EnvironmentAnalysisII

advertisement

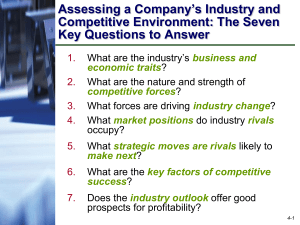

Strategy: Core Concepts and Analytical Approaches CHAPTER 3 Evaluating a Company’s External Environment Copyright © 2010 by Arthur A. Thompson and Glo-Bus Software, Inc. “Analysis is the critical starting point of strategic thinking.” Kenichi Ohmae Consultant and author Chapter Learning Objectives 1. To gain command of the basic concepts and analytical tools widely used to diagnose a company’s industry and competitive conditions. 2. To become adept in recognizing the factors that cause competition in an industry to be fierce, more or less normal, or relatively weak. 3. To learn how to determine whether an industry’s outlook presents a company with sufficiently attractive opportunities for growth and profitability. 4. To understand why in-depth evaluation of specific industry and competitive conditions is a prerequisite to crafting a strategy well matched to a company’s situation. The Key Topics Covered in Chapter 3 The Strategically Relevant Components of a Company’s External Environment Thinking Strategically About a Company’s Industry and Competitive Environment ► Question 1: What Kinds of Competitive Forces Are Industry ► ► ► ► ► Members Facing, and How Strong Is Each Force? Question 2: What Forces Are Driving Industry Change and What Impacts Will They Have? Question 3: What Market Positions Do Rivals Occupy—Who Is Strongly Positioned and Who Is Not? Question 4: What Strategic Moves Are Rivals Likely to Make Next? Question 5: What Are the Key Factors for Future Competitive Success? Question 6: Does the Outlook for the Industry Present the Company with Sufficiently Attractive Prospects for Profitability? Understanding a Company’s Situation Managers are not prepared to act wisely in steering a company in a different direction or altering its strategy until they have a deep understanding of two especially pertinent facets of a company’s situation: ► The industry and competitive environment in which the company operates and the forces acting to reshape this environment ► The company’s own market position and competitiveness—its resources and capabilities, its strengths and weaknesses vis-à-vis rivals, and its windows of opportunity. Insightful diagnosis of a company’s external and internal environment is a prerequisite for managers to succeed in crafting a strategy that is an excellent fit with the company’s situation Figure 3.1: From Thinking Strategically About the Company’s Situation to Choosing a Strategy A Company’s Macroenvironment A company’s macroenvironment includes all factors and influences outside the company’s boundaries that are important enough to have a bearing on the decisions the company ultimately makes about its direction, objectives, strategy, and business model. The categories of these forces and influences include ► ► ► ► ► ► General economic conditions Population demographics Societal values and lifestyles Governmental legislation and regulation Technology The immediate industry and competitive arena in which the company operates Figure 3.2: The Components of a Company’s Macro-environment Question 1: What Kinds of Competitive Forces Are Industry Members Facing? The state of competition in an industry is a composite of competitive pressures operating in five areas of the overall market: 1. Competitive pressures associated with the market maneuvering and jockeying for buyer patronage that goes on among rival sellers in the industry. 2. Competitive pressures associated with the threat of new entrants into the market. 3. Competitive pressures coming from the attempts of companies in other industries to win buyers over to their own substitute products. 4. Competitive pressures stemming from supplier bargaining power and supplier–seller collaboration. 5. Competitive pressures stemming from buyer bargaining power and seller–buyer collaboration. Figure 3.3: The Five Forces Model of Competition Analyzing the Five Competitive Forces: How to Do It Step 1: Identify the specific competitive pressures associated with each of the five forces Step 2: Evaluate how strong the pressures comprising each competitive force are (fierce, strong, moderate to normal, or weak?) Step 3: Determine whether the collective strength of the five competitive forces is conducive to earning attractive profits Competitive Pressures Created by the Rivalry among Competing Sellers Rivalry among competing sellers is usually the strongest of the five forces because ► When one firm deploys a strategy or makes a new strategic move that produces good results, its rivals typically respond with offensive or defensive countermoves of their own. ► This pattern of action and reaction, move and countermove, adjust and readjust produces a continually evolving competitive landscape where the market battle ebbs and flows, sometimes takes unpredictable twists and turns, and produces winners and losers. In effect, a market is a competitive battlefield where the contest among competitors is ongoing and dynamic. Figure 3.4: Weapons for Competing and Factors Affecting Strength of