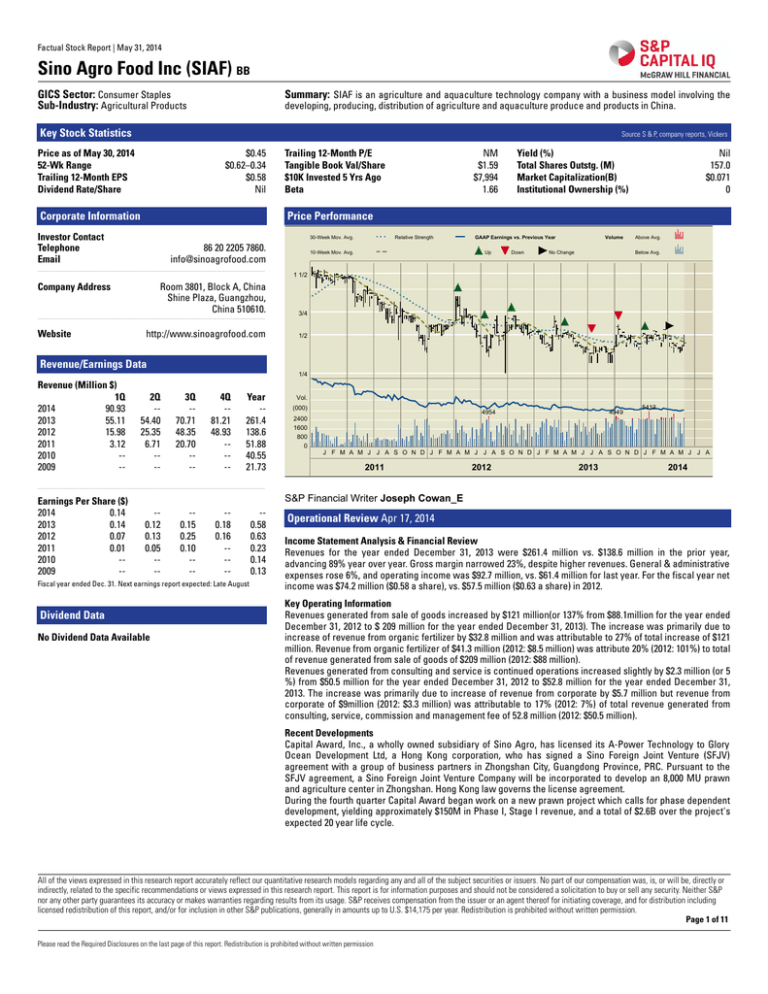

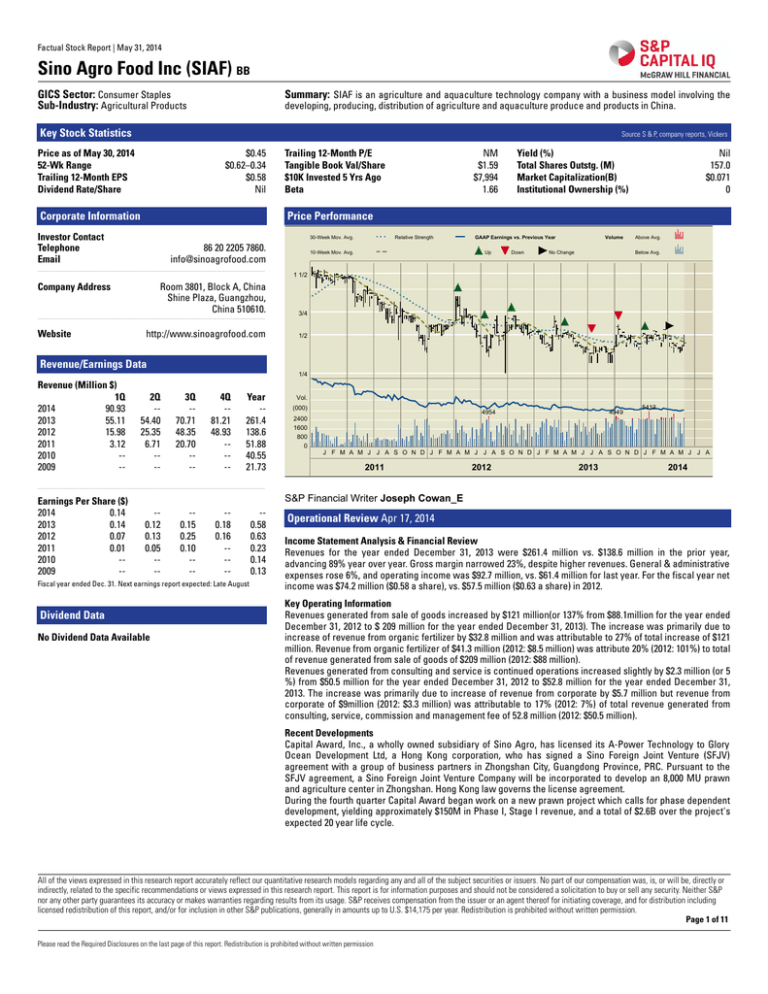

Factual Stock Report | May 31, 2014

Sino Agro Food Inc (SIAF) BB

GICS Sector: Consumer Staples

Sub-Industry: Agricultural Products

Summary: SIAF is an agriculture and aquaculture technology company with a business model involving the

developing, producing, distribution of agriculture and aquaculture produce and products in China.

Key Stock Statistics

Source S & P, company reports, Vickers

Price as of May 30, 2014

52-Wk Range

Trailing 12-Month EPS

Dividend Rate/Share

$0.45

$0.62–0.34

$0.58

Nil

Corporate Information

NM

$1.59

$7,994

1.66

Yield (%)

Total Shares Outstg. (M)

Market Capitalization(B)

Institutional Ownership (%)

Nil

157.0

$0.071

0

Price Performance

Investor Contact

Telephone

Email

30-Week Mov. Avg.

86 20 2205 7860.

info@sinoagrofood.com

...................................................................................................................................................................

Company Address

Room 3801, Block A, China

Shine Plaza, Guangzhou,

China 510610.

...................................................................................................................................................................

Website

Trailing 12-Month P/E

Tangible Book Val/Share

$10K Invested 5 Yrs Ago

Beta

http://www.sinoagrofood.com

Relative Strength

10-Week Mov. Avg.

GAAP Earnings vs. Previous Year

Up

Down

Volume

No Change

Above Avg.

Below Avg.

1 1/2

3/4

1/2

Revenue/Earnings Data

1/4

Revenue (Million $)

1Q

2014

90.93

2013

55.11

2012

15.98

2011

3.12

2010

-2009

--

2Q

-54.40

25.35

6.71

---

3Q

-70.71

48.35

20.70

---

4Q

-81.21

48.93

----

Year

-261.4

138.6

51.88

40.55

21.73

Vol.

(000)

4954

4949

5412

2400

1600

800

0

J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A

2011

2012

2013

2014

...................................................................................................................................................................

Earnings Per Share ($)

2014

0.14

2013

0.14

2012

0.07

2011

0.01

2010

-2009

--

S&P Financial Writer Joseph Cowan_E

-0.12

0.13

0.05

---

-0.15

0.25

0.10

---

-0.18

0.16

----

Fiscal year ended Dec. 31. Next earnings report expected: Late August

Dividend Data

No Dividend Data Available

-0.58

0.63

0.23

0.14

0.13

Operational Review Apr 17, 2014

Income Statement Analysis & Financial Review

Revenues for the year ended December 31, 2013 were $261.4 million vs. $138.6 million in the prior year,

advancing 89% year over year. Gross margin narrowed 23%, despite higher revenues. General & administrative

expenses rose 6%, and operating income was $92.7 million, vs. $61.4 million for last year. For the fiscal year net

income was $74.2 million ($0.58 a share), vs. $57.5 million ($0.63 a share) in 2012.

