State Budget Update

advertisement

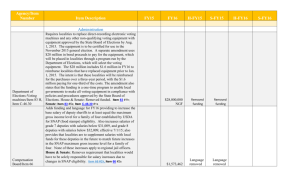

State Budget Update Scott Cummings Virginia Department of Planning and Budget 1 Agenda • Review of 2014 Appropriation Act • Overview of HB 5010 • Next steps 2 2014 Appropriation Act • Provides appropriation for FY2015 and FY2016 • Provided $156.1 million in FY15 and $248.0 million in FY16 in new general fund support to Direct Aid over the amount provided in FY2014 • With Lottery and Literary Fund support added in, new state spending reaches $487.3 million for the biennium • Revised K-3 Class Reduction Formula – Creates savings of $5.2 million each year – Uses a three-year average of free lunch eligibility rather than a one year snapshot • Eliminated funding for the Opportunity Educational Institution (OEI) 3 2014 Appropriation Act • Approved June 23, 2014 • Prior to the budget’s passage, state revenues were not tracking with approved forecast • Expected total of $1.55 billion shortfall • Response: – $842.5 million in general fund resources left uncommitted in new biennium – $707.5 anticipated Rainy Day Fund withdrawal 4 Interim Reforecast • Based on the FY2014 shortfall, the Governor called for an official reforecast • Revised forecast presented August 15 • Forecast assumed lower growth rates than were included in budget’s revised figures • New anticipated shortfall of $881.5 million beyond that predicted in 2014 budget 5 HB 5010, 2014 Special Session I • General Assembly still in session – Planned reconvene date of September 18 • Governor and General Assembly money committees agreed on framework for action • Provides sufficient time for state agencies to implement FY15 reduction strategies • Gives bond rating firms assurance that Virginia is addressing its anticipated shortfall 6 Actions taken in HB 5010 • Amends and reenacts 2014 budget – Governor’s proposed budget in December will include HB 5010 changes • Updates revenue assumptions • Appropriates $470 million in FY15 and $235 million in FY16 from the Rainy Day Fund • Establishes four reversion accounts to close the remaining shortfall of $345.5 million in FY15 and $536 million in FY16 7 Net Effect of Revenue Shortfall and Interim Reforecast 8 HB 5010 Reversion Accounts 9 HB 5010 Agency Reductions • Represents approximate cut on state agencies of four percent • Includes Department of Education, but not Direct Aid budget • On September 19, agencies submitted reduction plans of five percent for FY15 and seven percent for FY16 • The General Assembly has authorized agencies to implement strategies, so they can begin once the plan is approved by the Governor 10 HB 5010 Aid to Locality Reductions • Savings amount of $30 million each year – Represents 0.3 percent reduction in total local aid contained in the budget • Localities will be given flexibility in determining impact of reduction • DPB will establish a target for each locality – Depends on locality’s share of total aid, likely excluding K-12 and possibly car tax reimbursements 11 HB 5010 Miscellaneous Reversion Clearing Account • Includes net spending adjustments of $40.6 million in FY15 and $284.9 million in FY16 – From a series of balance reversions, transfers and other actions • Actions to achieve FY16 savings of $272 million will be submitted in the Governor’s introduced budget for consideration by the 2015 General Assembly • All actions are on the table for consideration 12 Next Steps • HB 5010 will be approved • Governor will announce FY15 reductions strategies proposed by state agencies • DPB will notify localities of their share of the reduction amount • Governor will submit introduced budget to General Assembly on December 17 – Contain remaining actions to address budget shortfall – Include updates to Direct Aid based on latest enrollment figures and program participation levels – Be based on November revenue forecast 13