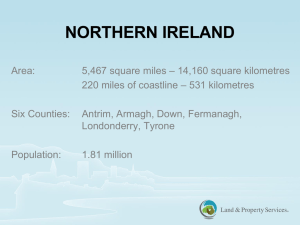

Central Electronic Registry

advertisement

In respect of creation of mortgages through institutional finance, a number of frauds were taking place in which multiple documents of title relating to the same property were deposited with different lenders The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act contains provisions for setting up a “Central Registry” for the purposes of registration of transaction of securitisation and reconstruction of financial assets and creation of security interest. Section 20. Central Registry (1) The Central Government may, by notification, set-up or cause to be set-up from such date as it may specify in such notification, a registry to be known as the Central Registry. (2) The head office of the Central Registry shall be at such place as the Central Government may specify and for the purpose of facilitating registration of transactions referred to in sub-section (1), there may be established at such other places as the Central Government may think fit, branch offices of the Central Registry. ◦ Sections 21, 22 [summarised] [Central Registrar and Central Register] GOI may by notification set up or cause to be setup the Central Registry GOI may by notification appoint Central Registrar Central Register shall be kept at the head office of the Central Registry under the control and management of Central Registrar. ◦ Sections 23, 24, 25 [summarised] Filing of transactions of securitisation, reconstruction and creation of security interest Modification of security interest registered under the act Reporting of satisfaction by Securitisation company, reconstruction company or secured creditor ◦ Section 26 Right to inspect particulars of securitisation … ◦ Section 31 Not applicability of the act to ….. (h) financial asset not exceeding Rs. 1 lakh, (i) security interest created in agricultural land, and (j) when amount due is less than 20% of principal plus interest ◦ Section 38 Power of Central Government to make rules … ◦ Section 39 Provisions of section 21(2-4), 22 – 27 to apply after Central Registry is set up In the Budget speech for 2011-12, the Union Finance Minister had announced that the Central Registry would be operationalised by March 31, 2011. CERSAI was incorporated and soft launched on March 31, 2011 for the purpose of operating and maintaining the Central Registry under the provisions of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act). The records maintained by the Central Registry will be available for search by any lender or any other person desirous of dealing with the property. The company has been setup with an authorised capital of Rs 100 crore and authorised paid up capital of Rs 49 crore with Government’s contribution of 51% and rest 49% by 11 shareholding banks. National Housing Bank State Bank of India Punjab National Bank Bank of Baroda Bank of India Canara Bank IDBI Bank Ltd Union Bank of India Central Bank of India Syndicate Bank Indian Overseas Bank Government of India (25 crore) National Housing Bank (25 lac) State Bank of India (25 lac) Punjab National Bank (25 lac) Bank of Baroda (25 lac) Bank of India (25 lac) Canara Bank (25 lac) IDBI Bank Ltd (25 lac) Union Bank of India (25 lac) Central Bank of India (25 lac) Syndicate Bank (25 lac) Indian Overseas Bank (25 lac) Before the registration of transactions can be done on the Central Registry by an institution, the institution has to apply for registration of User Administrator(s) with CERSAI. The User Administrator creates and authorizes users of the institution to access the Central Registry for various purposes. The process of registration of transactions of securitisation, asset reconstruction and creation of security interest is carried out through the portal of the Central Registry which can be accessed on the Internet. The URL of this web-portal is www.cersai.org.in. The transactions related to registration of mortgage by deposit of title deeds in favour of banks and financial institutions are entered in the system. As per Central Registry Rules 2011, each institution has to register a security transaction with central registry system within thirty days of the creation of charge / securitization. There is a fee for each registration which has to be paid at the time of registration. The registration process has since been extended to the assignment of debt (factoring transactions). Serial Number (1) Nature of Registered transaction (2) to be FORM No. Amount of fee payable (3) (4) 1. Particulars of creation or FORM I modification of Security Interest in favour of secured creditors 500 for creation and for any subsequent modification of Security interest in favour of a secured creditor for a loan above 5 lakh. For a loan upto 5 lakh, the fee would be 250 for both creation and modification of security interest. 2. Satisfaction of Security Interest 250 any existing FORM II No fee is charged on subsisting registrations Form I - Creation and modification of charge Form II - Satisfaction of Charge Form III - Securitisation or Reconstruction of Financial Assets Form IV - Satisfaction of Securitisation or Reconstruction of Financial Assets Registration of the entity / institution Registration of two Primary User Administrators (PUAs) with CERSAI. Registration of Maker and Checker users for respective institutions Availability of Digital Certificate for PUAs and Checkers Registration of Digital Certificate with CERSAI portal Ernst & Young was engaged initially as a management consultant for preparation of RFP document, finalisation of SLA and UAT testing. The task of setting up the portal was entrusted to TCS. The IT infrastructure for Central Registry has since been commissioned with Data Centre (DC) at Noida and Disaster Recovery Site (DRS) at Chennai. These centers are