Rivalry The Common “Weapons” that Companies Use in Competitive Battles with Rivals Lower prices More or different performance features Better product performance Higher quality Stronger brand name and image Wider selection of models and styles Bigger/better dealer network Low interest rate financing Higher advertising and/or better ads Stronger product innovation capabilities Better customer service Stronger capabilities to provide buyers with custom-made products Better warranty coverage What Causes Rivalry to be Stronger? The rivalry among industry members is weaker when Competing sellers are active in making fresh moves to improve their market standing and business performance. Buyer demand is growing slowly. Buyer demand falls off and sellers find themselves with excess capacity and/or inventory. The number of rivals increases and rivals are of roughly equal size and competitive capability. The products of rival sellers are commodities or else weakly differentiated. Buyer costs to switch brands are low. One or more rivals are dissatisfied with their current position and market share and make aggressive moves to attract more customers. Rivals have diverse objectives and strategies and/or are located in different countries. Outsiders have recently acquired weak competitors and are trying to turn them into major contenders. One or two rivals have powerful strategies and other rivals are scrambling to stay in the game. What Causes Rivalry to be Weaker? The rivalry among industry members is weaker when Industry members move only infrequently or in a non-aggressive manner to draw sales and market share away from rivals. Buyer demand is growing rapidly. The products of rival sellers are strongly differentiated and customer loyalty is high. Buyer costs to switch brands are high. There are fewer than five sellers or else so many rivals that any one company’s actions have little direct impact on rivals’ business. Competitive Pressures Associated With the Threat of Potential Entry Several factors determine whether the threat of new companies entering the marketplace adds to the competitive pressures faced by industry members: The size of the pool of likely entry candidates and the resources at their command Whether the likely entry candidates face high or low entry barriers How attractive the growth and profit prospects are for new entrants Figure 3.5: Factors Affecting Threat of Entry Figure 3.5: Factors Affecting Threat of Entry Common Barriers to Entry The cost advantages enjoyed by industry incumbents Strong brand preferences and high degrees of customer loyalty High capital requirements The difficulties of building a network of distributors–retailers and securing adequate space on retailers’ shelves. Restrictive regulatory policies Tariffs and international trade restrictions The ability and willingness of industry incumbents to launch strong defensive maneuvers to maintain their positions and make it harder for a newcomer to build a clientele When Is the Threat of Entry Stronger? Entry threats are stronger when: The pool of entry candidates is large and some have resources that would make them formidable market contenders. Entry barriers are low or can be readily hurdled by the likely entry candidates. When existing industry members are looking to expand their market reach by entering product segments or geographic areas where they currently do not have a presence. Newcomers can expect to earn attractive profits. Buyer demand is growing rapidly. Industry members are unable (or unwilling) to strongly contest the entry of newcomers. When Is the Threat of Entry Weaker? Entry threats are weaker when: The pool of entry candidates is small. Entry barriers are high. Existing competitors are struggling to earn good profits. The industry’s outlook is risky or uncertain. Buyer demand is growing slowly or is stagnant. Industry members will strongly contest the efforts of new entrants to gain a market foothold. Factors That Make the Entry of New Competitors Likely Potential entrants are highly motivated to commit the resources needed to hurdle entry barriers when ► Market demand is growing rapidly ► The profit prospects for new entrants are good • When profits are sufficiently attractive, entry barriers are unlikely to be an effective entry deterrent. At most, they limit the pool of candidate entrants. The best test of whether potential entry is a strong or weak competitive force in the marketplace is to ask if the industry’s growth and profit prospects are strongly attractive to potential entry candidates. When the answer is no, potential entry is a weak competitive force. When the answer is yes and there are entry candidates with sufficient expertise and resources, potential entry is a strong competitive force. Competitive Pressures from the Sellers of Substitute Products Concept Substitutes matter when customers are attracted to the products of firms in other industries Examples Sugar vs. artificial sweeteners Eyeglasses and contact lens vs. laser surgery Music CDs vs. digital music players (iPod) How to Tell Whether Substitute Products