Michael Kulp – President & CEO, KBP Foods - 2015 Multi

advertisement

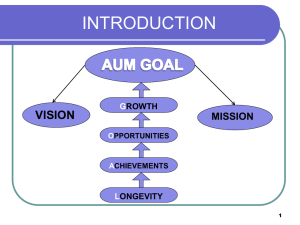

Develop Your Capital Growth Plan Workshop Facilitator: Michael Kulp, President & CEO, KBP Foods Panelists: Nick Cole, Executive Vice President, Wells Fargo Corporate Banking Jeffery Kolton, Principal, Franchise Market Ventures Anil Yadav, President, JIB Management, Inc. Michael Kulp – President & CEO, KBP Foods For more than a decade, Michael Kulp’s passion for creating a great place to work, a great place to eat, and a great place to own have provided unique opportunities for those at KBP Foods. Under his direction, KBP has grown from $7 million to $260 million in annual revenue over a 12-year period and is ranked among the 10 fastest-growing restaurant companies in the country. In addition to being President/CEO at KBP, Michael serves on the National KFC advisory board, is the chair of the national operations subcommittee, and sits on the national marketing committee. He also serves on a franchise advisory board to Yum! Brands, in partnership with PricewaterhouseCoopers, and is a member of the board of directors at Fresh Alternatives, a holding company that owns and operates fast casual restaurants in Florida. Michael holds bachelor’s degrees in Business Administration and Marketing from University of Colorado and Colorado Mesa University, and also played collegiate-level athletics. Michael and his wife Stephanie are proud parents of three children and have dedicated their time and talent to many philanthropic efforts in their home town of Kansas City, such as First Downs for Down Syndrome organization and the Truman Medical Health and Wellness Center. Franchisee: KFC, Pizza Hut, Taco Bell, Long John Silver's - Nick Cole – Executive Vice President, Wells Fargo Corporate Banking Nick Cole is an executive vice president responsible for the Wells Fargo Restaurant Finance and Gaming groups. Restaurant Finance is based in Carlsbad, California and provides capital and other banking services to owners of multi-unit, branded retail businesses in the restaurant and convenience store sectors. Prior to joining Wells Fargo in 2006, Nick was a managing director and senior client manager with Bank of America Securities, where he spent 11 years in corporate and investment banking. Nick was a founding member of the Restaurant Finance Group at the Bank of Boston, a predecessor company to Bank of America. He was also a merger arbitrage trader in the Equity Asset Management Group of Dresdner Securities in New York City. Nick holds a B.A. degree in history from Haverford College in Pennsylvania, and an M.A. degree in economics from Columbia University in New York City. Nick is an active supporter of several youth soccer clubs in San Diego, and serves on the Board of Directors at the San Diego Ronald McDonald House. Nick lives in Del Mar, Calif., with his wife and two children. Jeffrey Kolton – Principal, Franchise Market Ventures Jeffrey Kolton is highly regarded as one of the leaders and innovators in the franchising community. With over 25 years experience at the highest levels within the legal, research, marketing and finance sectors, Jeffrey brings a unique perspective and an invaluable rolodex to every deal he works on. He has been a partner in one of the leading franchise law firms in the country (Kaufmann Gildin); founded and built the leading franchise research firm in the country (FRANdata Corporation); was elected to the highest position among industry suppliers by his peers (the Supplier Forum); and was a member of the Board of Directors of the industry’s leading trade association (the International Franchise Association). Jeffrey has also served on the Board of Directors of both publicly-traded franchisor Emerging Visions Inc. (which he helped take private), as well as venture-backed SinglePlatform, which was purchased by publicly-traded ConstantContact in July 2012 (in a deal valued at $100 million). He is a retained advisor to high net-worth individuals and private equity funds on investment opportunities in the franchise sector. Jeffrey is an honors graduate of Cornell University and the London School of Economics, and received his law degree from Georgetown. Franchisee: FMV Anil Yadav – President, JIB Management Inc. Anil Yadav is an independent franchisee of Jack in the Box, Denny’s and Sizzler’s restaurants. Anil has been franchisee with Jack in the Box since 1989 and currently owns and operates 262 restaurants in California and Texas. Jack in the Box accounts for 221 units. Anil is the largest Jack in the Box franchisee in the United States and largest Denny’s franchisee in California. In 2012, he further diversified his restaurants holdings through the acquisition of six Sizzler restaurants. He began his career with Jack in the Box corporate as a Restaurant Manager. His outstanding performance was recognized year over year as a top Manager in the Jack in the Box system. Anil purchased his first restaurant in 1989 and has been involved with the dayto-day operations ever since. He has achieved top sales and performance awards year over year and also earned the distinction of “Operator of the Year” as well as “Marketer of the Year” awards. In 2007, Anil was awarded the “Franchisee of the Year Award” by Jack in the Box. He was elected to the position of President for the JIB Franchise Association in February 2009, and currently serves as Chairman Franchisee: Jack in the Box, Denny's, Sizzlers, Area Developer: Marco's Pizza Session Objectives Prepare your organization to secure financing for growth Introduce components of a strong growth plan — Growth strategy — Structural preparation — Cultural implementation Growth Plan Elements Growth Strategy Structural Preparation Growth Plan Cultural Implementation S.W.O.T Analysis Growth Strategy Development Be Intentional — What’s Your Why? Organizational alignment to grow Have a clear strategy Play to strengths Structural Preparation for Growth Proper Preparation Prevents Poor Performance – The Five Ps Internal diligence — Legal — Financial — Tax Infrastructure planning and evolution Cultural Implementation of Growth Plan Pre-close planning Post-close planning Delivering the plan — Lenders — Equity Providers — Franchisors Build Your Growth Plan Top 3 Priorities for Growth — Category — Today’s Date — Target Completion Date — Date Achieved — The Goal (Specific, Measurable, Attainable, Relevant, Time Bound) — Benefits to Achieving this Goal — Resources Needed (Skills, Knowledge, Tools, Money, Support, etc.) — Possible Obstacles — Possible Solutions — Action Steps (Break It Down Into Small Bites) — Deadline — Complete Impact of Proper Planning Open Panel Discussion How much impact does this level of planning make in securing financing? Tangible differences How has this worked? It’s A Great Time To Grow!