Touch Technologies

advertisement

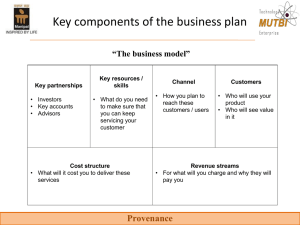

The Worldwide Touch Market and what andersDX can offer V1.0 Touch Screen Manufacturers Technology 2009 Suppliers 2010 Suppliers Acoustic (SAW) 9 9 Combo (Bending Wave) 3 3 Combo 4 4 Digitizer 6 7 In-Cell 6 6 Infrared 13 15 Optical Imaging 10 10 Projected Capacitive 27 56 Resistive 64 90 Surface Capacitive 22 29 Z-Other Technology 6 7 Multi-Touch 50 54 Tactile Feedback 4 6 Controller IC Only 16 23 On-Cell 2 2 Touch Screen Manufacturers Geographic Distribution Geographic distribution of touch screen suppliers shows Japan with the highest percentage. Source: DisplaySearch 2009 Touch Panel Market Analysis Report Touch Shipments and Revenue Forecasts Shipments of touch screen modules (sensor + controller) expected to grow at compound annual growth rate (CAGR) of 17% to 1.4 billion units by 2015. Touch module revenue expected to grow at 14% CAGR to $9 billion by 2015. Source: DisplaySearch 2009 Touch Panel Market Analysis Report Touch Module Revenue Forecast New technologies for mid- to large-size applications expected. Projected capacitive for mobile phone and iPad-like products driving 2010 revenue. Optical imaging with higher ASPs contributes to revenue, however volume is not high yet. Source: DisplaySearch 2010 Touch Panel Market Analysis Report Touch Panel Shipment by Technology Projected capacitive is growing rapidly, mostly in mobile phones/PCs. Resistive is losing momentum in mobile phones. On-cell reached good yield rates (70-89%) at end of 2009. In-cell expected to take off in 2011. Optical imaging is being used for all-in-one PCs (61%) and education (25%). Combo had good growth in 2009 since it was adopted into notebook PCs; faces competition from P-CAP in 2010 and beyond. Source: DisplaySearch 2010 Touch Panel Market Analysis Report Touch Panel Shipment by Technology There are many competing touch technologies with no perfect solution. Choice of technology is highly dependent on application and/or size requirements. Few of today’s touch technologies are used in high-volume applications. Resistive and projected capacitive are considered the mature technologies. Vertical applications have high margins, but CE and IT have volume, driving cost and capacity. Touch Technologies Source: DisplaySearch 2010 Touch Panel Market Analysis Report Technology: 2009 Touch Market Review Projected capacitive grew from 12.5% to 23.9% share due to mobile devices Optical imaging has advantages for 20”+ such as AIO, where projected capacitive has a lower yield. Source: DisplaySearch 2010 Touch Panel Market Analysis Report Technology: Touch Market Forecast Resistive technology is still strong but projected capacitive is gaining. Projected capacitive is growing fast, moving to medium sizes; revenue is growing faster than shipments; projected capacitive has overtaken resistive, accounting for ½ of market revenues. Projected capacitive is replacing resistive in 3”+ mobile applications. Source: DisplaySearch 2010 Touch Panel Market Analysis Report Application: 2009 Market Review CE is driving shipment volume, but vertical markets contribute revenue. Source: DisplaySearch 2010 Touch Panel Market Analysis Report Market Forecast: Mobile Phone Mobile phones are the key volume driver for touch growth. Smart phone trend proves usage is far beyond purpose of making calls. Source: DisplaySearch 2010 Touch Panel Market Analysis Report Influential Factors: Scenarios for Devices Different devices have different input methods and performance tradeoffs. Source: DisplaySearch 2010 Touch Panel Market Analysis Report Market Analysis Summary Technology Resistive Resistive will retain 86% share of shipments through 2015; however, resistive revenue share will drop from 78% in 2007 to 64% in 2015. Resistive multi-touch is becoming more common. Projective Capacitive Projected Capacitive ranked #2 in 2009, forecast #1 in 2010, but the field is getting crowded. Projected Capacitive market share is growing; expanding to larger sizes made with film type materials. Projected Capacitive is now being produced in single layer or film and can cover sizes greater than 100 inches. Optical Imaging Optical imaging is growing – Opportunity is with sizes over 10.” Optical imaging is limited for all-in-one PCs Market Analysis Summary Applications Touch penetration in mobile phones is more than 30% and growing. Mobile phones will account for 34% and 21% of all touch panel shipments and revenues respectively, through 2015. Shipments of touch enabled phones will reach 223 million units by 2015 Both pen and finger input are gaining momentum, especially for consumer products. Slate/tablet PCs and touch enabled pocket projectors are on the rise. Displays for e-books and other portable units must be sunlight readable. Source: Lightblueoptics.com Market Analysis Summary Value Chain Many suppliers from varying industries are moving to projected capacitive. Glass-based projected capacitive driving changes in value chain. 