manned on 24X7 basis by the IT vendor of the company. The help-desk support is being extended from the Project Office at Bhikaji Cama Place, New Delhi. The support center is manned by six persons from the IT vendor. All Commercial Banks Private Banks Foreign Banks Co-Operative Banks RRBs Selected HFCs (22) FIs Asset Reconstruction Companies Factoring Regulation Act - every factor shall file, for the purposes of registration, the particulars of every transaction of assignment of receivables in its favour with the Central Registry. Form-I for registration of factoring transactions and Form-II for satisfaction of factoring transactions along with fee for registration are prescribed by the Government. Factoring transactions are also being registered at CERSAI portal. Number of institutions registered Number of users registered 292 108089 Number of fee based transactions 1861189 Number of subsisting registrations (non-fee based) 5552909 Total Transactions Registered 7414098 Average number of transactions (last 10 days) 94441 Institutions Number Public Sector Bank 26 Private Bank 20 Foreign Bank 26 Co-operative Bank 66 Regional Rural Bank 72 Housing Finance Company/FIs 76 Local Area Bank Grand Total 1 287 Institution Name Public Sector Bank Private Bank Foreign Bank Co-operative Bank Regional Rural Bank Housing Finance Company / Fis Local Area Bank Total Users 94,270 7,941 326 1,657 1,018 1,570 6 1,06,788 Period Subsisting Regular 2188475 1066707 April 2012 744868 49355 May 2012 94503 29459 June 2012 960413 131284 July 2012 331885 171220 August 2012 227691 100054 September 2012 841570 197065 October 2012 166649 118493 Till March 2012 INSTITUTION_NAME COUNT STATE BANK OF INDIA 1668756 HDFC LIMITED 1075240 PUNJAB NATIONAL BANK 313652 ICICI BANK LIMITED 257588 CANARA BANK 232340 UNION BANK OF INDIA 227462 BANK OF BARODA 221870 IDBI BANK LIMITED 196619 BANK OF INDIA 175246 SYNDICATE BANK 164553 Institutions Registered Factoring Companies (Public) 3 Factoring Companies (Private) 2 Total 5 Number of users registered Total number of factoring transactions 62 588 Training programmes for Public Sector Banks, Housing Finance Companies, Private & Foreign Banks, Co-operative Banks, Regional Rural Banks and other Financial Institutions were organised at New Delhi, Mumbai, Bengaluru and Kolkata during Jan-Feb 2012. The training programmes were aimed to enhance awareness and capability among the member users of the registration system, and also enrich the participants through exchange of views/ideas between CERSAI and the member institutions. Training programmes were conducted in eight different batches with two days each per batch. The total number of participants who attended the training programme was 509. The records maintained by the Central Registry are required to be available for search by any citizen on deposit of requisite fee as prescribed under the Rules. Online search will be on the uploaded Security Interest records present in the Central Registry’s database. This facility will be helpful to general public to check the encumbrance status on a given property and common knowledge of the encumbrance status by all lending institutions will help in preventing frauds. This facility is expected to start from 3rd week of January 2013. Property ownership, its history, and information on buy/sell transactions is not available easily to the average citizen. Central Registry addresses the encumbrance status of a property, there is no mechanism available in the Central Registry system to check the ownership of a property. Although CR is aimed at curtailing frauds wherein multiple loans are availed by deposit of same title deed with multiple lenders, non-availability of information like ownership etc. at the time of creation of security interest does not guarantee whether the borrower is the actual owner of the property. With land being a state subject governed by respective state laws, it is required to have a synergy between the CR system and the state registries. This will be beneficial for both the Central Registry and State governments as well. This common synergy will benefit lenders by way of providing information on the existence of the property and genuineness of the title. At the same time, state governments can check the encumbrance status before accepting the transaction and title claim. This common registry will benefit all stake holders viz, citizens, lending institutions, central and state governments. For states this will provide a more transparent market resulting in greater funds flow. For the lenders, total title information will become available besides encumbrance. In the absence of information on the genuine title, only encumbrance certificate will not be sufficient to prevent fraud. Bank Guarantees are governed under the Indian Contract Act, 1872 RBI had issued several guidelines for avoiding frauds in bank guarantees, however, there are several instances of fake BGs Availability of information on BGs on a Central Portal for online search may be explored Credentials can be verified online CERSAI passing through a rapid expansion stage and required to move fast to fulfill the responsibility placed and to provide knowledge feedback to government and other stake holders. IFC has shown interest in extending cooperation IFC’s collateral Registries / Secured Lending Program provides advisory services to help strengthen the development of the private sector in South Asia. IFC has agreed to provide co-operation on the following. (i) Study of Registries in other countries and their operations (ii) Strategy and Business Planning (iii) Study / Research for Legislative and Regulatory Support (iv) Supporting streamlining of internal processes and procedure (v) Operational Support (vi) Planning for Monitoring of Compliances and Expansion.