Key Operating Information

Revenues generated from sale of goods increased by $121 million(or 137% from $88.1million for the year ended

December 31, 2012 to $ 209 million for the year ended December 31, 2013). The increase was primarily due to

increase of revenue from organic fertilizer by $32.8 million and was attributable to 27% of total increase of $121

million. Revenue from organic fertilizer of $41.3 million (2012: $8.5 million) was attribute 20% (2012: 101%) to total

of revenue generated from sale of goods of $209 million (2012: $88 million).

Revenues generated from consulting and service is continued operations increased slightly by $2.3 million (or 5

%) from $50.5 million for the year ended December 31, 2012 to $52.8 million for the year ended December 31,

2013. The increase was primarily due to increase of revenue from corporate by $5.7 million but revenue from

corporate of $9million (2012: $3.3 million) was attributable to 17% (2012: 7%) of total revenue generated from

consulting, service, commission and management fee of 52.8 million (2012: $50.5 million).

Recent Developments

Capital Award, Inc., a wholly owned subsidiary of Sino Agro, has licensed its A-Power Technology to Glory

Ocean Development Ltd, a Hong Kong corporation, who has signed a Sino Foreign Joint Venture (SFJV)

agreement with a group of business partners in Zhongshan City, Guangdong Province, PRC. Pursuant to the

SFJV agreement, a Sino Foreign Joint Venture Company will be incorporated to develop an 8,000 MU prawn

and agriculture center in Zhongshan. Hong Kong law governs the license agreement.

During the fourth quarter Capital Award began work on a new prawn project which calls for phase dependent

development, yielding approximately $150M in Phase I, Stage I revenue, and a total of $2.6B over the project's

expected 20 year life cycle.

All of the views expressed in this research report accurately reflect our quantitative research models regarding any and all of the subject securities or issuers. No part of our compensation was, is, or will be, directly or

indirectly, related to the specific recommendations or views expressed in this research report. This report is for information purposes and should not be considered a solicitation to buy or sell any security. Neither S&P

nor any other party guarantees its accuracy or makes warranties regarding results from its usage. S&P receives compensation from the issuer or an agent thereof for initiating coverage, and for distribution including

licensed redistribution of this report, and/or for inclusion in other S&P publications, generally in amounts up to U.S. $14,175 per year. Redistribution is prohibited without written permission.

Page 1 of 11

Please read the Required Disclosures on the last page of this report. Redistribution is prohibited without written permission

Factual Stock Report | May 31, 2014

Sino Agro Food Inc (SIAF) BB

GICS Sector: Consumer Staples

Sub-Industry: Agricultural Products

Summary: SIAF is an agriculture and aquaculture technology company with a business model involving the

developing, producing, distribution of agriculture and aquaculture produce and products in China.

Business Summary April 17, 2014

Sino Agro Food, Inc. (SIAF), an agricultural technology and organic food company,

is focused on developing, producing, and distributing agricultural products in the

People's Republic of China. Revenues are generated from activities that they divide

into five stand-alone business divisions or units: (1) Fishery, (2) Cattle, (3) Organic

Fertilizer, (4) HU Plantation, and (5) Marketing and Trading. This fifth and newest

division, "Marketing and Trading" represents the strongest push to vertically

integrate the company's operations, furthering the company's overall "farm to plate"

concept.

Sino Agro conducts its operations through various subsidiaries to work with local

governments and farmers to form agricultural cooperatives. Once these

cooperatives have been formed, Sino Agro Food develops the infrastructure and

provides the education and training to bring what were once small individual farms

and communities into commercial-scale operations.

A-Power Technology (APT) is an engineered, self-contained water treatment and

recirculating aquaculture system (RAS) for the growing of aquatic animals on a

commercial scale. The treatment mainly consists of the A-Power Grow Out Basin

and the A-Power Treatment Stack equipment and operating techniques and

procedures which Capital Award has established as essential or desirable for the

establishment, development, and operation of the A-Power aquaculture system. An

APT-designed fish growing system is fully integrated, automated, and

climate-controlled. According to the company, the enhanced growing conditions

enable improved productivity, mortality rates of less than 8%, and a feed-to-fish

conversion ratio of 1:1 for pallet feed and 2:1 for non-pallet feed. The system is

housed on land in an enclosed environment under fully controlled conditions, and

by avoiding contact with any outdoor contamination and using treated water, APT

RAS produces healthy farmed fish guaranteed free of antibiotics and other

pollutants, according to the company.

Capital Award, Inc. (CA) is a wholly owned entity of Sino. Currently engaged in

modern fishery project management and consultancy services, CA provides

consulting and management services to fish farms that are adopting the A Power

Technology and for the development of fish farms using A Power Technology

systems. Capital Award commenced engaging in the marketing and sale of fish and

seafood in 2011. CA is the sole marketing, sales and distribution agent of the

Re-circulating Aquaculture System for fishery and prawn farms, and purchases all

marketable fish and prawns (or shrimp) from SIAF's farms, in turn selling them to

wholesale markets. CA also supplies the farms with fingerling, baby or adult fish or

prawns and stock feed.

Another subsidiary of SIAF, Jiang Men City Heng Sheng Tai Agriculture

Development Co. Ltd., engages in the farming of Hylocereus Undatus, commonly

known as Bean Capers or Pitaya (also known as dragon fruit), at Juntang Town, in

the vicinity of the City of Enping, Guangdong Province, China. The company

generates revenue by harvesting the green flowers from the Hylocereus Undatus

plants before they mature into fruits and selling them as vegetables; drying the

green flowers harvested and selling them as dried vegetables for human

consumption; and processing and packaging the dried and fresh flowers into salted,

pickled, and in brine vegetables.

Sino Agro Food holds a minority interest in Qinghai Sanjiang A Power Agriculture

Co. Limited, which engages in manufacturing of bio-organic fertilizer, livestock feed,

cash crops farming, and beef cattle rearing and fattening in the County of

Huangyuan, in the vicinity of the City of Xining, Qinghai Province, China.

In addition, the company anticipates that its Tri-way Industries Limited subsidiary

will generate revenues through participation in a fish farm project to be developed

in the City of Enping, Guangdong Province, under the supervision and consultancy

of Capital Award using the APT RAS.

The system recycles all water used in the farm and enables the consistent

production and supply of fish in the vicinity of an urban area all year round. The RAS

has been commercially applied in Europe and Australia for the past 30 years and

APT has been commercially developed and used in Australia since 1998. However,

the RAS and APT are relatively new to Asian countries including China, according

to the company.

Peer Comparison Chart - 1 Year

Company vs Market Comparison Chart - 1 Year

Sino Agro Food

Agria Corp ADS

Brasilagro Cia Bras De Prop ADS

Company

Sino Agro Food

Index

S&P 500

Sector

Consumer Staples

Industry

Food Products

60

60

40

40

20

20

0

0

-20

-20

-40

-40

-60

-60

-80

-100 May

-80

Jun

2013

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

2014

-100 May

Jun

Jul

2013

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

2014

Page 2 of 11

Please read the Required Disclosures on the last page of this report. Redistribution is prohibited without written permission

Factual Stock Report | May 31, 2014

Sino Agro Food Inc (SIAF) BB

GICS Sector: Consumer Staples

Sub-Industry: Agricultural Products

Summary: SIAF is an agriculture and aquaculture technology company with a business model involving the

developing, producing, distribution of agriculture and aquaculture produce and products in China.

Key Growth Rates and Averages

Past Growth Rate (%)

Sales

Net Income

Expanded Ratio Analysis

1 Year

3 Years

5 Years

9 Years

88.61

28.95

92.97

NM

75.64

87.60

NA

NA

.................................................................................................................................................................................................................................................

