Third-Party Service Providers

advertisement

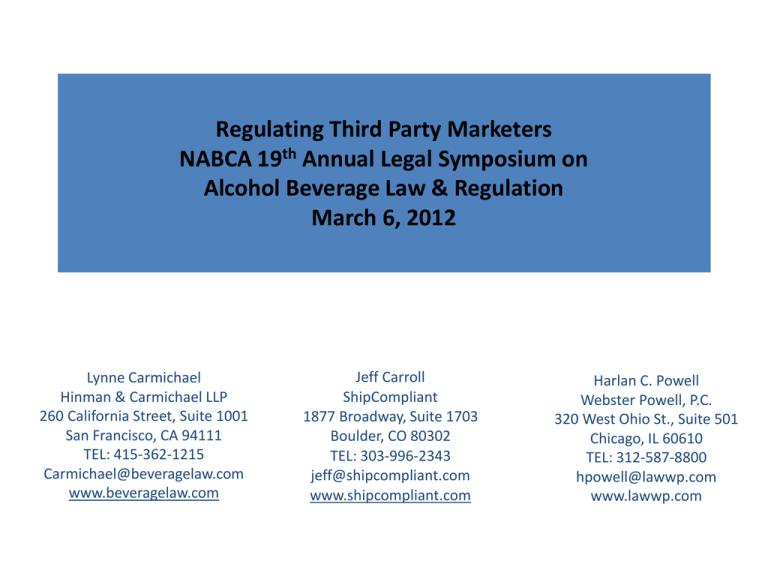

Regulating Third Party Marketers NABCA 19th Annual Legal Symposium on Alcohol Beverage Law & Regulation March 6, 2012 Lynne Carmichael Hinman & Carmichael LLP 260 California Street, Suite 1001 San Francisco, CA 94111 TEL: 415-362-1215 Carmichael@beveragelaw.com www.beveragelaw.com Jeff Carroll ShipCompliant 1877 Broadway, Suite 1703 Boulder, CO 80302 TEL: 303-996-2343 jeff@shipcompliant.com www.shipcompliant.com Harlan C. Powell Webster Powell, P.C. 320 West Ohio St., Suite 501 Chicago, IL 60610 TEL: 312-587-8800 hpowell@lawwp.com www.lawwp.com State and Federal Alcoholic Beverage Law: Only licensees may exercise license privileges. Includes: Purchasing decisions. Pricing decisions. Fulfillment of orders. Profiting from sale of alcoholic beverages. Biggest issue tends to be fees for services provided—if based upon sale of alcoholic beverages (such as percentage basis) then problematic. State and Federal Alcoholic Beverage Law: Suppliers cannot supply anything of value to retailers unless specifically allowed. Includes: Shelf-stocking. Point-of-sale materials. Wine lists – on tablets? Directing consumer orders to particular retailers with three-tier interstate retail deliveries? Biggest issue tends to be suppliers indirectly providing something of value to retailers—even if there is an exception for providing the service. Distinguishing Characteristic – the third party controls the customer base, has invested in the customer experience and has a stake in the customer experience being positive. Compensation: Licensee pays Wine Club a royalty or other fee for access to membership base and right to use Wine Club trademark and membership list in different ways. Defining Characteristic: Use of multiple media, such as video or TV, to reach consumer with visual sales message, either live or taped. Order information often processed by telephone banks. Compensation formula: percentage of total revenue produced through medium. Potential Problems: order acceptance process and payment protocols “operators standing by…” Customer virtually directed to retailer or winery. Licensee accepts and processes the sale. Customer clicks on product. Compensation: percentage of revenue based on traffic through site Potential Problem: Customers want to have one shopping cart for all their purchases. This will not work with alcoholic beverages under direct shipment permit regulations. One-time, limited-offer, purchase. Customer buys a voucher from flash site for a specific product (or is directed to seller’s site). Customer redeems voucher at retail or producer licensee location. Potential Problem: When the flash site controls the customer and the transaction. INDUSTRY ADVISORY Third Party Providers In June 2009, the Department issued an Industry Advisory entitled “Unlicensed Third Party Service Providers.” In that Advisory, the Department expressed concern about activities engaged in by unlicensed providers of certain services to licensees in connection with the sale of alcoholic beverages, particularly in the context of Internet sales. A number of regulatory issues and concerns were identified. Since the issuance of that Advisory, the Department has received numerous inquiries seeking clarification or further guidance in the context of various unlicensed activities and licensee relationships with unlicensed service providers. In response, in February 2011, the Director of the Department asked stakeholders to present an evaluation of the different types of services offered and to address issues posed by existing laws and regulations. The Department was consulted throughout this process and worked with stakeholders to address the issues presented. Although the Department remains concerned that certain activities by Third Party Providers may violate California law, particularly in the areas of sales by a person without a license and the exercise of impermissible control of a licensee by a person without the privilege of that license (Business and Professions Code section 23300), the Department believes that licensees and Third Party Providers can form business