TTA Turkey Fund - IP Conference 2014

advertisement

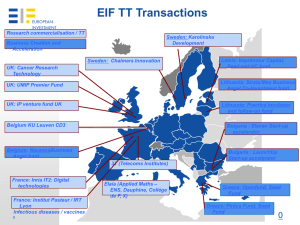

Technology Transfer Accelerator Turkey (“TTA Turkey”) IP Conference Turkey 30 October 2014 Istanbul 1 Agenda 1. 2. About EIF EIF Resources, Governance and Investments Equity Highlights EIF Technology Transfer: History and Characteristics About TTA Turkey Background, Structure and Objectives TTA Turkey Fund Targets, Investment Criteria, Investment Process and Structure Main Terms & Conditions, Flow of Funding, Time Frame and Process Investment Considerations and Assessment Criteria 2 What is the EIF? “ The leading developer of risk financing for entrepreneurship and innovation across the EU Helping SMEs, microenterprises and European regions innovate and grow by making finance more accessible ” Fulfilling our dual goal and pursuing EU policy objectives as well as financial sustainability Addressing market needs by acting as a countercyclical investor in tough economic times Working with financial intermediaries across the 27 EU countries, EFTA and all Accession countries 3 EIF Current Investment Focus Involved throughout the Business Cycle Technology Transfer Accelerator Strategic Challenges Technology Transfer Proof of Concept Business Angels Seed Stage Instruments to stimulate innovation, competitiveness and cross-border investment European Commission Resources Investing in VC funds Early Stage Business Angels Fill funding gap left by institutional investors EIB / EIF Resources Investing in Growth Capital Expansion/ Development Capital Support VC ecosystem and decrease dependency on public finance Mezzanine Lower Mid-Market Catalyse hybrid debt finance for growth Member States / Private Sector Resources 4 EIF’s Resources “ EIF manages resources from different stakeholders European Investment Bank Risk Capital Mandate (RCR) EUR 5bn Mezzanine Facility for Growth (MFG) EUR 1bn ” European Commission Competitiveness and Innovation Framework Progr. (CIP) EUR 1bn allocated to equity and guarantees Risk-Sharing Instrument (RSI) EUR 120m National & Regional Funds 20 European and regional Funds-of-Funds including Germany, Portugal, Spain, Turkey, UK 14 Holding Funds supported by structural funds EUR 1.3bn Progress Microfinance EUR 200m 5 Equity Highlights (EUR / m) 2013 2012 2011 2010 2009 2008 Equity Signatures 1 468 1 350 1 126 930 733 409 PE Assets under 7 904 Management 6 952 5 919 5 367 4 103 3 535 6 EIF’s Governance “ Committed to the highest standards of governance and integrity Board of Directors has a supervisory role and approves all EIF transactions ” Chief Executive is responsible for the day-to-day management of the EIF Audit Board and both in- and external auditors oversee Chief Executive and Board of Directors Risk Management, Legal and compliance units 7 EIF Technology Transfer Aims to Bridge the Gap between the Research and the Market R&D University / Research Organisation Technology Transfer “Technology IP” Spin-out Marketable Product “Prototype IP” Market Licensing Collaboration (Contract Research) IP / Idea 8 EIF Technology Transfer History and Characteristics History of EIF Technology Transfer Investments Scale-up of activities since TTA study (2005) No dedicated mandate Investments so far with own resources, the European Commission and the EIB 33 operations in total Characteristics of Technology Transfer Operations Different shapes and sizes Long lead times and low transformation ratio Key point: Scale Difficult fundraising periods 9 Long-term, Sustainable Vehicles With Like-Minded Investors Close collaboration with TTOs Access to good scientific research IP adequately protected under relevant legislation No direct financing of research Governance - no investor involvement in investment decisions Independence and non-competition of Management Team Adequate incentives to Management Team Alignment of interests with long-term focus, up to 10-20 years Minimum critical size ca. EUR 20-30m 10 EIF Technology Transfer Investments To Date Vintage Year Investment Country Fund Size (EUR m) EIF investment (EUR m) % Fund France Belgium Belgium UK Sweden UK Sweden Belgium Belgium France France France UK UK France UK France France Norway EU EU EU EU EU EU 38 15 8 37 17 38 36 16 43 21 35 45 30 31 30 36 57 40 27 44 60 55 50 25 30 4.3 4.5 4 18 9 11 27 8 15 10 15 20 15 10 10 24 15 12 12 20 30 22.5 20 10 12 11% 30% 50% 49% 53% 29% 75% 50% 35% 49% 43% 44% 50% 32% 33% 67% 26% 30% 44% 45% 50% 41% 40% 40% 40% 864 358 42% 8 12 18 11 11 9 10 14 93 7.6 9 6 8.5 11 9 7 9.3 67.4 95% 75% 33% 77% 100% 100% 70% 66% 