Discussion of AMP - the Advanced Manufacturing

advertisement

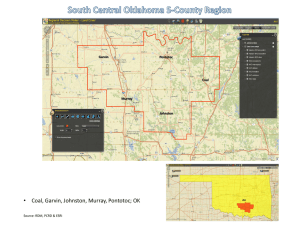

The D. Allan Bromley Memorial Lecture: Bringing Advanced Innovation to Manufacturing William B. Bonvillian Director, MIT Washington Office University of Ottawa, May 14, 2012 D. Allan Bromley 2 Background: The U.S.-Canada Partnership U.S.-Canada – the largest bilateral trade relationship in the history of the world – Total merchandise trade: $530B (2007 pre-recession) Enhanced through deep trade agreements - U.S.Canada Auto Pact of 1965 to NAFTA U.S.-Canada economies highly integrated – comparable standards of living and industrial structure U.S. (pre-recession 2007): $300B in in imports from Canada and $230B in exports We must care a lot about each other I bring today a perspective on U.S. manufacturing but it affects both nations I will outline steps I believe the U.S. must consider, and have been active in a number, but will leave details on the actions and who the actors might be to Q&A 3 4 BACKGROUND POINTS ---why “manufacturing matters” Hollowing Out? 5 Employment: Down almost 1/3 in a decade Investment: Manufacturing fixed capital investment declined (accounting for costs) in the 2000s for the first time since the data has been collected Output: Adjusting gov’t data (for foreign component origin and inflationary assumptions in IT and energy sectors), manufacturing output value declined in the 2000s Decline in 16 of 19 sectors Productivity: If output lower than assumed, productivity is lower We have been assuming we have been losing manufacturing jobs because of productivity gains Recent work – “The Race Against the Machine,” for example is telling us that multiplying productivity gains from IT are displacing work as we know it. Yet, historically - most recently in the tech boom of the 90’s productivity gains, although disruptive initially, grow more jobs Maybe that history is still true – and maybe we need to search for our profound job losses in the manufacturing sector. That means “The Great Recession” is structural, not business cycle, so the Keynesian stimulus tools we have been applying won’t work well. The Manufacturing Hollowing Out is why these aren’t working – requires a Structural strategy not a maco-economic strategy 6 Sharp Decline in Mfg. Employment, 2000-2010 -- drop so steep that productivity gain can’t explain 7 Manufacturing Remains a Major Sector Manufacturing = $1.7 Trillion of $15T U.S. economy Employs 12 million in workforce of 140m Dominates the U.S. innovation system – 70% of of industrial R&D, 80% of patents, employs 64% of scientists and engineers, The currency of international trade is complex high value goods – 80% of U.S. exports are high value goods (capital goods, industrial supplies, transport goods, medicines) U.S. pre recession ‘07: $500B deficit in goods – on track to return to that level Services surplus ($160B) growing gradually but will not offset manufacturing deficit in foreseeable future 8 9 Underlying Issue: Our “Innovate here/Produce Here” Assumption Since WWII - U.S. economy organized around leading the world in technology advance. US led all but one of the innovation waves of the 20th century – and growth economics tell us that technological & related innovation = 60%+ of growth from aviation to electronics, to nuclear power, to computing, to the internet, to biotech Missing an innovation wave is serious: Japan led quality mfg.; 1973-1991 tough for U.S. – GDP and productivity 1% below historical averages Response: ‘90s IT innovation wave and record growth Our operating assumption - we would innovate here and WE would translate those innovations into products Would realize the full range of economic gains from innovation at all stages It worked – world’s richest economy 10 “Innovate here/Produce here” Bonds Breaking? With global economy, assumption of innovate here/produce here no longer holds. In some industrial sectors, can now sever R&D and design from production – That brings the economic foundation of our innovation-based economy into question. Why invest in innovation here if gains elsewhere? Last 25 years – IT/electronics allowed severing of R&D/design from production via IT-based specs; commodity goods, too Distributed Manufacturing – Apple iPod example But other sectors still require deep connection between R&D and production – constant reengineering and improvements to cut costs 11 Mind The Connection between R&D/Design and Production in Different Sectors 12 3 basic kinds of produced goods: (1) IT, (2)bio/pharma, and complex (3) electromechanical-aero First – can sever R&D/design from production using batch processing (bio/pharma), IT specs (IT goods) Electro-mechanical-aero – tie R&D/prod.