PCI DSS - Vigitrust

advertisement

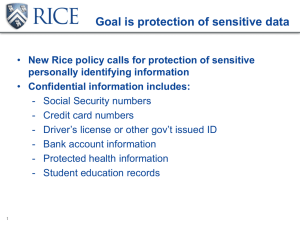

3rd European PCI DSS Roadshow Dublin, March 5th 2013 Mathieu.gorge@vigitrust.com www.vigitrust.com Monday, 13 April 2015 (c) VigiTrust 2003-2013 1 Today’s Agenda Start Finish 08:30 09:00 09:00 09:10 09:10 09:55 Dublin Registration Welcome Note Keynote – PCI SSC Perspective 09:55 10:10 10:10 10:30 10:30 10:50 10:50 11:20 Mobility & Retail - Impact for Payments & Security PCI DSS - Perspective On Continuous Compliance Break Payments as part of Critical National Operations – Risks Overview 11:20 11:50 11:50 12.00 12:00 12:15 The Positive Economist – A Perspective on Payments Concluding thoughts Q&A (c) session VigiTrust 2003-2013 Description Main event Registration run by VigiTrust Provided by VigiTrust Jeremy King, European Director, PCI SSC Rowan Fogarty, Managing Director at PortHand Mathieu Gorge, CEO, VigiTrust Tea/Coffee Break Peadar Duffy, Chairman, RMI Susan Hayes, founder, The Positive Economist VigiTrust Moderated Q&A with speakers Mathieu Gorge CEO & Founder, VigiTrust - Founded VigiTrust in 2003 - InfoSecurity Ireland Chairman - Created PCI DSS European RS - Independent Security Expert for ENISA - East West Institute working groups - ANSI – PHI reviewer - Geneva Security Forum - ISS world Monday, 13 April 2015 • ISSA WCC (since 2008) • ISACA NYC (since 2009) • PCI Council SIGs (since 2011) • Articles – techTarget (Security) – ISACA – Searchstorage.com – Computer Fraud & Security – SC Magazine – ISSA Journal (c) VigiTrust 2003-2013 – Baseline About VigiTrust CSMS Compliance & Security Management Suite SAMS MCP Security Accreditation Management System Merchant Compliance Portal Enterprise Agregators eSEC Security eLearning Modules Mid-Size 5 Pillars of Security Framework™ Physical Security, People Security, Data Security, IT Security, Crisis Management (c) VigiTrust 2003-2013 Setting PCI DSS Global Scene (c) VigiTrust 2003-2012 Payments Industry – a Definition Payment security entails managing and securing payment data across an organization’s full order lifecycle, from the point of payment acceptance, through fraud management, fulfilment, customer service, funding and financial reconciliation, and transaction record storage. The presence of payment data at any of these points, whether on organization systems, networks or visible to staff, exposes the organization to risk. The presence of payment data …. exposes the organization to risk. Therefore you need to fully understand your own ecosystem and payments data flow (c) VigiTrust 2003-2013 2010 to 2012 – A very busy time for PCI DSS • US remains the most compliant territory in terms of PCI DSS • Europe Gaining Traction – Appointment of Jeremy King as European Director • PCI DSS was updated in October 2010 – PCI DSS Lifecycle Update – Changes or lack of same in v2.0 • New Guidance papers from the Council – 2011 & 2012 – Tokenization, P2PE, Wireless, Virtualization – includes Cloud Computing Definitions – Cloud, Cloud, Cloud – Mobile, Mobile, Mobile • Visa – is the US really going Chip & PIN? (c) VigiTrust 2003-2013 Changes to Data Protection in the EU • Not a directive but a single regulation in the EU – Harmonization at European level…but with challenges • Applies to companies based outside in the EU if personal data is handled abroad by companies that are active in the EU and offer services to EU citizens • Right to be forgotten • Controllers responsibilities – Policies & procedures, Staff Training • Data processing impact assessment – If any data is likely to present risks to individuals • Security – Both processor and controllers must put security measures in place • Fines • Data Breach Notification – Within 24 hours of noticing the breach • Data Portability (service providers) & Data Transfers • Data Protection Officers Monday, 13 April 2015 (c) VigiTrust 2003-2013 10 Intersection between PCI DSS compliance and the DPA • Need for appropriate levels of security • Compliance with PCI DSS should enable compliance with key provisions of the DPA • ICO in the UK made an example of Lush (Lush Cosmetics Ltd) – "This breach should serve as a warning to all retailers that online security must be taken seriously and that the Payment Card Industry Data Security Standard or an equivalent must be followed