957 426 TT Funds 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 2001 2003 2006 2006 2008 2008 2009 2010 2011 2011 2012 2012 2012 2013 2013 2013 2013 2013 2013 2013 2014 2014 2014 2014 2014 ….2014 TOTAL T-Source Louvain Vives I Leuven CD3 (Centre for Drug design and Discovery) IP Venture Fund Chalmers Innovation Seed Fund Manchester UMIP Premier Fund Karolinska Development Leuven CD3 II (Centre for Drug design and Discovery) Louvain Vives II Telecom Technologies Transfert (3T) Demeter Cleantech seed fund Elaia Alpha fund Cancer Research Tech (CRT) Pioneer Fund Rockspring INRIA IT Translation IP Venture Fund II Grand Ouest d'Amorcage Sante Auriga Bioseeds IV SINTEF Venture IV "TT Fund" (confidential) in progress "TT Fund" (confidential) in progress "TT Fund" (confidential) in progress "TT Fund" (confidential) in progress "TT Fund" (confidential) in progress "TT Fund" (confidential) in progress …………….. Business Incubation / Acceleration Funds 26 27 28 29 30 31 32 33 2009 2010 2012 2012 2012 2012 2012 2012 TOTAL TOTAL Strata/Mes Imprimatur Nauseca Practica Eleven Lauchub Openfund Piraeus Lithuania Latvia Belgium Lithuania Bulgaria Bulgaria Greece Greece 11 Agenda 1. 2. About EIF EIF Resources, Governance and Investments Equity Highlights EIF Technology Transfer: History and Characteristics About TTA Turkey Background, Structure and Objectives TTA Turkey Fund Targets, Investment Criteria, Investment Process and Structure Main Terms & Conditions, Flow of Funding, Time Frame and Process Investment Considerations and Assessment Criteria 12 TTA Turkey This project is co-financed by the European Union and the Republic of Turkey This financing is provided from IPA funds allocated to Regional Competitiveness Operational Programme which is supported by EU and Republic of Turkey. The Contracting Authority of this Project is the Ministry of Science, Industry and Technology, DG for EU and Foreign Relations, IPAPO, and final beneficiary is the Scientific and Technological Research Council of Turkey. 13 TTA Turkey – Project Level Background Funded by IPA monies Deadline for Project Implementation: 31 December 2017 End Beneficiary: The Scientific and Technological Research Council of Turkey (TÜBİTAK) 2012 2013 2014 2015 2016 2017 Market Needs Assessment carried out Business Plan for the Project submitted Negotiations and Approval Project Amount: EUR 30.5 million Project Components: 1. 2. 3. 4. Signature Date: July 2014 Cornerstone TTA Turkey Fund – EUR 26.3 million Advisory Services and Networking for TTOs and TÜBİTAK – EUR 1.35 million Visibility – EUR 200,000 Impact Evaluation – EUR 100,000 14 TTA Turkey Project Structure and Main Objectives IPA Resources EIF as Advisor & Project Manager Visibility Advisory Services and Networking (Technical Assistance) TTOs IPA Commitment to TTA Turkey Fund Impact Evaluation proceeds TÜBİTAK TTA Turkey’s main purpose is to: Establish an independently managed Technology Transfer Accelerator Fund that invests in commercialisation of technology intensive research coming out of universities and research centres Increase the R&D commercialisation capacities of TTOs so that they can play a successful interface role between the industry and the university 15 TTA Turkey Fund Target Investments and Region TTA Turkey to invest in: proof of concept generation projects university / research center spin-offs, start-ups intellectual property (IP) assets / projects return for equity into start-ups, spinoffs, and SMEs 100% of the investments to be made in Turkey A minimum of 30 projects to be selected by the Fund Manager by 31 December 2017 At least 15 projects shall be identified and invested in the Target Region (12 NUTS II, 43 provinces) 16 TTA Turkey Fund Structure 17 Main Terms & Conditions Target Fund Size EUR 30 million Maximum Contribution from IPA Funds EUR 26.3 million Maximum Investment Amount to a Single Company/Project EUR 2.5 million Maximum Duration of the Fund 10 years Indicative Maximum Amount of Funding Minimum Third Party Capital (Private Investors) Applicant’s Own Commitment in the Fund EUR 40 million EUR 2.8 million 1-5% of the total Fund size Over 12 months Possibility of extension for 1+1 years 12 years Deadline for the Fund’s Investment / Selection 31 December 2017 Period 31 December 2017 Deadline for Disbursements by the Fund Portfolio Diversification Minimum of 30 projects/companies Target Industry Sectors Generalist with preferred and excluded sectors as covered in details in the Call for EoI 18 Flow of Funding IPA Contracting Authority Monies to