2-in1 glass and in/on cells technologies may impact future value chain. Vertical integration and module production capacity expansion are key strategies. Demand for controller ICs and semiconductor companies is growing. Industry opportunities include developing ITO replacements, new/better touch technologies, advanced touch software and controller ICs and emerging applications. Source: Lightblueoptics.com Market Analysis Summary Complexity New technologies can create new applications. Application demands will sustain several technologies. Multi-touch software is in high demand due to multi-touch growth. Source: Microsoft.com/surface Summary Pricing Touch screen revenues will increase from $4.3 B in 2009 to $13 B by 2016; touch industry is growing 10 times faster than display industry. The overall average selling price of touch panels will increase nearly 8% between 2007 and 2015. In many applications, increases in panel sizes and functionality mix will offset price declines for older panels. For projected capacitive pricing to become more competitive, lower-cost technologies (such as single substrate, transparent conductor patterning, on-cell) are needed. Source: 3M andersDX Enabling the touch in your product Custom Solutions Touch Screens Controllers Firmware Display Enhancements Analogue Resistive ShadowsenseTM Optical Touch Projected Capacitive FlushTouch Display Enhancements Resistive Technology Resistive products 4 –Wire 5-Wire 8-Wire Multi-Touch Analogue Resistive Features & Characteristics Construction: Film on Glass Compatible to Many Competitor’s Sensors Can be Designed ‘Backwards Compatible’ Controllers Many Options on Market; I/C & Logic Built into Off-the-Shelf Micros & A/D Converters andersDX Sensors can be Compatible to Competitors Controllers Resistive Technology 2 Common Resistive Configurations Film/Glass Film/Film/Glass Resistive Technology (Common Configurations) Advantages Low Cost Solution Multi-Touch Capable Low Power Consumption Not Affected by Dirt, Water, Light and Most EMI Noise Works with Finger, Glove, and Any Pointing Device Disadvantages Plastic “Face” is Not as Durable as Other Technologies Lower Transmittance and Overall Optical Quality Requires Periodic Recalibration Applications Medical Instruments Industrial Automation Handheld Military Systems Signature Capture Devices Multi-Touch Resistive Technology Multi-Touch Analog Resistive (MARS) is most recent addition to resistive technology. Multi-Touch Analog Resistive Sensor (MARS) Like traditional resistive technology, MARS is pressure sensing; however, the co-ordinates are scanned like projected capacitive Features & Characteristics Construction: Film on Glass Multi-Touch Capable Flexible Design Capabilities Controllers Board & Chipset Solutions Available Multi-Touch Resistive Technology Advantages Low Power Consumption Not Affected by Dirt, Water, Light and Most EMI Noise Works with Finger, Glove, and Any Pointing Device Drift-Free Coordinates with no Recalibration Disadvantages Plastic “Face” is Not as Durable as Other Technologies Lower Transmittance and Overall Optical Quality Applications Cockpit Display Medical Instruments Signature Capture Devices Military Navigation Systems Projected Capacitive Technology The advent of the iPhone has ushered in a seismic change in the touch screen business by popularizing projected capacitive touch technology. Projected capacitive incorporates the best of competing technologies. Features & Characteristics Construction: Glass, Film or Both Multi-Touch Capable Flexible Design Capabilities Often Has a Cover Glass Layer Controllers Board & Chipset Solutions Available Apple iPhone Example Projected Capacitive Technology Advantages Long-Life Excellent Optical Properties Multi-Touch Capable Ease of Integration Highly Reliable and Durable Operates in Environmental Extremes Drift-Free Coordinates with no Recalibration Disadvantages Higher Cost Does not Work with all Glove or Stylus Inputs Applications Medical Instruments Retail Signature Capture Industrial Instrument