Is Asia the Answer? - Dr. Brian W. Tempest

advertisement

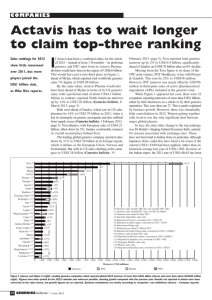

Is Asia the Answer? Dr. Brian W Tempest www.briantempest.com The 2008 IMS Pharma Strategy Conference New York –12th February 2008 DR. BRIAN W. TEMPEST CSci, CChem, MRSC, BSc, PhD Dr. Brian Tempest advises companies and investment funds on their strategy in Asia based on his wide experience in China, Japan, SE Asia and India where he has lived for the last 9 years and continues to have a home. Tempest has previously been President, Managing Director, CEO, Chief Mentor and Executive Vice Chairman of Ranbaxy Laboratories(the leading Indian Pharmaceutical Company) during the 12 years between 1995 and 2007. He is one of the few westerners (if not the only westerner) to lead a Sensex Nifty 50 Indian blue chip MNC and as a result has a valuable insight into India. Tempest has also been Regional Director Far East for Glaxo responsible for Japan, China, Korea and Taiwan. Tempest has worked in the Pharmaceutical Industry for the last 37 years and led Global Healthcare businesses, R&D and Global Manufacturing Organisations. Tempest has also led Investor meetings across Asia, Europe and USA. He is now a Non Executive Director of Ranbaxy India, an advisor to the JM Financial India Private Equity Fund and a Honorary Professor of the Management School at Lancaster University, UK. He speaks at worldwide conferences on the Challenge from India and China and more information on these presentations is available on www.briantempest.com brian.tempest@gmail.com / brian.tempest@clara.co.uk Mobile +91-98100-91192 / Tel:+44 1753 864 616 Asia’s Share of the World GDP (at PPP in %) Year 1870 1913 China India Japan Rest of Asia 17% 12% 2% 7% 9% 8% 3% 5% Total Asia 38% 25% 1950 5% 4% 3% 7% 19% Source – WEF - was 59% in 1820 with India 16%, China 33% 1973 2001 5% 3% 8% 9% 12% 5% 7% 13% 25% 37% The View from Europe – the Challenge Source – FT The View from India - a Global Competition The View from the USA – Asian Cars The View from Japan - a Race to Prosperity Japan’s Wealth Advantage Taiwan 1% Switzerland 1% Spain 1% Rest of World 10% Netherlands 2% Canada 2% Germany 4% Italy 4% France 5% USA 37% UK 6% Japan Source: The World Distribution of Household Wealth 27% Is Asia the Answer? Market drivers Competition is rising Branded generics from Asia IP changes in USA M&A and Private Equity East-West Alliances Drug Development The Asian Productivity Advantage India 1 chemist 70 hours/week $ 800 monthly a usa Pharma view Better education x 1.3 Longer working time x 1.3 Lower cost x 20 USA 1 chemist 50 hours/week $ 12,000 monthly Sources: IPHMR Conferences, New Delhi August 2004 The Asian Education Advantage The Asian Education Advantage Engineers/Science graduates p.a – India 0.7m, China 0.5m, EU 0.5m, USA 0.4m, Japan 0.3m Asia’s Youthful Advantage Percentage of Population aged 65 and older 29.2 22.7 21.5 21.4 18.7 14.8 14.7 13.2 2000 A 12.3 2050 E 8.3 6.9 5 China India 2025 E Europe North America Patent Expiry Dates Company Expiry 2010 Expiry 2011 Expiry 2012 % at Risk Pfizer Aricept - $800m Lipitor - $12.1bn Xalatan - $1.6bn Viagra - $1.7bn Detrol - $860m Geodon - $1.1bn 41% Astra Zeneca Arimidex - $2.2bn Seroquel - $4.7bn Symbicort - $3.7bn 38% Sanofi-Aventis Taxotere - $2bn US Plavix - $3.8bn Avapro - $2.1bn Lovenox - $3.1bn 34% US Plavix - $4.8bn Avapro - $1.3bn Abilify - $2.1bn BMS GSK Advair - $3.8bn Avandia - $2.5bn 30% 23% Sources: AXA Framlington Asian Competition is Rising CPHI Attendees, Milan, 2nd – 4th Oct’07 1. China 467 – 33% 2. India 189 – 13% 3. Germany 96 4. Italy 80 5. USA 75 6. UK 55 7. France 55 8. ROW 387 Total As registered on July 25, 2007 1404 Generics – API’s USA DMF filings by India 2004 2005 2006 India 187 252 357 China 48 87 128 Source: US FDA / J P Morgan, 6th August 2006 % Share of USA DMF filings 2005 2006 Q1’07 Q2’07 Q3’07 India 37% 44% 48% 37% 42% China 10% 14% 17% 18% 16% Source: US FDA / J P Morgan, 2 may 2007 Source: US FDA, Credit Suisse Generics - ANDAs ANDA Filings in USA by Indian Companies 300 250 250 200 144 150 100 46 50 64 24 0 2002 2003 2004 2005 2006 - One in every four ANDAs filed by Indian Companies in top USA FDA filers Source: KPMG - No Chinese generic company has yet filed a USA FDA ANDA but expected in 2008 Top 5 Global Pharma Markets 2020 Rank Country Size 1. USA $ 475b 2. China $ 125b 3. Japan $ 61b 4. France $ 51b 5. India $ 43b Sources: Goldman Sachs 2007 The Rise of the Indian Middle Class R&D Productivity is Falling Global Pharmaceuticals Sales Trends Global Pharmaceuticals Equity Trends Shareholder Value BCG 100 Challengers Country Total State Private China 41 29 12 India 20 0 20 Brazil 13 1 12 Russia 6 3 3 Source BCG Speed of Clinical Trials in India Patients Sites Time EU India 85 22 36m 650 5 18m Patients Sites Time Neck Cancer CT 300 patients, 30 sites $5.6m EU/USA vs $ 1.8m plus 30% faster at $800K per day savings Plan Actual 100 10 5m 130 9 2.5m Overactive bladder CT No. of USA investigators: 2001 2006 26,000 18,000 Sources: CT Outsourcing Conference, 24th July 2007, Mumbai Electronic Data Capture in India % Trials in EDC Accuracy 2005 2007 - 300 GSK Staff 25% 45% - 2.2m Clinical Data sheets - 450 Trials Savings Paper EDC - No data security issues $2.8m $ 0.5m - Error rate <0.01 / 100k 2004 data Sources: CT Outsourcing Conference, 24th July 2007, Mumbai Source: BCG report “Looking Eastward, Sept’2006” Branded Generics Promotion to doctors rather than pharmacists Consistent sales year on year No huge highs & lows for sales and profits Need field force to promote products Tend to be profitable Promoted in conventional manner Global generic brands Relevant to Central Europe, East Europe, Latam, Asia Ranbaxy half branded generics & half commodity generics Branded Generics - the Analyst’s view “Branded Generics are the most profitable place to be in generics and there are a few markets with better branded characteristics than those of the Middle East and North Africa region” Frances Cloud Nomura September 14 2007 Different Global Generic Market Sizes $bn Region Sandoz 2006 IMS 2008 USA 23 68 West Europe 14 19 East Europe 13 NA Japan 3 3 Latam/Canada 10 3 (Canada only) ROW 37 7 Total 100 100 ROW Top 10 Generic Markets - $bn IP – USA Pendulum “A key USA Supreme Court ruling KSR VS Teleflex led to Pharmaceutical patents being more easily challenged on the grounds of obviousness, a ruling which immediately came into play when J&J & Merck had a US patent for Pepcid Complete (Famotodine) found to be obvious”. Scrip, July 6th 2007, p3 The full beneficial impact of this ruling on the generic industry is yet to be seen . Bilateral FTAs - USA Pendulum Democrats now chairing Committees- Ways & Means USTR legally required to work within TRIPS USA has been incorporating TRIPS PLUS IP protection into bilateral free trade agreements Corrections to bilateral trade agreements eg Peru, Columbia, Panama FTAs TRIPS TRIPS PLUS Basic product patent + Data exclusivity Data protection + New forms, isomers etc + New Indications + New Combinations 82% of the world population accounts for only 12% of the Global pharmaceutical sales Region North America Europe Japan Pharma Sales $255 b $158 b $59 b 47% 30% 11% Population 332 725 128 88% Asia/Africa/Aus Latam $41 b $20 b 8% 4% 18% 4711 558 12% Worldwide Sources: 1. IMS Midas, March 2005 2. Earth Trend Data Tables 2005 $533 b 100% 5% 11% 2% 73% 9% 82% 6454 100% Should IP be the same across all Countries? USD Per Capita Expenditure on Healthcare 2002 6000 5000 4000 3000 2000 1000 0 USA Brazil Thai China India Sources: World Health Report 2005 Enforcement or Evergreening ? India IP Filed Examined Granted - 02/03 11466 9538 1379 06//07 28882 14119 7359 140 patent examiners 2007 600 more planned Attrition an issue Weekly patent journal IP Appellate Court Source: Business Standard, 16th Aug’2007 • 1995 – 2005 FDA cleared 327 drugs • 95% pre 1995 – before WTO deal • 16 basic patent molecules possible • However 9000 Pharma applications - for