Contracting Authority from Special Account – after 31 Dec 2017 Thereafter from whomever transfer of holding has been made to (if anybody) Monies to Special Account EIF Special Account Monies to Fund on Capital Calls from Fund Manager based on establishment of Companies once start up invested Monies to Special Account on receipt from TTA Fund TTA Fund Monies to Fund due to project spin-outs, licensing, contract research with consequent dividend payment Monies to Companies once Projects identified – before 31 Dec 2017 Co A Monies to projects on milestone basis during the Term of the Fund 1 2 3 4 1 5 2 Co B Co C Co D Start up Co D 6 1 3 4 1 5 2 2 Co D Start up 3 4 Monies to Companies from successful projects on spin-outs, licensing, contract research, other 5 6 6 3 4 5 6 19 Time Frame and Process Next Steps Deadline Requests for Clarifications from Applicants Accepted Friday, 15 August 2014 EIF to Reply to Clarification Requests Friday, 22 August 2014 Call for EoI Open for Applications Thursday, 11 September 2014 First Screenings September 2014 Scoring and Second Screenings October 2014 Due Diligence of Shortlisted Applicants October 2014 Legal Negotiation & Execution December 2014 20 Assessment Criteria & Scoring QUALITY ASSESSMENT CRITERIA WEIGHTING 1 Project Relevance, Quality and Coherence • Evaluation of the Fund focus and proposed investment strategy, including viability of Fund’s size. • Evaluation of the Fund Manager’s team profile, including but not limited to: (i) Team stability and dynamics. (ii) Its ability to implement the Financial Instrument (iii) Operational, financial, technical and VC competences. Capabilities as members of Boards and/or committees of an investment and/or advisory nature. (iv) Prior experience in technology transfer field, commercialisation of research and development, business development, IP law. • Evaluation of Applicant’s investment processes, including deal flow generation, ability to invest, ability to add value to companies and exit strategy. 40 points 2 Project Maturity, Investment Readiness • Demonstration of ability to raise at least EUR 2.8 million of the Fund from private investors. • Demonstration of ability to source deals in Turkey (SMEs/projects). • Investment readiness of the proposed structure like maturity of the proposed legal structure, including internationally proven best market practices; outline of any different legal entities required; planned establishment costs and details thereof; detailed term sheet; proposed law firm etc. in order to execute the closing of the fund timely and efficiently. 40 points 3 Institutional Capacity & Sustainability • Fund Manager organisation, structure and long-term viability. • Assessment of the corporate governance in place. • Assessment of legal structures and independence. • Terms and Conditions, including management fee and profit share arrangements. • Assessment of the alignment of interests between the Fund Manager and the Investors. • Assessment of Reporting and Control Procedures. 20 points 21 Investment Process and Indicative Timelines 12 months First Screening Understand concept Based on preliminary questionnaire / concept note Second Screening Due Diligence Investment readiness Stress testing and verification Legal documentation EIF team conducts on site visits (min. 2 days). May, or may not lead to term sheet After EIF BoD approval, legal docs drafted on behalf of Manager. EIF reviews importance of legal counsel Physical meeting (typically in Luxembourg), opportunity to articulate investment opportunity, understand EIF Board Approval 22 Investment Considerations First Screening Second Screening Due Diligence Board Approval Partner Institutions Market Investment Strategy Deal flow Potential Investors Investment Process Team Track Record Governance Management Company Economics Remuneration / Incentives 23 Criteria (1/4) Partner Institutions Metrics: Research budget, peer group comparisons, invention disclosures, IP filed, IP awarded, growth rates, commercialisation income, encumbrances, 3rd party agreements Structure: Organisation structure of TTO, roles, ownership of TTO Deal flow and pipeline Origination: Source of projects, networks (formal and informal), privileged / preferential access, rights of first refusal, option rights Fees: Payments in lieu of access to pipeline Policies: IP policy, rules, regulations, ownership rights Historical Analysis: e.g. 3-5 years evolution of deal flow by source, sector, etc. Activities: Industry co-operations, advisory services, contract research, etc. Selectivity