Ratio Analysis (Annual Avg.)

Net Margin (%)

% LT Debt to Capitalization

Return on Equity (%)

28.39

0.57

30.35

NA

NA

NA

Price/Sales

Price/EBITDA

Price/Pretax Income

P/E Ratio

Avg. Diluted Shares Outstg (M)

2013

0.25

0.67

0.68

0.87

127.4

2012

0.35

0.75

0.76

0.84

92.0

2011

0.75

1.86

1.85

2.48

67.2

2010

2.01

3.86

6.41

9.58

61.2

33.38

0.22

NA

30.49

2.00

16.95

2013

1.58

0.61

0.58

Nil

Nil

0.71

0.34

1

1

2012

1.19

0.65

0.63

0.01

2%

1.05

0.25

2

NA

2011

0.93

0.25

0.23

0.01

4%

1.60

0.36

7

2

2010

0.93

0.17

0.14

Nil

Nil

1.90

0.44

14

3

2009

0.56

0.16

0.13

Nil

Nil

1.28

0.02

NM

NM

2008

0.43

0.09

0.07

Nil

Nil

1.80

0.01

NM

NM

2007

0.43

0.07

0.06

Nil

Nil

10.00

0.25

NM

NM

2006

NA

NA

NA

NA

NA

NA

NA

NA

NA

2005

NA

NA

NA

NA

NA

NA

NA

NA

NA

2004

NA

NA

NA

NA

NA

NA

NA

NA

NA

261

96.2

3.50

0.39

94.4

NA

74.2

139

64.3

2.38

0.28

63.3

NA

57.6

51.9

20.9

1.26

Nil

21.1

NM

15.7

40.6

21.1

2.21

0.35

12.7

NM

8.50

21.7

11.2

1.69

0.47

9.02

NM

6.81

16.2

6.74

1.31

0.42

4.97

NM

3.69

16.2

10.4

0.40

0.08

3.36

NM

3.14

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

93.7

188

368

34.0

1.91

291

334

58.2

77.7

5.5

0.6

28.4

24.3

30.4

8.42

134

243

22.7

0.18

198

217

29.9

59.9

5.9

0.1

41.5

NA

NA

1.39

74.2

152

16.5

Nil

125

135

1.60

17.0

4.5

Nil

30.2

12.1

14.7

3.89

43.8

108

2.94

3.78

87.5

105

7.47

10.7

14.9

3.6

21.0

8.9

11.3

2.36

27.5

84.1

7.73

4.40

63.0

76.3

1.41

8.49

3.6

5.8

31.3

8.6

11.4

1.73

21.2

75.2

5.65

6.84

56.0

69.5

1.98

5.01

3.8

9.8

22.8

5.4

7.2

0.36

28.5

62.8

6.21

4.11

47.1

56.6

5.42

3.54

4.6

7.3

19.4

7.3

9.4

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

Figures based on calendar year-end price

Company Financials Fiscal Year Ended Dec. 31

Per Share Data ($)

Tangible Book Value

Cash Flow

Earnings

Dividends

Payout Ratio

Prices:High

Prices:Low

P/E Ratio:High

P/E Ratio:Low

Income Statement Analysis (M $)

Revenue

Operating Income

Depreciation

Interest Expense

Pretax Income

Effective Tax Rate

Net Income

Bal Sheet & Other Financial Data (M $)

Cash

Current Assets

Total Assets

Current Liabilities

Long Term Debt

Common Equity

Total Capital

Capital Expenditures

Cash Flow

Current Ratio

% Long Term Debt of Capitalization

% Net Income of Revenue

% Return on Assets

% Return on Equity

Data as orig reptd.; bef. results of disc opers/spec. items. Per share data adj. for stk. divs.; EPS diluted. E-Estimated. NA-Not Available. NM-Not Meaningful. NR-Not Ranked. UR-Under Review.

Quantitative Evaluations

Relative Strength Rank

58/MODERATE

58

Lowest=1

Volatility

LOW

High

AVERAGE

HIGH

Highest=99

Technical Evaluation

NEUTRAL

Since May, 2014, the technical indicators for SIAF

have been NEUTRAL.

Page 3 of 11

Please read the Required Disclosures on the last page of this report. Redistribution is prohibited without written permission

Factual Stock Report | May 31, 2014

Sino Agro Food Inc (SIAF) BB

GICS Sector: Consumer Staples

Sub-Industry: Agricultural Products

Summary: SIAF is an agriculture and aquaculture technology company with a business model involving the

Corporate Information

Corporate History

List of Officers

Y. Lee Chrmn, Pres, Chief Acctg Officer & CEO

O. Lai CFO

B.

Chen Secy

...................................................................................................................................................................

List of Board Members

Y. Lee

B. Chen

D. Ritchey

N.E. Sandberg

L. Soh

P. Tan

K.

Yap

...................................................................................................................................................................

Founded

1974

...................................................................................................................................................................

Employees

(#)

556

...................................................................................................................................................................

Stockholders

5008

...................................................................................................................................................................

Transfer Agents

Broadridge Corporate Issuer

Solutions, Inc.

...................................................................................................................................................................

Auditor

Anthony Kam & Associates Limited,

CPA

...................................................................................................................................................................

Subsidiaries

A Power Agro Agriculture Development (Macau) Limited

Capital Award Inc.

Jiang Men City Heng Sheng Tai Agriculture

Development Co. Ltd.

LEAF Ventures II, LLC

LEAF Ventures, LLC

Macau Eiji Company Limited

Merit Capital Advance, LLC

Merit Capital Manager, LLC

Merit Processing, LLC

Parkwin Services, LLC

Prompt Payment, LLC

RA Equity Co.

RCP Bent Oaks Manager, LLC

RCP Cape Cod Manager, LLC

RCP Chenal Brightwaters Manager, LLC

RCP Coach Lantern Manager, LLC

RCP Foxglove Manager, Inc.

RCP Heritage Lake Manager, LLC

RCP Heritage Lake Manager, LLC

RCP

Magnolia Manager, LLC

...................................................................................................................................................................

developing, producing, distribution of agriculture and aquaculture produce and products in China.

INCORPORATED in Nevada Oct. 1, 1974, as Volcanic Gold, Inc.; name changed to A Power Agro Agriculture

Development, Inc. Aug. 24, 2007, and to Sino Agro Food, Inc. Oct. 9, 2007. On Aug. 24, 2007, the company

acquired all of the outstanding Common stock of Capital Award Inc., a Belize corporation, for 32,000,000

Common shares of the company. Capital Award Inc. was incorporated on Nov. 26, 2004.

Company Management Bios

Y. Lee Chrmn, Pres, Chief Acctg Officer & CEO

Mr. Yip Kun Lee, also known as Solomon, has been the Chief Executive Officer of Sino Agro Foods, Inc. since

August 2007 and serves as its President and Principal Accounting Officer. Mr. Lee has been the Owner of

Accurate Asset Group Ltd., and the Chief Executive Officer of Capital Award Inc. Since 2003. He is Pioneer of

Fish Protech Projects in the South Pacific Region. He has over 35 years experience in the Fishery Industry and

Food Industry. He served as the Chief Financial Officer of Sino Agro Foods, Inc. He served as the Chief

Executive Officer for Irama Edaran Sdn. Bhd. (“Irama”), AA Concepts Sdn, Bhd., the Companies located in

Malaysia and in the Business of Aquaculture Fishery Development from 1998 to 2002. He has been Chairman of

Capital Award Inc. Since 2003. He serves as the Chairman of Sino Agro Foods, Inc. and has been its Director

since August 2007. He has been a Director of Accurate Asset Group Ltd. Since 2003. Mr. Lee holds B.A in

Economics & Accounting from Monach University Melbourne Australia.

