Cap-and-Trade - A New Story Foundation

advertisement

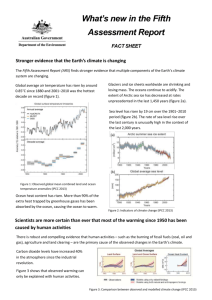

CAP AND TRADE Investing in a Parachute Daniel Reader Dept. of Geography & Geology September 13, 2010 CLIMATE CHANGE Natural flux due to many causes Anthropogenic contribution THE GREENHOUSE EFFECT GREENHOUSE GASES CARBON DIOXIDE AND FOSSIL FUELS Petroleum (gasoline, diesel, etc.) Natural Gas CO2 + H2O Coal CO2 CO2 + H20 THE INTERGOVERNMENTAL PANEL ON CLIMATE CHANGE (IPCC) Increased risk of more frequent, longer-lasting heat waves THE INTERGOVERNMENTAL PANEL ON CLIMATE CHANGE (IPCC) Increased summer dryness (drought) THE INTERGOVERNMENTAL PANEL ON CLIMATE CHANGE (IPCC) Increased winter wetness (flooding) IPCC RECOMMENDATIONS 1) Get ready – the climate is changing now, and is expected to get worse. 2) Mitigation options include a “large shift in the pattern of investment in energy plants and other infrastructure.” 3) “In order to respect equity, the emissions of developed countries must decrease by between 25 and 40% between now and 2020, and between 80 and 95% between now and 2050, compared to the level in 1990.” IPCC RECOMMENDATIONS “Policies that provide a real or implicit price of carbon could create incentives for producers and consumers to significantly invest in low-GHG products, technologies, and processes.” CAP AND TAX Set limits per producer on carbon emissions Production exceeding established limits subject to taxation Establishes a negative incentive to produce carbon emissions Prompts greater efficiency, lower production, or both Favored by environmentalists, but few others Politically inexpedient, and an enforcement nightmare CREATING A CARBON MARKET Limit carbon emissions to create a fixed supply. Provide a means to acquire units of permissible carbon emissions, enabling the expression of demand. Competitive demand for a fixed supply will create a market for carbon emissions permits. CAP AND AUCTION “Free Market” approach to carbon capping Carbon emission permits are put to auction in lots and then bid upon Results in the wealthiest entities amassing a disproportionate share of emissions permits May result in necessary services (such as mining) becoming subsidized or exempted as they fail to compete effectively CAP AND TRADE Issue a fixed number of permits to carbon producers based upon past performance. Those producers that become more efficient produce less carbon than they have permits for, resulting in a surplus. Those producers that require additional carbon capacity may then purchase or trade for permits from those with a surplus. Considered to be the “least of evils” by most THE REINSURANCE INDUSTRY Insurance underwriters Some of the largest corporate entities in the world Vested interest in objective risk assessment MUNICH RE ON CLIMATE CHANGE “Climate Change is one of the greatest risks facing mankind.” “The figures speak for themselves… Weather related natural catastrophes have produced US$ 1,600bn in total losses since 1980, and climate change is definitely a significant contributing factor. We assume that the annual loss amount attributable to climate change is already in the low double-digit Euro range. And the figure is bound to rise dramatically in the future.” SWISS RE ON CLIMATE CHANGE “Climate is warming at a rate which cannot be explained with natural factors alone.” “We'd be out of our minds if we wrote weather insurance on the opinion global warming would have no effect at all.” - Warren Buffett 2006 annual Shareholder meeting SWISS RE ON CLIMATE CHANGE THE COST OF DOING NOTHING Simple cost-benefit analysis rejects inaction. Failure to respond immediately with some method of curtailing carbon emissions will result in untold losses for the foreseeable future. The most reasonable FIRST STEP in reducing carbon emissions is to establish an upper limit at some level substantially lower than current output. We must be able to step carbon production down, preferably at a rate which the economy can withstand - but it must be done. WAIT, THERE’S MORE.. HUBBERT PEAK OPEC INTERVENTION A NATURAL CAP ON CARBON Crude oil and natural gas production are now peaking globally GLOBAL PEAK COAL PRODUCTION IN 2011 COAL, COUNTRY BY COUNTRY PEAK CARBON EMISSIONS Peak Coal projections beat 36 of 40 IPCC projections for carbon emissions The worst case scenarios for climate change are unlikely Beginning in the next few years, rates of carbon emissions should peak, and go down thereafter CAP AND WHATEVER NO TIME LIKE THE PRESENT We have, at most, a few years to fully implement whatever fossil fuels policy we decide upon The price is exorbitantly high; yet the cost of inaction is higher still The longer we wait, the faster the price increases Now is not a good time to do this…yet there will never be a good time The question becomes not one of carbon emissions, but instead how much plateau to invest in INVESTING IN A PARACHUTE An economy in forced decline due to resource shortfalls is non-negotiable We can choose to invest in a brief plateau to retool for a managed decline The plane is on fire. We can ride it out until we crash. Or instead, we can invest in a parachute to jump to a mountaintop from which we can hike down. The choice is ours, but we need to decide immediately. FURTHER INFORMATION For information on any of the material in this presentation, please contact me at daniel.reader@wku.edu

![Difficulties and Solutions of Emissions Trading in China [Author] Shi](http://s3.studylib.net/store/data/007029352_1-0bf411fb9d6a7c4e3c3e21f6b6535ac9-300x300.png)