in a useful way credibly increases incentives to stay in the game – Dupont: actual construction of a new plant – PS #3, Capacity choice game Short of true commitment, rely on reputation, or engage in tactics to influence rivals’ and buyers’ perceptions – Crandall’s claims about commitment to Value pricing – Dupont’s announcements of expansion plans – MSN’s claims about bug in AIM 28 Strategic effects: anticipate competitors’ responses to strategic commitments E.g. if I invest in lowering costs and want to lower my price, how will you respond, and how will that affect my price & profit? With strategic complements (e.g. prices), – tough commitments have a negative strategic effect: PS #3, export subsidy for railroad engines – soft commitments have a positive strategic effect: ValuJet With strategic substitutes (e.g. capacity), tough commitments have a positive strategic effect: Dupont Short-run competition is normally in price, long-run competition may be about capacities: apply Cournot model 29 Entry deterrence Ways to deter entry: 1. Preemption: Incumbent has incentive to preempt entry if otherwise entry is certain (efficiency effect) CCS in plastics, Dupont, PS #3: capacity choice game Preemption strategies are investments in a first-mover advantage (or don’t invest: EMI) 2. Any other investments that reduce entrant’s potential profits: Pricing strategies to deter/fight entrants: limit pricing, predatory pricing: Delta vs. ValuJet Antitrust law prohibits attempts to monopolize. 30 Entry games For small entrants: reduce incumbents’ incentive to respond aggressively – “Judo economics”: stay small, differentiate – ValuJet (Groups of) Firms may get caught up in a “war of attrition” if they fight for market in which only one fits – Another game you don’t want to be in – Like $20 auction 31 Innovation management Company that makes innovation is not necessarily best positioned to produce/market final product: EMI – Options: go alone, JV, license, sell Normally: sell innovation if it’s worth more to others than to you – Need capabilities in production, marketing etc. as well Value of innovation is irrelevant! Basic problem: if I want to sell you my idea, I have to tell you first what it is, but then you already have the idea… Contracting may be difficult if intellectual property protection is weak 32 Standards How strong are forces towards standardization? – Can competing technologies exist? Instant messaging: yes Go alone or alliance/licensing/open standard? – Go alone: good if you (1) have a great product, (2) are the first mover, (3) can produce complementary product (if relevant) AOL – Alliance etc: good to increase chance of establishing own technology as standard: JVC in VCRs, supporters of open standard in instant messaging But how will you make money? 33 Fact-based strategy: Use/collect data to inform strategic decisions Quick & dirty investment analysis: Coors Cost & benefit comparisons: – – – – (Simple) How is Coors positioned? (Better) How large is Dell’s cost advantage? Can Big 3 in cereal squeeze private labels by cutting price? (Fancy) Is Dupont’s cost advantage big enough to pull off “growth” strategy? Entry decisions: – Is Delta pricing like a monopolist? – What does it take to enter the cereal industry as a small player? Market forecasts: When will CT scanner market be saturated, and how does that affect EMI’s options? 34 Concluding remarks Principles of good strategy are enduring and do not change with management fashions. But companies are unique and must apply those principles to discover the optimal strategy for them. – Cookie-cutter recommendations rarely helpful Economics is useful for strategy. – How can companies make profits in the long run? – Unique resources and capabilities don’t come out of the blue – Ultimately, understanding how firms interact in markets is essential for answering the question 35