O. Lai CFO

Ms. Olivia Lai has been Chief Financial Officer at Sino Agro Foods, Inc. since May 21, 2014. Ms. Lai has over 20

years accounting and finance experience and held senior positions in many multi-national and public

accounting and consulting firms; including Cisco Systems, Ernst & Young and PricewaterhouseCoopers. She is

a U.S. and Hong Kong Certified Accountant with memberships in the American Institute of Certified Public

Accountants, Charted Global Management Accountants, Hong Kong Institute of Certified Public Accountants,

and the Taxation Institute of Hong Kong. Ms. Lai received her Bachelor of Science in Accounting with the

Highest Distinction. She has an Executive Master of Business Administration from the Kellogg School of

Management of Northwestern University in the U.S., and the University of Science and technology in Hong

Kong.

B. Chen Secy

Mr. Bor Hann Chen, also known as Michael, has been a Secretary of Sino Agro Foods, Inc. since August 2007.

Mr. Chen serves as Manager of its office in Macau. He is a merchant with many years of experience in the

Fishery Industry and is one of the pioneers of Fish Protech Projects, Malaysia. He served as Secretary of

Capital Award Inc. and was responsible for the marketing and development of aquaculture farms in the P.R.C.

From 1998 to 2005, Mr. Chen worked as Project Manager for Irama responsible for the development and

commissioning of farms. He has been a Director of Sino Agro Foods, Inc. since August 2007. He served as a

Director of Capital Award Inc.

Page 4 of 11

Please read the Required Disclosures on the last page of this report. Redistribution is prohibited without written permission

Factual Stock Report | May 31, 2014

Sino Agro Food Inc (SIAF) BB

GICS Sector: Consumer Staples

Sub-Industry: Agricultural Products

Summary: SIAF is an agriculture and aquaculture technology company with a business model involving the

Stock Performance

Sub-Industry Outlook

Based on S&P 1500 Indexes

Month-End Price Performance as of 5/30/14

We have a neutral fundamental outlook for the agricultural products sub-industry for the next 12 months. We

think there were some relatively large crop harvests in 2013, and we expect product demand to be bolstered by

foreign markets. However, we view an EPA proposal to lower expected renewable fuel use in 2014 as a

negative for a U.S. ethanol producers.

S&P 1500

Sector

developing, producing, distribution of agriculture and aquaculture produce and products in China.

Sub-Industry

250

We think prospects for a much larger U.S. corn harvest in 2013 helped bring corn prices in the futures market

down from the highs of the 2012 summer, when we believe futures prices were affected by hot weather and

drought conditions in parts of the U.S. Corn costs can affect various businesses, including ethanol and

livestock producers.

200

In December 2013, the USDA forecast a 35% narrowing of the U.S. agricultural trade balance in fiscal 2014

(ending September) to +$27.5 billion, which would be the smallest surplus since 2009. In FY 13, the trade

balance was +$37.1 billion, up 14%, year to year, with exports up 4% and import value largely unchanged from

that of the year-ago period.

150

We are not expecting a major near-term impact on crop prices from the Environmental Protection Agency

(EPA) announcing waivers for increased ethanol use in newer vehicles, which could result in fuel containing

up to 15% ethanol, versus up to 10% previously. However, over time, a shift toward a 15% blend could bolster

demand for the use of U.S. corn in ethanol production.

100

Long-term, we anticipate that overall agribusiness-related production and revenue will increase, helped by

world population growth, heightened global demand for proteins and grain-based crops, and continued

industry consolidation and globalization of operations. With the U.S. market relatively mature, we think

developing international markets will provide faster future demand growth than the U.S. market does.

50

0

2009

2010

2011

2012

2013

2014

Note: All Sectors & Sub-Industry information is based on the Global

Industry Classification Standard (GICS)

Over time, we expect that U.S. food processors will boost their presence in international markets. Continued

globalization should lead to improvement in sourcing raw materials and increased capabilities in meeting

global demand. We expect product demand in international markets to reflect rising income levels in

developing markets, and changes in consumer lifestyles and diets.

Year to date through February 21, the S&P Agricultural Products Index was down 3.2%, compared to a 0.5%

decline for the S&P 1500. In 2013, the S&P Agricultural Products Index was up 45.9%, compared to a 30.1% rise

for the S&P 1500.

--Joseph Agnese

Sub-Industry: Agricultural Products Peer Group*: Based on market capitalization within GICS Sub-Industry

Stock

Symbol

Recent

52 Wk

Yield

Quality

Stk Mkt

P/E Fair Val

S&P IQ

Ret on

LTD to

Stk ($)

H/L ($)

Beta

(%)

Ranking

Cap (M)

Ratio

Calc($)

%ile

Rev (%)

Cap (%)

Sino Agro Food

SIAF

71

0.45

0.61/0.34

1.66

Nil

1

NA

NR

NA

28.4

0.6

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

Agria Corp ADS

GRO

39

1.41

2.12/1.05

2.20

Nil

NM

NA

NR

8

NA

18.7

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

Brasilagro Cia Bras De Prop

LND

267

4.59

5.47/3.18

1.02

Nil

51

NA

NR

31

NM

8.7

ADS

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

China Fruits

CHFR

2

0.05

0.10/0.01

2.02

Nil

5

NA

NR

7

NM

NA

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

Global Clean Energy Holdings

GCEH

3

0.01

0.03/0.01

0.88

Nil

NM

NA

C

3

NM

50.5

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

Imperial Ginseng Prod

IGPFF

NA

0.00

0.37/0.25

-1.09

Nil

NM

NA

C

NA

39.5

9.6

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

Le Gaga Holdings ADS

GAGA

3

3.54

3.83/2.94

-0.26

Nil

11

NA

NR

28

26.6

NA

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

Limoneira Co

LMNR

329

23.40

27.41/18.98

0.79

0.6

49

14.80

NR

40

5.8

36.2

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

Origin Agritech Ltd

SEED

52

2.27

3.47/1.17

2.69

Nil

NM

NA

NR

7

1.9

14.2

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

Royal Hawaiian

NNUTU

24

3.14

3.79/2.00

0.39

Nil

NM

NA

NR

16

NM

12.7

Orchards'A'LP

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

S&W Seed

SANW

78

6.68

9.21/4.82

-0.15

Nil

NM

5.20

NR

8

NM

8.4

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

Scheid Vineyards'A'

SVIN

25

31.00

31.00/19.02

0.69

Nil

NM

NA

B38

NA

NA

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

Shandong Zhouyuan Seed &

SZSN

1

0.01

0.07/0.00

NM

Nil

1

NA

NR

39

NM

NA

Nursery

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

YaSheng Group

HERB

137

0.89

2.49/0.35

-1.78

Nil

1

NA

NR

30

13.5

NA

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

Yew Bio-Pharm Grp

YEWB

10

0.00

1.10/0.12

NA

Nil

NM

NA

NR

NA

52.4

NA

..................................................................................... ...................................................................................................... ................................................. .............................................................. ............................. ............................... .......................................................................................................................................

NA-Not Available NM-Not Meaningful NR-Not Rated. *For Peer Groups with more than 15 companies or stocks, selection of issues is based on market capitalization.

Page 5 of 11

Please read the Required Disclosures on the last page of this report. Redistribution is prohibited without written permission

Factual Stock Report | May 31, 2014

Sino Agro Food Inc (SIAF) BB

GICS Sector: Consumer Staples

Sub-Industry: Agricultural Products

Summary: SIAF is an agriculture and aquaculture technology company with a business model involving the

developing, producing, distribution of agriculture and aquaculture produce and products in China.

