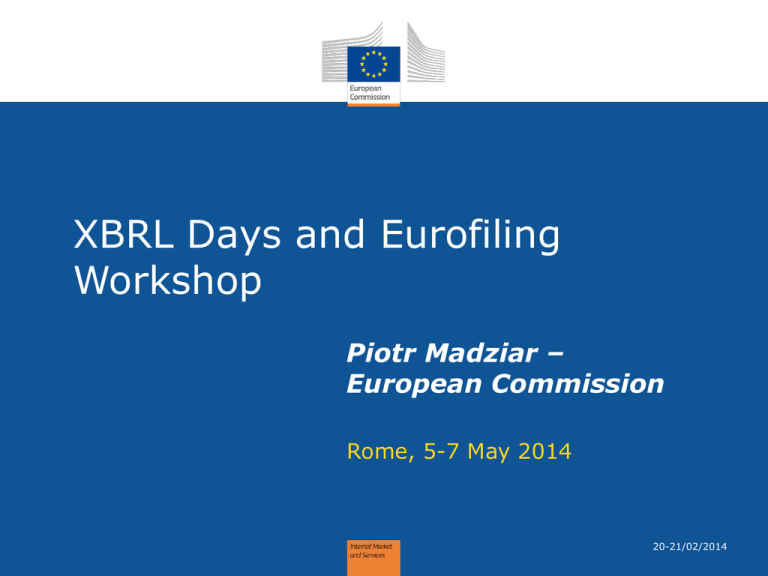

European Institutions update

advertisement

XBRL Days and Eurofiling Workshop Piotr Madziar – European Commission Rome, 5-7 May 2014 20-21/02/2014 1 Context EP, Barroso II financial initiatives: SSM, ESAs BRIS Accounting Directive Transparency CRDIV Solvency Main Challanges Timing: • EBA now • BRIS 2015 • TD 2016 • Solvency. 2 Barroso II Commission – some achievements SSM ESAs TD Stres s tests EMIR AQR OTC SME account s CRDIV European Semester European Stability Mechanism Digital Agenda BRIS ICT standardisati on agenda CBV/ROV/RegOr CEN/DPM. 3 Brussel’s role Level 1 leader: Propose EU directives Negotiate with EP and Council Publish framework Legislation (Directives) Level 2 – typically assistance only: Monitor ITS development (incl. DPM, taxonomies, implementation etc.) Comfort EP and Council (if necessary) Publish ITS 4 Level 1 examples: ESMA will develop draft ESEF (like XBRL) and submit it to COM by end 2016. All issuers will file ESEF annual financial reports as of 1/1/2020, ESMA will develop and run EEAP where all regulatory info (now in OAMs), single cross-border search etc. will be available. BRIS: COM will develop and run BRIS, an exchange platform assuring cross-border multi-language access, unique identification, features, universal search etc. 5 2014 -2020 EP Hot topics Solvency? Fiscal Union? Transparency of budgets incl. transactional level Standardisation EU economic monitoring and risk management • Blend private industry standards with official ones •Digital EU endorsement of int’l standards economy • • Complete digital agenda Translate achievements into growth advantages 6 Non – TD criteria There are several strategic issues that should play a role once the Commission considers the adoption of the ITS: - We promote interoperability, burden reduction and re-use of data, - We support international standards, especially if their adoption in the EU enhances financial stability, free trade and investments - We promote open data in open standards Several strategic EU acts and docs, G8 an G20 declarations etc. outline those objectives. 7 Duplication of fiscal and supervisory data Tax administration costs Business Register / Corporate Transparency costs Corporate Fiscal Data (VAT, CIT, PIT… Data OAM Financial supervision (ESAs, their members, ECB… Cost of statistics… OAM Data Supervisory Data Statistical Data Busines s 8 Simplification & burden reduction - SBR concept Taxation Business Register / Corporate Data costs Transparency (VAT, CIT, PIT… OAM Financial supervision Statistics Repository of reusable data Busines s 9 XBRL -> national GAAPs issue EU core taxonomy IFRS for all EU issuers Basis EU Accounting directive IFRS Options • National regulatory extensions? IFRS for SME? • Company extensions? Pros • Brand new Directive • Two birds in one shot – electronic reporting requirement in Accounting Directive resolved Cons • Is it still ESEF? • In 2002 IFRS was • Is national framework costselectively applied for efficient? a reason • Who will do it? • IFRS for SME received • May require extensive review of mixed views in the EU. national GAAPs 10 • True ESEF • Completion of IAS reform of 2002 XBRL challenges Learn, test and use at the same time Legacy systems, business case National rules and practices Due process for EU adoption of international standards 11 Thanks for your attention! Questions? All the comments are of personal nature and cannot be taken for an official position of the Commission. 12