AE/ME Wind Engineering Lecture #2

advertisement

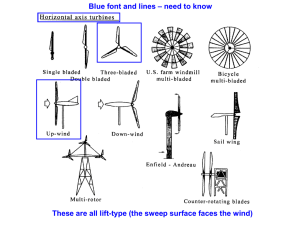

AE/ME Wind Engineering Module 1.2 Lakshmi Sankar lsankar@ae.gatech.edu OVERVIEW • In the previous module 1.1, you leaned about the course objectives, topics to be covered, and the deliverables (assignments) • In this module, we will first review the history of the wind turbines • We will also learn some basic terminology associated with wind turbines • We will also discuss what factors go into choosing sites where you may build/deploy your own wind turbines or farms. – We will conduct this discussion through case studies. History of Wind Turbines http://www1.eere.energy.gov/windandhydro/wind_history.html • Technology is old, in some respects! – Wind was used to propel sail boats as early as 5000 BC in Egypt. – Chinese used wind energy to pump water by as early as 200 BC – Persians used wind energy about the same time to grid grain • By the 11th century, people in the middle east were using wind mills for food production • Traders and crusaders carried the ideas to Europe. History of Wind Turbines (Continued..) • Dutch were looking for ways of draining lakes and marshes. – Wind turbines became very popular. • The technology spread to US when settler brought these ideas to America. • Industrialization (use of coal to generate steam) brought a decline in the use of wind energy. • Steam engines replaced wind mills for pumping water and producing electricity. • Rural electrification began in the 1930s. • Wind turbines had to make their case economically! – Their popularity rose and fell with the availability and cost of alternative forms of energy production. – Oil crisis in the 1970s and energy crisis during the past decade has brought wind energy’s potential as a clean, renewable, sustainable, energy source, Wind Power's Beginnings (1000 B.C. - 1300 A.D.) • Persians used the drag of the blades (i.e. aerodynamic force along the direction of the wind) to generate rotation of the blades. • Struts connected the sails to central shaft. – Grinding stone was attached to the central shaft. • Only one half of the turbine was useful at any instance in time. Early Designs http://www.telosnet.com/wind/early.html Lift vs Drag • The aerodynamic force along the direction of the wind is called drag – Early wind turbines used drag to generate the torque. • The aerodynamic force normal to the wind direction is called lift. – For a properly designed blade (or airfoil) lfit to drag ratio may be 100 to 1! • Dutch began using lift force rather than drag to turn the rotor. • Over the past 500 years, the design has evolved through analysis and experimentation. Use of Drag to Produce Torque Pelton Wheel uses this concept Wind Drag Force Use of Lift forces for Torque Production L D Lsinf Wr f Dcosf Vwind - Vinduced Propulsive force = Lsinf - Dcosf V induced V L wind D Ωr Wind Turbine History in the US • During the 19th century wind mills were used to pump water. – – • Eray designs used wood as the material and had a paddle like shapes. – • – • Drag force was used. Later designs used steal blades which could be shaped to produce lift forces. – • Rotor diameter reached 20 meters. Water was used to operate steam engines, The blades spun fast, requiring gears to reduce the angular velocity. Mechanisms were developed for folding blades in case of high winds. In 1888, electricity was produced using the wind turbine shown on the lower right by Charles F. Brush. By 1910s, coal and oil fired steam plants became popular, and the use of wind turbines became less common. Installed Wind Power Generation (in MW) http://www.windenergyinstitute.com/installed.html Rank County 2005 2006 2007 1 Germany 18,415 20,622 22,247 2 United States 9,149 11,603 16,818 3 Spain 10,028 11,615 15,145 4 India 4,430 6,270 8,000 5 China 1,260 2,604 6,050 6 Denmark (& Faeroe Islands) 3,136 3,140 3,129 7 Italy 1,718 2,123 2,726 8 France 757 1,567 2,454 9 United Kingdom 1,332 1,963 2,389 10 Portugal 1,022 1,716 2,150 11 Canada 683 1,459 1,856 12 Netherlands 1,219 1,560 1,747 Basic Terminology • Vertical Axis (or Darrieus) Wind Turbines vs. Horizontal Axis Wind Turbines – We will study HAWTs in this course. Terminology (Continued) http://www.energybible.com/wind_energy/glossary.html • Availability Factor – The percentage of time that a wind turbine is able to operate and is not out commission due to maintenance or repairs. • Capacity Factor – A measure of the productivity of a wind turbine, calculated by the amount of power that a wind turbine produces over a set period of