S&P Analyst Research Notes and other Company News

May 22, 2014

Sino Agro Foods, Inc. announced that Ms. Olivia Lai has accepted the position of

Chief Financial Officer. Ms. Lai has over 20 years accounting and finance

experience and held senior positions in many multi-national and public accounting

and consulting firms; including Cisco Systems, Ernst & Young and

PricewaterhouseCoopers.

operations attributable to the company and subsidiaries was $49,462,486 or $0.40

per diluted share compared to $38,686,788 or $0.47 per diluted share a year ago. Net

cash provided by operating activities was $38,065,409 compared to $10,291,120 a

year ago. Acquisition of property and equipment were $4,188,660 compared to

$2,527,245 a year ago. Acquisition of land use rights was $489,904. Payment for

construction in progress was $31,494,031 compared to $2,317,082 a year ago.

May 19, 2014

Sino Agro Foods, Inc. reported unaudited consolidated earnings results for the first

quarter March 31, 2014. For the quarter, the company's revenue was USD 90,927,789

against USD 55,107,751 a year ago. Net income from operations was USD 25,891,454

against USD 19,317,429 a year ago. Net income before income taxes was USD

25,941,857 against USD 19,911,313 a year ago. Net income from continuing

operations attributable to the company and subsidiaries was USD 20,787,919 against

USD 16,378,772 year ago. Net income was USD 25,941,857 or USD 0.14 per diluted

share against USD 19,911,313 or USD 0.14 per diluted share a year ago. Net cash

provided by operating activities was USD 20,725,513 against USD 4,257,374 a year

ago. Purchases of property and equipment were USD 907,666 against USD 126,182 a

year ago.

August 21, 2013

Sino Agro Foods, Inc. reported unaudited consolidated earnings results for the

second quarter and six months ended June 30, 2013. For the quarter, the company

reported revenue of $54,400,329 compared to $25,348,287 a year ago. Net income

from operations was $17,782,143 compared to $10,822,571 a year ago. Net income

before income taxes was $18,272,928 compared to $11,405,729 a year ago. Net

income from continuing operations attributable to the company and subsidiaries

was $14,330,940 or $0.12 per diluted share compared to $10,290,022 or $0.13 per

diluted share a year ago. The increase in revenue was primarily due to the natural

growth of revenue generated from the fishery, cattle farm, beef and the maturity of

on-going divisional businesses improving their revenue. For the six months, the

company reported revenue of $109,508,080 compared to $41,328,303 a year ago. Net

income from operations was $37,099,572 compared to $16,613,841 a year ago. Net

income before income taxes was $38,184,241 compared to $17,947,404 a year ago.

Net income from continuing operations attributable to the company and

subsidiaries was $30,709,712 or $0.27 per diluted share compared to $15,961,484 or

$0.20 per diluted share a year ago. Net cash provided by operating activities was

$16,120,653 compared to $9,887,541 a year ago. Purchases of property and

equipment were $490,323 compared to $20,423 a year ago. Acquisition of land use

rights was $490,323. Payment for construction in progress was $13,596,632

compared to $6,626,688 a year ago.

April 15, 2014

Sino Agro Foods, Inc. reported audited consolidated earnings results for the fourth

quarter and full full year ended December 31, 2013. For the year, revenue was

$261,425,813 against $138,613,639 a year ago. Net income from operations was

$92,671,373 against $61,420,306 a year ago. Net income before income taxes was

$94,441,246 against $63,252,540 a year ago. Net income attributable to the company

and subsidiaries was $74,206,529 or $0.58 per diluted share against $57,545,832 or

$0.63 per diluted share a year ago. Net cash provided by operating activities was

$84,241,349 against $44,425,379 a year ago. Purchases of property and equipment

were $7,002,878 against $10,756,744 a year ago. Comprehensive net income from

continuing operations in the fourth quarter totaled $25.2 million, a sequential

increase of $5.8 million, or 30%, over the third quarter, 2013.

February 11, 2014

Sino Agro Foods, Inc. announced that it has added two new independent members

to its board of directors: Mr. Daniel Ritchey and Mr. Lim Chang (Anthony) Soh. Mr.

Ritchey is currently a partner in three companies: DC Capital LLC, 3-D Oil and Gas

LLC, and 3-D Ranch LLC, a 2,200 head of cattle/1,500 head pig farm for which Mr.

Ritchey serves as Finance Director. Mr. Soh is a partner in the law firm, Edwin Lim

Suren & Soh, in Kuala Lumpur, Malaysia. Until October 31, 2013.

May 17, 2013

Sino Agro Foods, Inc. reported unaudited consolidated earnings results for the first

quarter March 31, 2013. For the quarter, revenue was $55,107,751 against

$15,980,016 a year ago. Net income from operations was $19,317,429 against

$5,791,270 a year ago. Net income before income taxes was $19,911,313 against

$6,541,674 a year ago. Net income from continuing operations attributable to the

company and subsidiaries was $16,378,772 against $5,632,769 year ago. Net income

was $19,911,313 or $0.14 per diluted share against $6,541,674 or $0.07 per diluted

share a year ago. Net cash provided by operating activities was $4,257,374 against

$4,996,624 a year ago. Purchases of property and equipment were $126,182 against

$7,223 a year ago.

December 20, 2013

Sino Agro Food, Inc. announced that it has formed Sino Agro Food Sweden

Aktiebolag (publ) (SIAFS), a wholly owned subsidiary. SIAFS was registered with

the Swedish Companies Registration Office (Bolagsverket) on December 16, 2013.

The objects of SIAFS shall be to carry out IR representation, to provide services in

agriculture and aquaculture, marketing, sales and trading of agriculture and

aquaculture products, facilitate capital raisings and thereby related business.

November 19, 2013

Sino Agro Foods, Inc. reported unaudited consolidated earnings results for the third

quarter and nine months ended September 30, 2013. For the quarter, revenue

increased by $22,357,009 or 46.24% to $70,707,697 compared to $48,350,688 for the

three months ended September 30, 2012. The increase was primarily due to the

natural growth of revenue generated from the organic fertilizer, beef and plantation

divisions, and corporate and other operations not commenced in 2012. Net income

from operations was $24,096,136 against $24,435,075 a year ago. Net income before

income taxes was $24,355,502 compared to $25,202,139 a year ago. Net income from

continuing operations attributable to the company and subsidiaries was $18,752,774

or $0.15 per basic and diluted share compared to $22,725,305 or $0.25 per diluted

share a year ago. For the nine months, the company reported revenue of

$180,215,777 compared to $89,678,991 a year ago. Net income from operations was

$61,195,708 compared to $41,048,916 a year ago. Net income before income taxes

was $62,539,743 compared to $43,149,542 a year ago. Net income from continuing

Page 6 of 11

Please read the Required Disclosures on the last page of this report. Redistribution is prohibited without written permission

Factual Stock Report | May 31, 2014

Sino Agro Food Inc (SIAF) BB

GICS Sector: Consumer Staples

Sub-Industry: Agricultural Products

Summary: SIAF is an agriculture and aquaculture technology company with a business model involving the

developing, producing, distribution of agriculture and aquaculture produce and products in China.

Glossary

Quantitative Evaluations

S&P Capital IQ Fair Value Calculation

The quantitative evaluations covered in this report

and described below are derived from proprietary

arithmetic models. The quantitative model focuses on

a shorter-term horizon and is designed to capture

current information such as performance, market

conditions and certain risk factors. The objectives and

inputs to the model are static and should be viewed as

reflective of current trends and market conditions at

the time of each update and may take a shorter- term

view of a company than the qualitative report on the

same company.

The Fair Value formula uses forward EPS estimates to

calculate a company's projected return on equity. A

stock's "Fair Value" is then derived by comparing its

current valuation relative to the company's projected

ROE relative to historical valuations versus ROE for

the company, industry, and a benchmark index.