Are a Strong Competitive Force Whether the competitive pressures from substitute products are strong, moderate, or weak depends on three factors: Whether substitutes are readily available and attractively priced Whether buyers view substitutes as being comparable or better How much it costs end users to switch to substitutes Figure 3.6: Factors Affecting Competition From Substitute Products When Is the Competition From Substitutes Stronger? Competitive pressures from substitutes are stronger when: Good substitutes are readily available or new ones are emerging. Substitutes are attractively priced. Substitutes have comparable or better performance features. End users have low costs in switching to substitutes. End-users grow more comfortable with using substitutes. When Is the Competition From Substitute Products Weaker? Competitive pressures from substitutes are weaker when: Good substitutes are not readily available or don’t exist. Substitutes are higher priced relative to the performance they deliver. End users have high costs in switching to substitutes. Signs that Competition from the Sellers of Substitute Products Is Strong There are three signals that competitive pressures from the sellers of substitute products are strong: Sales of substitutes are growing faster than sales of the industry being analyzed (an indication that the sellers of substitutes are drawing customers away from the industry in question). Producers of substitute products are moving to add new capacity. Profits of the producers of substitutes are on the rise. Competitive Pressures From Suppliers and Supplier-Seller Collaboration Whether the relationships between industry members and their suppliers represent a weak, moderate, or strong competitive force depends on The degree to which suppliers have sufficient bargaining power to influence the terms and conditions of supply in their favor Whether close collaboration between one or more industry members and certain important suppliers allow these industry members to capture competitively valuable supply chain benefits that put other industry members at a competitive disadvantage Figure 3.7: Factors Affecting Bargaining Power of Suppliers Figure 3.7: Factors Affecting the Bargaining Power of Suppliers When Is the Bargaining Power of Suppliers Stronger? Supplier bargaining power is stronger when: Industry members incur high costs in switching their purchases to alternative suppliers. Needed inputs are in short supply (which gives suppliers more leverage in setting prices). A supplier has a differentiated input that enhances the quality or performance of sellers’ products or is a valuable or critical part of sellers’ production processes. There are only a few suppliers of a particular input. Some suppliers are a threat to integrate forward into the business of industry members and perhaps become a powerful rival. When Is the Bargaining Power of Suppliers Weaker? Supplier bargaining power is weaker when: The item being supplied is a “commodity” that is readily available from many suppliers at the going market price. Seller switching costs to alternative suppliers are low. Good substitute inputs exist or new ones emerge. There is a surge in the availability of supplies (thus greatly weakening supplier pricing power). Industry members account for a big fraction of suppliers’ total sales and continued high volume purchases are important to the well-being of suppliers. Industry members are a threat to integrate backward into the business of suppliers and to self-manufacture their own requirements. Collaborative partnerships between industry members and select suppliers provide attractive win-win opportunities. How Industry Member-Supplier Collaboration Creates Competitive Pressures Industry members often forge strategic partnerships with select suppliers to ► Reduce inventory and logistics costs ► Speed availability of next-generation components ► Enhance quality of parts being supplied ► Squeeze out cost savings for both parties Benefits of these collaborative partnerships can translate into ► Competitive advantage for industry members who capture sizable benefits from their partnership arrangements ► Competitive disadvantage for industry members who do not enjoy the benefits of such arrangements, which then heightens the supplier-related competitive pressures they experience Competitive Pressures From Buyers and Seller-Buyer Collaboration Whether buyers are able to exert strong competitive pressures on industry members depends on The degree to which some or many buyers have sufficient bargaining leverage to obtain price concessions and other favorable terms and conditions of sale The extent and competitive importance of collaborative arrangements that certain industry members may have with important customers. Figure 3.8: Factors Affecting the Bargaining Power of Buyers When Is the Bargaining Power of Buyers Stronger? Buyer bargaining power is stronger when: Buyer switching costs to competing brands or substitute products are low. Buyers are large and can demand concessions when purchasing large quantities. Large