relationships that facilitate lawful transactions for sales of alcoholic beverages over the Internet. Accordingly, the Department now issues the following advisory guidelines to assist licensees and unlicensed Third Party Providers in complying with California law: For the purposes of this advisory, the term “Third Party Provider” refers to unlicensed entities that are involved with the promotion, marketing, and facilitation of sales of alcoholic beverages by licensees over the Internet. Third Party Providers are involved in one or more of the steps in the transfer of title of an alcoholic beverage from a licensee to a consumer, such as placement of advertising, making recommendations to consumers, directing consumers to licensees, receiving orders and passing them on to licensees, processing payments, and assisting with shipping arrangements. October 2011 Third-Party Merchandisers/ Demo Companies • 3rd party merchandisers are agents of the licensee and may perform services that the licensee may lawfully perform itself… ▫ BUT they may not be involved at all in the sale transaction or take title (i.e., pay for) the products being demonstrated/poured for customers. The TTB is “in the enforcement business” -John Manfreda, Administrator, at NCSLA, Chicago, IL. June 30, 2008 and Nashville June 18, 2009 HEADLINES FROM TTB.GOV IN 2011, TTB ACCEPTS offers in compromise totaling $1.9 million from six industry members alleged to have violated the federal tied house “slotting fee” provisions with regard to advertising and display items furnished to Harrah’s Hotels and Casinos in Las Vegas by a third- party merchandising company. In June of 2012, the TTB issued a circular regarding industry members’ participation in retail programs . . . Industry Circular DEPARTMENT OF THE TREASURY Alcohol and Tobacco Tax and Trade Bureau Number: 2012-01 Date: January 11, 2012 To: Proprietors of Distilleries, Bonded Wineries, Bonded Wine Cellars and Breweries, Importers and Wholesalers of Distilled Spirits, Wines and Malt Beverages, and Other Interested Parties. 1. What is the Purpose of this Circular? The Alcohol and Tobacco Tax and Trade Bureau (TTB) issues this industry circular to inform all industry members and other interested parties of the Bureau's position regarding participation in retail promotional programs. In this circular, TTB provides guidance on its views of several permissible and impermissible activities for industry members who provide promotional support to alcohol beverage retailers. The circular also reminds industry members that furnishing things of value to alcohol beverage retailers for the purpose of obtaining the retailer's express or implied agreement to place the industry member's products on any particular shelf or in any particular display space may result in Tied-House violations of the Federal Alcohol Administration Act (FAA Act), 27 U.S.C. 205(b). 2. What is TTB's Authority to Issue this Guidance? TTB administers the Tied-House provisions of the FAA Act as promulgated under Title 27, Code of Federal Regulations (CFR), part 6 (27 CFR part 6). The part 6 regulations, among other things, restate the statutorily prohibited means to induce, including but not limited to furnishing, giving, or selling any equipment, fixtures, signs, supplies, money, services, or other things of value to a retailer, subject to the exceptions listed under Subpart D (27 CFR 6.81 – 6.102), or the "Subpart D" exceptions or items. TTB regulation 27 CFR 6.21(c) deems certain things of value, such as product displays, point of sale advertising materials, equipment and supplies, and outside signs, as limited exceptions to the general rule that furnishing things of value to retailers constitutes an unlawful inducement. TTB's regulations deem a promotion wherein an industry member rents display space at a retail establishment (i.e., where the industry member pays "slotting allowances") as both an interest in the retailer's property, as proscribed by 27 CFR 6.21(b) and a payment to the retailer for rendering a display service, as proscribed by 27 CFR 6.21(d). (See also 27 CFR 6.35 and 27 CFR 6.56.) Further, an industry member that purchases or rents display, shelf, storage, or warehouse space from a retailer places the retailer's independence at risk, as outlined under 27 CFR 6.152(b). 