S&P Capital IQ Quality Ranking

Growth and stability of earnings and dividends are

deemed key elements in establishing S&P Capital IQ's

Quality Rankings for common stocks, which are

designed to capsulize the nature of this record in a

single symbol. It should be noted, however, that the

process also takes into consideration certain

adjustments and modifications deemed desirable in

establishing such rankings. The final score for each

stock is measured against a scoring matrix

determined by analysis of the scores of a large and

representative sample of stocks. The range of scores

in the array of this sample has been aligned with the

following ladder of rankings:

A+

A

AB+

NR

Highest

High

Above Average

Average

Not Ranked

B

BC

D

Below Average

Lower

Lowest

In Reorganization

S&P Capital IQ Fair Value Rank

Using S&P's exclusive proprietary quantitative model,

stocks are ranked in one of five groups, ranging from

Group 5, listing the most undervalued stocks, to Group

1, the most overvalued issues. Group 5 stocks are

expected to generally outperform all others. A positive

(+) or negative (-) Timing Index is placed next to the

Fair Value ranking to further aid the selection process.

A stock with a (+) added to the Fair Value Rank simply

means that this stock has a somewhat better chance

to outperform other stocks with the same Fair Value

Rank. A stock with a (-) has a somewhat lesser

chance to outperform other stocks with the same Fair

Value Rank. The Fair Value rankings imply the

following:

5-Stock is significantly undervalued

4-Stock is moderately undervalued

3-Stock is fairly valued

2-Stock is modestly overvalued

1-Stock is significantly overvalued

Dividends on American Depository Receipts (ADRs)

and American Depository Shares (ADSs) are net of

taxes (paid in the country of origin).

Insider Activity

Gives an insight as to insider sentiment by showing

whether directors, officers and key employees who

have proprietary information not available to the

general public, are buying or selling the company's

stock during the most recent six months.

Funds From Operations (FFO)

A financial measure used by Real Estate Investment

Trust's to reflect their operating performance. As

reported by co. based on NAREIT definition.

Volatility

Rates the volatility of the stock's price over the past

year.

Technical Evaluation

In researching the past market history of prices and

trading volume for each company, S&P Capital IQ's

models apply special technical methods and formulas

to identify and project price trends for the stock.

Relative Strength Rank

Shows, on a scale of 1 to 99, how the stock has

performed versus all other companies in S&P's

universe on a rolling 13-week basis.

Global Industry Classification Standard (GICS)

An industry classification standard, developed by

Standard and Poor's in collaboration with Morgan

Stanley Capital International (MSCI). Under the GICS

structure, companies are classified in one of 154

sub-industries, which are grouped into 68 industries,

24 industry groups, and 10 economic sectors

(consumer discretionary, consumer staples, energy,

financials, health care, industrials, information

technology, materials, telecom services, and utilities).

This four-tier structure accommodates companies

across the world and facilitates sector analysis and

investing.

Exchange Type

ASE - American Stock Exchange; AU - Australia Stock

Exchange; BB - Bulletin Board; NGM - Nasdaq Global

Market; NNM - Nasdaq Global Select Market; NSC Nasdaq Capital Market; NYS - New York Stock

Exchange; OTN - Other OTC (Over the Counter); OTC Over the Counter; QB - OTCQB; QX - OTCQX; TS Toronto Stock Exchange; TXV - TSX Venture

Exchange; NEX - NEX Exchange.

Page 7 of 11

Please read the Required Disclosures on the last page of this report. Redistribution is prohibited without written permission

Factual Stock Report | May 31, 2014

Sino Agro Food Inc (SIAF) BB

GICS Sector: Consumer Staples

Sub-Industry: Agricultural Products

Required Disclosures

The data and information provided in S&P Capital IQ's

Factual Reports (the "Factual Reports") are selected by

financial writers who obtain this data from multiple

sources, including, but not limited to, S&P Capital IQ's

quantitative research models, S&P Capital IQ's

research commentaries from equity analysts and

consensus opinions from analysts who are not

employees of S&P Capital IQ and/or any of its

affiliates. Factual Reports may contain some

estimates, opinions and other types of non-factual

information.

Some Factual Reports may contain S&P Fair Value

Ranking information. Refer to the Glossary Section of

this report for detailed methodology and definition of

S&P Fair Value Rank.

S&P Capital IQ also produces STARS Stock Reports

and Quantitative Stock reports. These reports rank

stocks in accordance with the following ranking

methodologies:

STARS Stock Reports: S&P Capital IQ's qualitative

STARS recommendations are determined and

assigned by S&P Capital IQ equity analysts.

Quantitative Stock Reports: S&P Capital IQ's

quantitative evaluations are derived from S&P Capital

IQ.s proprietary Fair Value quantitative ranking model.

The Fair Value Ranking methodology is a relative

ranking methodology. As a quantitative model, Fair

Value relies on history and consensus estimates and

does not introduce an element of subjectivity.

Factual Reports, STARS Stock Reports and

Quantitative Stock Reports: The methodologies used

in Factual Reports, STARS Stock Reports and

Quantitative Stock Reports reflect different criteria,

assumptions and analytical methods and may have

differing recommendations.

S&P Capital IQ believes that the methodologies and

data used to generate the different types of Research

Reports are reasonable and appropriate. Generally,

S&P Capital IQ does not generate reports with

different ranking methodologies for the same issuer.

However, in the event that different methodologies or

data are used on the analysis of an issuer, the

methodologies may lead to different views or

recommendations on the issuer, which may at times

result in contradicting assessments of an issuer. S&P

Capital IQ reserves the right to alter, replace or vary

models, methodologies or assumptions from time to

time and without notice to clients.

Factual Reports:

S&P Capital IQ receives compensation from the

issuer or an agent thereof for initiating coverage, and

for distribution including licensed redistribution of

the report, and/or for inclusion in other S&P

publications, generally in amounts up to $12,900 per

year.

STARS Stock Reports:

S&P Capital IQ Global STARS Distribution as of

March 31, 2014

Summary: SIAF is an agriculture and aquaculture technology company with a business model involving the

developing, producing, distribution of agriculture and aquaculture produce and products in China.

Malaysia, by Standard & Poor's Malaysia Sdn Bhd,

North

Asia

Europe

Global

which is regulated by the Securities Commission of

America

Malaysia; in Australia, by Standard & Poor's

Buy

35.4%

41.9%

35.8%

36.2%

Information Services (Australia) Pty Ltd ("SPIS"),

Hold

52.3%

54.3%

43.3%

51.0%

which is regulated by the Australian Securities &

Sell

12.3%

3.8%

20.9%

12.8%

Investments Commission; and in Japan, by

Total

100%

100%

100%

100%

McGraw-Hill Financial Japan KK, which is registered

by Kanto Financial Bureau.

