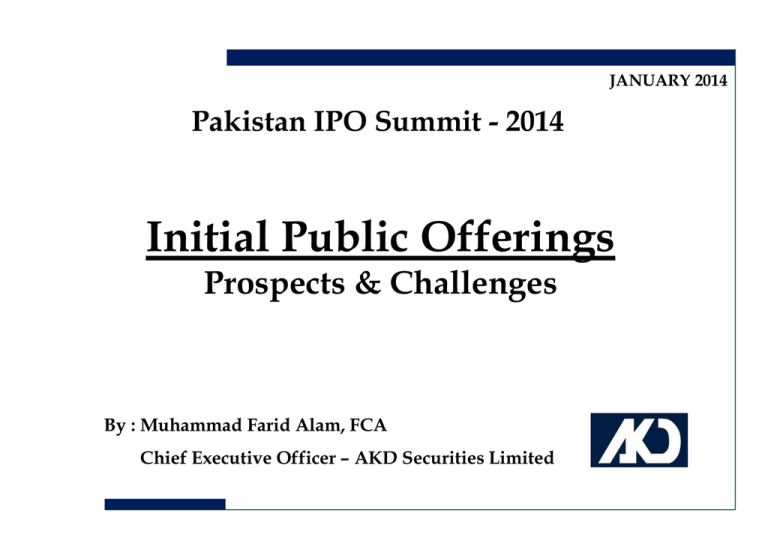

Mr. Muhammad Farid Alam, CEO, AKD Securities Limited.

advertisement

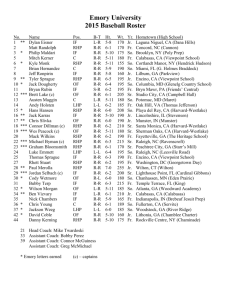

JANUARY 2014 Pakistan IPO Summit - 2014 Initial Public Offerings Prospects & Challenges By : Muhammad Farid Alam, FCA Chief Executive Officer – AKD Securities Limited Table of Contents 1. AKD Securities Limited: Leading Corporate Brokerage House Outstanding Investment Banking Credentials Landmark Transactions Investment Banking Prowess Corporate Relationships 2. Benefits of Listing: Unlimited Access to Global Capital Unlocking the True Value of a Company Creating Invest-omers Wealth Creation Succession Planning 3. Issues & Challenges: Issues Faced by Financial Advisors Issues Faced by a Company 4. The Way Ahead 1 1. AKD Securities Limited AKD Securities Limited Leading Corporate Brokerage House AKD Securities Limited (“AKDS”) is one of the leading securities firm in Pakistan with an 8% to 10% market share in average daily traded volume at KSE. We provide a comprehensive range of investor focused services, including equity brokerage, economic and securities research, investment banking and financial advisory services. AKDS Investment Banking prowess is well established in the industry. Outside of the large domestic banks, we have consistently been ranked among one of the leading underwriters and arrangers of equity in capital markets transactions. AKDS has over 100 institutions, domestic and international, along with high net-worth clients across several sectors including: International Equity Funds Leasing Companies & Modarbas International Broker - Dealer Arrangements Mutual Funds & Investment Companies Commercial & Investment Banks Corporate Provident & Pension Funds Development Financial Institutions Public & Private Sector Corporations From 2008 till date, AKD Securities Limited accounted for 40% of all domestic equity offerings AKDS also provides access to a diversified investor network through sales/trading desks. its institutional and Deutsche Bank online Recipient of “Deal of the Year” Award at ICAP Excellence Awards 2013 for Participation Term Certificate of Treet Corporation Limited “The Best Equity Brokera House” Award for the yea 2005-06 and 2006–07, by CF Association of Pakistan Also featured as the second best brokerage by Asia Money polls in the year 2007 “Best Corporate Finance House of the Year” and “Runner-up Best Brokerage House” Award 2010 2011 by the CFA Association of Pakistan 3 AKD Securities Limited Outstanding Investment Banking Credentials Arrangement Capability Recognition Market Share Successfully advised for and arranged over Ranked “Best Corporate Finance House of the Year – Equity & Advisory” for the year 2011 Successfully executed PKR 45bn 43% of the total 28 domestic equity listings since CY2008 which clearly reflects our investment banking prowess in domestic capital markets through equity listings, right issuance, debt arrangements, equity underwritings and term finance certificates for successfully executing landmark transactions during the year Innovation Pioneer Book Runner Privatization Awarded “Best Transaction of the Year” for the year 2012 by Institute of Chartered Accountants of Pakistan (ICAP) A convincing market share of Successfully advised and arranged for transactions worth 70% PKR 19bn for Advisory & Arrangements of Pakistan’s 1st ever PTC representing our domination in all domestic book buildings held in Pakistan’s capital markets to date based out of GoP’s Privatization Program and are also mandated as advisors for the GDR of NBP along with the consortium of Deutsche Bank AG and Morgan Stanley 4 AKD Securities Limited Investment Banking Prowess Mergers & Acquisitions Includes buy / sell side advisory services to both local and international clients. Services range from multistage M&A i.e. deal structuring, valuation, divestment, structure optimization, target company and JV identification Corporate Bonds Debt Capital Markets Includes fund raising via Debt (both secured and unsecured) and Equity issuance – IPO, OFS, Rights / Bonus, SPO / FPO, Convertible Loan and Equity Linked Instruments and Pre-IPO Placements (Private Equity Placement) Debt Arrangements Mergers & Acquisitions Privatization Project Finance Providing advice on capital structure, determining debt and equity strategy and arranging finance for working capital requirements, expansion, acquisition, refinancing with negotiation for key terms and covenants Business Restructuring Public Offerings Debt Restructuring Advisory on structuring secured and unsecured debt facilities and negotiation for debt scheduling. Performance feasibility analysis on plans of reorganization as well as risk assessment and opportunities Equity Merger & Acquisitions Private Placements 5 AKD Securities Limited Landmark Transactions Lalpir Power Limited Highest Over-Subscribed Book Building: Acted as Lead Manager, Arranger & Book Runner for the Offer for Sale of Shares where the Book Building of 28.48mn shares was over subscribed by 6 times which is the highest over-subscription received for any domestic Book Building. Treet PTC First Ever PTC in Pakistan’s Capital Markets: Acted as Financial Advisor & Arranger for the first ever Participation Term Certificate in the history of Pakistan’s Capital Markets for Treet Corporation Limited worth PKR 1,255mn. Engro Fertilizers Limited One of Pakistan’s Best Performing Listings: Acted as Book Runner for the Book Building of 75mn shares of Engro Fertilizers Limited at a floor price of PKR 20/- per share and received over 400 bids with an overwhelming response resulting in a strike price of PKR 28.25/- per share. Attock Petroleum Pakistan’s Highest Ever Over-subscribed Offer for Sale of Shares: Lead Managed the PKR 577mn Offer for Sale of Shares of Attock Petroleum Limited that was over-subscribed by a record 19 times. National Refinery Privatization of Pakistan’s Second Largest Refinery: Buy-side Financial Advisor for the Attock Group of Companies on their PKR 16,240mn Offer for the acquisition of 51% stake in National Refinery Limited. Ghani Gases Limited First Ever Domestic Book Building: Lead Manager & Book Runner for the first ever domestic listing via Book Building mechanism for the Offer for Sale of Shares of Ghani Gases Limited. Nishat Power Limited Re-opening of IPO Market: Acted as the Financial Advisor & Arranger for IPO of Nishat Power Limited. AKDS reopened equity markets for Pakistan post domestic political volatility and a deadlock in IPO market for nearly one year. 6 AKD Securities Limited Corporate Relationships 7 2. The Benefits of Listing The Benefits of Listing Unlimited Access to Global Capital Raise virtually unlimited money from markets all across the globe Top 10 Largest Global IPOs Company Name Agricultural Bank of China Industry Financial Services Size $22.1bn Year Jul-10 Listed in China Industrial & Commercial Bank of China Financial Services $21.0bn Oct-06 China Automotive $20.1bn Nov-10 US Insurance $20.5bn Oct-10 Hong Kong Financial Services $19.7bn Mar-08 US Social Media $18.4bn May-12 US NTT Mobile Com. Network Telecom $18.1bn Oct-98 Japan ENEL S.p.A. Utilities $16.6bn Nov-99 Italy Nippon Telegraph & Telephone Telecom $13.7bn Oct-86 Japan Deutsche Telekom Telecom $12.5bn Nov-96 Germany General Motors American International Assurance Visa Facebook 9 The Benefits of Listing Unlocking the True Valuation of a Company Company’s true value is unlocked through price valuations – – – – Market takes into account tangible & intangible assets' values Growth potential is factored into the company's valuation Market Value = Book Value of Assets + Future Earning The secondary market helps to unlock the true value of a company • Floor Price of PKR 20/- share • Book Building helped in the price discovery where a strike price of PKR 28.25/- per share was determined which also led to an overwhelming response in the General Public • The share capital of Engro Fertilizers was PKR 12.28 billion (USD 115mn) prior to the IPO • Post-listing with a share price of PKR 45.96/- per share as at January 30, 2014 the total market capitalization of EFERT is approximately PKR 59.65 billion (USD 