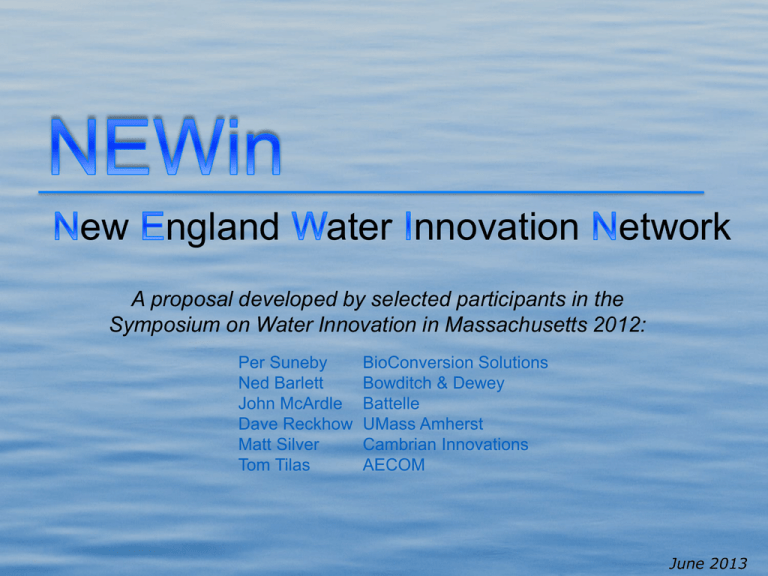

New England Water Innovation Network (NEWin) - Swim-MA

advertisement

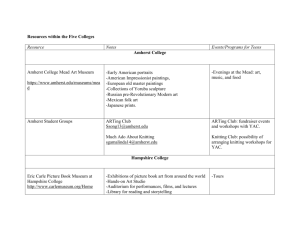

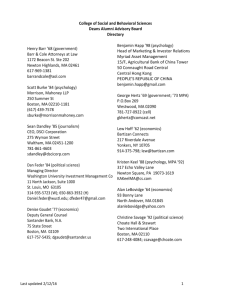

ew ngland ater nnovation etwork A proposal developed by selected participants in the Symposium on Water Innovation in Massachusetts 2012: Per Suneby Ned Barlett John McArdle Dave Reckhow Matt Silver Tom Tilas BioConversion Solutions Bowditch & Dewey Battelle UMass Amherst Cambrian Innovations AECOM June 2013 is: A network of resources to test, pilot, and demonstrate new water technologies, in order to: Attract companies and researchers to work and build businesses in Massachusetts; Advance new solutions to local water issues; and Connect innovators to industry. June 2013 The Network of Resources Equipment Test Bed Sites • Existing sites • Easily upgraded sites • Enabled for private use by approved parties + Labs Marketed & coordinated by Experts June 2013 Who Would Use ? Startup companies Major equipment companies Engineering firms Researchers Students State and federal government June 2013 Why ? Water Technology Innovation Roadmap Invention; Proof of Concept Technical Evaluation; Market Testing; Scaling Concept Pilot / Beta Demonstrate Commercialize Typical Effort: 3-4+ years and $X Million+ e Problem: Access to test beds, expensive lab equipmen and specific expertise is time-consuming and expensive June 2013 Why ? Water Technology Innovation Roadmap Invention; Proof of Concept Invention; Proof of Concept Technical Evaluation; Market Testing; Scaling Concept Technical Evaluatio n; Market Testing; Scaling Concept Pilot / Beta Pilot / Beta Demon -strate Demonstrate Commercialize Commercialize June 2013 Business Model Resource Providers • Information about capabilities • Key contact • Marketing • Booking • Billing • Connections Clients • Startup companies • Major equipment companies • Engineering firms • Researchers • Students • State and federal government Test Beds Equipmen t Labs • Memberships • Fees • Sponsorships • Fees • Services Experts June 2013 Benefits For a Water Utility Simplify and accelerate new technology evaluation • • • • Sourcing Vendor communications/expectations Standardized approach Potential access to gov’t/sponsor funds Lower technology adoption risk Raise industry leadership profile • World-class utility • More attractive employer Support state initiative to grow industry June 2013 Benefits Constituency Work Experience / Jobs Time to Market Test New Tech. ✔✔ Public Utilities Startups Large Equipment Vendors ✔ ✔ ✔ ✔ ✔✔ ✔ ✔ University Researchers VCs/Investors Governments ✔ ✔✔ ✔✔ Expert Services ✔✔ Engineering Firms Students Research ✔ ✔✔ ✔ ✔ ✔✔ ✔ ✔ ✔ ✔ ✔ June 2013 Test Beds Are Core to Building Clusters Location Public Test Bed(s) Singapore (SINGwater: Singapore Innovation Gateway for Water) Since 2002 Israel (Mekorot WaTech: Center for Technology Innovation & Cooperation) Since 2006 Milwaukee (Milwaukee Water Council’s Collaborative Research Center) Ontario, Canada (WaterTAP: Technology Acceleration Project) Ohio