take-over

advertisement

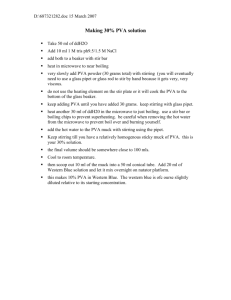

Acquisitions and restructuring Target How should the evaluation be done? diversification? uncertainties? Differences: 1. No access to intelligence about the target beyond published financial and market data 2. Takeovers are undertaken for longer-term strategic motives, and the benefits are hard to quantify. ‘The Strategic Window Problem’ Learning objectives • Why firms select acquisitions rather than other strategic options • How acquisitions can be financed? • How acquisitions should be integrated? • How the degree of success of a takeover can be evaluated • How corporate restructuring can enhance shareholder value Structure • • • • • • Definitions. Motives for take-over. Take-over evaluation. Why do take-overs fail? Why do take-overs succeed? The impact of take-overs. Types of acquisition • A take-over is: – absorption of a target firm into a new parent – acquirer offers capital (cash, shares, or stock) in exchange for equity of acquiree. • A merger is: • – a ‘pooling of interests’ into a new enterprise, involving a ‘friendly’ re-structuring of the assets and capital of the two parties into a new organisation. Most amalgamations are take-overs – true mergers are very rare, but the word ‘merger’ is frequently used to apply to both forms. Motives for merger and takeovers • Managers acting in best interests of shareholders seek out valuable opportunities to exploit. • Two sources of enhanced value: – value release – acquisition of target for less than it true value e.g. asset stripping – EMH. – value creation – expanded firm worth more than the two separate entities, due to exploitation of ‘synergies’. VA+B>VA+VB How different types of acquisition creates value Conglomerate or unrelated integration Horizontal integration Vertical integration Sources of value creation • Scale economies – a function of size • Cost savings – elimination of duplication • Synergies – matching of corporate resources and capabilities, unrelated to size • Exploitation of new markets • Restoration of growth impetus • Accretion of market power • Diversification to lower risk. • To provide ‘critical mass’ The market for managerial control • Take-overs usually result in ousting of old set of managers, hence a way of securing changes in management control. • More effective than two other main mechanisms i.e. corporate failure, voting. • So, a ‘market for corporate control’ (Jensen) is the favoured mechanism for replacing inefficient managers with an alternative group more committed to working in shareholder interests. The ‘Managerial’ explanation 1. Managers seeking own personal objectives The 3 Ps – pay, power and prestige are all enhanced by size A reflection of the agency problem. 2. Managerial ‘hubris’ – despite failure record of take-overs, managers still believe they can succeed. Financing a take-over • Cash-for-shares: – easy to understand; cannot fall in value – may trigger tax liability for selling shareholders – may lead to excessive leverage if bidder borrows • Shares-for-shares exchanges: – – – – easier on cash flow but value fluctuates with bidder’s share price may dilute EPS of bidder may alter balance of voting power –‘reverse take-over’ • Mixed offers: – cash or shares; or cash or shares plus cash. Evaluating an acquisition using cash (Company A taking over company B) • The gain = PVA + B – (PVA + PVB) • The net cost = The outlay less the value obtained e.g. cash spend – PVB • The NPV = The gain - the cost = PVA + B - (PVA + PVB) - (cash spend - PVB) = PVA + B - PVA - cash spend Example of cash bid • • • • Bidder: Fewston, value = £200M, 100M shares Target: Dacre, value = £40M, 10M shares Predicted merger savings = PV of £20M Fewston buys Dacre for £50M cash NPV = PVF + D - PVF - Cash Spend = (£200M + £40M + £20M) - £200M - £50M = £10M • Hence, merger benefits split 50/50 between both firm’s shareholders i.e. £10M to each group. Financing via shares • Again, the gain = PVA + B - (PVA + PVB) • The cost = What you give up less what you receive = [target’s owners share of merged firm (S%) less value of target] i.e. S(PVA + B) - PVB • NPV = gain - cost i.e. PVA + B - (PVA + PVB) - [S(PVA + B) - PVB] = PVA + B - PVA - S(PVA + B) = (1 - S) PVA + B - PVA Fewston/Dacre example • Share prices: Fewston: (£200M/100M) = £2; Dacre: (£40M/10M) = £4. If Fewston bids £50M, must offer (£50M/£2) = 25M shares • Number of shares = (100M + 25M) = 125M • Hence, Fewston gives up (25M/125M) = 20% of firm • NPV of merger = (1 - S) PVF + D - PVF = (1 - 0.2)(£260M) - £200M = £8M • Balance of gains (£12M i.e. 60%) tilted towards Dacre – share exchange passes over some of the benefits to target’s shareholders. Why do take-overs fail