PowerPoint

advertisement

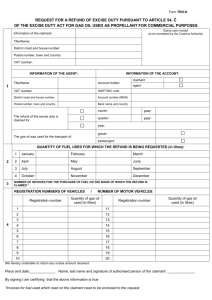

Your Motor Fuel Excise Tax Solution

Are you tired of Motor Fuel Excise Tax

Compliance software that expects

your business to conform to it, rather

than it conforming to your business?

Unique

At IGenFuels we understand that your business is unique.

So why shouldn’t your

Compliance software be

also?

Core Philosophy

We believe that to the greatest extent possible, Excise Tax Compliance

software should conform to your business,

not require your business

to conform to the

software.

Key Principles

That’s why we developed IGenFuels with these 3 key principles in mind.

It must be:

• Flexible

• Configurable

• Extensible

Built using our one-of-a-kind widget technology,

IGenFuels can adapt to your business today, tomorrow

and in the years to come.

Flexibility

We realize that your business is unique. You are constantly evolving to stay

competitive; and just like no two companies are the

same, neither is their data required to support Excise

Tax Compliance and Reporting.

Because of this, we’ve designed our software to adapt

to the many diverse datasets and business practices

throughout the industry.

With IGenFuels, you can configure the software to

match your current business processes for gathering,

preparing and reviewing tax filing data.

Configurability

You can build and maintain your workflows,

processes, and even user forms & schedules

with our user friendly graphical user

interfaces (GUI’s).

Extensibility

If you find yourself faced with a new challenge that is outside the

current capabilities of the system,

no problem, you have the option to add the

necessary functionality on your own.

Yes even your own forms and schedules!

Solution

At IGenFuels, we understand that report generation and electronic

filing are just one piece of the puzzle related to Motor Fuel Excise Tax

Compliance and Reporting.

Pieces of the Puzzle

Motor Fuel Excise Tax filing is a puzzle that consists of many pieces.

Data

Acquisition

Data

Preparation

Data

Analytics

You Decide

Reporting

/ e-Filing

Data Acquisition

Getting the needed data can be a challenge.

With our data acquisition widgets you can:

• Pull data from multiple data sources

• Accounts Receivable systems

• Accounts Payable systems

• Terminal Automation Systems

• General Accounts Ledger

• In various formats

• Database • Text files

• CSV files • Excel

• …

• From different platforms

• Consolidate it all into a single, central repository of tax compliance &reporting information

• Single source for cleaned and validated data

• Can be used for jurisdictional compliance reporting

• Also other internal business process reporting

Data Preparation

Acquiring the data is only the first piece of the

puzzle. All the data in the world will not help

if it is not complete, correct and in the proper

format.

That’s why we provide data preparation widgets to standardize, clean, supplement,

and validate your data.

• Standardize master data w/ our

Master Data Management Module

• Data cleansing

• Fill data gaps

• Validate against master lists of licenses, TCNs, etc.

• Eliminate duplicate & non-reportable transactions such as credit n rebills

• Generate transactions for missing fuel movements

Data Analytics

You need to be confident in your data prior to

generating your excise tax reports. The risks are

too great. That’s why we provide you robust

tools that will allow you to:

• Validate data to be reported

• Built-In

• Custom

• Cross-match data from various lines-of-business

• Reconcile to your General Ledger

• Custom Reports

• Ad-Hoc reporting tools

• Reports and trend analysis of data issues to drive process improvement.

Reporting / e-Filing

IGenFuels will contain most of the common

forms and schedules required by clients to file

Motor Fuel Excise Taxes

• If the system does not have a needed form, you have the ability to add it yourself

OR

• Access the IGenStore where the user community can share the forms, schedules &

analytics they have created

• Ability to generate required electronic files in various formats

• EDI

• XML

• CSV

• Data can be fed back to source systems, ERP and Data Warehousing systems

You Decide

What else do you do as part of you tax

preparation process, or better yet, what else

would you like to do?

With IGenFuels you decide. Using our unique Widget, Workflow and Process building

blocks, you determine what you want the software to do.

Functionality

Widgets, Workflows & Automated Processes

• Widgets are the building blocks.

• There are widgets to:

• Import data

• Validate data

• Cleanse data

• Manipulate Data

• Report data

• Send emails

• …

• Automated Processes allow multiple steps / widgets

to be grouped together, linked and then run,

thereby automating those steps.

Can be run individually, called from within other processes.

Functionality

Widgets, Workflows & Automated Processes (cont.)

• Workflow Processes allow for the linking of multiple steps and / or processes into a

meaningful flow.

• Controls processing order

• Aid in documenting processes

• Provides an indicators of:

• Progress through overall flow

• Status of each steps

• Workflow processes can have 3 types:

• Workflow Template – Cannot be used directly.

They are templates from which an instance or copy

will be created to do the actual work.

• Workflow Instance – Created by the system from a template. They are copies of a

template which the user will interact with, rather than the template directly.

• Standard Workflow - Standard workflows are interacted with directly.

Sample Monthly Motor Fuels Filing Process

Acquire

Term Data

Clean, Prep

& Validate

Term Data

Process Aaron’s Return Data

Review / Correct

Validation Errors

PA / TOR

ExSTARS/ PL

Matching

Acquire PL

Data

Clean, Prep

& Validate

PL Data

Acquire GL

Data

Prep GL

Data

Process Sally’s Return Data

Review / Correct

Validation Errors

MI / TOR

Reconcile

to GL

Process MFT Return Data

Acquire

FM Data

Clean, Prep

& Validate

FM Data

WI / TO CS

Review / Correct

Validation Errors

OK / EXP

TX / SUP

Archive &

Cleanup

Recommended Data Flow

Using our recommended data flow, you will realize

efficiencies by minimizing the number of times you

touch each transaction.

Tax; Company; &

Jurisdiction Specific

Selection Process

Working

Storage

(WSTF)

Schedule Selection Process

Working Copy

of Source Data

(WSOR)

Data Cleansing; Data Validation;

Data Prep; Transaction Creation,

Omission & Summary

Pipelines

Original Copy

of Source Data

(OSOR)

Pipelines

Terminals

Fuel Marketing

Jurisdiction Specific

Working Storage

(Historical)

Terminals

Original SOR Data {OSOR} - Maintains source format & values as acquired. Used for reference.

Fuel Marketing

Tax Specific /

Non-Jurisdiction Specific

Data Cleansing; Data Validation;

Matching Verification; Transaction

Creation & Omission

Working Storage of SOR Data {WSOR} - Copy of SOR data which is modified as needed. This is

where all of the global, non-application specific processing is done. Those things which can be

done once and apply to every subsequent application of the data.

Application Specific Working Storage {WSAF} – A working storage area specifically designed for

a given application of the data. A subset of the WSOR data can be copied here where processing

specific to a particular application can be applied.

System Architecture

Current System Architecture:

Windows based

Platform: .NET framework 4.0

Language: .NET (C#/VB.Net), Javascript, PHP5, HTML5

DBMS:

SQLServer 2008 or better, SQLLite, FireBird

Application: Thick Client, Browser engine for forms

review. Thin Client proposed for finished product.

Demo

Contact Dan Zeise dan.zeise@igenfuels.com for demo of what IGenFuels can do for you.

Philosophy

Philosophy

We believe that to the greatest extent possible, software should conform to the customer’s

business, not require their business to conform to the software.

You, the customer, are why we are in business.

Our #1 job is to make you happy.

Flexible

Configurable

Extensible