561mn) Pre-listing – PKR 12.28 billion Post-listing – PKR 59.65 billion PRICE DISCOVER IN ITS TRUEST SENSE Case in Point – IPO of Engro Fertilizers Limited: 10 The Benefits of Listing Creating Invest-omers Investors of listed companies also become loyal customers that creates ‘Invest-omers’ – Investors are more likely to buy products from the same company in which they hold shares – According to a study ‘inves-tomers’ spend 1.7 times more often than the typical shopper and spend 1.5 times as much money – They remain customers 1.1 times longer and generate 2.1 times the number of business referrals (Source: Mowrey, 2000) – MYER, an Australian chain of upmarket departmental stores, embraced the ‘inves-tomer strategy’ where shareholders were encouraged to become retail customers and resultantly at least 60,000 new shareholders joined the register 11 The Benefits of Listing Wealth Creation Listed companies provide an opportunity to create further riches and are an indication of personal wealth for savvy entrepreneurs – Majority of the richest men made their fortunes through appreciation of their companies’ shares which is vindicated by the fact that all of the top 10 richest people in the world owe their wealth to the stakes held in listed companies – Carlos Slim is 2013's richest person with a wealth of USD 73 billion due to a rise in Mexican Stock Market – Mian Mohammad Mansha is the first Pakistani businessman to be featured in Forbes list of billionaires due to the market value of his shareholdings in numerous listed bluechip companies – Mukesh Ambani (Chairman – Reliance Industries) at one time became the richest man in the world as result of increase in share prices – Mark Zuckerberg became the youngest billionaire at the age of 28 years with an estimated worth of USD 15 billion after the IPO of Facebook Inc. 12 The Benefits of Listing Succession Planning The structure and required level of corporate governance in listed companies supports in efficient and smooth succession planning – According to a independent PWC research, 7 out of 10 private businesses do not have any procedures for resolving business conflicts between family members and almost half of them have no formal succession plans – It is easier for listed companies to confront the problem of succession as it has better access to human resource capital – Leadership transitions in global conglomerates had negligible effects on the Company's value: Steve Jobs - Apple Bill Gates - Microsoft Warren Buffet - Berkshire Hathaway 13 The Benefits of Listing Listing – A Winning Combination For All 14 3. Issues & Challenges Issues & Challenges Challenges Faced by Financial Advisors • Listing a company is not about just adding another number to the Exchange • Lesser incentive for attracting successful companies • Demanding , over-ambitious and impatient managements / sponsors • Corporate governance and corporatization are the greatest fears of domestic sponsors • Dilution of shareholding is considered a sin • Company is considered a part of the family’s silver by the sponsors • Sponsors / managements shy away from stringent regulatory reporting • Inexperienced boutique investment banks mislead high potential companies • Not willing to offer shares at ‘Patriotic Par’ • Listing in itself has great benefits – and benefits never come underwritten so comprises are required…… At least initially!!! “The only good companies stay unlisted” 16 Issues & Challenges Challenges Faced by Companies • Absence of fiscal incentives is a great hurdle • Lack of self-believe and level of preparedness in terms of financial reporting and structuring of the Company • Start-up companies have nowhere to go while only brownfield companies are entertained • Newcomers and single – entity sponsors are not welcomed • Discomfort in sharing of information with outsiders • Cost of listing • Stringent regulatory deadlines at times delay processes • Drive to grow and glow is missing • Lack of trust in the eyes of potential investors 17 4. The Way Ahead The Way Ahead STEP UP PREPARE FOR LISTING GROW & GLOW 19 THANK YOU! 20