IDB Group_presentation_comcec_workshop

advertisement

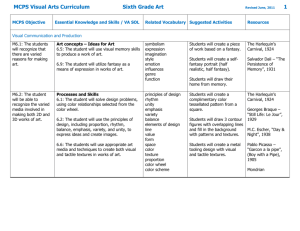

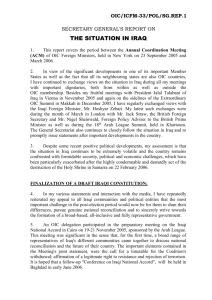

The Islamic Development Bank Group “Together We Build a Better Future” OIC Workshop on “Country Partnership Models with Central Asia” 1 No COUNTRY MAY 1999 FEB 2012 Approved in 2010 Approved in 2011 Approved in 2012 1 AZERBAIJAN 62.87 1,205.3 (57) 351.22 (11) 265.2 (4) - 2 KAZAKHSTAN 22.73 857.5 (45) 274.15(5) 0 - 3 KYRGYZ REPUB 45.61 177.8 (37) 1.0 (1) 23.08 (1) - 4 TAJIKISTAN 23.42 239.5 (44) 10.2 (2) 19.0 (1) 5 TURKMENISTAN 26.62 647.7 (22) 218.6 (3) 121.48 (2) - 6 UZBEKISTAN* 0 617.8 (36) 180.4(3) 95.0(1) - 217.44 3,745.9 (241) 1,035.6 (25) 523.7 (9) GRAND TOTAL (Number) Number of projects *Since joining to the IDB (2003) 17.35 (1) 17.35 (1) No IDB GROUP MAY 1999 FEB 2012 Approved in 2010 Approved in 2011 Approved in 2012 1 ORDINARY 216.18 3,307,3 891.9 523.7 17.35 2 ICD 0.0 221.9 68.1 0 0 3 ITFC 0.0 207.9 75.5 90 0 4 Trust Fund 0.0 2.2 2.2 0 0 5 SAO 1.25 6.65 0 0 0 217.44 3,745.9 1,037.5 613.7 17.35 GRAND TOTAL No COUNTRY Operations Complex* ICD ITFC Trust Fund SAO TOTAL 1 AZERBAIJAN 1,051.1 113.3 38.9 0.0 1.990 1,205.3 2 KAZAKHSTAN 695.11 15.5 145.0 0.0 1.937 857.5 3 KYRGYZ REPUB 157.6 18.4 0.0 1.2 1.884 177.2 4 TAJIKISTAN 212.1 12.5 14.0 0.0 0.844 239.5 5 TURKMENISTAN 637.7 0.0 10.0 0.0 0.325 648.0 6 UZBEKISTAN 553.72 62.2 0.0 1.0 1.873 617.8 TOTAL 3,307.3 221.9 207.9 2.2 8.84 3,745.9 88.3% 5.9% 5.5% 0.1% 0.2% 100% Percentage, % *financing under Operations Complex includes loans and ordinary operations N o COUNTRY LOAN 1 AZERBAIJAN 93.13 (10) 31.03 (3) 370.6 (3) 552.79 (7) 0 3.52 (13) 2 KAZAKHSTAN 36.04 (4) 17.40 (3) 0 423.71 (4) 214.7 (9) 3.26 (13) 3 KYRGYZ REPUB 133.94 (13) 18.50 (2) 0 0 0 4.49 (13) 4 TAJIKISTAN 207.31 (21) 0 0 0 0 4.83 (16) 5 TURKMENISTAN 29.57 (3) 81.51 (6) 0 524.91 (5) 0 1.42 (5) 6 UZBEKISTAN 33.0 (3) 53.72 (3) 122.72 (4) 297.22 (4) 45.0 (3) 2.07 (6) 532.9 (54) 202.16 (17) 493.32 (7) 1,798.63 (20) 259.7 (12) 19.59 (66) 16.0% 6.1% 7.9% 0.5% TOTAL Percentage, % IN.SALE LEASING 15.0% (Number) Number of Projects % - According to the amount of the Mode of Financing ISTISNA’A LoF 54.7% TA (Grant) ICD`s Special Economic Zones Trusty Fund & SME Development Fund TA for Development of Islamic Finance in CIS TA for Capacity Building Program for WTO related issues STATCAP – Building Capacity of Statistical Agencies Alliance of Avoidable blindness VOLIP – Vocation Literacy Program ITAP – Investment for Technical Assistance Program TCPP – Technical Cooperation and Promotion Program TACP – Technical Assistance Cooperation Program (New Vice Presidency complex with focusing on Cooperation & Capacity Development IDB Scholarship Program & others 6 Issue: Less focused interventions by different providers (too many cooperation areas of TA), sometimes creating duplications/repetitions; Solution: Closer partnership and harmonization among OIC sister institutions and other organizations Issue: Donor –Recipient/North-South relationship, creating unbalanced distribution of benefits of TA activities at expenses of Member Countries. Central Asia – recipient region in terms of TA; Solution: Promoting South-South Cooperation (Triangular relationship MC-Facilitator-MC). Central Asia – provider of TA 7 Issue: Process-oriented Technical Cooperation/TA activities, with minimal consideration of outcome/impact Solution: Design Results-oriented activities based on comprehensive Results-Matrix (with measurable KPIs, detailed targets, outcome evaluation and impact assessment) Issue: Lack of Ownership and Sustainability of targeted activity Solution: MC should ensure proper medium to long term budget allocation for subject activity 8 Member Country Partnership Strategy (MCPS) Introduced in 2010 (Turkey, Kazakhstan in the Region),before 3-Year Work Program Formulation Consultation Consultations Government Development Partners Civil Society Private Sector Academia Research Institute Seeks Common Grounds Country National Development Strategy MCPS and Results Framework IDB Vision 1440H and Results Framework Diagnosis Knowledge Repository inputs Diagnostic and Analytical Papers Sector and Thematic Assessments Sector Road Maps Self and Independent Assessments 9 How Do We Develop an MCPS? 1. “In House” Start with … Leading to … Consultations Diagnostic studies (CEW, SW) / desk reviews Concept Note (pre-MCPS) preparation Operations Committee review Bank-wide “Core & Multidisciplinary Team” formation Internal Committee`s review/clearance Guidance by Management on key policy & operational issues How Do We Develop an MCPS? – Consultation with Client/ Stakeholders 2. Consultations MCPS Field Mission “In Country” “Consensus” on areas of engagement Back to Office With Government Finalization Active Players incl. OIC institutions, Coordination Group and other MDBs Approval of Management Board for Information What is Unique about the MCPS? - Reverse Linkage IDB Group’s Strategic Thrust (#8): “Facilitate integration of IDB Member Country economies among themselves and with the world” Interventions to strengthen cooperation Sharing Knowledge, Positive Experiences and Know-How Strategic cooperation leading to Economic Integration RLs are mechanisms where a MC, based on its competitive advantage, can offer its expertise, knowledge and know-how to another MC with the IDB Group serving as an “enabler” in a mutually beneficial (win-win) process facilitating strategic alignments between the IDB Group and the MCs Progress on MCPS Initiative (End Year 1432H) Completed and Under Implementation Nearing Completion Indonesia Kazakhstan Mali Mauritania Turkey Malaysia Bahrain Egypt GCC Regional Kuwait Morocco Uganda Pakistan Under Preparation Senegal Niger Syria Tunisia *An MCPS for Fragile/Post-Conflict LDMCs is also under planning Pillar 1: Increasing Competitiveness (Transport and Energy Infrastructure) Pillar 2: Economic Diversification (Non-extracting industry, agriculture and rural development) Pillar 3: Financial sector deepening (Islamic Finance and Banking Advancement) Pillar 4: Regional Integration (Cross – Border Cooperation &Trade) – OIC Food Security Fund, IDBG Financing Envelope: USD 1.2 billion for 2012- 2014 MCPS duration 14 Prospective areas of technical cooperation: Trade & Transport Facilitation, Renewable Energy, CommunityDriven Development, Islamic Finance and Promotion of Employment Generation in the region Regional Strategic Approach – Central Asia & Caucasus Development Program is being prepared (covering all Muslim CIS countries and Muslim Communities in nonmember CIS countries) Uzbekistan: 2nd MCPS in the Region and CEW by the end 2012 To include (i) Azerbaijan, being OIC MC, in the Action Plan of OIC for Central Asia and (ii) Muslim communities in non MCs of the Region Advancement of Triangular/South-South Cooperation through New IDBG Initiative “Reverse Linkage” 15 Thank You “Together We Build a Better Future”