Hinds & Pope - Valuation of Golf Courses

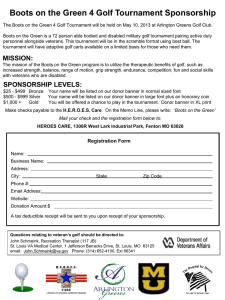

advertisement

North Carolina Department of Revenue ADVANCED PERSONAL PROPERTY SEMINAR Joseph S. Koury Convention Center Sheraton Greensboro Hotel at Four Seasons Mall Greensboro, North Carolina September 26, 2013 9:00 pm – 9:50 pm Valuation of Golf Properties Andy Hinds, MAI, SGA® * David Pope, MAI, SRA, SGA® Hotel and Club Associates, Inc. ahinds@hotelandclub.com dpope@hotelandclub.com 336-379-1400 * Member of the Appraisal Institute, Society of Golf Appraisers I. Cost Approach Seldom Used by Buyers/Sellers/Brokers Courses typically built to add value to surrounding real estate – amenity Limitations Land Valuation Subjective Clubs sell at a fraction of replacement costs Hard to measure external obsolescence Land Value According to the Dictionary of Real Estate Appraisal, Consistent Use is defined as “The concept that land cannot be valued on the basis of one use while the improvements are valued on the basis of another.” Land Value Continued Challenges Value based on consistent use – lack of golf land comparables Golf not same as residential use Golf land more akin to open space Residential developers sometimes give land to golf course developers Depreciation Physical Depreciation Greens; Tees; Irrigation Cart Paths 15 – 30 year life 15-20 year life 10-15 year life 5-30 year life External Obsolescence Significant levels obsolescence in current market How to measure II. Income Approach 1. Uniform System of Financial Reporting for Clubs 1 An example of the Uniform System of Financial Reporting for Clubs for a hypothetical public golf facility is shown next. 1. Uniform System of Financial Reporting for Clubs, Sixth Revised edition Club Managers Association of America, Inc. www.cmaa.org Uniform System Example $ Amount % of Total $600,000 $240,000 $30,000 $180,000 $120,000 $30,000 $1,200,000 50.0% 20.0% 2.5% 15.0% 10.0% 2.5% 100.0% $20.00 $8.00 $1.00 $6.00 $4.00 $1.00 $40.00 DEPARTMENTAL COSTS & EXPENSES: Golf Course Maintenance Golf Carts Range Food & Beverage Pro Shop Other Total Departmental Costs & Expenses: $300,000 $60,000 $20,000 $144,000 $150,000 $26,000 $700,000 50.0% 25.0% 66.7% 80.0% 125.0% 86.7% 58.3% $10.00 $2.00 $0.67 $4.80 $5.00 $0.87 $23.33 UNDISTRIBUTED EXPENSES: Administrative & General Management Fees Marketing & Entertainment Professional Fees Utilities Clubhouse Repairs & Maintenance Total Undistributed Expenses: $120,000 $40,000 $20,000 $6,000 $30,000 $20,000 $236,000 10.0% 3.3% 1.7% 0.5% 2.5% 1.7% 19.7% $4.00 $1.33 $0.67 $0.20 $1.00 $0.67 $7.87 REVENUE BEFORE FIXED CHARGES: $264,000 22.0% $8.80 FIXED CHARGES: Real & Personal Property Taxes Property Insurance Reserves for Replacement Total Fixed Charges: $30,000 $18,000 $24,000 $72,000 2.5% 1.5% 2.0% 6.0% $1.00 $0.60 $0.80 $2.40 TOTAL COSTS & EXPENSES: $1,008,000 84.0% $33.60 NET OPERATING REVENUE: $192,000 16.0% $6.40 REVENUES: Public Greens Fees & Annual Fees Golf Cart Fees Range Fees Food & Beverage Pro Shop Other Total Revenue: $ Per Round 2. Capitalization Sources of overall golf capitalization rates: Actual Golf Sales from: buyers & sellers, brokers, appraisers Society of Golf Appraisers www.golfappraisers.org Realty Rates www.realtyrates.com III. Sales Comparison Approach 1. Sources of Data a) Public Records b) Articles c) Appraisers and Brokers CB Richard Ellis www.cbre.com Hilda Allen www.hilda-allen.com Marcus & Millichap www.marcusmillichap.com Hodges Ward Elliott www.hwehotels.com Coldwell Banker Commercial www.kbgolfcoursesales.com d) Golf Pros, Managers and Owners e) Publications Golf Inc. www.golfincmagazine.com Golf Business Magazine www.golfbusiness.com 2. Units of Comparison a) GRM – Gross Revenue Multiplier or NIM – Net Income Multiplier b) Price per Hole c) Price Per Round, Price Per Acre or Price Per Member GOLF SALE NAME: LOCATION: DATE OF SALE: GRANTOR: GRANTEE: DEED BOOK / PAGE: DESCRIPTION Type of Facility: Acres: Holes: Yards: Golf Course: Clubhouse: Other Buildings: Amenities: Equipment: Golf Carts: Sample Golf Course Anytown, NC January 1, 2011 Sample Golf, Inc. Sample Golf, LLC 2000 / 100 Semi-Private 150 18 7,000 The course opened in 1990 and was designed by Andy Hinds. It features a mixture of flat terrain with rolling hills and wooded areas. Fairways are generous, just a few are treelined. Greens are medium in size with undulations. Four tee boxes per hole. Water hazards come into play on nine holes. 3,000 SF, one-story building constructed in 2000 6,000 SF metal golf maintenance building built in 2000 and 4,000 SF metal golf cart storage building built in 2000 Putting green, chipping area, restaurant, full bar All golf maintenance equipment included 72 leased electric carts included SALES PRICE: Terms: Price Per Acre: Price Per Hole: Price Per Yard: Price Per Round: $1,920,000 Cash to Seller $8,000 $66,667 $171 $40 ECONOMIC INDICATORS Gross Income: Operating Expenses: Net Operating Income: Gross Income Multiplier (GIM): Overall Cap Rate (OAR): Actual (show either Actual or Buyer’s Pro Forma or both) $1,200,000 $1,008,000 (84.0%) $192,000 1.60 10.0% OPERATING DATA Rounds of Golf: 30,000 COMMENTS: The course was owned by a local family and acquired by a regional golf management company. The market period was about 12 months. Allocation Total Going Concern Value/Price Must Allocate Business Personal Property Intangible Business Enterprise Real Property