RFOA HLOS Presentation 270312 - Freight Transport Association

advertisement

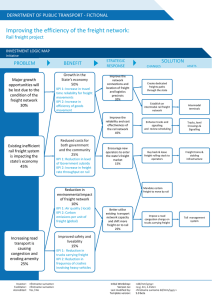

Rail Freight Operators’ Association “The collective voice of rail freight operators” Rail Freight - strategically important to Scotland Plays a vital role in supporting economic connectivity and Scottish business with the rest of the UK and the world. 10 trains a day move between the Central Belt and the West Midlands moving everyday goods for retailers in both directions Providing a gateway to the world for Scottish exports, notably whisky and other drinks moving in deep-sea containers to Felixstowe, Southampton, Tilbury, Liverpool and the Humber Ports Moving Scottish mined coal to English power stations and supplying coal to Longannet and Cockenzie power stations to generate electricity The Freight Market - A Competitive Sector Rail operators compete directly with each other, road and ship Competition helps drives efficient behaviour. The Rail Value for Money study (McNulty) concluded that rail freight operators had achieved: A 32 per cent improvement in staff productivity since 1998/99 48% growth with half the locomotives and two thirds of the wagons employed in the mid-1990s In the future, more flexibility & efficiency is needed to keep up with competing modes and drive further modal shift: Longer&/or heavier trains Operating more days of the week Simple, national access and planning regimes Key rail freight markets in Scotland Deep sea intermodal (both imports and exports) Domestic intermodal Coal (Anglo-Scottish and wholly Scottish flows) Petroleum products Chemicals Cement Waste Nuclear Pipes Automotive products Metals Mail Timber Coal currently accounts for 76% of movements Intermodal has been the fastest growing sector with 37% growth in container tonnes by rail to/from/within Scotland since 2004 UK Growth Since 1994/95 UK rail freight has grown by 48% - to 19.23 billion tonne km Coal for electricity generation has declined – although rising gas prices has increased volumes in the last year Intermodal has become the largest sector in the market and has grown by 61% since 2003/4 whilst road movements have reduced by 14% Investment in the Strategic Freight Network in England has enabled growth and increased modal share by rail: Gauge clearance from major ports Enabling longer trains Growth in Scotland 16,000,000 15,000,000 14,000,000 MDS Transmodal revised forecast freight tonnage to Scotland for 2010-2030 (based on agreed industry forecast but updated to take into account recessionary impacts) 13,000,000 12,000,000 11,000,000 10,000,000 9,000,000 8,000,000 7,000,000 2011 2013 2015 2017 2019 2021 2023 2025 2027 2029 Scottish Parliament announced January 2012 objective to increase exports by 50% by 2017 Considerable continued growth in Intermodal sector Coal decline but potential for biomass and extension to coal usage through fitment of carbon capture storage (CCS) at power stations 2010-2030 forecast growth: 604% growth in Domestic Intermodal 877% growth in Waste (for energy) and Biomass forecast Strategic Freight Network “a core network of trunk freight routes, capable of accommodating more and longer freight trains, with a selective ability to handle wagons with higher axle loads and greater loading gauge, integrated with and complementing the UK’s existing mixed traffic network.” In CP4 the Strategic Freight Network has been funded in England and Wales only CP4 interventions were mainly gauge clearance projects. These have unlocked immediate growth – gauge clearance from Southampton increased rail modal share from 30 to 35% Key projects have been on time and under budget partly due to innovation – e.g. Southampton tunnel The principles behind the Strategic Freight Network are designed to support value for money initiatives: Maximising train lengths to minimise the paths needed and increase rolling stock utilisation Flexible use of capacity continue current practice of minimising operations during periods of peak passenger operation around major conurbations Extended hours of operation to enable more services per week - increasing use of both capacity and resources Proposed CP5 Strategic Freight Network Fund for Scotland In CP5 Network Rail and RFOA propose a £50 million Strategic Freight Network fund in Scotland to support: Economic growth Modal shift to rail Environmental benefit/reduce road congestion One intermodal train removes on average 50 equivalent lorry journeys. Scotland’s economy and sustainability targets to increase modal shift to rail Key enablers to achieve this include Improving freight access and capacity on the core Anglo – Scottish corridors (ECML/WCML) Provide improved capacity and connectivity to locations north of the Central Belt such as Aberdeen and Inverness that could generate further growth. Scottish Freight Aspirations for CP5 Gauge Clearance W10 ECML Berwick to Carstairs Grangemouth Dundee – Aberdeen – Inverness – Elgin Glasgow and South Western Capacity Enhancement Mossend Area: Accommodation of 775m trains for intermodal traffic using Central Scotland terminals (allowing more efficient utilisation of network capacity) Freight Capacity WCML/ECML: Interventions required to accommodate forecast future Anglo-Scottish freight growth Freight Capacity Central Belt – Inverness/Aberdeen: Interventions required to accommodate future growth and improve access to the rail network for business in the North of Scotland Infill Electrification: Grangemouth Edinburgh Suburban Shotts Line Justifying the Investment case for CP5 Investment in the network infrastructure is needed to achieve the forecast growth and modal shift to support economic growth CP4 Strategic Freight Network funding in England and Wales has delivered high Value for Money schemes, (business case for West Midlands – Doncaster has a BCR of 7.7:1). Strategic Freight Network bid for £350m of funding for England and Wales with 2 projects already confirmed in the Autumn Statement to align with Scotland fund Strategic Freight Network CP4 governance structure is being treated as best practice and likely to be rolled out to other “funds” in CP5 A specific ring fenced freight fund for Scotland will enable: Synergies with Strategic Freight Network Fund in England and Wales to enhance a national network Assessment of CP5 freight proposals so the highest value for money schemes can be prioritised Focus on freight (in a passenger dominated network) Wider impacts of Periodic Review The Office of Rail Regulation is also reviewing access charges and incentive regimes for 2014-2019 Policy alignment is needed to support modal shift to rail Retaining access charges at existing level is vital to continue to compete with road Opportunity to increase intermodal movements by rail further and faster if access charges reduced Concern over impact to Scottish open-cast collieries of proposed increase in coal access charges Opportunity for different approach by Transport Scotland Network Rail must be incentivised to improve 7 day access enable a reliable offering Operators and Network Rail should be incentivised to work together to reduce each other’s costs