LeaderSHIP 2020

advertisement

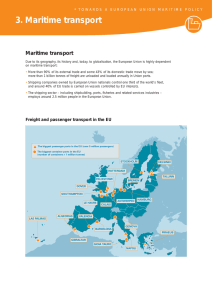

LeaderSHIP 2020 Douwe Cunningham Secretary General LeaderSHIP: Origin and Background 2002 LeaderShip started as an industry initiative, which was subsequently endorsed by Commission and Council 2007 Progress report in a boom situation of the industry 2008 Beginning of the current crisis in shipbuilding Dec 2011 VP Tajani proposes to Competitiveness Council to invite all stakeholders to consider a revision of the LeaderShip process Feb 2013 Report on the new initiative "LeaderShip 2020 - The Sea, new opportunities for the future" endorsed by all stakeholders in the review process LeaderShip 2020 – policy context and scope Changing Policy Context: Europe2020 Limassol Declaration A Stronger European Industry for Growth and Economic Recovery Wider scope of LeaderShip 2020 Maritime technology industry = all the enterprises in the design, construction, maintenance of ships and other relevant marine structures, including the supply chain (systems and equipment) This wider scope reflects the increased importance of off-shore and marine energy for diversification of the shipbuilding industry The Shipbuilding Industry in 2012 Situation of the industry today current problems - parallel crisis in shipping, shipbuilding and ship finance - massive reduction of production and orderbook - more than 50,000 jobs lost and an increasing number of yards closed - recovery of the market will take time because of large global overcapacities Situation of the industry today positive elements - long term market fundamentals remain intact (growing maritime trade for growing population) - further growth of cruise tourism and robust demand for mega yachts - growing importance of emerging new markets (off-shore oil & gas, off-shore wind, marine energy) - strong move to more energy efficiency and less emissions; this creates more demand for retrofitting and maintenance of existing ships LeaderShip2020 – priorities for short and medium term action Analysis and recommendations concentrate on four priority areas: - employment and skills - market access and fair market conditions - access to finance - research, development and innovation The following slides present a selection of the 24 recommendations in the report Employment and Skills ● Anticipation and management of change: systematic consultation and coordination should become common practice in order to soften the social impact of adjustment of employment and unemployment. ● Effectively communicating the long term potential of the maritime industries, in order to attract talented and young people to the industry. Existing tools provided by EU programmes and initiatives (eg. Shipbuilding Week, European Maritime Day, etc.) should be harnessed. ● A systematic approach at EU level to map the available skills and to address skills and training needs that are key to the future of the industry through the use of available EU programmes such as Programme for Social Change and Innovation 2014-2020. Improving Market Access and Fair Market Conditions ● The role of the OECD Working Party on shipbuilding needs to be redefined, in order to consider new ways to regulate unfair market practices. This should include monitoring of government interventions and price developments. New ways to reduce capacity and overhaul common rules should also be explored. ● The European maritime technology industry supports the continuation of work on bilateral and multilateral free trade agreements. Where relevant these should include specific provisions on the maritime industries. Access to Finance ● Making best use of EIB financing opportunities , primarily for projects related to green shipping, offshore renewable energy, and retrofitting. ● In the context of eventual EU action on long-term financing, the opportunity of a potential measure for long term ship financing should be explored (project bonds ?). ● The industry, where necessary in cooperation with the European Commission, Member States or Regions should fully explore the possibility of a ‘Blue PPP’ in the light of the European industry structure and respecting state aid rules (adapting the Japanese practice of temporary joint ownership of vessels by a private and a public entity). Research and Development ● As soon as possible the European maritime technology industry will develop a comprehensive roadmap, providing the justification for a public private partnership (PPP) at EU level, which could be considered for financing in the framework of Horizon 2020. The PPP will aim on focussing maritime research towards zero emission and energy efficient vessels and towards zero technical accident vessels and emerging market opportunities. ● After expiry of the existing Shipbuilding Framework at the end of 2013, the European Commission envisages including the existing provisions on innovation aid for the shipbuilding industry in the Community Framework for State aid for research and development and innovation. ● Member States and coastal regions should investigate the possibility of allocating structural funds for the diversification of the maritime technology industry into new maritime market sectors, especially in the context of regional strategies for smart specialisation. Further reading The full text of the LeaderShip2020 report is available in English, French, German, Italian and Spanish on EC website: http://ec.europa.eu/enterprise/sectors/maritime/s hipbuilding/leadership2015/index_en.htm12