Innovative Financing and Partnerships for Water Initiatives

advertisement

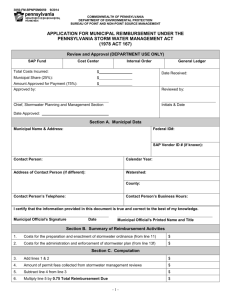

1 A Green Thumb for the Invisible Hand Green Infrastructure and Beyond 2 Who Are We? Founder and Partner of EKO Asset Management Merchant Bank for Ecosystem Services We invest in people, projects, and companies in this space Backed by investors such as Wolfensohn and Co., David Blood, Rothschild Family, etc. Match patient capital to people, projects, and expertise on the ground Flexible in investment approach 3 Who are we Really? 4 Where are We? 5 The Man-made Planet 6 Two Systemic flaws First we don’t value nature... We neither see nor pay for the services it provides It doesn’t show up on anyone’s books Secondly, we don’t learn from nature... We don’t see it as technology to be emulated... and valued Bio-mimicry to a new level 7 “Irrigation of the land with seawater desalinated by... ... fusion power is ancient. It's called rain”. Michael McClary Natural Infrastructure • Why does Infrastructure always have to be man-made? • Nature provides infrastructure solutions: • Flood control • Pollination • Clean air • Clean water • Stormwater management • Cities and businesses are beginning to realize that these “natural infrastructure” solutions are better, cheaper, more efficient • Can we invest in “natural infrastructure” the way we invest in “grey infrastructure”? 8 9 Grey vs. Green Infrastructure 10 The Stormwater Opportunity Stormwater runoff generates 10 trillion gallons of untreated, polluted water each year Federal “Clean Water Needs Survey” has identified over $100 billion of infrastructure investment needed over the next twenty years to address stormwater and sewage overflows Decline in traditional funding sources for municipal stormwater improvements (municipal budgets and federal funds) Traditional “gray” infrastructure has proven environmentally and economically costly, integration of green infrastructure (GI) can help: Reduce the costs of clean water compliance Improve urban quality of life Create green job growth Encourage economic revitalization 11 Philadelphia’s Answer Over the next 25 years, Philly is committed to deploying the most comprehensive network of green infrastructure found in any U.S. city. Plan is unique among US cities because it: Invests more in green infrastructure than in traditional (“gray”) infrastructure At least $1.67 billion -- potentially up to $2 billion – for greened acres. Relies on green infrastructure for a majority of the required reductions in sewage overflows. Leverages investments from the private sector to help satisfy pollution reduction requirements Substantial portion of greened acres will come from redevelopment projects, which must meet local stormwater performance standards. Plan dovetails with various programs that incentivize private property owners to retrofit existing development – including stormwater fees and credits. 12 Green Infrastructure: From this.. 13 Green Infrastructure: To this... 14 Green Infrastructure: From this.. 15 Green Infrastructure: To this... 16 Green Infrastructure: From this.. 17 Green Infrastructure: To this... 18 Green Infrastructure: From this.. 19 Green Infrastructure: To this... 20 So How do you Fund it? 21 Financial Challenges Most commercial owners will seek third-party financing for retrofits due to longer payback periods (~10 years) Similar challenges to financing as energy efficiency sector Lack of collateral, existing mortgages on property, unproven track record of project performance Early investment will likely require some combination of the following: Long term stormwater fee structure and discount longevity assurance Utilization of existing revenue collection streams - property taxes and utility bills Given performance uncertainty: some form of credit enhancement to insulate early investors from potential losses 22 Pay-for-Performance • Reaps most cost-effective GI investment opportunities city-wide, across full range of land types, and facilitates project aggregation on city-scale • Example: Government entity contracts to make a regular payment to a private or nonprofit entity which, under the terms of the PfP contract, will deliver and manage a specified number of greened acres for a fixed period. • Benefits: • Lower the costs of construction and maintenance • Accelerates project implementation (aggregators can bundle projects, not rely on individual owners’ decisions to retrofit) • Access new sources of investment capital • Preserve municipal balance sheet capacity • Incentivize optimal performance by shifting performance risk to private partners where payments are tied directly to performance. 23 Galileo Galilei “What greater stupidity can be imagined than calling jewels, silver, and gold ‘precious’ and earth and soil ‘base’? People who do this ought to remember that if there were a greater scarcity of soil as of jewels or precious metals, there would not be a prince who would not spend a bushel of diamonds... to have enough soil to plant a jasmine in a little pot, or to sow an orange seed and watch it sprout, grow and produce its handsome leaves, it fragrant flowers, its fine fruit.” 24 “In theory there is no difference between theory and practice. ... In practice there is.” Yogi Berra