GLOBAL TRENDS IN POST TRADE

IMPLICATIONS TO CIS AND CEE REGION

YEREVAN, OCTOBER 2011

© Copyright 2010, TheSTRICTLY

NASDAQ OMX

Group, Inc.

All CONFIDENTIAL

rights reserved.

PRIVATE

AND

CONTENTS

Regulatory changes

TRENDS IN POST

TRADE INDUSTRY

Increasing importance of clearing, CCP

Introduction of variety of new products

Interoperability, cross-margining

Technology playing a key role

NASDAQ OMX

CLEARING AND

CSD TODAY AND

IN THE FUTURE

Post trade capabilities

Product offering

Key initiatives

Internationalization and standardization

2

IMPLICATIONS TO

CIS AND CEE

Derivatives and clearing

LATEST

DEVELOPMENT IN

ARMENIAN CSD

Pension System

Technology requirements

Settlement model

CSD technology

WHAT DRIVES THE FUTURE ?

Algorithmic / High Frequency Trading

- High performance position handling

- DMA / Sponsored access

- Advanced risk monitoring and control

- Netting across clearing venues

- Collaborative environment

Financial Crises – Infrastructure challenges

- Focus on Counterparty risk

- OTC Derivatives being cleared

- Need for prudent environment

• Regulatory supervision

• Transparent risk management

• Controlled processing

- Expansion of FI products

Increased focus on technology

– Functional requirements

– Cost efficiency

Competition / Desire to grow business

- Unbundling of services

- OTC Trading service

- Underlying cash/spot market cleared

with derivatives

- Serving Multiple markets

- Product Innovation

Competition / Globalization

- International Investor Community

- Foreign products and currencies

- Multi time-zone operation

- Cross-boarder settlement

- “Level playing field” / Interoperability

Regulatory

- T2S

- OTC Derivatives

- Repository (exchange traded and OTC)

- Compliance and surveillance

- ESMA, EMIR, IOSCO, G20

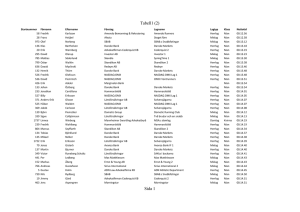

EUROPEAN LANDSCAPE FOR EXCHANGE TRADED EQUITY CASH AND DERIVATIVES

Sweden

Cash

Der

NASDAQ

Trading OMX

NASDAQ

OMX

Clearing EMCF

NASDAQ

OMX

CSD

Euroclear Sweden

Germany

Cash

Der

Trading Börse

Eurex

(Deutche

Börse&

SWX)

Eurex

clearing

Clearing (Eurex)

Eurex

clearing

(Eurex)

Deutche

CSD

Clearstream (Deutche

Börse)

Finland

Cash

Denmark

Der

Cash

Italy

Der

Cash

NASDAQ

OMX

Eurex

(Deutche

NASDAQ Börse&

NASDAQ NASDAQ

OMX

SWX)

OMX

OMX

EMCF

Eurex

NASDAQ clearing

OMX

(Eurex)

Euroclear Finland

Switzerland

EMCF

Ireland

Der

SWX

Eurex

(Deutche

Börse&

SWX)

The Irish

Stock

Exchange

(ISE)

LSE

X-clear

(SWX)

Eurex

clearing

(Eurex)

Eurex

clearing

(Eurex)

4

Cash

Der

Italian

Derivative

s Market

Borsa

IDEM

Italiana

(Borsa

(LSE)*

Italiana)

Cassa di

Cassa di

Compensa Compensa

zione e

zione e

Garanzia Garanzia

(Borsa

(Borsa

Italiana)

Italiana)

Monte

Titoli

(Borsa

Italiana)

VP

Cash

SIS Segasettle (SWX)

NASDAQ

OMX

N/A

Spain

Cash

Borsas y

Mercados

Espanoles

(BME)

LCH.

Clearnet None

UK

Der

Cash

Der

LSE

Liffe

Euronext

(Euronext) (NYSE)

Cash

LCH.Clea LCH.Clear LCH.

rnet

net

Clearnet

Poland

Oesterreichische

Kontrollbank (ÖKB)

Cash

Der

Portugal

Cash

Liffe

(Euronext)

Euronext

(NYSE)

Liffe

(Eurone Euronext Liffe

Euronext

xt)

(NYSE) (Euronext) (NYSE)

LCH.Clearnet

LCH.Clear LCH.Cle LCH.Clea LCH.Clear LCH.Clear LCH.Clear LCH.Clearn

net

arnet

rnet

net

net

net

et S.A

Interbolsa

Greece

Norway

Der

Cash

Athens

Exchange

(Hellenec

Exchange Oslo

s (banks)) Börs

Hellenec

Exchange

s SA

(banks)

N/A

National Depository of Hellenec Exchanges SA

Securities (KDPW)

(banks)

Cash

Der

Luxembourg

Der

Euroclear

Belgium

Der

France

Cash

Cash

Athens

Warsaw Warsaw Exchange

Wiener

Stock

Stock

(Hellenec

MEFF

Börse

Wiener Exchange Exchange Exchanges

(BME)

(WB)

Börse

(WSE)

(WSE)

(banks))

