DPU Draft Presentation 2.5.13 - Massachusetts Grid Modernization

advertisement

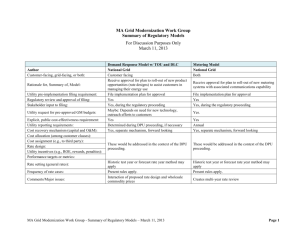

Ratemaking and Regulation for Massachusetts Electric Utilities Jeff Hall and Ben Davis MA DPU Grid Modernization Steering Committee February 5, 2013 1 Disclaimer This presentation is not intended to represent official views of the Massachusetts Department of Public Utilities or the Commission. 2 Purpose of Presentation • Provide a high level introduction to ratemaking and regulation to help the Working Group consider the question: “What policies might we recommend to the DPU to advance grid modernization goals?” • Present (1) a snapshot of basic principles of “traditional” ratemaking and (2) alternative regulatory approaches used in Massachusetts. • Not intended to be exhaustive; does not address complexities, nuances, or debates about various elements. • Goal: provide a “baseline” of understanding to foster useful discussion. 3 Outline • Basic principles of “traditional” ratemaking • Regulatory developments in Massachusetts • Performance Based Ratemaking • Service Quality Regulation • Decoupling • Cost Recovery Mechanisms outside of “traditional” ratemaking • Energy Efficiency •Time-varying pricing? • How does this discussion inform the Working Group? 4 Traditional Method for Setting Distribution Rates RR = O&M + D + T + r(RB) RR = Revenue Requirement O&M = Operating and Maintenance Expense D = Depreciation and Amortization T = Taxes r = Rate of Return (both debt service and shareholders) RB = Rate Base 5 Traditional Method for Setting Rates • Decisions are based on extensive Department precedent. • Distribution rates are non-reconciling and are frozen between rate cases. • Utility bears risk of change in revenue as well as costs. • Utility will file for a rate change because revenues are too low or costs are too high. • DPU may order a utility to make a rate filing if over earning (G.L. c. 164, sec. 93). 6 Performance Based Ratemaking (“PBR”) • PBR is an example of an innovation to traditional ratemaking to increase the incentive for companies to reduce costs. • Price cap model used in Massachusetts, but there are other models for PBR, such as a revenue cap. • Utility operates under a term during which it will not file for a rate case in exchange for annual, formulaic rate increases (typically 10 years). • Increases the utility’s incentive to reduce expenses while providing ratepayer with certainty of future rate increases. • To ensure that the utility’s efforts to reduce costs do not result in a reduction in service quality, service quality (“SQ”) standards were introduced. 7 Service Quality Originally part of Restructuring Act, updated several times since. Companies file annual SQ reports, which include many metrics, e.g.: System and Circuit Outage Duration and Frequency SAIDI & SAIFI: Average minutes or durations per customer. Customer Service – telephone answering, service appointments Safety – Lost work time due to accidents Penalties associated with certain metrics, up to a total of 2.5% of annual transmission and distribution revenue. Current NOI “tees up” several aspects (e.g., alternative metrics (DG), methods of benchmarking, penalty framework) and seeks input. Attorney General filed detailed report on strengthening SQ standards. Purpose of SQ is to measure day to day service; therefore, major events (such as large storms) are excluded. 8 Regulatory Framework For Storms Major events such as large storms are excluded from SQ metrics and are evaluated outside of SQ. In recent years, the regulatory framework for storms has evolved: Legislation – e.g., Emergency Response Plans, Penalty Authority D.P.U. Regulations D.P.U. Investigations 9 Decoupling • Docket D.P.U. 07-50 (Generic) • Purpose – To eliminate potential barriers to distribution companies’ aggressive pursuit of energy efficiency and demand resources. • Main principle: • To sever revenue recovery from sales volumes while adhering to the Department’s ratemaking principles (fairness, equity, continuity, etc.). 10 Mechanics of Revenue Decoupling - Electric • The annual base rate adjustment equal to the difference between actual billed distribution revenues and annual target revenues divided by forecasted sales. • Annual rate adjustment capped at 3% of total revenues so as to maintain rate continuity (utility can defer any unrecovered balance for recovery in the subsequent year). • NSTAR is only electric company that has not decoupled. • NSTAR collects Lost Base Revenue (“LBR”) associated with its energy efficiency programs (Merger Settlement, D.P.U. 10-170). 11 Tracking & Recovering Costs Outside Base Rates • Mechanisms track actual costs & utilities file for DPU approval of recovery. • Simply a pass through of costs. • Utilities have had reconciling cost recovery mechanisms for decades (e.g., fuel charge). • Creation of these mechanisms based on several factors: legislation (utility ownership of solar facilities; long term contracts for renewable energy); public policy objectives (low-income discount); volatile costs outside of a utility’s control (pension costs). • Many examples: Pension Adjustment Factor (PAF), Residential Assistance Adjustment Factor (RAAF), Smart Grid Adjustment Factor (SGAF), Solar Cost Adjustment Factor (SCAF), Energy Efficiency Surcharge (EES), etc. 12 Tracker Mechanisms for Capital Investments • Essentially allows a company to recover certain capital investments in a manner similar to rate base, on an annual basis outside of base rates, subject to review & DPU approval. • Earn a “return of” and “return on” investment • Reduces regulatory lag • Including value of depreciation • Examples: National Grid’s CapEx, Bay State Gas’ TIRF • Use of these mechanisms is topic of ongoing discussion. 13 Energy Efficiency Long history of energy efficiency programs in MA Green Communities Act - statewide, three-year approach to achieve “all available cost-effective.” Mechanism to recover projected costs; later reconciled to actual, approved costs. Includes performance incentive. Based on achievement of benefits, net benefits, and meeting “performance metrics” (designed to encourage specific activities). Company must achieve at least 75% of “design” level incentive to begin earning incentive; cap at 125%. 2013-2015 Three-Year Plans, approved January, 2013. 14 Time-varying Pricing? Presentation – mostly distribution rate portion of the bill Current form – Not “time-varying.” Should time-varying rate be considered? Reflect costs? Supply portion of the bill Most small customers on basic service (DPU policy governs); most large customers on competitive supply. Basic service – currently not “time-varying.” Should it be? What would the impacts be? Who benefits? Question - capabilities of meter, communications, data management, and billing systems? What would be needed? Benefits vs. costs? 15 Recap The purpose of this presentation? To help the WG consider questions like: To what degree is ‘traditional’ regulatory framework sufficient/ insufficient to achieve certain GM goals? To what degree are current SQ or storm regulations sufficient/ insufficient to achieve certain GM goals? Should SQ metrics be updated to achieve certain GM goals? Should modification or additional cost-recovery mechanisms be considered/ or not? Is a broader change needed, akin to PBRs or decoupling? Does an alternative framework, such as what is used for energy efficiency, provide ideas? In other words… 16 In which box (or boxes) do Grid Modernization activities fit? Do we need a new box? 17