What is an escrow? - Windy City Summit

1

Banking on Escrow:

Best Practices for Offering an Escrow

Sub-Account Solution to Your Customers

Windy City Summit

June 7, 2012

2

Session Objectives

Obtain knowledge in what escrow sub-accounting is, who uses it, and how it works

Gain a better understanding of the current trends in escrow sub-accounting

Learn what financial institutions are doing to offer escrow accounting solutions

Review common best practices to implement escrow accounting solutions

3

Situation Analysis and Current Trends

Joseph Vitale

Vice President

Senior Product Manager

Situation Analysis – Escrows

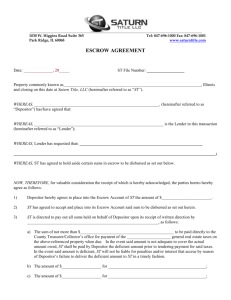

What is an escrow?

An arrangement to help parties perform contracts and avoid disagreements

What parties are involved in an escrow arrangement?

A depositor, an escrow agent, a beneficiary

How does an escrow work?

The depositor is required to entrust money or property with an escrow agent

The escrow agent holds the deposit until it can be released to the beneficiary upon some future event

4

There are many uses for escrows of all which have contractual or legal obligations

5

Situation Analysis – Escrows

What types of funds are held in escrow?

Down payment for the purchase and sale of real property

Legal settlements, rent security deposits, new home construction, advance fees paid to brokers, membership fees, assisted care deposits

Who needs escrows?

Law Firms: client trusts, IOLTAs

Real Estate: property management, title companies, 1031 exchanges

Pre-Need: nursing homes, funeral homes, cemeteries, crematories

State Government: local bond funded projects

Federal Government: federal projects, EB-5

6

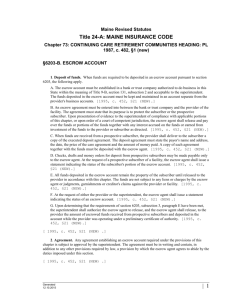

Situation Analysis – Escrow Rules and Regulations

Every industry that uses escrow accounts has unique and specific rules and regulations to follow based on several factors, including, but not limited to:

Interest payments

Taxes

Financial reporting

Oversight and disclosure

Agreements and contracts

Funds management and disbursement

State and federal mandates

Each escrow application has unique rules and regulations

Situation Analysis – Escrow Accounting Products

Escrow accounting products have been increasing in demand and usage over the last few years. Businesses require more visibility into and control over accounts and can no longer wait for month end statements or rely on bank custodial management. Industry solutions typically have the following characteristics:

Web-based online reporting and account administration

Unlimited sub-accounts

Interest allocation and apportionment

Deposit and funds segregation

Reconcilement and adjustment identification

Statement and activity reporting

Document storage and retrieval

1099 reporting

Financial institutions have seen an increase in demand and adoption for escrow products

7

Situation Analysis – Escrow Accounting Products

Financial institutions are now developing escrow accounting products and services to meet the increasing demands of businesses. These products have a typical workflow in terms of how they are setup and used.

6.

7.

1.

2.

3.

4.

5.

Customer is setup on an escrow accounting product with master or main escrow account(s)

Customer creates subaccounts in the product off of the main interest bearing or noninterest-bearing account structures

As deposits come into the main account(s), they are posted to the product on a prior day or same day basis

If the subaccount is identified on the incoming deposit, the subaccount is automatically updated with the deposit, or if not identified, unallocated funds will need to be reconciled

As the bank calculates and posts interest to the main account, all subaccounts that accrue interest are automatically updated

Customer can generate reports to verify transaction activity and reconcilement

When it comes time to disburse the funds, customer can initiate payments or write a check to the account holder and then close the sub-account

8

Escrow accounting products bring reporting and administration tasks online

Situation Analysis – Escrow Accounting Products

Typical escrow account structure hierarchy:

Escrow Account

Master Account 1

(Interest Bearing)

Master Account 2

(Non-interest Bearing)

Sub-account 1

Account Holder

Sub-account 2

Account Holder

Sub-account 1

Account Holder

9

This structure allows organizations to build unlimited subaccount hierarchies

Industry Trends – Risk and Compliance

Financial institutions and businesses are experiencing a shift in oversight, risk management, regulatory changes, and enhanced compliance standards.

Regulatory

Compliance

RISK CATEGORY

Risk Management

Business Resumption and Continuity

RISK

Asset allocation

Counterparty

Currency

Economic

Direct, industry specific

Indirect, banking

Direct, industry specific (SOX, SSAE 16)

Indirect, banking

Natural disasters are no longer a once or twice in a lifetime occurrence

Pandemic, operational or process breakdown

The business community is dealing with an onslaught of risk and regulatory challenges

10

Industry Trends – Technology

Technology is changing rapidly and organizations are dealing with when to begin to upgrade, change, and use new systems to run the business.

