Account opening and registration integration process – key milestones

advertisement

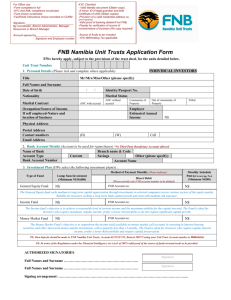

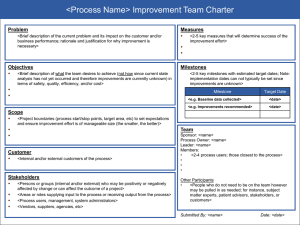

Companies and Intellectual Property Commission (CIPC) and First National Bank (FNB) Collaborative efforts to implement customer centric improvements ECRF : June 2013 Company Confidential, Business Banking Content • Introduction to CIPC and FNB • Key value proposition for Business customers • Annual Renewals process • Annual Renewals process : key milestones • Account opening and registration integration process • Account opening and registration integration process : key milestones • Questions Company Confidential, Business Banking Introduction Company Confidential, Business Banking Who is CIPC? • Established as an independent agency in May 2011 with introduction of new Company law; • Legislation aimed to make company registration and maintenance easier and stripped away a lot of unnecessary requirements for small firms: • e.g. audit requirements; • Name reservation; • Challenge has been to align processes and systems with letter and spirit of the law and to continuously streamline and innovate; Legislative Mandate • CIPC administers all or part of 15 laws in the corporate and intellectual property domains; • Vast legislative compliance role - registration of corporate entities, intellectual property rights, business names and business rescue practitioners, monitoring compliance with governance and disclosure rules, protecting certain IP rights, providing education on the laws and their implications and providing policy support – clear focus on creative industries, protecting invention and facilitating enterprise Mandate may appear diverse, but presents unique opportunity to explore synergy and interrelationships Facts about CIPC Companies Register • Total size of the register (companies and close corporations): about 1.3 million • CIPC registers about 20,000 companies per month; • 70% of registration is electronic; • Average turnaround time – for manual transactions: 20 days – for electronic transactions: 3 days (bringing time taken down every day – most electronic transactions processed within 1 day, excl. name reservation); FNB and FirstRand London, UK China Dubai Africa India Existing Africa countries South Africa Namibia Botswana Lesotho Mozambique Swaziland Zambia Tanzania REP Office Angola Nigeria Kenya Banking operations footprint FirstRand Bank Branch Representative Office Priority countries Nigeria Ghana Making it easier to start a (formal) business • • • • and Making it easier to transact with CIPC; run – 96% of our customers have e-mail addresses and overwhelming majority prefer to transact electronically with us; – Customers struggle to get hold of us – need to dramatically improve our telephone service; Reducing the need for duplicate filings with government departments; Providing integrated service offerings with collaboration partners – three way value proposition: – CIPC – Partner institution – end user/client 2 obvious partners – Banks, South African Revenue Services – Combine compliance and convenience for businesses; – Integrated service offerings to businesses; – Improved identity verification for CIPC Using collaboration to improve ease of doing business • Due to Know Your Customer rules, banks collect very similar information as CIPC (and the revenue service); • Company hijacking/corporate identity theft has highlighted need for more secure processes – very similar to personal identity theft that banks face; • Close alignment of processes – upfront face-to-face verification, security for changes • Opportunity identified to collaborate with banks; • Initiated pilot project with one bank, First National Bank (FNB), but have been very open to initiatives with all banks and have extended an invitation to them; Key value proposition for Business customers Integration into yearly / half-yearly tax submissions. Account Opening Rewards for right behaviour Multiple channels Access mechanisms Account Maintenance Facilities Value Adds Devices CIPC / Tax Account life-cycle management. Financial documentation, renewal process alerts and automation. Integrated account opening processes and name reservations, across all channels. Fulfillment Switch or Migrate Processes completed Customer has close to immediate ability to get business going and to transact. Realises importance of compliance and legislative processes. Easing administrative burden of doing business Value proposition extends to CIPC, and other legislative / governmental bodies Annual Renewals process Analytics and MI shared between CIPC and FNB to verify customer numbers and type of intervention required – customer contact details also shared Within Annual Renewal Notification timeframe Past Annual Renewal Notification timeframe In Deregistration Process timeframe Customer base ID’ed to require Annual Renewals Tailored customer communication, with step by step processes to renew and / or prevent deregistration Customer call to action mointored Annual Renewals process - key milestones Highlights Benefit In excess of 100,000 customers now contacted via the phased process (annual renewals process went live in August 2012). Fully operational contact process, with multi-pass strategies in effect. Improved customer engagement, entrenchment and ultimately reduced attrition. General customer receptivity has been very positive. Integration for all phases of customer and account activity to communicate CIPC processes in all available channels. Process flow changes prevent customers from being targeted repeatedly. Scale available for all segments within Firstrand. Account opening and registration integration process FNB’s Online Account opening landing page for Business Accounts – also available via Internet Banking kiosks in branches. Account opening and registration integration process Account selection also includes a host of free value adds meant to ease management of the account, and ties into the ‘easing of administrative burdens’ strategy. Account opening and registration integration process Product Basket (at left) also allows selection of core cross-sales of key products. Account opening and registration integration process This step differentiates between new to bank customers versus existing customers wishing to deepen their relationship with FNB by now opening a Business Account. Account opening and registration integration process Capturing of customer details then commences, with step by step instructions on what requires completion. Account opening and registration integration process The customer is next offered the integrated registration process option – if this is chosen (for businesses without an existing registration number) the integration process begins. Account opening and registration integration process The last step requires completion of all details required for the CIPC registration. Fulfillment activities now commence – no further customer action is required except customer verification which is handled using FNB’s existing processes. Account opening and registration integration process – key milestones Highlights Benefit Pilot phase commenced in late May 2013. End to end integration for pilot customers to stress test the process. Manual fall-back processes in place to ensure that customer applications are not orphaned in the event of system or communication issues. Fulfillment processes completely linked into FNB’s Online account opening processes to ensure standardisation. Full go-live implementation scheduled for third week of June 2013. Sufficient time allocated for piloting. Coincides with marketing campaigns advertising other key features and benefits of FNB’s Business Banking account. Questions?