– variables too complex Energy, for ex., is in the 3rd electro-mechanical category – need to connect R&D/design with production If offshore production, will design/R&D follow? Distributed Mfg.: risk losing production; the rest: lose production, will design/innovation follow? Underlying all this: Competing with low cost/wage high tech competitors: must have production productivity gains That means new innovation req’d: technology and processes If Manufacturing is changing, what are the New “Geopolitics of Manufacturing”? 13 U.S. has gone through 3 phases: 1789-1945 – Alexander Hamilton saw that U.S. independence and security would be built on its commercial strength – U.S. pursued strong self-dependence in manufacturing through WW2 1945-1993 – Cold war competition with Marxist economic system – U.S. strategy: North America, Western Europe, Japan in a system of mutual economic dependence and integrated economies among allies. 1993-now: Clinton: unified global economy is way to integrate China into the world system – manufacturing would be global – decentralized and integrated If manufacturing is no long a tool of national security, can technology leadership shift? Historical Examples of Manufacturing Shifts 14 Post-WW2, U.S. built a comparative advantage in innovation – but unlike the Ricardo comparative advantage in resources, comparative advantage in innovation can shift – it is not eternal (Samuelson 2004) 1. US takes leadership of Industrial Revolution mid- 19th century through development of the “American system” of interchangeable machine-made parts Result of 20-year DOD technology development of precision machine tools at Harper’s Ferry Arsenal 2. Japan 1970’s-80’s – Quality Mfg. - new quality/price tradeoff, just in time inventory, making labor a fixed cost for labor flexibility – tech: IT, computer driven machine tools, tied to production process - built in quality at every phase 3. US recaptures Semiconductor manufacturing lead in 80’s – focus on mfg. process – advances in Semiconductor equip. suppliers, roadmapping In All Three Shifts: tech innovation, process, business model Competiveness Then and Now – much more complex JAPAN v. U.S. – 1970’S – 80’S CHINA v. U.S. - Today High cost, high wage, advanced technology economy – comparable to the U.S. Low cost, low wage, increasingly advanced technology economy U.S. had entrepreneurial advantage, Japan had industrial policy advantage Entrepreneurial and pursuing industrial policy Rule of Law Limited Rule of Law IP Protections Extensive IP theft 15 Subsidizes currency, buys U.S. debt Following Japan’s model: subsidizes currency and largest holder of U.S. debt This Competition = Eroding U.S. Advanced Technology Sectors Shifted abroad: Every brand of notebook computer Every mobile/handheld Displays Shifting abroad? Major erosion in: Advanced materials Computing and communications Renewable energy technologies and storage Semiconductor production The Kindle could not be made in the U.S. $100B trade deficit advanced tech goods 16 Behind it all: Understanding the Hourglass -<---- Resources, Suppliers, Components, Innovation <--- Production (12m jobs) <--- Distribution, Sales, Life Cycle 17 It is an Hourglass because we know Mfg. is a Job Multiplier: Economic Policy Institute: Mfg. job multiplier - 2.90 Milken Institute: 2.50 multiplier Zobel (Germany) smart manufacturing factory supports 5.2 additional jobs High-tech manufacturing industries appear to have greater multipliers Electronic computer manufacturing multiplier of 16 [ITIF 4/11 summary] 18 Change in Median Household Income, 2000-2011 (inflation adj.) +2 0 -2 -4 -6 -8 -10 -12 CAUSE: STRUCTURAL RECESSION – Centered in Mfg. Source: G.Green, J.Coder (10/11, based on Census Bur. Data) 19 If it is a structural recession with a base in manufacturing, this requires: Innovation in Advanced Manufacturing: 9 Steps to consider 20 Need to Keep in Mind the Levels in the US Manufacturing Sector 21 Three elements in US mfg.: Large Multinationals (MNCs) – very international - will locate in low cost production centers for productivity gains; need to be in emerging markets Start-up and entrepreneurial firms – increasingly offshoring production – not a core competency, can’t get financing So: next gen technologies shift? 300,000 small manufacturers – suppliers, component makers – bulk of US mfg Thinly capitalized, risk adverse, no R&D Step #1: What technology advances = new manufacturing productivity = new paradigms? 