Budgeting

New products and services

Risk and compliance

Core Systems

Accounting, Billing/Purchasing

Treasury Management Workstations, ERP

DDA, Analysis, Payment systems

Platforms

Online banking

Software as a Service (SaaS)/Cloud mCommerce (mobile)

Go Green/Eco-friendly initiatives

11

Businesses have been on the same system platform for an average of 7-10 years

Industry Trends – Fraud and Security

Fraud prevention and overall transaction security is a primary concern for all organizations.

Online Banking

Secure payments and account/transaction data

Protected browser sessions

Timely alert notifications

Fraud Mitigation

Check and ACH Positive Pay, blocks, filters

Dual control, out of band, security tools

User access permissions, transaction limits

Risk Management

Enterprise risk

Predictive analysis and scoring

Back office system detection

12

The expectation is we all must do more to assist in fraud education and prevention

13

Best Practices in Partnering with a Bank

Judy Hill

Senior Vice President

Sales Advisory

Determining the Need for an Escrow Partner

Do you have a need to segregate accounts and keep funds separate for tracking and reporting?

Would you like the convenience of opening and closing escrow accounts quickly online?

Would you like the ability to attach relevant account documents such as W9s, legal agreements, and service contracts directly to online accounts?

Do you require visibility and transparency into all main and subaccounts to meet audit and compliance policies?

Is FDIC insurance important to your customers?

Would you like to offer your clients interest on the earnest money or escrow funds you manage and administer for them?

Are you required to create and distribute 1099s?

14

Case Study: Real Estate Brokerage Company

Company Overview

40 offices across the county

In excess of 1,500 active brokers

Current Environment

150 escrow deposits per month

Average deposit amount $13,000

Average deposit time 90 days

75% non-interest bearing deposits

25% interest bearing deposits

150 distributions per month

Escrow deposits tracked manually via spreadsheet

Interest calculated manually at time of disbursement

Manual bank reconciliation

Mission Impossible – accurate production of 1099s

15

Challenge with Manual Process

16

Challenges with Manual Process

Challenge

It takes too long and it’s too expensive to open separate accounts at the bank.

I need to keep funds segregated for tracking and management.

I am required to pay interest on some of the accounts and can’t easily calculate it.

Issuing 1099’s at year end is a significant task.

Solution

You can administer the sub accounts online without contacting the bank. Your bank should allow for an umbrella agreement that covers all of the OFAC and KYC procedures.

These solutions maintain a logical hierarchy for Master and Sub

Accounts - allowing you to maintain and view each account separately or you can group accounts uniquely to provide information the way you need it.

Interest can be allocated at both the Master and Sub Account level and can be applied using different rates for each account.

1099 reporting is facilitated to work within your current reporting process and will provide more efficiency. Helping you to meet IRS reporting requirements.

Accounts can be set-up so that all funds have full FDIC coverage.

My customers demand FDIC coverage on their deposits.

I have separate systems to access important client documents of escrow accountholders.

These solutions have a document upload function so you can attach all relevant documents like escrow agreements and invoices directly to online profiles.

17

Value Proposition for Businesses

Feature

Online system access

Escrow sub-accounting

Interest accrual

Risk and compliance

Reporting

Benefit

Users manage all accounts and administration online in a separate product module in a safe and secure environment

Main accounts can be broken down into subaccounts for individual tracking and reporting and store related documents like W9s and agreements

Interest can be allocated at both the main and sub-account level and can be different for each account

Complete audit trails, visibility and transparency into all account activity to meet risk and compliance standards

Statement reports, charts, graphs, analytics, and 1099 reporting

18

There are several benefits businesses can take advantage of from day one

Best Practices in Implementing Escrow Solutions

Analyze your current process and escrow needs

What are your challenges

Where are your risks

Outline all legal and compliance requirements

Work with your financial institution to:

Understand the options for the account structure to best meet your needs

Identify operational efficiencies based on the features of your banking partner’s product offering

Understand the value proposition for your customers

Create business case to sell internally

Use the IPDE method – Identify, Predict, Decide, and Execute

19

Summary

There is an increase in demand in the industry for online escrow subaccount solutions

State, federal, and industry regulations and compliance standards are driving adoption of escrow subaccount products

The primary market segments with escrow accounting needs are law firms, real estate, pre-need, and government

Escrow accounting solutions offer several key benefits to both businesses and financial institutions

Follow best practices when marketing and implementing escrow accounting products and services

Understanding your escrow needs and requirements is key to an effective program built to meet revenue goals, reduce costs, and satisfy compliance standards

20