Recommendation

advertisement

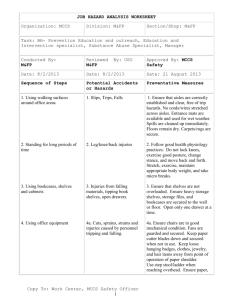

Recommendations for a Legal and Regulatory Framework for Microfinance in Serbia Access to finance a problem for SMEs • Small and medium enterprises (SMEs) are critical to increasing employment and economic growth and decreasing poverty in Serbia • Two-thirds of SMEs in Serbia report problems getting credit • Available loan products are poorly suited for SMEs in terms of loan size, collateral requirements, and physical access • Microcredit provides an alternative, market-based approach to providing financing better suited to the needs of SMEs However, legal and regulatory framework prevents existence of “real” microfinance industry in Serbia 1 of 13 Microfinance has real potential in Serbia High demand/unmet need Strong investor interest • Estimated potential portfolio for microcredit is EUR 267M • Only 2-7% of current demand being met • “Missing” middle between current microcredit (EUR 9601,600) and bank loans (> EUR 10,000) • Investors actively looking for investment opportunities given saturation in other markets in region • Numerous investors already expressed interest in investing ~EUR 40M in existing providers With an enabling legal framework, it is estimated that loan portfolios could expand by 50% at existing providers alone 2 of 13 Components of microcredit regulatory framework Law on Microcredit Companies (MCCs) Harmonization with Existing Regulatory Framework Overindebtedness and Financial Crimes 3 of 13 Guiding principles for MCC law Key components of MCC law • Definition of “microcredit” • Registration of MCCs • Ownership and governance • Permissible activities • Prudential regulation, loan loss provisioning, and risk management • Supervision • Reporting and auditing requirements • Others… Strike appropriate balance between providing minimum requirements for key legal components while not overregulating Overburdening non-deposittaking institutions with excessive regulation increases compliance costs, ultimately decreasing access to finance A risk-based approach is recommended by the EU 4 of 13 Definition of “microcredit” Considerations Type of Client & Use of Funds Loan Size Limits Recommendations • Helps prevent regulatory arbitrage by institutions with different objectives • However, limits flexibility of MCCs to serve necessary range of clients • Difficult to determine where to draw the line • If included, use general language to convey policy intentions • Goal of microfinance to “alleviate poverty, increase employment, assist in the development of social entrepreneurship” in Kyrgyz Republic • Recommended as more concrete method to maintain policy focus • Two-pronged approach: 1. Higher single loan size limit, plus 2. Lower average outstanding loan balance • Two-pronged approach allows MCCs to serve some clients with larger loans, while majority of clientele remain low-income clients • Look to current microcredit operations as starting point, consider how portfolio may evolve with MCC law 5 of 13 Registration of MCCs Case Studies • Microcredit agencies (MCAs) and microcredit companies (MCCs) obtain certificate (not license) from National Bank of Kyrgyz Republic • Documents required: o Application o Establishment documents o State registration certificate o List of members of management body o Confirmation of funds as charter capital • Minimum capital for NBFIs in Romania is EUR 200,000 • Initial minimum capital requirement: low enough to allow entry of new MCCs, high enough to bar entry of unprofessional institutions • Risk-based approach recommended, with less extensive registration requirements than for banks • “Licensing” vs. “registering” • May require registrants submit: – Ownership structure – Directors and senior management – Evidence of minimum capital paid – Initial operating plans • Link requirements to confirming compliance with regulatory objectives 6 of 13 Ownership and governance and permissible activities Ownership and governance Permissible activities • Ensure requirements don’t impede foreign equity holders or foreign investors • Include “fit and proper” requirements for directors and officers, adapted for microfinance • Other corporate governance rules should be limited and not overly prescriptive • Permission to lend • Consider: financial leasing, guarantees, factoring, insurance intermediaries, payment and transfer • Allow secondary, related activities (i.e. training) • Ban deposit-taking, though clarify regarding cash collateral 7 of 13 Prudential regulation and loan loss provisioning • In general, prudential regulation not warranted for MCCs as they do not pose systemic risk or put public savings at risk • Imposes unnecessarily high compliance costs on supervisors and MCCs alike • If standards issued for certain topics such as client documentation, leverage ratios, or risk management, should be adapted for microlending simplified and allow room for innovation • MCCs need ability to create loan loss reserves and write-off such serves for tax purposes • Any guidelines for loan classification should be adapted for microcredit (i.e. more aggressive provisioning for delinquent microloans) 8 of 13 The supervision question Responsibilities • Maintain public register of approved MCCs could include: • Serve as repository of periodic reports by MCCs • Develop and promote sound financial performance and consumer protection standards Option 1: Delegated supervision (recommended) • Industry association serves as agent for MoFE or NBS • Provides formal link to financial regulator and allows MoFE or NBS to monitor and control association’s work • Association could collect registration info, collect data and reports, recommend sanctions, and provide consumer protection oversight Option 2: Self-regulation • Supervision by industry association • Has traditionally achieved mixed results with respect to prudential supervision • May still be beneficial for consumer protection purposes, and least costly option • Association could take on responsibilities listed above 9 of 13 Harmonize with existing regulatory framework • Critical that financial consumer protection rules apply to MCCs and microcredit clients • Typical microfinance clients have low-literacy, low-numeracy, and less familiarity with formal financial sector • All providers of similar financial services should be held to same consumer protection standards, to provide level playing field and comprehensive protection to consumers • However, existing consumer protection rules in Serbia limited to natural persons or banks, resulting in gaps in coverage Recommendation: Revise rules to cover microenterprises and MCCs, and consider what body will be responsible for monitoring • Also harmonize: tax, accounting, payments, bank laws and regulations 10 of 13 Addressing overindebtedness and financial crimes Overindebtedness Financial crimes • Microfinance not inherently riskier than bank lending • Risk factors: irresponsible provider behavior, poor borrowing decisions by consumers, oversaturation of microcredit market • Tools to address risk: o Credit bureaus (mandate participation by MCCs) and assessment of creditworthiness o Disclosure and transparency o Financial literacy and education o Market monitoring • Non-depository microcredit providers not historically part of pyramid schemes or similar abuses • Regardless, MCCs should be subject to existing controls to prevent AML/CFT, fraud and financial crimes, and identity fraud • Financial Action Task Force (FATF) recommends risk-based approach, adapting rules for characteristics of microfinance (i.e. customer due diligence) 11 of 13 Complementary policy initiatives and long-term financial inclusion strategy • New MCC legal framework should be accompanied by welltargeted, complementary policy initiatives – Guarantee programs to domestic banks for wholesale funding to MCCs – Targeting of development funds – Reaching out to and encouraging investments from international investors, including shifting target of existing internationally-funded credit lines for SMEs to smaller loans/clients • Long-term financial inclusion strategy needs to be developed, addressing issue from multiple angles – When to transition to deposit-taking microfinance institutions (MFIs) – Strategic adjustments to prudential framework that encourage banks to move down market, balancing with need for financial stability and management of risk 12 of 13 Next steps to consider 1. 2. 3. 4. Assess the potential impact of microcredit in Serbia Assess the potential for investment in microcredit in Serbia Convene stakeholders and form an official working group Begin process of drafting MCC law 13 of 13