wk5-6ch12soc.ins.sp12

advertisement

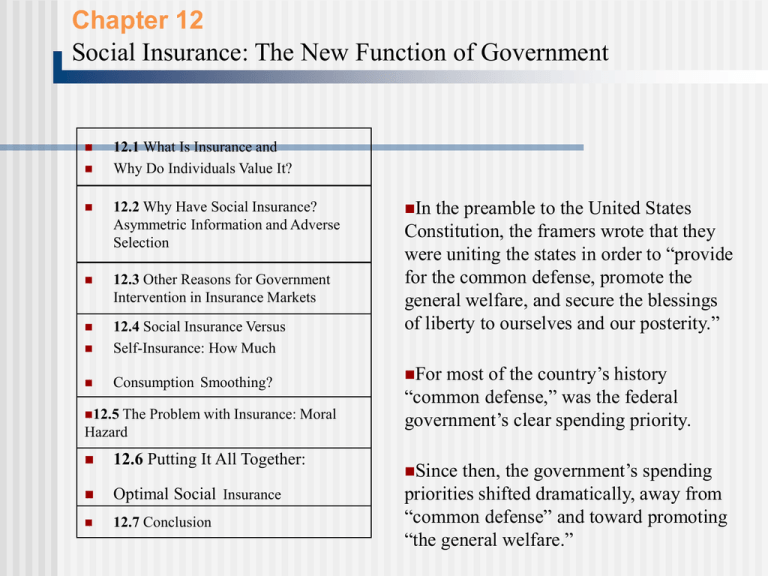

Chapter 12 Social Insurance: The New Function of Government 12.1 What Is Insurance and Why Do Individuals Value It? 12.2 Why Have Social Insurance? Asymmetric Information and Adverse Selection 12.3 Other Reasons for Government Intervention in Insurance Markets 12.4 Social Insurance Versus Self-Insurance: How Much Consumption Smoothing? 12.5 The Problem with Insurance: Moral Hazard 12.6 Putting It All Together: Optimal Social Insurance 12.7 Conclusion In the preamble to the United States Constitution, the framers wrote that they were uniting the states in order to “provide for the common defense, promote the general welfare, and secure the blessings of liberty to ourselves and our posterity.” For most of the country’s history “common defense,” was the federal government’s clear spending priority. Since then, the government’s spending priorities shifted dramatically, away from “common defense” and toward promoting “the general welfare.” Important Social Insurance Programs Social Security Unemployment insurance Disability Insurance Workers Compensation Medicare CHAPTER 12 ■ SOCIAL INSURANCE: THE NEW FUNCTION OF GOVERNMENT Public Finance and Public Policy Jonathan Gruber Third Edition Copyright © 2010 Worth Publishers 3 of 29 Common features of Social Insurance programs Contributions are mandatory A measurable, enabling event Benefits are not related to one’s income or assets (not means tested) Understanding the economics of insurance markets Why individuals value insurance Why insurance markets may fail Adverse selection Moral hazard What tradeoffs in designing social insurance Key terms Adverse selection—the insured individual knows more about their own risk level than does the insurer Moral hazard---when you insure against adverse events, you can encourage adverse behavior. Why insurance Insurance premium---paid to insurer In return, insurer promises payment to individual if adverse event happens Examples: Health, car, property, farm crops, Why do individuals value insurance? Individuals value because of Diminishing marginal utility Ie. They choose 2 years of smooth income over 1 year of high consumption and 1 year of starving --because excessive consumption does not raise utility as much as starvation lowers it. They prefer to smooth out consumption Why individuals value insurance? When outcomes are uncertain, individuals wish to smooth their consumption over possible states of the world Examples: State1: get hit by a car State2: not getting hit Goal is to make choice today that determines consumption in future for each of these states Insurance, contd. Consumers smooth by using some of today’s income to insure against adverse outcome tomorrow. Basic insurance theory suggests that individuals will demand full insurance to smooth their consumption across states of the world. Same consumption possible whether accident occurs or not 12.1 What Is Insurance and Why Do Individuals Value It? Formalizing This Intuition: Expected Utility Model expected utility model The weighted sum of utilities across states of the world, where the weights are the probabilities of each state occurring. Expected utility is written as: actuarially fair premium Insurance premium that is set equal to the insurer’s expected payout. Expected Utility Model EU = (1-p) U(C ) + pU(C ) 0 1 Where •p stands for the probability of an adverse event •C and C stand for consumption in the good and bad states of the world 0 1 Analyzing an individual’s demand for insurance Assume, a 1% chance for and accident with $30,000 of damages Sam can insure some, none, or all of these medical expenses Policy cost: m cents per $1 of coverage A policy pays $b for an accident His premium is $mb Full insurance: m x $30,000 State 0: $mb poorer State 1: $b-$mb richer than if he doesn’t buy insurance Expected utility model Sam’s desire to buy depends on price of insurance An actuarially fair premium sets the price charged equal to the expected payout $30,000 x .01 = $300 (act. fair prem.) Expected (Utility) Decision to buy insurance also affected by risk preference Assume a utility function U= √C. (risk averse) C0= 30,000 Without insurance: .99√30,000+.01 √0 =171.5 With actuarially fair insurance: .99√29,700 + .01√29,700 = 172.3 Utility is higher with insurance Partial insurance is lower utility Table 1 The expected utility model If Sam … Doesn’t buy insurance Buys full insurance (for $300) Buys partial insurance (for $150) And Sam is … Consu mption Utility √C Not hit by a car (D=99%) $30,000 173.2 Hit by a car (D=1%) 0 0 Not hit by a car (D=99%) $29,700 172.3 Hit by a car (D=1%) $29,700 Not hit by a