time, divided by the amount of power that would have been produced if the turbine had been running at full capacity during that same time interval. Terminology (Continued) • Rotor – Comprises the spinning parts of a wind turbine, including the turbine blades and the hub. • Hub – The central part of the wind turbine, which supports the turbine blades on the outside and connects to the low-speed rotor shaft inside the nacelle. • Root Cutout – The percentage of the rotor blade radius that is cut out in the middle of the rotor disk to make room for the hub and the arms that attach the blades to the shaft. • Nacelle – The structure at the top of the wind turbine tower just behind (or in some cases, in front of) the wind turbine blades that houses the key components of the wind turbine, including the rotor shaft, gearbox, and generator. Parts of a Wind Turbine • Turbine controller is connected to the rotor. • Converter controller, connected to converters and main circuit breaker, is needed to control the output voltage and power Wind Power Classification http://www.awea.org/faq/basicwr.html Wind Power Class Wind Speed m/sec (mph) Power density W/m^2 at 50 m Wind Speed height m/sec (mph) 1 <100 <4.4 (9.8) <200 2 100 - 150 4.4 (9.8)/5.1 (11.5) 5.6 (12.5)/6.4 200 - 300 (14.3) 5.1 (11.5)/5.6 (12.5) 6.4 (14.3)/7.0 300 - 400 (15.7) 5.6 (12.5)/6.0 (13.4) 7.0 (15.7)/7.5 400 - 500 (16.8) 5 250 - 300 6.0 (13.4)/6.4 (14.3) 7.5 (16.8)/8.0 500 - 600 (17.9) 6 300 - 400 6.4 (14.3)/7.0 (15.7) 8.0 (17.9)/8.8 600 - 800 (19.7) 7 >400 >7.0 (15.7) >800 Power density W/m^2 at 0 m height 3 150 - 200 4 200 - 250 <5.6 (12.5) >8.8 (19.7) The following slides are from a Presentation in 2002 by American Wind Energy Association Wind Power is Ready Clean Energy Technology for Our Economy and Environment American Wind Energy Association, 2002 Image courtesy of NEG Micon Wind Power Market Overview Ancient Resource Meets Century Technology st 21 Wind Turbines: Power for a House or City Ready to Become a Significant Power Source coal coal petroleum petroleum natural gas natural gas nuclear nuclear hydro hydro other renewables other renewables wind wind Wind currently produces less than 1% of the nation’s power. Source: Energy Information Agency Wind could generate 6% of nation’s electricity by 2020. Wind is Growing Worldwide United States 5000 00 20 97 19 94 19 91 19 88 0 19 5. India: 1507 MW Europe 10000 85 4. Denmark: 2492 MW Rest of World 15000 19 3. Spain: 3195 MW 20000 82 2. U.S.: 4260 MW 25000 19 1. Germany: 8754 MW Source: AWEA’s Global Market Report Wind Taking Off in the U.S. • • • • U.S. installed nearly 1,700 MW in 2001 Wind power capacity grew by 66% Over 4,265 MW now installed Expecting over 2,500 of new capacity in 2002-2003 combined Source: AWEA’s U.S. Projects Database United States Wind Power Capacity (MW) Washington 180.2 Montana 0.1 Oregon 156.9 Wyoming 140.6 North Dakota 1.3 South Dakota 2.9 Nebraska 3.5 Utah 0.2 Colorado 61.2 Minnesota 322.7 Michigan 2.4 Massachusetts 1.0 New York 48.2 Iowa 324.3 Pennsylvania 34.5 Tennessee 2.0 New Mexico 1.3 Source: AWEA’s U.S. Projects Database Texas 1,095.5 Alaska 0.9 Hawaii 1.6 Maine 0.1 Vermont 6.0 Wisconsin 53.0 Kansas 113.7 California 1,715.9 New Hampshire 0.1 4,270 MW as of 07/31/02 Washington 180 Wisconsin 30 New York Minnesota 30 218 Oregon 132 Main Areas of Growth in 2001 Iowa 82 Pennsylvania 24 Kansas 112 1,697 MW added in 2001 Texas 915 Source: AWEA’s U.S. Projects Database U.S. Wind Power Capacity Growth *Source: AWEA’s U.S. Projects Database Wind Power Economics Cost Nosedive Driving Wind’s Success 38 cents/kWh $0.40 $0.30 $0.20 2.5-3.5 cents/kWh $0.10 $0.00 1980 1984 1988 1991 1995 2000 2005 Levelized cost at excellent wind sites in nominal dollars, not including tax credit Wind Power Cost of Energy Components Cost (¢/kWh) = (Capital Recovery Cost + O&M) / kWh/year – Capital Recovery = Debt and Equity Cost – O&M Cost = Turbine design, operating environment – kWh/year = Wind Resource Capital Costs • Revenue Streams – Commodity Power Sale: $30-$45/MWh – Production Tax Credit: $18/MWh – “Green Credit”: New Market, Values Vary • Debt/equity ratios close to 50%/50% – Increased debt/equity ratios can significantly increase return Long-Term Debt • Better loan terms with longer-term power purchase agreement (PPA) • Loan terms up to 22 years, determined largely by PPA Equity Considerations • Return requirements vary with risk – Perceived risk of wind projects may be larger than real risk • Returns evaluated after tax credit – Wind energy projects can expect return in low teens (10% to 15%) Turbine Technology Constantly Improving • • • • Larger turbines Specialized blade design Power electronics Computer modeling produces more efficient design • Manufacturing improvements How big is a 2.0 MW wind turbine? This picture shows a Vestas V-80 2.0-MW wind turbine superimposed on a Boeing 747 JUMBO JET Construction Cost Elements Financing & Legal Fees 3% Development Activity 4% Interconnect/ Subsation 4% Interest During Construction 4% Towers (tubular steel) 10% Construction 22% Design & Engineering 2% Land Transportation 2% Turbines, FOB USA 49% Technology Improvements Leads to Better Reliability 100 % Available • Drastic improvements since mid-80’s • Manufacturers report availability data of over 95% 80 60 40 20 0 1981 '83 '85 '90 '98 Year Improved Capacity Factor • Capacity Factors Above 35% at Good Wind Sites – Performance Improvements due to: – Better siting – Larger turbines/energy capture – Technology Advances – Higher reliability Examples: Project Performance (Year 2000) Big Spring, Texas •37% CF in first 9 months Springview, Nebraska •36% CF in first 9 months Bottom Line 20 Years of Wind Technology Development 1981 1985 1990 1996 1999 2000 Rotor (Meter) 10 17 27 40 50 71 KW 25 100 225 550 750 1650 $65 $165 $300 $580 $730 $1300 $2,600 $1,650 $1,333 $1,050 $950 $790 21% 25% 28% 31% 33% 39% MWh produced over 15 years 675 3300 8250 22,200 33,000 84,000 Amortized cost of turbine per unit of energy 9.6 5 3.6 2.6 2.2 1.5 Total Cost Cost/kw Capacity Factor Economy of scale reduces price per kw of capacity Technology improvements yield more energy bang for the buck Combined, they dramatically reduce turbine price per unit of energy produced Benefits of Wind Power Advantages of Wind Power • Environmental • Resource Diversity & Conservation • Cost Stability • Economic Development Benefits of Wind Power Environmental • • • • No air pollution No greenhouse gasses Does not pollute water with mercury No water needed for operations Electricity Production is Primary Source of Industrial Air Pollution Sulfur Dioxide 70% Carbon Dioxide 34% Nitrous Oxides 33% Particulate Matter 28% Toxic Heavy Metals 23% 0% 20% 40% 60% Percentage of U.S. Emissions Source: Northwest Foundation, 12/97 80% Benefits of Wind Power Economic Development • Expanding Wind Power development brings jobs to rural communities • Increased tax revenue • Purchase of goods & services Benefits of Wind Power Economic Development Case Study: Lake Benton, MN $2,000 per 750-kW turbine in revenue to farmers Up to 150 construction, 28 ongoing O&M jobs Added $700,000 to local tax base Benefits of Wind Power Fuel Diversity • Domestic energy source • Inexhaustible supply • Small, dispersed design reduces supply risk Benefits of Wind Power Cost Stability • Flat-rate pricing can offer hedge against fuel price volatility risk • Electricity is inflation-proof Wind Project Siting • Winds Siting a Wind Farm – Minimum class 4 desired for utility-scale wind farm (>7 m/s at hub height) • Transmission – Distance, voltage excess capacity • Permit approval – Land-use compatibility – Public acceptance – Visual, noise, and bird impacts are biggest concern • Land area – Economies of scale in construction – Number of landowners Power in the Wind (W/m2) = 1/2 x air density x swept rotor area x (wind speed)3 A V3 Density = P/(RxT) P - pressure (Pa) R - specific gas constant (287 J/kgK) T - air temperature (K) kg/m3 Area = r2 m2 Instantaneous Speed (not mean speed) m/s Perceived Market Barriers • Siting – Avian – Noise – Aesthetics • Intermittent Fuel Source Actual Market Barriers • Transmission constraints • Financing • Operational characteristics different from conventional fuel sources Wind Characteristics Relevant to Transmission System • • • • • Intermittent output Generally remote location Small project size Short/flexible development time Low capacity factor Wind Development Issues Transmission Grid Operating Rules • What wind wants: – – – – – Liquid, transparent spot market for imbalance settlements Near real time, flexible scheduling protocols Robust secondary markets in transmission rights (“flexible firm”) Postage stamp pricing allocated to load (or volumetric pricing) Statistical determination of conformance to load shape to set value • What wind gets: – System designed exclusively to transport firm, fixed blocks/commodity strips – Rigid advance scheduling protocols/onerous imbalance charges – License plate pricing allocated to incremental generation – Grid balkanization/rate pancaking Wind Development Issues Transmission Expansion • What