22 “Network centric” – mix of advanced IT, RFID, sensors in every stage and element, new decision making from “big data” analytics, advanced robotics, supercomputing w/adv’d simulation & modeling Advanced materials “materials genome” – ability with supercomputing to design all possible materials with designer features Biomaterials, bio fabrication, syntehtic biology Lightweighting everything Nanomanufacturing fabrication at the nano-scale Mass Customization Production of one at cost of mass production (ex.: 3D printing/additive mfg, etc.) Distribution efficiency IT advances that yield distribution efficiencies (incl. in supply chain) Energy Efficiency – energy is “waste These tech paradigms are not optional – Companies will have to meet them Timetable – starting to see these adv’d mfg. technologies emerge – will be pervasive in next 15 years Just as with “Lean Mfg.” (way US firms responded to Japan’s model of the 70s-80s), today’s firms will need to pursue these advanced technologies because the competitive efficiencies are major How will mass of 300,000 US SMEs adapt to these tech advances? Big challenge US: strength on the design side – real limits on the commercialization and scale-ability side which advanced mfg. innovation would enable US is not yet working systematically on this agenda 23 Step #2 – Pick Tech Paradigms that Apply across Sectors Manufacturing is sectoral, but with increasing sectoral overlap for complex, high value goods An airplane is complex system: aero design, electronics, IT, materials, etc. Technology paradigms have to make sense in the sectors Run a matrix – technology options against sectors they apply to – pick technologies with payoff across sectors Include emerging sectors 24 MATRIX: Tech Sectors/Mfg. Paradigms 25 Sector and Mfg. Pardigm Bio/pha Aerorma space IT/elect ronics Heavy Equip ment Digital search, network New energy Trans port Network centric x x x x x x x Advanced materials x x x x x x Nano Mfg. x x x x x x x Mass Customization x x x x x x x Distribution x Efficiency x x x x x Energy Efficiency x x x x x x x Step #3 – Technology is Not Enough…Need to Look at all Three: A) New Adv’d Mfg. Technology Paradigms - first building block B) But need Process – adapt to production system C) Then need Business and Organizational Model – has to 26 Step #4:, It’s no longer Manufacturing or Services 21st Century firm increasingly fuses services, production, supply chain management and innovation – IBM’s Lou Gerstner originated this model in the 90’s Many of these capabilities are knowledge “intangibles” not fixed assets – learning to tie new equipment and technologies to new processes – fusing IT-informed services models with new mfg. What is this emerging firm model? How pervasive? is it vertical or horizontal? is it integrated or the result of flexible leveraging other firms’ specialty capabilities? Business model stage - will need to look at optimal combined mfg./services model 27 Step #5: Need to Look Over Our Shoulders 28 Look at competitor nation strategies Hard to understand the future of U.S. manufacturing without evaluating the context of global manufacturer competitors and their strategies – learn from them – they are doing this and have “top down” not just “bottom up” Look at: China/India/Brazil – large emerging Germany/Japan – large established High wage & cost – yet major mfg. surpluses Korea/Taiwan – smaller scale, key niches Expanding mfg. employment Step #6: Build the Workforce Most of mfg. is now defined as services – Need a new level of fused knowledge, skills in both 29 STEM Ed req’d; mfg.: pervasive basic STEM skill sets Ed system doesn’t understand that innovation requires “mind and hand” “intelligent hand” - mix of skills, experimentalists and theorists – learning by doing Additive manufacturing in schools? It’s not just design as a stand-alone stage, design is over time also the ability to make, as well – education needs to incorporate Very hard, still, despite distributed IT manufacturing, to sever design from production – mutually informative Community college skills role w/industry certification New adv’d mfg. engineering curriculum – how to develop process from lab bench technologies – lost in engineering curriculum Step #7: Innovation Organization The Pipeline and the Seams 30 US pipeline innovation model organized with heavy federal basic research investment, some applied (from DOD) Limited investment in manufacturing R&D (including tech, process, business model) - $800m – and not interagency We institutionalize the “Valley of Death” in our R&D model profound problems at the seams of the innovation pipeline – big disconnects between actors U.S. research strong; scaling/commercialization a problem: Research – basic research agencies, univ’s Applied and later stages – industry, some DOD support But other intermediate steps will need