car (D=99%) $29,850 Hit by a car (D=1%) $14,850 172.3 Expected utility 0.99x173.2 + 0.01x0 = 171.5 0.99x172.3 + 0.01x172.3 = 172.3 172.8 121.8 0.99x172.8 + 0.01x121.8 = 172.2 Result implications Even if insurance is expensive, if premium is actuarially fair, individuals will want to insure against adverse events. Implication: The efficient market outcome is full insurance and thus full consumption smoothing Role of risk aversion Risk aversion: extent to which an individual is willing to bear risk Risk averse individuals have a rapidly diminishing marginal utility of consumption Individuals with any degree of risk aversion will buy insurance priced fairly. If not priced fairly, they will not buy Why have social insurance? Asymmetric information Insurance markets have information asymmetry between individuals and insurers Individual knows more about their likelihood of an accident than insurer Example: Health: the individual knows more about their health history Insurer is reluctant to sell an actuarially fair policy to a person with “high risk” Asymmetric Information Ex. 2 groups of 100 people—prob. of $30k accident 1st has 5% chance of injury 2nd has .5% chance Table 2---results People have the option of buying insurance and will do so for fair deal Only high risks take policy loses money 12 . 2 Why Have Social Insurance? Asymmetric Information and Adverse Selection Example with Full Information Example with Asymmetric Information 150 $150 Adverse Selection Problem Insurance market fails because of adverse selection: Individuals know more about their risks than insurance company Only those with high chance of adverse outcome, or if premium is a fair deal, buy insurance Adverse selection causes insurance companies to lose money ?should we mandate buying insurance? Example (HIV, pre-existing condition, Will asymmetric information lead to Market Failure? Not if: Most individuals are fairly risk averse (ie they will buy an actuarially unfair policy) Policy has a risk premium above the actuarially fair price This leads to a pooling equilibrium where people buy insurance even though it is not fairly priced to all individuals Insurance companies can offer separate products at different prices Consumers reveal info on their riskiness Separating equilibrium- for different individuals Asymmetric information Separating equilibrium leads to a market failure Insurers force low risks to choose between expensive (unfair) full insurance or partial low cost insurance Low risk group do not get full insurance—suboptimal University health policy options How does government address adverse selection problem? It could: Impose a mandate that everyone buy private insurance ($825 per policy) Offer insurance directly Both options have low risks subsidizing high risks Other reasons for government intervention Externalities Administrative costs Economies of scale in administration Redistribution Negative health externalities With full information (genetic testing), insurers can identify high risks Fairness of this discrimination? Paternalism Individuals won’t insure unless govt. forces Government failure is refraining from helping Other ways to smooth consumption Self-insurance (Unemployment ex.) Own savings Labor supply of family Borrowing from friends charity Government Unemployment Insurance crowds out private provision No gain from government action Efficiency costs from raising government rev. Example: Unemployment Insurance The UI replacement rate is the ratio of unemployment insurance benefits to preunemployment earnings. Figure 2a shows some examples of the possible relationship between the UI replacement rate and the drop in consumption when a person becomes unemployed. A larger fall in consumption means less consumption smoothing. Example: Unemployment Insurance Panel A shows the scenario in which a person has no self-insurance (e.g., no savings, credit cards, or friends who can loan money to her). With no UI, consumption falls by 100%. Each percent of wages replaced by UI benefits reduces the fall in consumption by 1%, shown by the slope equal to 1 in panel A. In this case, UI plays a full consumption smoothing role: there is no crowd-out of self-insurance (because there is no self-insurance). Each $1 of UI goes directly to reducing the decline in consumption from unemployment. Example: Unemployment Insurance Consider the other extreme, in panel C. A person has full insurance (perhaps private UI or rich parents). With no UI, consumption falls by 0%. Each percent of wages replaced by UI benefits does not reduce the fall in consumption at all, as shown by the slope equal to 0 in panel C. In this case, UI plays no full consumption smoothing