River Valley (KY, IN, & OH) (Confluence: Water Technology Innovation Cluster) Planned 2013 Exist & planned Exist & planned June 2013 Example: Mekorot’s “WaTech” CALL FOR JOINT R&D WITH MEKOROT 2014 June 2013 The Survey Says: “What Should We Focus on to Re-enforce Our Leadership?” • • • • • • Pilot & validation sites 30% Communications 18% Water sector strategy 15% Water sector incentives 15% Accelerator programs 12% Regulation 10% Source: Audience response at “Water Innovation in Action” Conference, Toronto, Feb 27, 2013 June 2013 Some Potential Site Test Bed Sites Waste water Drinkin g water Mass. Alternative Septic System Test Center (MASSTC) (Sandwich, Cape Cod) ✔ Amherst WWTP / UMass Amherst ✔ ✔ MWRA (Deer Island, Carroll, etc) ✔ ✔ Boston Water & Sewer Mobile lab ✔ ✔ Other TBD ✔ ✔ Storm water Systems & infrastructure Nutrification Salt water ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ June 2013 Financials Each test bed site All test bed sites Labs Launch Capital ($M)* Annual Operating Expense ($M)* $0 to $4 Breakeven/surplus < $10 Breakeven/surplus $0 Breakeven/surplus $0.2 $0.2 + * Estimated June 2013 Letters of Interest Universities • • • • • • • • Students Harvard MIT Water Club MIT Tufts WSSS Northeastern Tufts UMass Amherst UMass Dartmouth UMass Lowell WPI Companies AECOM American Water BioConversion Solutions Cambrian Innovation Clean Membranes Desalitech Oasys Water Resolute Marine Energy ThermoEnergy Xylem Investors ATV Capital Black Coral Clean Energy Venture Group Flagship Ventures Flybridge Partners Liberation Capital Oxford BioSciences Venrock June 2013 Legislative Support An Act to Promote Innovative Water Management in the Commonwealth (H. 2931) “The Massachusetts Clean Energy Center shall use state funds to develop and execute a state program to pilot and test innovative water technologies.” Water Infrastructure Finance Commission Recommendations: “Allocate resources for programs that mitigate the inherent risks in innovation by supporting pilot projects, proof of concept projects, and new technology;” “Invest in Massachusetts as a hub of innovation in the field of water, wastewater, and stormwater management and technology.” June 2013 A 2013 Survey Says: Ontario Audience Asked: “What Region Has The World’s Leading Water Hub?” • • • • • • Ontario Israel Singapore Germany Holland USA 25% 23% 23% 16% 7% 4% Source: Audience response at “Water Innovation in Action” Conference, Toronto, Feb 27, 2013 June 2013 Goal: A Future Survey Says: “What Region Has The World’s Leading Water Hub?” • Massachusetts • Israel tied • Singapore tied • All others (noise) #1 #2 #2 June 2013 Interested in ? Resource provider? Client? Sponsor? Implementation Committee? Contact: Michael Murphy mmurphy@MassCEC.com Massachusetts Clean Energy Center Business Development Manager, Water Innovations Per Suneby Ned Barlett John McArdle Dave Reckhow Matt Silver Tom Tilas psuneby@BioConversionSolutions.com nbartlett@Bowditch.com mcardlej@Battelle.org reckhow@ECS.UMass.edu silver@CambrianInnovation.com tom.tilas@AECOM.com June 2013