or succeed? It’s hard to assess what would happened had a takeover trail not been embarked… FAIL = does not enhance shareholders value • Acquirers pay too much, often in debt form – Poor evaluation, ‘machismo’ in a bidding war • Acquirers fail to plan integration • Acquirers fail to judge cultural differences SUCCEED • Generally, due to careful planning, evaluation of strategic contribution of the target and conservative valuation – ‘the strategic approach’. Payne’s strategic framework Figure 1: A strategic framework (based on Payne, 1985) Take-over defences • • • • • • • • • • • • • Rush out an enhanced profits forecast Denigrate the profit and share price record of the bidder Revalue assets Promise a higher dividend Stress bidder’s unsuitability – ‘lack of industrial logic’, ‘opportunism’ Lobby the competition authorities Seek a ‘White Knight’ Sell the ‘Crown Jewels’ ‘Pacman’ defence – launch a counter-bid for the raider Golden parachutes for senior staff Enhance firm size Share re-purchase (buybacks) Place shares in friendly hands. Drucker’s 5 Golden Rules Chances of successful merger enhanced if acquirer: 1. Ensures a ‘common core of unity’. 2. Contributes skills and resources to acquired firm. 3. Respects the products and markets of the acquired firm. 4. Provides top management for acquired firm. 5. Makes cross-company promotions. Jones’s integration sequence • • • • • Reporting relationships Rapid control of key factors Resource audit Harmonise corporate objectives Revise corporate structure Assessing the impact of mergers Two approaches: 1. Examine the financial ratios of the expanded firms relative to those of the separate firms premerger – ‘financial characteristics approach’. 2. Use the CAPM to examine the returns on shares of bidder and acquired firms before and after the take-over event – ‘capital market approach’ Problems with the financial characteristics approach • Different accounting policies between firms • Application of acquisition accounting – writeoff of goodwill to reserves? • Key ratios worsen post-merger when firms acquire an inefficient firm • What would have happened without the merger? • Ignores risk – merger may alter risk profile of firm. Capital markets approach • Method – examine share prices pre- and post-bid announcement; any abnormal returns attributed to bid event e.g. Beta = 1.2, return on market = 5%. • • • • • Return on take-over target = 30% on event day. Expected return = (1.2 × 5%) = 6%. Hence, abnormal return = (30% - 5%) = 25%. Suffers from usual problems with CAPM. Also, impact of bid spread out over time – e.g. pre-bid ‘creep’ in share price of target. Assessment • Most studies show the bulk of merger gains accrue to target’s shareholders • Little evidence that firms perform better postmerger • Easy to get caught up in a bidding war and to over-pay • Best strategy is to go for friendly acquisitions in related activities • A major key to success is carefully planned integration, and attention to cultural issues. “Value gaps” The near certainty that shareholders of targets will benefit suggests that market values typically fall short of the value that potential or actual bidders would place on them. These disparities are called value gaps. • • • • Poor corporate parenting Poor financial management Over-enthusiastic bidding Stock market inefficiency Corporate restructuring to create value • Concentration of equity ownership in the hands of the managers or ‘inside investors well-placed to monitor managers’ efforts. • Substitution of debt for equity • Redefinition of organizational boundaries through mergers, divestment, management buy-outs etc. Financial managers should be ever-alert to: Review the corporate financial structure from the shareholder’s viewpoint Increase efficiency and reduce the after-tax cost of capital through the judicious use of borrowing Improve operating cash flows through focusing on wealth-creating investment opportunities, profit improvement and overhead reduction programs Pursue financially-driven value creation using various new financing instruments and arrangements (i.e. financial engineering). Types of restructuring Corporate Business unit Asset Diversification/demerger Share issues Share repurchase Strategic alliances Leveraged buy-outs Liquidation Acquisitions Joint ventures Management buy-outs Sell-offs* Franchising Spin-offs* Pledging assets as security Factoring debts Leasing Sale and leaseback Divestment The structure of the parent company The structure of the strategic business unit Changing the ownership of assets Good restructuring should result in: • • • • Better business fit and focus Elimination of sub-standard investment Judicious use of debt Incentives for good performance