KDPW

Clearing

House

CCP

CCP

(Treasury,

Austria

Austria WSE,

KDPW

MEFFCLEA (ÖKB+WB (ÖKB+W National

Clearing

R (MEFF) )

B)

bank)

House

None

Euroclear UK and

Ireland Ltd (former

Crest)

Iberclear (BME)

Der

Belgium

Der

Euroclear UK and Ireland Ltd (former

Crest)

Austria

Cash

Netherlands

Euronext. Luxembour

Liffe

g Stock

(Euronext) Exchange

Euroclear France

Chi-X

Turq

Cash

BATS

NEURO

Der

Cash

Cash

Oslo

Börs

Chi-X

Turqouis

e

BATS

NEURO

VPS

Clearing

(VPS)

EMCF

Euro

CCP

EMCF

VPS (Oslo Börs)

Cash

Clearstre

am and

Euroclear

EMCF

Local CSDs

Cash

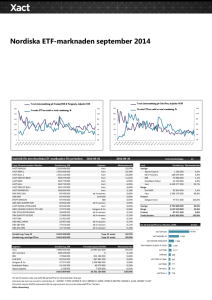

NASDAQ OMX POST TRADE TODAY

FOCUS AREA

NASDAQ OMX Post-Trade capabilities today cover the whole post-trade chain

• Central Counterparty Clearing (CCP)

• Central Security Depository (CSD)

Clearing and CSD

business and technology

development is one of

the key focus areas in

NASDAQ OMX

CCP Capability

• Derivatives on cash market and commodities

• Plan to implement Cash CCP in 2012

• Integrated with NASDAQ OMX trading systems

NASDAQ OMX operates

4 clearing houses and 4

CSD’s.

• Product coverage today

– Genium INET Trading

– X-Stream INET

– Genium INET Clearing

– X-Stream INET Clering

– Genium INET Risk Manager

CSD Capability

• Both equities and bonds

• Integrated with NASDAQ OMX clearing systems

• Product coverage today

– Genium INET CSD

5

NASDAQ OMX CLEARING

CURRENT PRODUCT SCOPE

NASDAQ OMX Nordic Derivatives Markets Clearing, Europe’s 3rd largest

derivatives clearinghouse

Nordic, Baltic and Russian Equities (Standardized and Flex/Tailor Made)

Futures, Forwards and Options on Single Stocks and Depository Receipts

Futures, Forwards and Options on Tradable Indexes

Futures, Forwards and Options on Custom Made Indexes

Nordic Fixed Income (Standardized and Flex/Tailor Made)

Forward Rate Agreements

Bond Forwards and Futures

Policy Rate Futures

Options on Bond Forwards

IRS

Clearing for NASDAQ OMX Commodities Europe, the world’s largest power

derivative exchange

Nordic, German, Dutch and UK Commodities (Standardized)

Futures, Forwards and Options on Electricity

Contracts for Difference (CfDs) on Electricity

Futures, Forwards, Options and Spot Contracts on Carbon Allowances

6

KEY INITIATIVES

DEFAULT FUND

• EMIR will require mandatory member sponsored default funds

• New business will require increased safeguard requirements

• To be introduced in Q1 2012

• Introduce new in-house Collateral Management solution and replace

current custodian institution model

COLLATERAL

MANAGEMENT

SYSTEM

• Solution based on International standard

• Deliver enhanced risk management procedures and services

• Launch in Q3 2012 in parallel with existing solution

OTC CLEARING

• Provide clearing of all Nordic derivatives and selected non-Nordic

derivatives that are mandated for clearing by EMIR/ESMA

• This includes trades created on NASDAQ OMX exchanges as well as

trades coming from external trading venues and trades created outside

organized trading facilities (OTC trades)

INTEGRATION

COMMODITIES/

FINANCIALS

7

• Migrate commodities to same technical platform as financials markets

• Will enable all members to trade and clear commodities using their

existing memberships

• Common collateral management, common settlement flows etc.

IMPLICATIONS OF GLOBAL TRENDS TO CIS AND CEE REGION

DMA and remote access require standardized and easy access to post trade

services

Globalization

requires

standardization

IOSCO, G30, EMIR etc. set

the standards.

Efficient use of collateral.

Cross-border capabilities

are needed.

Product variety and

serviced currencies will

increase.

• CCP a preferred solution but only if its cost efficient

• Globally accepted DvP model for settlement

• High standard risk management functionalities

• Post trade interoperability or linkages

OTC Clearing

• Important especially on fixed income and FX derivatives

• Typically complicated due the nature of OTC market

Technology

• Multi-instrument, multi-currency, multi-market, multi-time-zone

• Rich in risk management functionalities and interfacing capabilities

• Compliant with best practices

8

LATEST DEVELOPMENT IN ARMENIA

Building

infrastructure and

services

Financial literacy is still one

of the main development

barrier in Armenia.

Pension system forces

investors, market

participants and media to

educate themselves.

CBA in a key role to realize

the goals.

Armenian Pension System

• Three pillar system. Second pillar to be centrally operated by NASDAQ OMX

Armenia

• Launch in 2014

Central Depository Infrastructure

• Changes to settlement model

• Improved registry functionalities

• Guarantee fund to be established

New services

• Credit Resource market

• Product development initiatives together with CBA covering tradable monetary

policy and government issued securities

9