role, and plays only a crowd-out role. Each $1 of UI simply means that there is one less dollar of self-insurance. Example: Unemployment Insurance In a middle-ground case (Panel B), UI plays a partial consumption-smoothing role. It is both smoothing consumption and crowding out the use of self-insurance. Figure 2b summarizes these lessons. The UI consumption smoothing and crowding-out effects depend on the availability of selfinsurance. Lessons for Consumption-Smoothing Role of Social Insurance In summary, the importance of social insurance programs for consumption smoothing depends on: The predictability of the event. The cost of the event. The availability of other forms of consumption smoothing. THE PROBLEM WITH INSURANCE: MORAL HAZARD When governments intervene in insurance markets, the analysis is complicated by moral hazard, the adverse behavior that is encouraged by insuring against an adverse event. THE PROBLEM WITH INSURANCE: MORAL HAZARD Consider the Worker’s Compensation program, for example. Clearly, getting injured on the job is the kind of event we want to insure against. It is difficult, however, to determine whether the injury was really on-the-job or not. The insurance payouts include both medical costs of treating the injury, and cash compensation for lost wages. Under these circumstances, being “injured” on the “job” starts to look attractive. THE PROBLEM WITH INSURANCE: MORAL HAZARD By trying to insure against a legitimate event, the program may actually encourage individuals to fake injury. Nonetheless, moral hazard is an inevitable cost of insurance, either private or social. Because of optimizing behavior, we increase the incidence of bad events simply by insuring against them. What Determines Moral Hazard? The factors that determine moral hazard include how easy it is to detect whether the adverse event happened and how easy is it to change one’s behavior to establish the adverse event. APPLICATION Flood Insurance and the Samaritan’s Dilemma When a disaster hits, the government will transfer resources to help those affected. Since individuals know that the government will bail them out if things go badly, they will not take precautions against things going badly. To reduce taxpayer-funded federal expenditures on flood control, the federal government established the National Flood Insurance Program (NFIP) in 1968. • Areas with a 1% chance of flooding in any given year are given the option of buying flood insurance through the program. • Following Hurricane Katrina, it was revealed that nearly half of the victims did not have flood insurance. The claims from those who did have flood insurance bankrupted the program. • Failures of the NFIP have many sources. Among these is that many individuals opt out of paying for insurance. This is a classic example of the Samaritan’s Dilemma: If the government is going to continue to help individuals in disasters, and people are not required by law to buy flood insurance, then why buy it? A solution to this problem would be to mandate the purchase of flood insurance at actuarially fair prices in areas at risk of flooding. Moral Hazard Is Multidimensional Moral hazard can arise along many dimensions. In examining the effects of social insurance, four types of moral hazard play a particularly important role: Reduced precaution against entering the adverse state. Increased odds of entering the adverse state. Increased expenditure when in the adverse state. Supplier responses to insurance against the adverse state. PUTTING IT ALL TOGETHER: OPTIMAL SOCIAL INSURANCE There are four basic lessons: First, individuals value insurance and would ideally like to smooth consumption. Second, insurance markets may fail to emerge, primarily because of adverse selection. Third, private consumption smoothing mechanisms may be available; to the extent they are, one must examine new consumption smoothing versus crowding out of existing self-insurance. Fourth, expanding insurance encourages moral hazard. PUTTING IT ALL TOGETHER: OPTIMAL SOCIAL INSURANCE These lessons have policy implications. First, social insurance should be partial. Full insurance will almost always encourage adverse behavior. Second, social insurance should be more generous for unpredictable, long-term events where there is less room for private consumption smoothing. Third, more moral hazard should lead to less insurance. Recap of Social Insurance: The New Function of Government What is Insurance and Why Do Individuals Value it? Why Have Social Insurance? Social Insurance versus Self Insurance: How Much Consumption Smoothing The Problem with Insurance: Moral Hazard Putting it All Together: Optimal Social Insurance