Presentation Notes - BTG Management Services (Mauritius)

advertisement

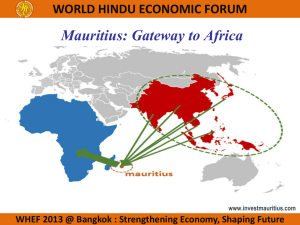

Business Through Mauritius Practical Aspects of Setting-up and Operating a Business from the Mauritius Financial Centre Introduction & Presentation Overview Problems Facing the South African Businesses How Business Achieve Growth in New (Frontier) Markets How Mauritius as a Financial Centre Adds Value? Stacking-up Mauritius as a Base for Businesses Practical Example –Family Business using Mauritius for Commercial Property Purchase Practical Example – Business Group Investing in Africa via Mauritius Key Risk Management - Legal, Tax and Exchange Controls Conclusion Problems Facing the South African Businesses Cross-border business - structural Impediments Business competitiveness Regulatory or exchange control “red-tape” Legal constraints How Businesses Achieve Growth in New (Frontier) Markets? Family Businesses Investment on global markets Exposure to foreign currency and assets Corporate Product/service expansion or geographic market expansion beyond national borders Estate and succession planning Centralising functions and risks on regional basis Asset protection New tax opportunities and risks Aligning current tax strategy and planning with corporate expansion strategy and planning Legal planning –entity, contracts, host country laws How Mauritius as a Financial Centre Adds Value? Favourable time-zone free choice of functional currency Stable political, investment and banking environment open stock exchange Attractive fiscal policies Double Taxation Avoidance Treaties No exchange controls Administrative ease of doing business no tax on dividends, interest or royalty income and no withholding taxes low or no income tax, no stamp duties and no capital gains tax reliable infrastructure availability of qualified labour force open policies for expatriate professionals enabling laws allowing for access to key region economic blocs, tax treaties and investment promotion treaties to reduce withholding taxes, customs duties and taxes on capital well established company and corporate law Stacking-up Mauritius as a Base for Businesses Top Ranking in Africa on Global Benchmark Indices Closest recognised International Financial Centre to Africa Well-regulated business jurisdiction - international standards and best practice. Close cultural and commercial ties with Africa, Europe, India and China, from which its diverse population hails. Signatory to major African conventions and a member of major African regional organisations - preferential access to African markets. A treaty‐based jurisdiction Stacking-up Mauritius as a Base for Businesses (cont.) Investment Promotion and Protection Agreements (IPPAs) with a number of African countries (six of which are in force - Burundi, Madagascar, Mozambique, Senegal, South Africa and Tanzania) which provide, amongst other things, for free repatriation of investment capital and returns, guarantee against expropriation, most favoured nation rule with respect to treatment of investment, and compensation for losses in case of armed conflict. Economic, political and banking stability. Good international telecommunication service. An abundance of professional service providers at a relatively low cost. An educated and multilingual workforce, with English and French being the main business languages. Stacking-up Mauritius as a Base for Businesses (cont.) Hybrid legal system consisting of British common law practice and the French Napoleonic Code. The Privy Council of the United Kingdom is the final court of appeal. Modern and flexible company and commercial legislation which is essentially based on British common law. The Financial Services Commission of Mauritius oversees the regulation of the non-banking financial services industry. Mauritius is not part of continental Africa. This limits spill-over effects of any potential neighbouring conflicts which are prevalent in certain regions in Africa. Offers a wide variety of vehicles that may be adapted to maximise African investment opportunities, including limited partnerships (of particular interest in the private equity context), protected cell companies, trusts and foundations. Wide Tax Treaty Network Africa Ratifying Congo Egypt Gabon Nigeria Signing Ghana Negotiating Algeria Burkina Faso Lesotho Malawi Tanzania Morocco In force Botswana Kenya Lesotho Madagascar Mozambique Namibia Rwanda Senegal Seychelles South Africa Swaziland Tunisia Uganda Zimbabwe Zambia Tax Treaties of Other IFC’s Comparison IFC Number of tax treaties with Africa South Africa (not IFC) 21 Mauritius 15 Netherlands 10 UAE 6 Botswana (not IFC) 5 Switzerland 5 Seychelles 4 Malta 4 Singapore 2 British Virgin Islands 0 Isle of Mann, Jersey & Guernsey 0 Presence of Global Banking Proximity to Market Practical Example – Family Property Business (South Africa) A South African family establishes a Mauritian Foundation and a Category 1 Global Business License Company (GBC1) holding company. The family capitalises the foundation with loans at interest. The Foundation injects debt and equity in a GBC1 The GBC1 acquires commercial property and earns rental income. Depending on location of investments in a treaty jurisdiction, withholding tax on dividends and interest can be ultimately reduced to between 0%-15%. Structure cannot be used South Africa 0% - 3% tax at Mauritius GBC1 level with no withholding taxes on dividends to the foundation. Foundation is tax exempt Repayment taxable. of loans by to re-invest into Foundation not Practical Example – Corporate Group (South Africa) A South African business (parent) establishes a Mauritius regional holding company. Mauritius regional holding company acquires multiple subsidiaries in the Southern Africa and engages directly in investment, financing and/or licensing activities. Open Mauritian offices and hire local and ex-patriate personnel Depending on location of subsidiary in a treaty jurisdiction, withholding tax on dividends, interest and royalties can be ultimately reduced to between 0%-15%. 0% - 3% tax at Mauritius company level with no withholding taxes on dividends to the ultimate parent. No capital gains on exit at subsidiary company level. Exempt dividends repatriated to South African parent Key Risk Management – Legal, Tax and Exchange Control Legal Tax Tax avoidance Transfer pricing Controlled foreign company Attribution of profits Exchange Controls Conclusions Thank You & Contact BTG Management Services (Mauritius) Limited 1st Floor, Building. B, Nautica Commercial Centre Royal Road, Black River, Mauritius Tel: +230 483 1212 Fax: +230 483 1313 E-mail: admin@btg-mauritius.com Boris Pelegrin b.pelegrin@btg-mauritius.com