wind wants: – Pro-active regional planning with political buy-in. – Programmatic expansion focused on shared goals. – Public infrastructure financing repaid through user fees. • What wind gets: – Reactive, piecemeal gridlock decoupled from political process. – Project specific expansion focused on immediate needs of existing players. – Uncertain capacity rights as sole rate recovery mechanism. Consequences of Wind Characteristics • Remote location and low capacity factor = higher transmission investment per unit output • Small project size and quick development time = planning mismatch with transmission investment • Intermittent output can = higher system operating costs if systems/protocols not designed properly Federal and State Policies to Promote Wind Power Production Tax Credit • Lowers price of electricity to make it more accessible to customers • Currently provides credit of 1.8¢ per kWh • Industry needs long-term extension to encourage investment Renewable Portfolio Standard • Requirement that U.S. suppliers get 10% of supply from renewable sources by 2020 • Texas example shows how RPS can enable green power markets to flourish by creating a supply of reasonably-priced renewable energy • Can create incentives to solve transmission issues Standard Market Design & Interconnection • Wind is “square peg in a round hole” – Intermittent – Site-specific, often rural – Small, with short construction lead time • SMD & Interconnection NOPRs designed to make markets more efficient, which could make a big difference in cost and availability of wind power Clean Air Act • Expect to see amendment to the Clean Air Act before 2004 elections • Without set-asides or direct allocation for renewables, would strip wind projects of ability to claim emissions reductions • Output based compliance that includes NOx, SO2 and CO2 could add revenue stream of 0.4 - 0.5 cents per kWh Small Turbine Incentives • 30% Investment Tax Credit • Net metering State Incentives • • • • State renewable portfolio standards Public Benefits Funds Electricity source disclosure Government procurement Green Power Market Green Power Market • Places a monetary value on environmental benefits • Raises visibility of renewable power & promotes customer awareness • Usually small scale, short-term contracts Premium prices Different Ways to Buy • Green Pricing – Regulated utility offers customers choice to support wind power construction • Green Marketing – In competitive market, customers empowered to choose service providers that contract to purchase renewables • Green Tags – environmental attributes divorced from energy Competitive Green Market • Has encouraged about 25 MW in CA & PA to date • Will encourage more than 75 MW in PA in next two years Green Pricing • Has encouraged over 15 new wind projects to serve green pricing market • Smaller projects • Spread throughout the U.S. – raises visibility of wind power Small Wind Turbine Market Development Programs for small wind development • Buy-down programs • Exemptions from sales, property tax • Standardized zoning requirements Buy-down programs • CA renewables fund refunds 50% of the cost of a renewable system – CA sales account for over half of the small wind turbine market • MA buy-down program refunds 10% capped at $100 – does not appreciably affect the market Property / Sales Tax • Property or sales tax exemption offered in several states • Programs to affect initial purchase price work best • Net metering programs (equalizing kWh costs paid and received by residential generators) do not seem to drive purchasing decisions Future Trends in Wind Power Expectiations for Future Growth • 2,500 MW new added by end of 2003 • 20,000 total installed by 2010 • 6% of electricity supply by 2020 = 100,000 MW of wind power installed by 2020 Wind Energy “U.S. Proven & Probable Reserves” Nameplate MW Region On-Line In Development Developable in Reserve @$2 natural gas West @$4 natural gas 2,254 2,750 35,000 200,000 900 500 400 350,000 90 330 500 7,000 Texas 1,016 300 --- 40,000 South 2 20 100 600 4,262 4,000 36,000 600,000 Midwest East Total Future Cost Reductions • Financing Strategies • Manufacturing Economy of Scale • Better Sites and “Tuning” Turbines for Site Conditions • Technology Improvements Future Technology Developments • Application Specific Turbines – Offshore – Limited land/resource areas – Transportation or construction limitations – Low wind resource – Cold climates ®Middelgruden.dk www.AWEA.org Windmail@awea.org American Wind Energy Association 122 C St, NW, Suite 380 Washington, DC 20001