Click here for Lynn`s presentation.

advertisement

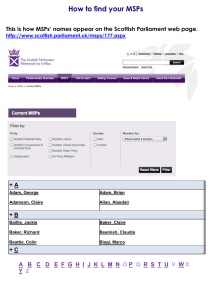

Recruitment International Audit and Compliance Pay When Paid Contracts Lynn Mildner – Towergate Credit 5th March 2013 Pay when Paid Contracts Introduction Acronyms - Terminology • • • • What are “pay when paid contracts”? Why are they an issue? Steps forward? Pitfalls The Acronyms GPS – Government Procurement Service RPO’s – Recruitment Process Outsourcing companies MSPs – Managed Service Providers APSCo –Association of Professional Staffing Companies ABFA – Asset Based Finance Association ABL – Asset backed lender What Are Pay When Paid Contracts? Used by RPO’s , MSPs or “master vendors” Agency supplying staff will not be paid until a third party has paid them • • • • Often “in full” No end stop date No contractual relationship with third party No protection against third party insolvency Why does this matter? • • • • Staff are paid with no income from contract Often no impetus to speed up payment from end client Funding - Invoice discounters/Factors Credit Insurers contractual principal/risk CASHFLOW The Construction Industry Latham report and 1996 Housing Grants and Construction and Regeneration Act • Assumed to have outlawed pay when paid, • Gives legalised framework - applied when third party insolvent • No model for reform of recruitment industry • Not reliant on cash flow funding Progress– Apsco Code - Summer 2012 • Pay, or allow contact with third party by given date • Most ROPs and MSPs sign up to new code • GPS committed to eradicating pay when paid contracts between agencies • ABLs cautiously continue funding agencies BUT............ Beware the re-factoring date....... Pitfalls Refactoring - c.123 days outstanding - deducted from new funding Credit Insurance – principal/overdue reporting/claim failure Funder £2200 Double funding – the ABL dilemma. Agency£1000 RPO £1200 Future Trends? Self Bill – the back door to pay when paid? • Bill when third party pays • Credit Insurance – Self Bill endorsements specify “bill by” • Contracts - Dates must be reflect credit insurance/ funder agreement Invoicing period Credit period Further Information Lynn Mildner – 07769880445 Business Manager Towergate Insurance - Credit 77 Leadenhall Street, London EC3A 3DE