Panels Aerospace Entertainment System Projected Capacitive Construction All projected capacitive designs have two key features in common: The ITO layer lies behind the touch surface and is fully protected No Moving Parts The most common design incorporates the concept shown below: Projected Capacitive Technology The most recent addition to projected capacitive technology is Multi-Touch Multi-Touch Projected Capacitive Sensor Projected Capacitive Technology There are Two Projected Capacitive Sensing Methods: Self-Capacitance (Rarely Used Now) Mutual Capacitance (Most Common) Mutual – How it Works Contains grid of sensing and driving lines to determine touch location. Makes use of the fact that most conductive objects are able to hold a charge if they are very close together. If another conductive object, like a finger, bridges the gap, the charge field is interrupted and detected by the microcontroller, resulting in a touch. Mutual Capacitance , compared to self-capacitance makes it easier to identify the specific touch points. Projected Capacitive Technology Scanning Projected Capacitive touch screens are “scanned”, meaning they are made up of a matrix of rows and columns that are “read” one by one to get a reading or count. How it Works To get an exact coordinate, the results from several row/column intersections are read and the counts are used to triangulate the exact touch location. Benefits The touch points are extremely precise and the resolution is usually 1024 by 1024 (ten bit). Scanning also has an advantage of being free of coordinate drift. Without the issue of coordinate drift, projected capacitive touch screens do not have to be calibrated by the end-user. ShadowSenseTM Optical Touch ShadowSenseTM is a revolutionary new 2D and 3D optical tracking technology that is a ‘potential game-changer’ for the rapidly growing medium to large size touch industry. It delivers responsive and highly accurate multi-touch and gesture recognition, at costs typically associated with single-touch solutions. Features & Characteristics True Multi-Touch which currently supports up to 4 simultaneous inputs Provides touch detection of objects from just 2mm in diamater Recognises accidental touches Supports any input type including finger, glove, stylus etc Controllers Integrated Board ShadowSenseTM Optical Touch Additional Features Tsense™ capable - Touch object size determination and reporting 6 to 8 millisecond response time Better than 2 millimeter accuracy across the entire touch surface - No ghosting or dead zones Static object detection and rejection - Continues to function with debris on the screen 3 mm tempered glass with 91% optical clarity - 93% and 95% transmissivity options available IP65 rated front seal (bezel to glass) USB HID interface to host - Windows 7 compliant - No drivers or CPU based processing Calibration free - Mechanically and thermally stable - No aging affects FlushTouchTM FlushTouchTM is a rapid, risk-free route to bringing consumer ‘look and feel’ to industrial and medical touchscreen applications with display sizes from 2” to 22”. Compatible with standard resistive and projected capacitive (PCAP) sensor technologies and easily integrated into or mounted on a target design, FlushTouch touch window and coverlens solutions deliver totally flat, bezel-free front panels. Features & Characteristics Low NRE Low MOQ Totally flat “i-pad” type panel From 2” to 22” Either resistive or P-CAP sensors Glass, Plastic or Membrane Cover Materials Panel Thickness from 1.1mm to 20mm Wide variety of custom design options FlushTouchTM Summary The global touch market has hit the tipping point for exponential growth Driven by consumer devices, the trend towards touch interfaces is now equally applicable for medical, industrial, military and other non-consumer applications. There are a number of competing technologies, all of which have technical & commercial benefits and disadvantages. The challenge is not only to select and design in the most appropriate touch technology for your product, but to recognise that this is only part of the challenge in delivering a next generation UI experience. andersDX not only offers a range of touch technologies, which can be customised for your product and integrated seamlessly but………… andersDX offers a holistic approach to the UI Enabling products which are the easiest and most enjoyable to use, leading to market adoption and sales growth for our customers. Contacts us today to learn more: http://www.andersDX.com/contact-us.aspx