STARS Stock Reports are prepared by the equity

research analysts of Standard & Poor's Investment

S&P Capital IQ or an affiliate may license certain

Advisory Services LLC ("SPIAS"). All of the views

intellectual property or provide pricing or other

expressed in STARS Stock Reports accurately reflect

services to, or otherwise have a financial interest in,

the research analyst's personal views regarding any

certain

issuers

of

securities,

including

and all of the subject securities or issuers. Analysts

exchange-traded investments whose investment

generally update stock reports at least four times

objective is to substantially replicate the returns of a

each year.

proprietary index of S&P Dow Jones Indices, such as

Quantitative Stock Reports:

the S&P 500. In cases where S&P Capital IQ or an

The Fair Value ranking distribution is a fixed

affiliate is paid fees that are tied to the amount of

distribution based on relative weightings as

assets that are invested in the fund or the volume of

described in the Glossary section of this report under

trading activity in the fund, investment in the fund will

S&P Capital IQ Fair Value Rank. Certain reports with

generally result in S&P Capital IQ or an affiliate

Fair Value Rank do not have a Buy/Hold/Sell

receiving compensation in addition to the subscription

recommendation, for ranking definition please refer

fees or other compensation for services rendered by

to the Glossary section of the respective report. The

S&P Capital IQ. A reference to a particular investment

Fair Value Ranking distribution includes all the

or security by S&P Capital IQ and/or one of its

stocks that have S&P Fair Value Ranking.

affiliates is not a recommendation to buy, sell, or hold

Quantitative Stock Reports are prepared by the equity

such investment or security, nor is it considered to be

research group of SPIAS. All of the views expressed

investment advice.

in these reports reflect S&P Capital IQ's research

models output regarding any and all of the subject

Indexes are unmanaged, statistical composites and

securities or issuers. Quantitative Stock Reports are

their returns do not include payment of any sales

updated daily. Quantitative Stock Reports rely on the

charges or fees an investor would pay to purchase

availability of data and therefore SPIAS do not

the securities they represent. Such costs would lower

provide a report when sufficient data is not available.

performance. It is not possible to invest directly in an

index.

STARS Stock Reports and Quantitative Stock Reports:

No part of analyst compensation and SPIAS.

S&P Capital IQ and its affiliates provide a wide range

compensation was, is, or will be, directly or

of services to, or relating to, many organizations,

indirectly, related to the specific recommendations

including issuers of securities, investment advisers,

or views expressed in Stock Reports and/or

broker-dealers, investment banks, other financial

Quantitative Stock Reports, as applicable.

institutions and financial intermediaries, and

Ranking

About S&P Capital IQ.s Distributors:

S&P Capital IQ's Factual Reports have been prepared

and issued by S&P Capital IQ and/or one of its

affiliates. In the United States, Factual Reports are

prepared by SPIAS and issued by Standard & Poor's

Financial Services LLC ("S&P"). SPIAS is authorized

and regulated by the U.S. Securities and Exchange

Commission. McGraw-Hill Financial Research Europe

Limited ("MHFRE"), which is authorized and regulated

by the Financial Conduct Authority and trades as S&P

Capital IQ, includes within its territorial scope under

the Markets in Financial Instruments Directive (MiFID)

in relation to the distribution of investment research

reports, the following European Union member states

and the three (3) European Economic Area European

Free Trade Association (EFTA) States (Iceland,

Liechtenstein and Norway): Austria; Belgium;

Bulgaria; Cyprus; Czech Republic; Denmark; Estonia;

Finland; France; Germany; Gibraltar; Greece; Hungary;

Iceland; Ireland; Italy; Latvia; Liechtenstein; Lithuania;

Luxembourg; Malta; Netherlands; Norway; Poland;

Portugal; Romania; Slovakia; Slovenia; Spain; Sweden

and the United Kingdom. In Hong Kong, Factual

Reports have been prepared and issued by Standard

& Poor's Investment Advisory Services (HK) Limited,

which is regulated by the Hong Kong Securities

Futures Commission; in Singapore, by McGraw-Hill

Financial Singapore Pte. Limited ("MHFSPL"), which is

regulated by the Monetary Authority of Singapore; in

accordingly may receive fees or other economic

benefits from those organizations, including

organizations whose securities or services they may

recommend, rate, include in model portfolios, evaluate

or otherwise address.

For details on the S&P Capital IQ research objectivity

and conflict-of-interest policies, please visit:

www.spcapitaliq.com/Policies

For a list of companies mentioned in a Research

Report for which McGraw Hill Financial, Inc. and/or

one of its affiliates own 1% or more of common equity

securities and for a list of companies mentioned in a

Research Report that own more than 5% of the

common equity securities of McGraw Hill Financial,

Inc. and/or one of its affiliates, please visit:

www.spcapitaliq.com/issuer-stock-ownership

For a list of companies mentioned in a Research

Report with whom S&P Capital IQ and/or one of its

affiliates has had business relationships within the

past

year,

please

go

to:www.spcapitaliq.com/Relationships]

Page 8 of 11

Please read the Required Disclosures on the last page of this report. Redistribution is prohibited without written permission

Factual Stock Report | May 31, 2014

Sino Agro Food Inc (SIAF) BB

GICS Sector: Consumer Staples

Sub-Industry: Agricultural Products

General Disclaimers

Notice to all jurisdictions:

Where S&P Capital IQ's Factual Reports are made

available in a language other than English and in the

case of inconsistencies between the English and

translated versions of a Factual Report, the English

version will control and supersede any ambiguities

associated with any part or section of a Factual

Report that has been issued in a foreign language.

Neither S&P Capital IQ nor its affiliates guarantee the

accuracy of the translation. Assumptions, opinions

and estimates constitute our judgment as of the date

of this material and are subject to change without

notice. Past performance is not necessarily

indicative of future results.

S&P Capital IQ, its affiliates, and any third-party

providers, as well as their directors, officers,

shareholders, employees or agents (collectively, "S&P

Parties") do not guarantee the accuracy,

completeness or adequacy of this material, and S&P

Parties shall have no liability for any errors, omissions,

or interruptions therein, regardless of the cause, or for

the results obtained from the use of the information

provided by the S&P Parties. S&P PARTIES DISCLAIM

ANY AND ALL EXPRESS OR IMPLIED WARRANTIES,

INCLUDING, BUT NOT LIMITED TO, ANY

WARRANTIES OF MERCHANTABILITY, SUITABILITY

OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In

no event shall S&P Parties be liable to any party for

any direct, indirect, incidental, exemplary,

compensatory, punitive, special or consequential

damages, costs, expenses, legal fees, or losses

(including, without limitation, lost income or lost

profits and opportunity costs) in connection with any

use of the information contained in this document

even if advised of the possibility of such damages.

Ratings from Standard & Poor's Ratings Services are

statements of opinion as of the date they are

expressed and not statements of fact or

recommendations to purchase, hold, or sell any

securities or to make any investment decisions.

Standard & Poor's assumes no obligation to update its

opinions following publication in any form or format.

Standard & Poor's ratings should not be relied on and

are not substitutes for the skill, judgment and

experience of the user, its management, employees,

advisors and/or clients when making investment and

other business decisions. Standard & Poor's rating

opinions do not address the suitability of any security.

Standard & Poor's does not act as a fiduciary. While

Standard & Poor's has obtained information from

sources it believes to be reliable, Standard & Poor's

does not perform an audit and undertakes no duty of

due diligence or independent verification of any

information it receives.

S&P Capital IQ keeps certain activities of its business

units separate from each other in order to preserve

the independence and objectivity of their respective

activities. As a result, certain business units of S&P

Capital IQ may have information that is not available to

other S&P Capital IQ business units. S&P Capital IQ

has established policies and procedures to maintain

the confidentiality of certain non-public information

received in connection with each analytical process.

Summary: SIAF is an agriculture and aquaculture technology company with a business model involving the

developing, producing, distribution of agriculture and aquaculture produce and products in China.

Standard & Poor's Ratings Services does not

Additional information on a subject company may be

contribute to or participate in the development of

available upon request.