volume purchases by buyers are important to sellers. Buyer demand is weak or declining. There are only a few buyers—so that each one’s business is important to sellers. Identity of buyer adds prestige to the seller’s list of customers. Quantity and quality of information available to buyers improves. Buyers have the ability to postpone purchases if they do not like the present deals being offered by sellers. Some buyers are a threat to integrate backward into the business of sellers and become an important competitor. When Is the Bargaining Power of Buyers Weaker? Buyer bargaining power is weaker when: Buyers purchase the item infrequently or in small quantities. Buyer switching costs to competing brands are high. There is a surge in buyer demand that creates a “sellers’ market.” A seller’s brand reputation is important to the buyer. A particular seller’s product delivers quality or performance that is very important to buyers and that is not matched in other brands. Buyer collaboration or partnering with selected sellers provides attractive win–win opportunities. How Industry Member-Customer Collaboration Creates Competitive Pressures Collaborative partnerships between industry members and some/many of their customers may result in mutual benefits regarding ► ► ► ► Just-in-time deliveries Order processing Electronic invoice payments Data sharing Benefits of these collaborative partnerships can translate into ► Competitive advantage for industry members who capture sizable benefits from their partnership arrangements with key customers ► Competitive disadvantage for industry members who do not enjoy the benefits of such arrangements, which then heightens the competitive pressures they experience Is the Collective Strength of the Five Competitive Forces Conducive to Good Profitability? As a rule, the stronger the collective impact of the five competitive forces, the lower the combined profitability of industry participants. The most extreme case of a “competitively unattractive” industry is when ► Rivalry among industry members is vigorous ► Entry barriers are low and entry is likely ► Competition from the producers of substitute products is strong ► Both suppliers and customers have considerable bargaining power Is the Collective Strength of the Five Competitive Forces Conducive to Good Profitability? An industry is “competitively attractive” in the sense that industry members can reasonably expect to earn good profits and a good return on investment when Rivalry is weak to moderate High barriers block further entry Good substitutes do not exist Both suppliers and customers are in a weak bargaining position Coping With the Five Competitive Forces Working through the five-forces model step by step not only aids strategy makers in assessing whether the intensity of competition allows good profitability but also promotes sound strategic thinking about how to better match company strategy to the specific competitive character of the marketplace. Effectively matching a company’s strategy to prevailing competitive conditions has two aspects: ► Pursuing avenues that shield the firm from as many of the different competitive pressures as possible. ► Initiating actions calculated to produce sustainable competitive advantage, thereby shifting competition in the company’s favor, putting added competitive pressure on rivals, and perhaps even defining the business model for the industry. Question 2: What Forces Are Driving Industry Change and What Impacts Will They Have? Industry conditions change because important forces are driving industry participants (competitors, customers, or suppliers) to alter their actions. Driving forces are the major underlying causes of changing industry and competitive conditions—they have the biggest influence on how the industry landscape will be altered. Where do driving forces originate? ► Outer ring of macroenvironment ► Inner ring of macroenvironment Analyzing an Industry’s Driving Forces Driving-forces analysis has three steps: 1. Identifying what the driving forces are 2. Assessing whether the drivers of change are, on the whole, acting to make the industry more or less attractive 3. Determining what strategy changes are needed to prepare for the impacts of the driving forces. Common Types of Driving Forces Most drivers of industry and competitive change fall into one of the following categories Changes in long-term industry growth rate Increasing globalization Emerging new Internet capabilities and applications Changes in who buys the product and how they use it Product innovation Technological change and manufacturing process innovation Marketing innovation Common Types of Driving Forces (continued) Entry or exit of major firms Diffusion of technical know-how across more companies and more countries Changes in cost and efficiency Growing buyer preferences for differentiated products instead of a commodity product (or for a more standardized product instead of strongly differentiated products) Regulatory influences and government policy changes Changing societal concerns, attitudes, and lifestyles