at all times” – For online retailers, the PCI DSS is clearly now best practice – Adherence to the PCI DSS should ensure compliance with the security obligations under the Act – Undertaking from Lush requires them to only store minimum amount of payment data necessary to receive payments, and keep for no longer than necessary. (c) VigiTrust 2003-2013 Jeremy King PCI SSC Rowan Fogarty PortHand Perspectives on Continous Compliance (c) VigiTrust 2003-2013 PCI DSS & GRC Process SOX SAS 70 II EU Data Protection PCI DSS HIPAA Others Regulatory, Legal and Corporate Governance Frameworks Policies & Procedures Education & Security Awareness Network & Hardware Security Self-Governed PreAssessment Official Assessors & Auditors Remediation Work Application Security Specialized Skills Transfer Step 1 Step 2 Step 3 Continuous Compliance Process GRC Process (c) VigiTrust 2003-2013 Step 4 Step 5 Understanding Your Ecosystem (c) VigiTrust 2003-2013 Scoping your ecosystem for PCI DSS • Scope your network’s perimeter to determine the ecosystem’s size – Traditional Perimeter – either in or out of the firewall – Cloud • Private / Public / Hybrid – Wireless networks – also part of your ecosystem – Mobile & I/O devices are also part of your ecosystem • Must be referenced in your asset inventory • Diagrams are key – Must cover your WHOLE ecosystem – Must be kept up to date • Flow of data between all ecosystem sub-areas must be clear – Know where the data comes from, where it might transit through, where it may be stored/copied, where it ends up (c) VigiTrust 2003-2013 Required Documentation • • • • • • • • • • • Diagrams and Data Flows – Ecosystem Diagrams – Data Flow Diagrams – Network Diagrams Asset Inventory Acceptable Usage Policy for staff Access Control Policy Firewall Rules and Business Justification for Rules AV, Anti-Spam and Intrusion Detection-Prevention Policy Incident Response Plan Hardening, Log and Patch Management Policy Back-Up and Media Storage Policy Security Assessment, Application Security & Vulnerability Management Policy Management of Third Parties Policy (c) VigiTrust 2003-2013 Technical Solutions typically required for PCI DSS • • • • • • • • • • Anti-Virus / Anti-Spam Firewalls & VPNs IDS/IPS Web Filtering / Mail Filtering IM monitoring File Integrity SIEM – Central Log solutions Asset Management PSD Mgt/Control Encryption • Onsite vs Managed Services Vs Cloud services? (c) VigiTrust 2003-2013 Building & Maintaining PCI DSS Teams (1) An effective PCI DSS project team is essential to the success of your PCI compliance process in terms of raising security awareness, enforcing security policies and implementing technical solutions. The first step in creating a project team is to decide which staff members to include on the team. IT Human Resources PCI Project Manager /Security Officer Who should be part of my PCI DSS team? Basically anyone who falls within the scope of PCI DSS may be a member of your PCI project team. A typical PCI DSS project team might consist of: • • • • • In-scope employees Development Fraud Operations IT Department staff/ IT Manager Development staff Human Resources staff Operations management Security staff (c) VigiTrust 2003-2013 Building & Maintaining PCI DSS Teams (2) In order to determine what role each member of the PCI Project team should have, we should first consider the elements that make up a security strategy. Typically there are five key elements: • • • • • Physical Security People Security Data Security IT Security Disaster Recovery and Business Continuity Building & Maintaining PCI DSS Teams (3) User Awareness Technical Solutions Policy Work January 2012 April 2012 July 2012 October 2012 January 2013 Finalise DR Scenarios + ERPs April 2013 July 2013 Develop and Roll out Storage Policy Develop and Roll-out Change Management procedures Roll out Encrypted Email usage policy Deploy new version of Anti-Virus on All Gateways Review all Firewall Configuration settings Awareness Strategic Session with HR Manager Install Laptop Encryption Software for all laptop & PDA users Decommissioning of old Helpdesk system + Rollout of new Helpdesk and CRM integrated solution Install and test all back-up systems at DR site Staff Awareness Program – Phase 1 Security Awareness presentation to the Board Install