Kenya Financial Consumer Protection

advertisement

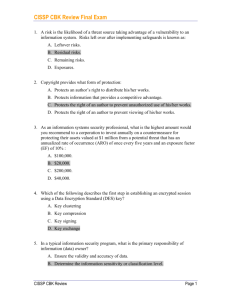

3RD ANNUAL AFRICA DIALOGUE FOR CONSUMER PROTECTION CONFERENCE ABUJA ,NIGERIA SEPT 13TH – 15TH 2011 BY MR. DANIEL ASHER PROGRAMME OFFICER CUTS AFRICA RESOURCE CENTRE, NAIROBI nairobi@cuts.org www.cuts-international.org 1. BACKGROUND 2. FINANCIAL CONSUMER PROTECTION AGENCIES IN KENYA 3. FINANCIAL CONSUMER PROTECTION LAWS/REGULATIONS IN KENYA 4. CONSUMER PROTECTION CHALLENGES IN KENYA 5. RECCOMMENDATION 2 Financial consumer protection is about ensuring a fair exchange between providers and consumers of financial services. In Kenya: Financial services consumers include users of basic credit, savings, and payment services provided by: Banks, mobile financial service providers, Savings and credit cooperatives (SACCOs), Microfinance institutions (MFIs). Insurance 3 Ministry of Finance lead provision of policy framework for the financial sector Other stakeholders in the regulation & supervision regime including: Central Bank of Kenya (CBK), Capital Markets Authority (CMA), Insurance Regulatory Authority (IRA), Retirement Benefits Authority (RBA), SACCO Societies Regulatory Authority (SASRA) Commissioner of Cooperatives, 4 The Government of Kenya’s Vision 2030 Strategy has broad goals that include promoting financial inclusion, improving transparency and affordability of financial services, and increasing competition in the sector to benefit customers and the overall economy. The IRA, RBA and CMA provide recourse to consumers unable to resolve their grievances through the provider dispute channels 5 Constitution recognizes consumer rights CBK, under ministry of finance, is responsible for: › formulation & implementation of monetary policy, › fostering the liquidity, › Solvency & proper functioning of financial system. development blue print “Vision 2030” has broad goals on promoting financial inclusion, improving transparency & affordability of financial services, emphasizes on enhancing financial stability to benefit financial service consumers . 6 Kenya has no laws or regulations for non-bank companies that offer mobile financial services. CCK regulates the Mobile Fin Ser Providers with the Kenya Communications Regulation of 2001 under authority of the Kenya Communication Act of 1998. The Central Bank of Kenya Act assigns authority to the CBK as the regulator of banking activities and in accordance to the Banking Act. The CBK Act fails to define specific mandate for consumer protection. Banking Act, establish the framework for CBK to regulate the conduct of banks in the interest of consumer protection. 7 Banking Act provides specific guidelines on practices that affect consumers. Section 11 prohibits, & holds bank officers accountable for fraudulent and reckless behaviour. Term “fraudulent” under Banking Act include “intentional deception, false and material representation, concealment or non-disclosure of a material fact or misleading conduct,” Section 16A prohibits the charging of fees on savings and fixed deposit accounts. Section 33, authorize CBK to exercise intervention options incase a bank operate “in any manner detrimental to or not in the best interest of its depositors or members of the public.” Section 44A (1)-(3) restricts the maximum amount banks can recover on non performing loans under the In-Duplum rule. 8 Article 44 instructs that “no institution shall increase its rate of banking or other charges except with the prior approval of the Minister.” Article 55(2) states that Central Bank may, at any time direct any person to withdraw amend or refrain from issuing any advertisement, brochure, circular or other document relating to deposits which, in its sole discretion, it considers to be misleading. 2010 Agent Banking Guidelines: has specific principle related to bank responsibility for the agent’s conduct and consumer protection measures. 9 2008 Credit Reference Bureau Regulations: addresses credit reporting-related issues of transparency, fair practice and recourse in a comprehensive way. The Insurance Act has a detailed consumer protection mandate for the IRA. The Act contains specific guidelines related to transparency, pricing, prohibited practices and consumer rights, and establishes a recourse role for the IRA. Insurance (Amendment) Act of 2006 Cap 487. empowers the IRA to protect the interests of policy holders and beneficiaries in any insurance contract IRA has an explicit mandate to operate a recourse mechanism The Cooperative Tribunal KBA has a recourse mechanism for consumers that cannot resolve their issues with their bank. banks have customer care desks in branches, 10 The Banking Regulations of 2006 prescribe procedures to be followed for increasing the rate of banking and other fees. Deposit-taking MFIs are regulated by the CBK with the same conventions found in the banking regulations. The Microfinance (Deposit Taking MFI) Regulations of 2008 forbid fraudulent or reckless credit and prescribe know-yourcustomer requirements. National Payment System Department of the CBK provide oversight to Mobile and other microfinance service providers focusing on integrity of IT and service delivery systems protecting customers from operational failures and financial failure of the MFSPs. SACCO Societies Act of 2009: establish comprehensive regulation and supervision framework for the SACCOs, creating the SACCO Societies Regulatory Authority SACCO members may complaints to the District or Provincial Cooperative Officer, which are eventually forwarded to the Cooperative Tribunal. 11 Kenya’s legal provisions are lacking in terms of financial consumer protection The consumer participation has been absent in many of the financial institutions in the country. Uncertainty about available options for recourse, and the legal basis in the consumer financial services The recourse systems in place are not friendly or timely, redress requires hiring of a lawyer Financial consumers are often confronted with the problems of ‘fine prints’: -Hidden fees and rates Non-standardized terms of financial services making financial products difficult to evaluate for rational consumer choices Lack of a pre-defined standard of recourse General financial consumer illiteracy in the country 12 Kenya Needs: An enforcement agency with a market-wide protection mandate to protect all financial consumers Sound regulations blended with precise and comprehensive financial consumer protection legislations to guide on: › minimum disclosure requirements for pricing and plain › › › › language in contracts. mode of communication to consumers on changes to the terms of the contract, consumer rights and obligations, provisions on monthly loan account statements The period under which consumers can refuse to take a loan after signing the contract and do not have to pay a penalty fee minimum requirements for provider-level dispute resolution mechanisms and independent third-party recourse Provider liability and responsibility for oversight of third-party agents who play a role in service delivery. 13 An all inclusive Consumer financial education with priorities on legal provisions; Standardized recourse process to all financial service consumers to curtail against unscrupulous financial service providers; Strong legislations to protect on confidentiality of financial consumer’s info policy reforms that enhance consumer trust towards financial system; 14 CONTACT: Daniel Asher Consumer Unity & Trust Society -Africa Resource Centre (CUTS-ARC), Nairobi Yaya Court- Room No.5, Ring Road Kilimani P.O.BOX 8188-00200 Nairobi, Kenya Ph: +254 20 386 214 9, 386 215 0, 20 232 911 2 Fax: +254-20- 3862149 Mobile: +254 725 913 125/ 733 990 202 Email: doa@cuts.org Website : www.cuts-international.org 15