Factual Reports. S&P may receive compensation for

its ratings and certain credit-related analyses,

Notice to all Non U.S. Residents:

normally from issuers or underwriters of securities or

from obligors. S&P reserves the right to disseminate

S&P Capital IQ's Factual Reports may be distributed in

its opinions and analyses. S&P public ratings and

certain localities, countries and/or jurisdictions

analyses are made available on its Web sites,

("Territories") by independent third parties or

www.standardandpoors.com (free of charge), and

independent intermediaries and/or distributors (the

www.ratingsdirect.com

and

"Intermediaries" or "Distributors"). Intermediaries are

www.globalcreditportal.com (subscription), and may

not acting as agents or representatives of S&P Capital

be distributed through other means, including via S&P

IQ. In Territories where an Intermediary distributes

publications and third-party redistributors. Additional

S&P Capital IQ's Factual Reports, the Intermediary,

information about our ratings fees is available at :

and not S&P Capital IQ, is solely responsible for

www.standardandpoors.com/usratingsfees .

complying with all applicable regulations, laws, rules,

circulars, codes and guidelines established by local

S&P Capital IQ and its affiliates do not act as a

and/or regional regulatory authorities, including laws

fiduciary. While SPIAS has obtained information from

in connection with the distribution of third-party

sources it believes to be reliable, SPIAS does not

research reports, licensing requirements, supervisory

perform an audit and undertakes no duty of due

and record keeping obligations that the Intermediary

diligence or independent verification of any

may have under the applicable laws and regulations

information it receives.

of the territories where it distributes the Factual

Reports.

S&P keeps certain activities of its business units

separate from each other in order to preserve the

Each Factual Report is not directed to, or intended for

independence and objectivity of their respective

distribution to or use by, any person or entity who is a

activities. As a result, certain business units of S&P

citizen or resident of or located in any locality, state,

may have information that is not available to other

country or other jurisdiction where such distribution,

S&P business units. S&P has established policies and

publication, availability or use would be contrary to

procedures to maintain the confidentiality of certain

law or regulation or which would subject S&P Capital

non-public information received in connection with

IQ or its affiliates to any registration or licensing

each analytical process.

requirements in such jurisdiction.

Factual Reports are not intended to be investment

Each Factual Report is not directed to, or intended for

advice and do not constitute any form of invitation or

distribution to or use by, any person or entity who is

inducement by S&P Capital IQ to engage in

not in a class qualified to receive Factual Reports

investment activity. This material is not intended as an

(e.g., a qualified person and/or investor), as defined by

offer or solicitation for the purchase or sale of any

the local laws or regulations in the country or

security or other financial instrument. Securities,

jurisdiction where the person is domiciled, a citizen or

financial instruments or strategies mentioned herein

resident of, or the entity is legally registered or

may not be suitable for all investors and this material

domiciled.

is not intended for any specific investor and does not

take into account an investor.s particular investment

S&P Capital IQ's Factual Reports are not intended for

objectives, financial situations or needs. Any opinions

distribution in or directed to entities, residents or

expressed herein are given in good faith, are subject

investors in: Albania, Belarus, Bosnia, Burma, Cote

to change without notice, and are only current as of

d.Ivoire, Croatia, Cuba, Democratic Republic of the

the stated date of their issue. Prices, values, or

Congo, Former Yugoslav Republic of Macedonia,

income from any securities or investments mentioned

Herzegovina, Iran, Iraq, Kosovo, Kuwait, Lebanon,

in this report may fluctuate, and an investor may, upon

Libya, Montenegro and Serbia, North Korea, Somalia,

selling an investment, lose a portion of, or all of the

Sudan, South Korea, Syria, Taiwan, Thailand, Turkey,

principal amount invested. Where an investment is

Yemen, Zimbabwe.

described as being likely to yield income, please note

that the amount of income that the investor will

receive from such an investment may fluctuate.

Where an investment or security is denominated in a

different currency to the investor.s chosen currency,

changes in rates of exchange may have an adverse

effect on the value, price or income of or from that

investment to the investor. The information contained

in Factual Reports does not constitute advice on the

tax consequences of making any particular

investment decision. Before acting on any

recommendation in this material, you should consider

whether it is suitable for your particular

circumstances and, if necessary, seek professional

advice.

The subject company may have been provided with a

copy of the report, for factual verification only, prior to

the Factual Report's publication.

Page 9 of 11

Please read the Required Disclosures on the last page of this report. Redistribution is prohibited without written permission

Factual Stock Report | May 31, 2014

Sino Agro Food Inc (SIAF) BB

GICS Sector: Consumer Staples

Sub-Industry: Agricultural Products

For residents of Australia: Factual Reports are issued

and/or distributed in Australia by SPIS. Any express or

implied opinion contained in a Factual Report is

limited to "General Advice" and based solely on

consideration of the investment merits of the financial

product(s) alone. The information in a Factual Report

has not been prepared for use by retail investors and

has been prepared without taking account of any

particular investor's financial or investment

objectives, financial situation or needs. Before acting

on any advice, any investor using the advice should

consider its appropriateness having regard to their

own or their clients' objectives, financial situation and

needs. Investors should obtain a Product Disclosure

Statement relating to the product and consider the

statement before making any decision or

recommendation about whether to acquire the

product. Each opinion must be weighed solely as one

factor in any investment decision made by or on

behalf of any adviser and any such adviser must

accordingly make their own assessment taking into

account an individual's particular circumstances.

SPIS holds an Australian Financial Services License

Number 258896. Please refer to the SPIS Financial

Services Guide for more information at

http://advisor.marketscope.com/static/

FinancialServicesGuide.pdf

More information about the written criteria and

methodologies for the generation of Factual Reports

and historical information for Factual Reports for the

past 12 months are available by contacting S&P

Capital IQ Client Services Department at

61-1300-792-553

or

via

e-mail

at

spsupportcenter@standardandpoors.com.

For residents of Bermuda: The Bermuda Monetary

Authority or the Registrar of Companies in Bermuda

has not approved the Factual Reports and any

representation, explicit or implicit, is prohibited.

For residents of British Virgin Islands: All products

and services offered by S&P Capital IQ and its

affiliates are provided or performed, outside of the

British Virgin Islands. The intended recipients of the

Factual Reports are (i) persons who are not members

of the public for the purposes of the Securities and

Investment Business Act, 2010 ("SIBA"); (ii) persons

who are professional services providers to the British

Virgin Islands business companies for the purposes of

SIBA; and (iii) any other person who is given the

Factual Reports by a person licensed as an

investment advisor in the British Virgin Islands. If you

are in any doubt as to whether you are the intended

recipient of this document, please consult your

licensed investment advisor.

For residents of Canada: Canadian investors should

be aware that any specific securities discussed in a

Factual Report can only be purchased in Canada

through a Canadian registered dealer and, if such

securities are not available in the secondary market,

they can only be purchased by eligible private

placement purchasers on a basis that is exempt from

the prospectus requirements of Canadian securities

law and will be subject to resale restrictions.

Information in Factual Reports may not be suitable or

appropriate for Canadian investors.

For residents of Chile: S&P Capital IQ is not acting as

Summary: SIAF is an agriculture and aquaculture technology company with a business model involving the

developing, producing, distribution of agriculture and aquaculture produce and products in China.

an intermediary of securities referred to in a Factual

past 12 months are available by contacting S&P

Report. S&P Capital IQ is not registered with, and

Capital IQ Client Services Department at (212)

such securities may not be registered in the

438-4510

or

via

e-mail

at

Securities

Registry

maintained

by

the

spsupportcenter@standardandpoors.com.

Superintendencia de Valores y Seguros de Chile

For residents of Guernsey, Isle of Man and Jersey:

(Chilean Securities and Insurance Superintendence or

The Factual Reports provide by S&P Capital IQ serve

"SVS") pursuant to the Chilean Securities Market Law

to assist the Intermediary in determining the advice it

18045. Accordingly, investment research presented in

provides to its clients, but are not intended as advice

a Factual Report is not intended to constitute a public

to any of the Intermediary's clients and the

or private offer of securities in Chile within the

intermediary, and not S&P Capital IQ, will be solely

meaning of Article 4 of the Chilean Securities Market

responsible for the provision of investment advice to

Law 18045, as amended and restated, and

the client.

supplemental rules enacted thereunder.

For residents of China: S&P Capital IQ's Factual

Reports are not distributed in or directed to residents

in The People's Republic of China. Neither S&P