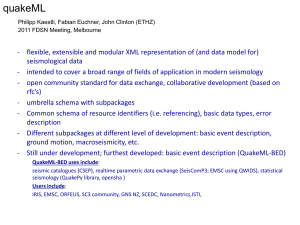

Financial manager - ETH

advertisement

Corporate Finance Fundamentals of Financial Management Dr. Markus R. Neuhaus Dr. Marc Schmidli, CFA Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 1 Corporate Finance: Course overview 2013 20.09. Fundamentals M. Neuhaus & M. Schmidli 27.09. No lecture 04.10. Interpreting Financial Statements M. Neuhaus & M. Schmidli 11.10. Mergers & Acquisitions I & II (4 hours) M. Neuhaus & S. Beer 18.10 Investment Management M. Neuhaus & P. Schwendener 25.10 Business Valuation (4 hours) M. Neuhaus & M. Bucher 01.11 Value Management M. Neuhaus, R. Schmid & G. Baldinger 08.11 No lecture 15.11 Legal Aspects Ines Pöschel 22.11 Turnaround Management M. Neuhaus & R. Brunner 29.11 No lecture 06.12 Financial Reporting M. Neuhaus & M. Jeger 13.12 Taxes (4 hours) M. Neuhaus & M. Marbach 20.12 Summary Repetition M. Neuhaus Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 2 Markus R. Neuhaus PricewaterhouseCoopers AG, Zürich Phone: Email: Grade Qualification Career Development Subject-related Exp. Lecturing Published Literature Other professional roles: Autumn Term 2013 +41 58 792 40 00 markus.neuhaus@ch.pwc.com Chairman Doctor of Law (University of Zurich), Certified Tax Expert Joined PwC in 1985, became Partner in 1992 and CEO from 2003 – 2012, became Chairman in 2012 Corporate Tax Mergers & Acquisitions SFIT: Executive in Residence, lecture: Corporate Finance Multiple speeches on leadership, business, governance, commercial and tax law Author of commentary on the Swiss accounting rules Publisher of book on transfer pricing Author of multiple articles on tax and commercial law, M&A, IPO, etc. Member of the board of économiesuisse, member of the board and chairman of the tax chapter of the Swiss Institute of Certified Accountants and Tax Consultants Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 3 Marc Schmidli PricewaterhouseCoopers AG, Zürich Phone: Email: Grade Qualification Career Development Lecturing Published Literature +41 58 792 15 64 marc.schmidli@ch.pwc.com Partner Dr. oec. HSG, CFA charterholder Corporate Finance PricewaterhouseCoopers since July 2000 Euroforum – Valuation in M&A situations Guest speaker at ZfU Seminars, Uni Zurich, ETH, etc. Finanzielle Qualität in der schweizerischen Elektrizitätswirtschaft Various articles in „Treuhänder“, HZ, etc. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 4 Contents Learning targets Pre-course reading Lecture „Fundamentals of Financial Management“ Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 5 Learning targets Financial management Understanding the flow of cash between financial markets and the firm‘s operations Understanding the roles, issues and responsibilities of financial managers Understanding the various forms of financing Financial environment Knowing the relevant financial markets and their players Being aware of various financial instruments Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 6 Contents Learning targets Pre-course reading Lecture „Fundamentals of Financial Management“ Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 7 Pre-course reading Books Mandatory reading Brigham, Houston (2012): Chapter 2 (pp. 25-53) Optional reading Brigham, Houston (2012): Chapter 1 (pp. 2-21) Volkart (2011): Chapter 1 (pp. 43-69) Volkart (2011): Chapter 7 (pp. 579-604) Bodie, Kane & Marcus (2009): Chapter 12 (p. 384-395) Slides Slides 1 to 11 – mandatory reading Other Slides – optional reading, will be dealt within the lecture Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 8 Contents Learning targets Pre-course reading Lecture „Fundamentals of Financial Management“ Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 9 Agenda I 1. Introduction Setting the scene Who is the financial manager? Roles of financial managers Shareholder value vs. Stakeholder value concept 2. Financing a business External financing Internal financing Asymmetrical information Pecking order theory Capital structure Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 10 Agenda „fundamentals of financial management“ II 3. Financial markets Different types of markets Financial institutions Financial instruments Efficient market hypothesis (EMH) 4. Q&A and discussion Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 11 Agenda: Introduction Setting the scene Who is the financial manager? Roles of financial managers Shareholder value vs. stakeholder value concept Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 12 Setting the scene I “Environment” Company (1) (2) Firm‘s operations (a bundle of real assets) Financial manager (e.g. CFO) (3) (1) (2) (3) (4a) (4b) (4a) Financial markets (investors holding financial assets) (4b) cash raised by selling financial assets to investor cash invested in the firm’s operations and used to purchase real assets cash generated by the firm’s operations reinvested cash cash returned to investors Source: Brealey, Myers, Allen (2012), 34. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 13 Setting the scene II Managers do not operate in a vacuum Large and complex environment including: Financial markets Taxes Laws and regulations State of the economy Politics, public view, press Demographic trends etc. Among other things, this environment determines the availability of investments and financing opportunities Therefore, managers must have a good understanding of this environment Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 14 Who is the financial manager? Chief Financial Officer (CFO) (responsibilities: e.g. financial policy, financial planning) Treasurer (responsibilities: e.g. cash management, currency trading, banking relationships) Controller (responsibilities: e.g. preparation of financial statements, accounting, taxes) Source: Brealey, Myers, Allen (2011), 34. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 15 Roles of financial managers Generally, managers do not own the company, they manage it The company belongs to the stockholders. They appoint managers who are expected to run the company in the stockholders’ interest Basic goal is creating shareholder value two problems emerge from this constellation Agency dilemma: asymmetric information and divergences of interests between principal (stockholders) and agent (management) lead to the so called agency dilemma which also arises in the context of financing decisions ( pecking order theory) Shareholder value vs. stakeholder value: shareholders own the company. Does a company merely consider the owners’ interest or the interests of all stakeholders affected by the company’s business activities? Also see Brealey, Myers, Allen (2011), 37-43. Autumn Term 2013 hires Agent Principal Stable growth, dividends, control Empire building, independence, high salaries performs Illustration: Agency dilemma Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 16 Shareholder value vs. stakeholder value I Shareholders’ wealth maximization means maximizing the price/value of the firm’s common stock Shareholders are considered as the only reference for the company’s course of business and performance Other stakeholders are strategically considered only to the extent they could have an impact on the stock price, the stockholders’ wealth Where does the risk in the shareholder value concept lie? ( incentives, sustainability) Employees If a new pharmaceutical product is launched, health considerations will be relevant only to the extent they could endanger the firm’s stock price (e.g. through a lawsuit) Suppliers Customers Value Investors State Also see Brealey, Myers, Allen (2011), 37-43. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 17 Shareholder value vs. stakeholder value II Stakeholder value means maximizing the company’s value taking into account every stakeholder the company affects in the course of its business The importance of stakeholder management is continually growing How can a company motivate its managers towards a careful handling of the company’s stakeholders? ( compensation programs, corporate governance) If a new pharmaceutical product is about to be launched, every stakeholder’s interest must be assessed and the product is introduced only if every interest can be honored Does the plant pollute the air? Could the new product be harmful to customers? etc. Employees Suppliers Customers Value Investors State Also see Brealey, Myers, Allen (2011), 37-43. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 18 Agenda: Financing a business External financing Internal financing Asymmetrical information Pecking order theory Capital structure Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 19 Possibilities of financing a business The management makes decisions about which investments are to be undertaken and how these investments are to be financed There are three basic ways of financing a business Equity External Debt 2. Debt 3. Equity Internal 1. Internal Internal financing Pecking order theory diagram Why would a company prefer debt over equity? ( cost of capital) Source: Brigham, Houston (2012), 465-466. For further reading also see Brigham, Houston (2012), 438-480. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 20 Financing a business – overview External financing: A company receives capital from outside the company, e.g. credit, capital increase Internal financing: The major part of a firm’s capital typically comes from internal financing (retained cash flows, profits from operating activities), except for e.g. startup or turnaround situations Liquidation financing: In this context, liquidation financing refers to the liquidation of assets (e.g. divesting of certain business areas) which have a financing effect External financing Internal financing Debt financing Equity financing Credit financing Issuing shares Liquidation financing Divesting activities Mezzanine / Hybrid financing Financing effect from accruals Retained cash flows and profits Financing impact from value of depreciation Source: Volkart (2011), 581. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 21 Financing a business – external financing Debt financing Given a solid capital base, the use of debt is reasonable as it broadens the financing base provided a certain amount of leverage exists and considerable tax advantages1) can be exploited The risk borne by a creditor is the risk of default driven by the company’s market and operational risks Because a bank would not lend money to a company without checking its financial health, a certain amount of debt gives a positive signal to other business partners Equity financing Equity serves as the capital base of a company because equity can not be withdrawn or taken away from the company In the case of incorporated companies (e.g. AG), equity bears the major part of the risk A company can raise equity capital by selling shares privately or publicly (e.g. IPO or capital increase) 1) General rule: Interest expense is tax deductible, dividend distributions not. Source: Volkart (2011), 583ff. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 22 Financing a business – internal financing Internal financing or self-financing Internal financing is determined by the cash flow from operating activities Internal financing means generation of cash flows from operating activities without using external sources Internal financing happens “automatically” as a consequence of the operating activities of a company From the company’s perspective, self-financing is the most convenient way of financing as the company does not have to debate with creditors and the discussion with equity holders is limited to the question of how much of the profits should be distributed. ( pecking order theory; see Slide 26) As opposed to external financing, internal financing is not fully reflected on the company’s balance sheet Source: Volkart (2011), 586ff. Also see Brigham, Houston (2012), 465-466. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 23 Asymmetrical Information I The problem of asymmetrical information does not occur only between principal and agents, but arises each time financing is needed as the fundamental interests of debt holders and shareholders differ significantly. Shareholders assume that management is negatively influenced by debt holders towards making “safe” investments in order to minimize the probability of default Debt holders will try to establish credit covenants in order to gain more control over investment decisions and the course of business Shareholders, on the other hand, prefer investment opportunities with potentially high returns as their shares will gain in value as the company’s cash flows grow As a result, each party tries to influence the management: Debt holders try to establish favorable credit covenants Shareholders set incentives through compensation plans Source: Volkart (2011), 584ff. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 24 Asymmetrical Information II Why do the different parties not get together and solve the problem? Game theory ( Nash) shows us that in such strategic situations with conflicts of interest, each party begins by holding back information in order to strengthen its negotiating position Shareholders do not know about possible credit covenants whereas creditors do not know anything about the investors’ motivation and decisions Law prohibits typically a company to disclose all relevant information in conclusion, we find a triangle situation in which each party tries to maintain or gain as much power and influence as possible in order to secure its interests Management Debt holders Autumn Term 2013 Shareholders Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 25 Pecking order theory I Bridging the problems of asymmetric information can be very expensive. The less information an investor has, the higher the required rate of return for the investment is. An outflow is the so called pecking order theory demonstrating the order in which the company prefers to finance its business 1. Internal financing No prior explanations to investors or creditors (except for level of dividends) Equity 2. Debt financing Banks want information about credit risk Management must provide possible creditors with sufficient and reliable information 3. Equity financing Potential shareholders will challenge the “real” share price as they have to rely “blindly” on the information given by the management Shareholders will request a low price as they cannot be sure whether the share is worth the price This makes equity capital very expensive for a company Debt Internal financing Pecking order theory diagram Source: Volkart (2011), 592ff. Also see Brigham, Houston (2012), 465-466 or Brealey, Myers, Allen (2011), 488-492. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 26 Pecking order theory II The importance of the different ways of financing fundamentally changes over the lifetime of a company From the perspective of a major listed company, internal financing is the most significant kind of financing Vital influence on conditions for external financing (stable operating cash flows more favorable credit conditions and higher stock prices) Without solid operating cash flows, a company will not be able to survive Phase of business Start up Expansion Consolidation Preferred financing Private equity / Venture capital - Equity - Debt - Internal Internal Illustration: How financing preferences can alter over a company‘s lifecycle Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 27 Capital structure The decisions on how the assets of a company are financed leads to the question: what is the optimal capital structure of a company? The relation between debt and equity reflects a company’s risk and is also called financial leverage The optimal capital structure is highly dependent on the industry Investors often urge greater financial leverage, and thus more risk, in order to generate more profit in relation to the equity capital invested. In addition, interests paid are taxdeductible. The capital structure can be defined by the debt to equity ratio Debt to Equity Financial Leverage Debt Equity Financial risk increases as the company chooses to use more debt What is the optimal capital structure? Source: Volkart (2011), 596ff. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 28 Agenda: Financial markets Different types of markets Financial institutions Financial instruments EMH Behavioral Finance Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 29 Basic need for financial markets Businesses, individuals and governments need to raise capital Company intends to open a new plant Family intends to buy a new home City of Zurich intends to buy a new generation of trams Of course, people and companies save money and have money of their own. However, saving money takes time and has opportunity costs Mr. Meier earns CHF 10’000 per month and has expenses of CHF 7’000. If he intends to buy a home worth CHF 1’000’000, it will take him a long time to save enough. But what if he wants to buy this home today? In a well-functioning economy, capital flows efficiently from those who supply capital to those who demand it Source: Brigham, Houston (2012), 26ff. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 30 Financial markets Physical asset vs. financial asset markets Spot vs. future market Money vs. capital markets Primary vs. secondary markets Private vs. public markets Recent trends: Globalization of financial markets Regulation and international cooperation of regulators Increased use of derivative instruments, especially as risk management (hedging) and speculation instruments. The current financial crisis reduced the total size of the derivatives market substantially. However, it is still far bigger in most areas as for instances in 2001. Source: Brigham, Houston (2012), 29ff. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 31 Financial Institutions Investment banks Commercial banks Financial services corporations Insurances ETFs, hedge- and mutual funds Other: Credit unions, pension funds, private equity companies The trend is clearly towards bank holdings / financial services conglomerates that provide all kinds of services under one roof. The large investment banks disappeared. Against that, in the current environment many banks are disposing of certain business divisions and focus on core competences. This trend will continue for regulatory reasons (lower risks, de-leveraging, etc.) and some trends towards nationalization and “home market” focus in the banking sector. Source: Brigham, Houston (2012), 34f. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 32 Financial instruments Stock: Unit of ownership which entitles the owner to exercise his voting right on corporate decisions and receive a certain payment (dividend) each year. No other obligation, nor any loyalty required. Bond: The issuer (company) owes the holder (investor) a certain amount of debt and is obliged to pay the holder a certain interest rate (coupon) and to repay the initial amount at a pre-determined date. Option: Financial contract which entitles the buyer to buy (call option) or sell (put option) a certain underlying asset at a pre-specified price at or before a certain point in time. Structured product: Packaged investment strategy, a mixture of different investment instruments, mostly derivatives which are intended to exploit, for instance, a certain market constellation. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 33 Efficient market hypothesis (EMH) vs. behavioral finance The EMH states that (1) share prices are always in equilibrium (2) the prices reflect all available information (e.g. on opportunities or risks) and everything that can be derived from it Therefore, it is impossible to “beat the market” Prices in financial markets react very quickly and fairly to new information Share prices are unpredictable as the information that influences prices also occurs by chance. We can analyze past stock price developments, but we cannot foresee any future results However, investors are no machines that can process all available information. This may lead to the fact that irrational factors come into play behavioral finance Source: Brigham, Houston (2012), 47ff. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 34 Behavioral finance I Behavioral finance assumes that investors may not always act rationally when investing in financial markets, primary due to observed market anomalies. Behavioral finance is based on two key elements. The theory is based on findings from psychology and suggests that irrational behavior arises as the EMH falls short of considering how investors and managers come to a decision. Behavioral finance also shows that possibilities of arbitrage are limited. Criticism states that behavioral finance is not an unified concept which explains different anomalies but is rather based on different elements. Source: Brigham, Houston (2012), 50; Bodie, Kane & Marcus (2009), 384 ff. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 35 Behavioral finance II Irrationalities due to: Forecasting errors: investors typically attach too much weight on recent experience Overconfidence: people tend to overestimate their abilities Conservatism: too slow to react to new information in the market Sample Size Neglect and Representativeness: investors often incorrectly assume that a small sample of historical evidence will be representative of future performance Framing: how decisions are framed affect the decision making process Regret Avoidance: unconventional decisions lead to more disappointment if the outcome is negative Possible limits to arbitrage are: Fundamental Risk: there is an uncertainty about how long an investor will have to wait for the stock to fully reflect its value Implementation cost: transaction costs can make it unattractive to exploit the mispricing Model Risk: valuation model of the security is incorrect Source: Brigham, Houston (2012), 50; Bodie, Kane & Marcus (2009), 384 ff. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 36 Final comments As the environment (capital markets, society, suppliers etc.) has significant influence on a company, the financial managers must have a profound understanding of this environment in order to make the right decisions A financial manager makes decisions about which investments are to be undertaken and how these investments are to be financed (treasurer) and accounted for (controller) Financing can come either from outside (external: debt and equity) or from inside (internal: internal financing through profit from operating business) the company The problem of asymmetrical information arises whenever financing is needed, because the level of information and the interests of debt holders and shareholders differ significantly. Bridging these problems can be very expensive and leads to the so called pecking order theory The theory that capital markets take into account all information and all that can be derived from this information, is called the efficient market hypothesis. However, as explained with the behavioral finance theory, not all investors act rationally in their decision making process. Autumn Term 2013 Markus Neuhaus I Corporate Finance I neuhauma@ethz.ch 37