Reductions in uncertainty and business risk Assessing the Impact of the Driving Forces Stopping with an identification of the driving forces is not sufficient. The second, and more important, step in driving forces analysis is to determine whether the prevailing driving forces are, on the whole, acting to make the industry environment more or less attractive. Answers to three questions are needed: ► Will the combined impacts of the driving forces cause demand for the industry’s product to increase or decrease? ► Will the combined impacts of the driving forces make competition more or less intense? ► Will the combined impacts of the driving forces lead to higher or lower industry profitability? Developing a Strategy that Takes the Impacts of the Driving Forces into Account The third step of driving forces analysis—where the real payoff for strategy-making comes—is for managers to draw some conclusions about what strategy adjustments will be needed to deal with the impacts of the driving forces. To the extent that managers are unclear about the drivers of industry change and their impacts, or if their views are off-base, the chances of making astute and timely strategy adjustments are slim. ► One cannot hope to wisely adjust a company’s strategy if one does not know what the driving forces are and what their likely impacts will be!!! So driving-forces analysis is not something to take lightly; it has practical value and is basic to the task of thinking strategically about where the industry is headed and how to prepare for the changes ahead. Question 3: What Market Positions Do Rivals Occupy? Understanding which companies are strongly positioned and which are weakly positioned is an integral part of analyzing an industry’s competitive structure. The best technique for revealing the market positions of industry competitors is strategic group mapping A strategic group is a cluster of industry rivals that have similar competitive approaches and market positions. Strategic Group Mapping Companies in the same strategic group can resemble one another in any of several ways: They may have ► Comparable product-line breadth ► Sell in the same price/quality range, Emphasize same distribution channels ► Use same product attributes to appeal to similar types of buyers ► Use identical technological approaches ► Offer buyers similar services ► Cover same geographic areas Procedure for Constructing a Strategic Group Map STEP 1: Identify competitive characteristics that differentiate firms in an industry from one another STEP 2: Plot firms on a two-variable map using pairs of these differentiating characteristics STEP 3: Assign firms that fall in about the same strategy space to same strategic group STEP 4: Draw circles around each group, making circles proportional to size of group’s respective share of total industry sales Figure 3.9 Comparative Market Positions of Selected Retail Chains: An Example of a Strategic Group Map Guidelines for Constructing a Strategic Group Map Variables selected as axes should not be highly correlated—if they are, then the circles will all fall along a diagonal and reveal nothing more about the relative positions of competitors than would be revealed by comparing the rivals on just one of the variables Variables chosen as axes should expose big differences in how rivals compete—when rivals differ on both variables, the locations of the rivals will be scattered, thus showing how they are positioned differently Variables chosen for either axis do not have to be either quantitative or continuous Drawing sizes of circles proportional to combined sales of firms in each strategic group allows map to reflect relative sizes of each strategic group If more than two good competitive variables can be used, several maps can be drawn Interpreting Strategic Group Maps Firms in the same strategic group are the closest rivals; the next closest rivals are in the immediately adjacent groups. Firms in strategic groups that are far apart on the map may hardly compete at all. Not all positions on the map are equally attractive ► Prevailing competitive pressures and driving forces often favor some strategic groups and hurt others ► Profit potential of different strategic groups varies due to strengths and weaknesses in each group’s market position Question 4: What Strategic Moves Are Rivals Likely to Make Next? Keeping close tabs on competitors enables a company to better anticipate what important actions rivals are likely to take next and to prepare needed defensive countermoves, to craft its own strategic moves with some confidence about what market maneuvers to expect from rivals, and to capitalize on opportunities stemming from competitors’ missteps or strategy flaws. Good competitive intelligence helps managers avoid the damage to sales and profits that comes from being caught napping by the surprise moves of rivals. What to Look For in Trying to Predict Rivals’ Next Moves To predict what rival companies are likely to do next, one needs competitive intelligence about ► Rivals’ strategies and how well these strategies are ► ► ► ► working (companies with weak or flawed strategies are certain to undertake fresh strategic initiatives) Their financial performance and which rivals are under pressure to improve their financial performance (pressures for better performance nearly always trigger new strategic moves and initiatives) Their resource strengths and weaknesses and which rivals have important problems/issues they need to address—the presence of thorny problems that need to be addressed signals likely new initiatives The actions and plans they have announced The thinking and leadership styles of their executives Questions to Consider in Predicting What Moves Rivals Are Likely to Make Answers to the following questions can help predict the likely actions of important rivals ► Which competitors have strategies that are producing good results—and thus are likely to make only minor strategic adjustments? ► Which competitors are losing ground in the marketplace or otherwise struggling to come up with a good strategy—and thus are strong candidates for adjusting important elements of their strategy? ► Which rivals badly need to increase their unit sales and market share and what strategic options are they most likely to pursue? ► Which rivals are likely to enter new geographic markets or make major moves to substantially increase their sales and market share in a particular geographic region? ► Which rivals are good candidates to be acquired? Which rivals may be looking to make an acquisition and are financially able to do so? Question 5: What Are the Key Factors for Competitive Success? Key Success Factors (KSFs) are those competitive factors that affect every industry member’s ability to be competitively and financially successful KSFs can relate to ► Specific strategy elements ► Product attributes ► Resource strengths ► Competencies ► Competitive capabilities ► Market achievements KSFs are so important to a company’s competitive success in the marketplace that all firms in the industry must pay close attention to them or risk becoming an industry also-ran. Identifying Industry Key Success Factors Key success factors vary from industry to industry, and even from time to time within the same industry, as driving forces and competitive conditions change. The answers to 3 questions often help pinpoint an industry’s KSFs ► On what basis do customers choose between competing brands of sellers? ► What resources and competitive capabilities does a company need to have to be competitively successful? ► What shortcomings are likely to place a company at a significant competitive disadvantage? Rarely are there more than 5 - 6 factors that are truly key to the future financial and competitive success of industry members Example: KSFs for Bottled Water Industry Access to distribution – to get a company’s brand stocked and favorably displayed in retail outlets Image – to induce consumers to buy a particular company’s product (brand name and attractiveness of packaging are key deciding factors) Low-cost production capabilities – to keep selling prices competitive Sufficient sales volume – to achieve scale economies in marketing expenditures Example: KSFs for Ready-to-Wear Apparel Industry Appealing designs and color combinations – to create buyer appeal Low-cost manufacturing efficiency – to keep selling prices competitive Strong network of retailers/company- owned stores – to allow stores to keep best-selling items in stock Clever advertising – to effectively convey a specific image to induce consumers to purchase a particular label Question 6: Does the Outlook for the Industry Offer an Attractive Opportunity? Involves assessing whether the industry and competitive environment presents a company with an attractive or unattractive opportunity for earning good profits Factors to consider: ► The industry’s growth potential. ► Whether competitive forces are conducive to good profitability and whether competition appears destined to grow stronger or weaker. ► Whether industry profitability will be favorably or unfavorably affected by the prevailing driving forces. ► The degrees of risk and uncertainty in the industry’s future and whether the industry confronts severe problems relating to regulatory or environmental issues, stagnating buyer demand, industry overcapacity, and so on. Factors to Consider in Assessing Industry Attractiveness As a general proposition ► If an industry’s overall profit prospects are above average, the industry environment is basically attractive ► If an industry’s overall profit prospects are below average, the industry environment is basically unattractive However ► A particular industry is not equally attractive or unattractive to all industry participants and all potential entrants. ► The attractiveness of the opportunities an industry presents depends heavily on whether a company has the resource strengths and competitive capabilities to capture them. ► A weak competitor in an “attractive” industry may conclude that its prospects for good profitability are dim because it cannot compete successfully against competitively stronger companies.