public-private connections –further down the pipeline to commercialization Not just R&D–pre-production networked organizational We Need these Guys - DOD: Operates at Every Stage of the Innovation System Historically Central Player - Role in Adv’d Mfg.? REMEMBER DOD’s 20th Century Innovation Waves: Aviation Electronics Nuclear Power Space Computing The Internet 31 Step #8: Build Regional Infrastructure 32 Research > Development > Prototype > Demonstration > Testbed > Production at Scale No longer the Old Pipeline model – gov’t does Research and industry picks up the rest Now: host of intermediary steps require public/private connections Especially important: the Testbed Where 300,000 SME’s test the efficiency and cost of new mfg. technologies – they lack resources for this stage Mfg. is regional not national – need to be in regional clusters Step #9: Financing Innovation - “5 Year Yardstick” doesn’t work in Mfg. 33 The Breakthrough system – the pipeline: federal R&D, univ. research, startups/entrepreneurs, VC’s angel, IPO’s 5-year yardstick based on IT model: VC’s fund technologies no more than 2/3 years from commercialization, then the flip to an IPO within 3 years New manufacturing technology paradigms probably require the breakthrough innovation system But advanced manufacturing doesn’t fit the 5 year yardstick 5-Year vs. 10-year Yardstick: 3 4 Manufacturing doesn’t fit the 5-year yardstick: New mfg. tech’s face the Valley of Death – Then they face the “Mountain of Death” – getting to market launch at scale: major financing and price competitive at the outset of launch + Valley of Death – 5 year scale up - creating connections and funding to move from research to late stage development Mountain of Death: 10+ year scale up; major financing needed to scale, price competitive from moment of market launch Work-Arounds for the Mountain 35 Manufacturing – the 10+year yardstick Requires deeper, longer term, patient capitalization/finance than IT Longer time to stage entry and to scale – 10+ years not 5 It’s a complex, established “legacy” sector US better at bringing innovation into new areas, not at introducing innovation into legacy areas Different mindset – can’t create a company to sell it, as in IT, biotech Work-Arounds for the Mountain of Death: Front end of the innovation system: R&D programs designed for the breakthrough and to drive down prices/reduce production costs US research agencies: “NMP” – Not My Problem – look at just research not the implementation – change? ARPA-E and EERE considering Back end of the innovation system? Andrew Lo – portfolio approach Small commitments by large nos. of investors – use the internet Crowd-funding? Lotteries? Remember Innovation Organization Effects for the 3 kinds of Mfg Firms Different --- 36 MNC’s Respond to competitive cost competition by locating where they need to Will locate R&D near production when nexus needed – can go abroad, avoid risk of adv’d technologies by offshoring to low cost Entreprenurial/Startups pursuing scaleable tech’s VC’s won’t fund mfg. – not core competency So: Offshore production – reduce risk and costs But risk product control – knowledge spillover Lose next gen technologies Small Manufacturers – bulk of US manufacturing Need productivity gains to stay competitive Lack resources, tech dev/access – so need proven technologies, processes Lack testbeds, financing for productivity options – miss tech waves 37 Remember the Steps: #1- Technology advances that yield new manufacturing paradigms #2 – Matrix - Pick new manufacturing technology paradigms that apply across range of manufacturing sectors #3 – Technology alone is not enough – also need process and business model #4 –Fuse Services and Manufacturing #5 – Other nations - Better look over our shoulder #6 – Build the Workforce #7 – Innovation Organization – Look at those intermediary stages #8 – Build Regional Infrastructure #9 – Financing – The 5 vs. 10 year yardstick Remember: Manufacturing Scales 38 Economics focused on “decreasing returns” Brian Arthur – helped us understand “increasing returns” tech advance lock in a standard, geometric increase Exs.: railroads, cars, Microsoft operating system,desktops, iPod-iPad-iPhone, Services scale slowly – face to face Manufacturing key to “increasing returns” in an economy – fundamental to strong growth Wrap- up: Focus here is innovation, the supply side – the demand side also needs attention: taxes, trade, regulation -- But: it’s STRUCTURAL NOT MACRO-ECONOMIC Remember the Hourglass - we must understand the tie between production and other employment sectors – that’s why mfg. must be taken seriously And Remember, Manufacturing Scales – key to growth 39