Career Day PowerPoint

advertisement

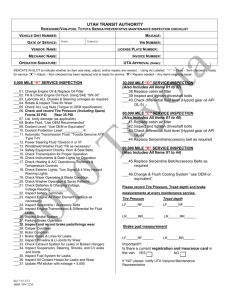

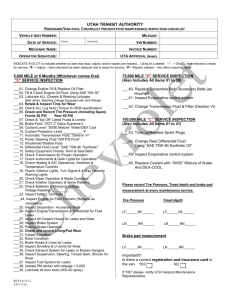

CAREERS IN INSURANCE The opportunities are endless…… Do you know? 60 percent of the insurance industry’s current employees are older than the age 45. The insurance industry had about 2.3 million wage and salary jobs in 2006. Insurance carriers accounted for 62 percent of jobs, while insurance agencies, brokerages, and providers of other insurance-related services accounted for 38 percent of jobs. Are you creative with entrepreneurial spirit? • • Top executives direct the operations of an insurance agency or an insurance carrier. Marketing managers direct development of new types of policies that might appeal to the public and strategies for selling them to customers. – • Market research analysts Sales managers direct the activities of the sales force. They sell insurance products, work with clients, and supervise staff. Do you like CSI type shows? Are you good with conflict? • • • • • 9.9% of insurance positions are in the claims related field. Claims adjusters work for property and liability insurance carriers or for independent adjusting firms. They inspect property damage, estimate how much it will cost to repair, and determine the extent of the insurance company’s liability. Insurance investigators handle claims in which companies suspect fraudulent or criminal activity, such as suspicious fires, questionable workers’ disability claims, difficult-to-explain accidents, and dubious medical treatment. Investigators often consult with legal counsel and are sometimes called to testify as expert witnesses in court cases. Auto damage appraisers usually are hired by insurance companies to inspect the damage to a motor vehicle after an accident and to provide unbiased estimates of repair cost. Claims examiners are the counterparts of the claims adjuster who works in a life and/or health insurance firm. Review health-related claims to see whether the costs are reasonable based on the diagnosis, interview medical specialists, and consult policy files to verify information on a claim, review causes of death in life insurance claims. Do you like knowing how things work and what can be done to make something safer? • Loss control representatives inspect the business operations of insurance applicants, analyze historical data regarding workplace injuries and automobile accidents, and assess the potential for natural hazards, dangerous business practices, and unsafe workplace conditions that may result in injuries or catastrophic physical and financial loss. Do you like putting pieces of a puzzle together and crunching numbers? • Underwriters evaluate insurance applications to determine the risk involved in issuing a policy. They decide whether to accept or reject an application, and they determine the appropriate premium for each policy. – • 3.9% of insurance positions Actuaries study the probability of an insured loss and determine premium rates. Do you connect well with people, love learning new things, traveling to different businesses, and have a skill for negotiation? • Insurance sales agents or producers may work as exclusive agents, or captive agents, selling for one company, or as independent agents selling for several companies. They recommend coverage, assist with claims, ensure customer satisfaction, and obtain referrals. Are you good with people, like educating others? • Customer service representatives have duties similar to insurance claims and policy processing clerks, except they work directly with customers by processing insurance policy applications, changes, and cancellations over the phone. They may also process claims and sell new policies to existing clients. – • 11.4% of insurance positions Human resources and training More people work in insurance than you can imagine? – – – Insurance companies’ lawyers defend clients who are sued, especially when large claims may be involved. These lawyers also review regulations and policy contracts. Nurses and other medical professionals advise clients on wellness issues and on medical procedures . Computer systems analysts, computer programmers, and computer support specialists are needed to analyze, design, develop, and program the systems that support the day-to-day operations. Are you good with numbers, computers, and want to work behind the scene? • • • Office and administrative support - secretaries, typists, word processors, bookkeepers, and other clerical workers. Bookkeeping, accounting, and auditing clerks handle all financial transactions and recordkeeping for an insurance company. Insurance claims and policy processing clerks process new policies, modifications to existing policies, and claims forms. – 9.6% of insurance positions Flexibility within the Industry • • • Employers prefer college graduates but some positions may be entered with a high school diploma. Specialized training is usually obtained on the job or through independent study. Insurance employees working in sales jobs often visit prospective and existing customers’ homes and places of business to market new products and provide services. Others working in the industry may need to frequently leave the office to inspect damaged property, and at times can be away from home for days, traveling to the scene of a disaster— such as a tornado, flood, or hurricane—to work with affected policyholders and government officials. What are employers looking for? • • • • • • • Graduation from high school or college- business, finance, economics, communication, or insurance degrees. Some insurance specialtiesengineering, medical, actuarial science, mathematics, or statistics etc are also a good degree. Courses in word processing and business math are good, and the ability to operate computers is essential. On-the-job training is provided by the employer. Most employers look for individuals with ingenuity, communicate well, and should be able to think on their feet. Persistence, good work ethic, and maturity also are important. Customer service representatives and agents need to become licensed. In some states claims adjusters also need to be licensed. Actuaries must pass a series of national examinations to become fully qualified. Completion of all the exams takes from 5 to 10 years. Several years of experience and training can help beginners advance to higher paying positions. Office and administrative support workers may also advance to higher paying claims adjusting positions and entry-level underwriting jobs. For more information, contact national staff at 1-800221-7917 or info@investprogram.org