evergreen changes - for new indications Source: Gopa Kumar “Centre for Trade & Development, Delhi” PCT Filings from Asia PCT Files from Developing Countries 2006 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Ranbaxy Patent Filings to 2005 Huawei - China LG - Korea Samsung - Korea LG Cem - Korea Elec Telecom – Korea 2TE – China STR – Singapore Ranbaxy – India CSIR – India NHN - Korea 24 32 49 86 146 170 185 M&A activity in India is rising M&A in India Year Deals Investments 2005 467 $ 18 b 2006 782 $28 b 2007 >1000 $ 70 b Source Grant Thornton Deal Tracker M&A Building the Top Players in the Global Generic Market % PE/VC Share of all Global M&A Deals 25 21% 20 17% 15 16% 10 9% 5 6% 5% 0 2000 2001 2002 2003 2004 2005 Sources: Thomson One Banker, BCG Analysis Asian PE Deals Country No. of deals Sum Invested - $m China 103 1489 India 90 1369 Hong Kong 5 186 Australia 26 71 Taiwan 6 33 S.Korea 30 29 Thailand 2 29 Singapore 4 16 New Zealand 9 3 278 3233 Total Sources: Thomson Financial in H1 2007 excluding Japan Private Equity Investment in India Year Deals Investments 2004 60 $1b 2005 124 $2b 2006 302 $8 b 2007 405 $ 19 b Source Grant Thornton Deal Tracker Key Challenges to the Asian Scenario Potential Challenge – Asian Flu* *50% of world chickens bred in Asia Potential Challenge – Climate Change CO2 emission - % of World total in 1990-2000 USA EU 25 China Russia Japan India – source: WRI, EIA 23% 17% 14% 7% 5% 4% Potential Challenge – Infrastructure “Our greatest potential will be realised only if we can ensure that our Infrastructure does not become a severe and critical handicap” Source – Manmohan Singh Corruption Perception Index Rank Country 1 5 11 16 20 42 51 70 121 163 Finland, Iceland, NZ Singapore Austria, Luxemburg, UK Germany Belgium, Chile, USA Mauritius, S.Korea South Africa, Tunisia Brazil, China, India, Mexico Philippines, Russia Haiti Sources: Transparency International 2006, selected countries only Potential challenge – Oil prices Source – BP • A war against Iran could drive oil > $200 a barrel - ‘Times’ 22nd June 2006 • India is expected to import 85% of crude oil by 2012 from 70% today Source – Assocham Potential Challenge – over the border Potential Challenge - Currency Volatility The Tempest Crystal Ball •India will continue to be a Key Driver in the Global Generic Industry •Competition is rising – Post TRIPs Indian companies will evolve •Discovery companies will continue to be attracted to India for CT, EDC, MO. China will be perceived to be stronger in biology/ toxicology •IP changes in US will slowly favor Generics •Alliances between Western Biotech and Asians companies will expand. M&A PE deals will grow. Singapore, Vietnam, Bangladesh & Nepal will take a rising importance •How to use Asia in Drug Development will become the key opportunity Is Asia the Answer for Drug Development? Early discovery leads from USA, Europe or Singapore Molecular optimisation from India Toxicology from China, Central Europe, Singapore Electronic Data Capture India API Manufacture India Drug Formulation Manufacture India, USA Phase 1 Clinical Trials Europe Phase 2,3 heavy use of India Corporate back office India Perceptions of Asia “The Indian System looks ramshackle and improvised. But at its best it is capable of brilliance” “When we say the Silicon Valley is built on ICs we don’t mean integrated circuits – we mean Indians & Chinese” “The UK needs to wake up to what India is becoming” Source: DEMOS report – January 2007 Summary Asia economic strength is returning to levels seen in the past India is a global strategic asset for developed markets having many advantages with some challenges. India is a rich location for R&D alliances and CT outsourcing MNCs will dip in & out of India & China South East Asian economies will be driven by India & China Japan will continue to represent a huge share of global wealth “China & India represent the future of Asia and quite possibly the future for the global economy” – Steve Roach, Morgan Stanley Thank You