3. What Action Has TTB Taken? TTB recently settled a series of trade practice investigations wherein the Bureau alleged violations under § 6.21(b), (c) and (d) that involved several industry members' participation in a retailer-initiated alcohol beverage promotional program. TTB alleged that through this promotional program, industry members directly or indirectly furnished retailers with things of value that were subject to the Subpart D exceptions, as well as things of value that were not subject to such exceptions. TTB further alleged that the specific purpose for furnishing these things of value was to assure preferential shelf and display space for the participating industry members' alcohol beverage products. Specifically, the retailer and the industry members mutually agreed that the retailer would place the participating industry members' products in specific locations within the retailer's premises. It is the industry member's responsibility to review, evaluate, and provide guidance to the third-party promotional company to ensure that the funds provided to the third-party promotional company are used in compliance with all Subpart D requirements. The industry member should be especially mindful if the selected third-party promotional company is owned, created, operated, or controlled by the retailer or is in any way acting on behalf of the retailer. In such cases, TTB may consider the industry member's furnishing of funds to the third-party promotional company as an indirect means to induce to the retailer. Best Practices for Industry Members • The supplier shall make NO fees or other payments for participating in merchandising activities to the retailer or anyone acting on the retailer’s behalf. • The retailer shall make ALL decisions concerning the purchase, placement, promotion, pricing, inventory and stock management of all alcoholic beverage products. • A supplier or its agent shall make only recommendations to the retailer – identify them as recommendations only. • A supplier or its agent shall not touch any competitor’s product in any retail store. Avoid involvement with any aspect of a competitor’s activities with the retailer. • Educate agents with respect to these practices. • Use a Certificate of Compliance! Jeff Carroll 3/6/2012 (888) 449-5285 Ensuring Licensee Control info@shipcompli ant.com (888) 449-5285 info@shipcompli ant.com Product Availability Licensee controls which products are available, and the inventory quantities. Fulfillment Licensee controls fulfillment and delivery times. State Availability Only list products that are available in the consumer’s state (888) 449-5285 info@shipcompli ant.com Sales Tax Collect accurate destinationbased sales tax based on licensee’s preferences. Tax collected is passed to the licensee. Licensee Display Make sure licensee is presented clearly to the consumer at checkout and on any consumer invoices. Address Validation Thorough address validation performed prior to compliance checking. Compliance at Time of Transaction • Address validation • Accurate sales tax collection (based on licensed seller’s tax policies, which will differ from licensee to licensee) • Age verification (use a third party like Lexis Nexis or IDology • Compliance check (against licensed seller’s permit) ▫ ▫ ▫ ▫ ▫ License verification Dry areas Volume limits Product registration State-specific rules • Payment authorization (do not capture funds) Licensee Acceptance • Important to give the licensee an opportunity to reject or accept the request Payment Capture • Capture funds after licensee acceptance and shipment notification • Payment Processing Examples: ▫ Single merchant account that settles into a trust account, which is then disbursed to licensee and service providers ▫ Dynamic gateway – merchant account of licensee used, funds settle directly into licensee’s bank account Funds Disbursement • Happens on a periodic basis (weekly, for example) • Licensed seller pays advertiser for services • Licensed seller pays for shipping and fulfillment services