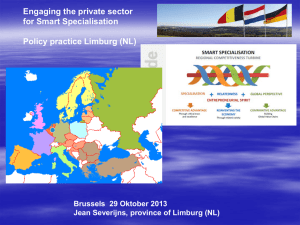

Doing business in the Netherlands

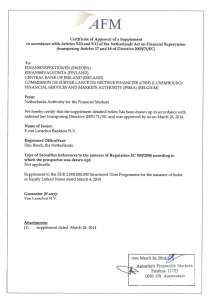

advertisement