Ratio: Historical examples / experience Financials: For TTO; revenues, royalty income, grants, licenses, cost of sales, gross profit, operating costs, gift aid, dividends Pipeline: Current and future opportunities Investment strategy Licensing / Spin-outs: Proposed route for commercialisation Strategy: Geographical focus, stage focus, sectors, investment sizes, followon and reserve policy, holding periods, role in financing rounds Fund Size: Justification for size through bottom-up analysis, min / target / max size, modification to strategy according to size scenarios Target Profiles: Criteria for investment targets (company profiles) Co-investors: Envisaged co-investors at different stages of investments Exits: Strategies based on previous examples 24 Criteria (2/4) Market / Competitors Trends: Targeted sectors, challenges faced, evolution in previous years Competitors: Financing, other sources of finance, private / public Demand Side Economics: Analysis and evidence of demand for targeted projects Potential Investors Sponsors: Main investors , anchor investors , special rights (e.g. fees, carry, information, co-investment, etc.) Names / Profiles: Like-minded, longterm investors with soft and hard commitments Team Investment: Investment to fund, e.g. 1%, 2%, 5%, absolute amount, split between team members (see also remuneration / incentives) Investment Process Process: Origination, screening, project / deal review, due diligence, deal approval, deal structuring, negotiation, deal completion, contracting third parties Decision-making Bodies: Bodies, or individuals take final decisions at each stage, delegations foreseen Fundraising Strategy: List of other potential / targeted investors, status of contacts, potential commitments 25 Criteria (3/4) Team Track Record Composition: Envisaged team responsible for managing fund, key individuals from TTO / other, secondees, new recruits (profiles) Previous funds: Metrics, vintage, total size, fund cash flows, net and gross IRR, LPs, amounts Profiles / CVs: Full CVs of team members and key individuals, specific dates, positions held, achievements Experience: Collective team experience in IP management, licensing, creation of companies, investing,, strategy, consulting, etc. Team Collaboration: Years worked together, prior collective working relationships Companies: Previous / current funds, dates of investment, investment at cost, FMV (EVCA), gross multiples, forecast exit dates, exit scenarios Individuals: Track record of individuals, other investment / relevant activity (e.g. licensing deals) Partner Institutions: Licensing and spinout company creation, notable success stories (e.g. Nobel prizes), products developed Governance Structure: e.g. UK-LP, SCR, FCR, NV, SPRL, SICAR, KB, etc. Relationships: Overall structure and relationships between governing and decision-making bodies. Role and function of each of the bodies. Specific individuals involved and respective voting powers and rights CoI: Conflict of interest management, for example with (other) investors in fund, any investor (LP) involvement in decision-making Advisory Board: Composition, largest investors, etc. Workload: Time commitment to fund vs. other activities, activity allocation, other board seats Board Members: CVs 26 Criteria (4/4) Management Company Economics Remuneration / Incentives History: Evolution, founders, key dates and events in development, significant changes in organisation, strategy, ownership Budget: Detailed forecast budget for Management Company over lifetime of the fund, under different scenarios, e.g. min / target / max size Alignment of Interests: Team investments to fund align with investors, long-term time horizon, team stability / instability Legal Status: Capital structure, ownership Management Fee: Justification for level of management fee, use of fees, fee offsets Remuneration: Detailed breakdown of remuneration for all team members including base salaries, bonuses Regulation: How the management company shall be regulated, adherence to AML/KYC Evolution: Historical evolution of remuneration for individual team members in previous years Incentives via Carry: Repartition of carry to individuals, unallocated carry if applicable, carry to partner institution(s) 27 Thank You! Jose Romano Head of Region j.romano@eif.org European Investment Fund 37B, Avenue J. F. Kennedy L-2968 Luxembourg Tel.: (+352) 42 66 881 Fax: (+352) 42 66 88 200 www.eif.org 28 Technology Transfer Accelerator Turkey (“TTA Turkey”) IP Conference Turkey 30 October 2014 Istanbul 29