Laptop Encryption Software for managers Design helpdesk Support & Shared Knowledge Base Policy Test all back-up Tape Units + Upgrade B-up S/w Roll-out VPN to all remote branches Fine Tune Internet & Web Content Filters January 2014 Roll out Tele-Working Policy Disseminate AUPs Finalise AUPs October 2013 HR Training on how to deal with Security Incidents Senior Managers Refresher Program Program Staff Awareness Campaign – Posters, Flyers, Security Events E-mail Etiquette Training to Sales Satff Staff Awareness Program – Phase 2 (c) VigiTrust 2003-2013 Staff Re-Fresher Sessions Finally Getting Some attention…User Awareness • PCI DSS Requirement 12.6 states: – “The company needs to implement a formal security awareness program, and educate employees upon hire at least once annually on the importance of cardholder data security. “ – PCI DSS requires every member of staff involved inbe trained as to what PCI DSS is about, why and how to protect card holder storing, transmitting or processing cardholder data to data as well as best practice security. • Qualified Security Assessors (QSAs) verify that awareness training is being delivered by randomly questioning employees about their security awareness levels for cardholder data. Organizations must be able to demonstrate compliance with 12.6. (c) VigiTrust 2003-2013 PCI DSS – Integration with other standards • PCI DSS can be mapped to other standards – E.g HIPPA Security & Administrative Rules – E.g. ISO 27001 • http://www.iso27001security.com/ISO27k_Mapping_ISO_27001_ to_PCI-DSS_V1.2.pdf Comparison Criteria ISO27k PCI DSS Defined by the entity Cardholder Data Choice of Controls Wide Very prescriptive Flexibility in Implementation of Controls High Low Very granular and well documented Not flexible and not comprehensive Scope Ongoing Management of Compliance Status (c) VigiTrust 2003-2012 Corporate Culture & Risk Management – The overall Picture Corporate Values Corporate Ecosystem Risk Management & Safeguards Residual Risk Surface which needs to be managed by your Organization Risk Management Strategy for Internal and/or external Risk Management Teams DPA, PCI DSS & ISO 27001 compliance Best Practices - Achieve and Maintain compliance with PCI DSS • What first steps can you take? – Remember the five accreditation process steps • • • • • Education Pre-assessment (internal) Remediation Actual Assessment Continuous compliance – Mix of 3 key elements • Policies & procedures • Technical Solutions • Awareness Training – What do you next then? • Policies & procedures: draw up a list of P&Ps in place @ your org. • Technical Solutions: update your network diagram + pen test • Awareness Training: identify in-scope employees and start the education process (c) VigiTrust 2003-2013 Recommended Reading www.pcisecuritystandards.org www.vigitrust.com http://searchcompliance.techtarget.com/tip/Does-using-ISO-27000-to-comply-with-PCI-DSSmake-for-better-security http://searchsecurity.techtarget.co.uk/news/2240036890/PCI-virtualisation-With-newguidelines-compliance-may-be-harder http://searchsecurity.techtarget.co.uk/tip/Employee-information-awareness-training-PCIpolicy-templates http://searchsecurity.techtarget.co.uk/expert/Mathieu-Gorge ENISA http://www.enisa.europa.eu/act/rm/files/deliverables/cloud-computing-riskassessment NIST http://www.nist.gov/itl/cloud/upload/SP_500_293_volumeII.pdf (c) VigiTrust 2003-2013 Networking Break Peadar Duffy RMI Susan Hayes The Positive Economist Concluding Thoughts on how to Achieve and Maintain compliance with PCI DSS • PCI DSS is evolving – PCI DSS v3.0 is long awaited • Mobility is here & the market welcomes the new guidance# – However we need the PCI SSC to invest its accumulated funds into helping the market with this new major challenge • PCI DSS adoption growth rate is driven by Data Protection in the EU – this will continue • PCI DSS adoption growth rate is driven by PHI and State PII in the US – this will continue and a Federal law will come in You need to start preparing now for upcoming changes in the standard and in legal frameworks incorporating PCI DSS (c) VigiTrust 2003-2013 3rd European PCI DSS Roadshow Dublin, March 5th 2013 Mathieu.gorge@vigitrust.com http://www.linkedin.com/in/mgorge www.vigitrust.com Monday, 13 April 2015 (c) VigiTrust 2003-2013 32