Payment_Options - Online Lenders Alliance

advertisement

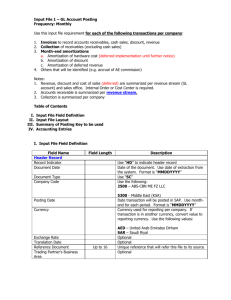

Instant Funds Transfer EFT Networks ONLINE LENDERS WANT CONNECTIVITY THROUGH A PROVIDER TO: • MAESTRO • SHAZAM • NYCE • PULSE • STAR • CU24 and others Near ubiquitous ability to credit a bank account Eliminate Friction & Delays in Money Movement Today’s Market • Cash, Checks, and Bank Wires are Cumbersome & Expensive • Most transfers take 1 – 2 Days • Electronic Methods Require Enrollment and Bank Routing & Transit Information • Only Available During Banking Hours • Virtual Wallet are Not Real Money Consumer’s Debit Card # is Captured…No Enrollment Transaction Rides EFT Network Rails… 24 x 7 x 365 Availability Real $’s in Consumer’s Bank Account in Seconds Hosted Services Web or Mobile Customer App Secure Web Services Portal Internet Web Servers Payment Servers PCI Compliant Lower cost compared to Printing and mailing checks Instant use of funds for the recipient PCI compliant Fast 24x7x365 payment alternative Payday Lending Is Check 21 the Solution? What is CheckAlt? CheckAlt is a Check 21 application company that specializes in enabling lenders to debit their borrowers account in the most efficient manner creating a more transparent, quicker and more secure experience. Our Management Team Shai Stern Co-Chairman and Chief Executive Officer Shai Stern is CEO of CheckAlt, LLC, a Check 21 application company specializing in check processing, mobile payments, and mcommerce. He also currently serves as Co-Chairman of Vcorp Services, Vstock Transfer and Vcheck Global. In 2002, Mr. Stern co-founded Vintage Filings, a New York based EDGAR filing firm, which was later acquired by PR Newswire in 2007. Mr. Stern served as CEO and Co-Chairman of Vintage Filings through November, 2011. Mr. Stern was formerly a vice president at American Stock Transfer Company where he initiated business relationships and was responsible for outstanding share balances of over 2,000 publicly held companies. He was instrumental in the growth of AST Stock Plan, which administered stock options and stock benefit plans to 500 publicly traded companies, prior to its purchase by Citibank. Additionally, Mr. Stern is on the board of Double Beam and Zipmark. George Karfunkel Co-Chairman George Karfunkel is currently the Chairman of Sabr Group in New York. He serves as a Director of American Stock Transfer & Trust Company, LLC, which serves approximately 3,000 public companies with over 6,000,000 shareholder accounts. He has been associated with AST since 1971 and served as its Senior Vice President through the first quarter of 2010. Mr. Karfunkel is also vice chairman of The Upstate Bank, and serves on the Board of Directors of AmTrust Financial Services (AFSI), as well as for several other companies. Jeryl Lederman Chief Information Officer Jeryl Lederman brings over 26 years of software development expertise to CheckAlt Payment Solutions, and he oversees the company’s software and server operations. He is also President of Lederman Group, a software development firm with extensive experience in the financial, advertising, construction, and medical service industries. Mr. Lederman was Co-Founder and Executive Vice President for Capital Market Decisions in Stamford, CT and Vice President for Smith Barney, Harris Upham & Co., in New York, NY. Capital Market Decisions was funded by Reuters to develop a desktop analytical trading system in 1990, and he was responsible for the technical development and nationwide roll-out. Mr. Lederman has an M.S. in Mechanical Engineering from the University of Illinois and a B.A. in Math-Physics from Colgate University. The Problem for Lenders Today • Regulators have spooked banks out of doing business with payday lenders • ACH processors have been shut down • Proof of authorization now required The Solution: eChecks via Check 21 • Provides additional transparency • Allows signature and loan number via eCheck API • Deposits directly into lender’s bank account • Schedules deposits based on time, amount of debits & value of debits • Enables additional screening (i.e. ensures account is open with balance ˃ zero) to minimize returns • Delivers posting files to LMS What Check 21 Looks Like Front and back image of check to deliver to the bank 6 additional lines of data (customer number, invoice number, loan number) Virtual endorsement to verify proof of authorization Easy to Set up 1. Create a CSV file of your items to deposit. 2. Transfer the file via Secure FTP site. 3. The Check21 transactions are processed at your bank. 4. Image Reporting is at your fingertips. Reduce Returns There are two simple steps that are required and are assured to reduce returns: 1. Run MicroBilt’s ID-Verify once on each consumer; ODFIs require this level of KYC for today’s transactions. 2. Run MicroBilt’s Risk Verify Database (rVd+) on each Check21 transaction to verify the status of the account: Name-MICR Match; Open/Closed, Positive/Negative balance, and many more fields with risk tiers… Commitment Check21 processing carries risk for the ODFI. This risk is off-set with a combination of holds and reserves. These items may be renegotiated over time as your Check21 relationship matures. Let’s get Started See us after the presentation for more details. Payments: Debit Card Processing How does Debit card processing work? Signature Debit Networks: • • • • Visa MasterCard Discover JCB Signature vs. Pinless? • Realtime Why Use Good the Debit Card as guaranteed Funds • No NSF returns Collateral? • Available 24/7 including weekends and holidays • Immediate answers • Positive Customer Experience- • Multiple attempts within 14 day period • Most all banks issue a debit card • Alternative to ACH- Visa/MC are private networks Payment Channels? • Initial loan application • Web • Tel • IVR • Mobile Text Best Practices • • • • • • • Pre Authorization Customer Vault Tokenization PCI Debit Only Monitor Charge-backs 1% Threshold - Unauthorized Challenges • MCC Code-6501 Quasi Cash • Some Issuers Block • Some Prepaid Blocked • Card Not Present Fraud • Abusive Practices • Sponsor Banks Proper Authorization? “I (we) hereby authorize [LENDER NAME] hereinafter called Company, to initiate debit/credit entries to my (our) account indicated below and the financial institution named below, hereinafter called Financial Institution, to debit/credit the same to such account for (Application). I (we) acknowledge that the origination of ACH transactions to my (our) account must comply with the provisions of U.S. law. Furthermore this authorization applies to my Credit/debit card number below, which I agree to pay above total amount according to Card Issuer Agreement.”