ICBA Quick Reference Charts: Ability-to

advertisement

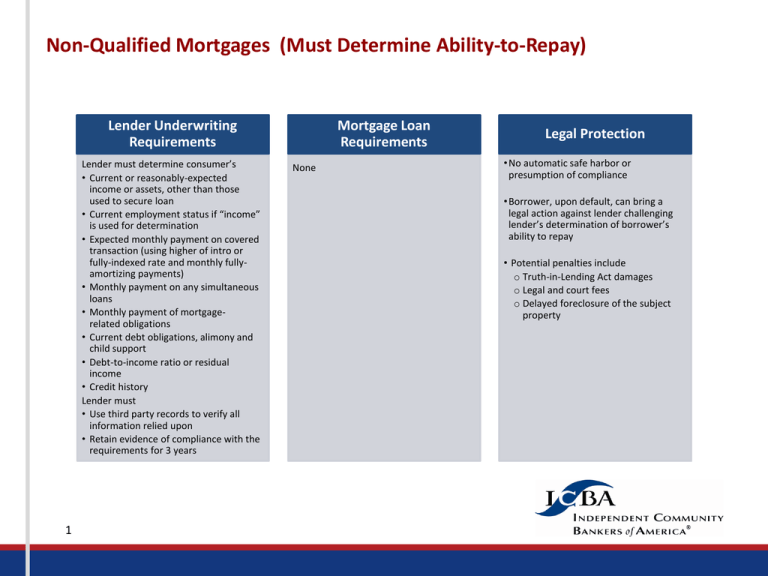

Non-Qualified Mortgages (Must Determine Ability-to-Repay) Lender Underwriting Requirements Lender must determine consumer’s • Current or reasonably-expected income or assets, other than those used to secure loan • Current employment status if “income” is used for determination • Expected monthly payment on covered transaction (using higher of intro or fully-indexed rate and monthly fullyamortizing payments) • Monthly payment on any simultaneous loans • Monthly payment of mortgagerelated obligations • Current debt obligations, alimony and child support • Debt-to-income ratio or residual income • Credit history Lender must • Use third party records to verify all information relied upon • Retain evidence of compliance with the requirements for 3 years 1 Mortgage Loan Requirements None Legal Protection • No automatic safe harbor or presumption of compliance • Borrower, upon default, can bring a legal action against lender challenging lender’s determination of borrower’s ability to repay • Potential penalties include o Truth-in-Lending Act damages o Legal and court fees o Delayed foreclosure of the subject property Qualified Mortgages (Ability-to-Repay Determination Not Required) 2 Lender Underwriting Requirements Mortgage Loan Requirements Lender must • Underwrite using maximum interest rate applicable during first 5 years of the loan, and payments that will repay loan within the loan term • Consider and verify consumer’s reasonably-expected income or assets, debt obligations, alimony, and child support • Confirm consumer’s debt-to-income ratio does not exceed 43 percent per requirements outlined in Appendix Q of the ATR rule or, insure loan satisfies a government sponsored enterprise /federal agency test, in which the loan is a QM if it is eligible for purchase or guarantee by Fannie Mae, Freddie Mac or another eligible federal government entity or program Mortgage loan must • Provide for regular, periodic, and equal payments that do not result in an increased principal balance, allow consumer to defer repayment of principal, or result in balloon payment loan (with some exceptions detailed on page 4) • Not exceed 30-year term • Not have points and fees exceeding 3 percent of the total loan amount for loans of $100,000 or more (the points and fees caps are higher for smaller loans) Legal Protection • Lenders receive Safe Harbor legal protection for loans with annual percentage rate (APR) less than 1.5 percentage points above average prime offer rate (APOR) • QM loans with higher APRs will only receive a legal Presumption of Compliance, which is a lesser legal protection for the lender Qualified Mortgage – Small Creditor Exception “Small creditor” defined as a creditor with less than $2 billion in assets and that originates no more than 500 first-lien, closed-end mortgages per year Lender Underwriting Requirements Lender must • Underwrite using maximum interest rate applicable during first 5 years of the loan, and payments that will repay the loan within the loan term • Consider and verify consumer’s reasonably-expected income or assets and debt-to-income ratio • Consider and verify the consumer’s debt obligations, alimony, and child support NOTE: 43 percent debt-to-income requirement per Appendix Q does NOT apply 3 Mortgage Loan Requirements Mortgage loan must • Provide for regular, periodic, and equal payments that do not result in an increased principle balance, allow consumer to defer repayment of principal or result in balloon payment loan (with some exceptions detailed on page 4) • Not exceed 30-year term • Not have points and fees exceeding 3 percent of the total loan amount for loans of $100,000 or more (the points and fees caps are higher for smaller loans) • Be held in portfolio for at least 3 years Legal Protection • Lenders receive Safe Harbor legal protection for loan with annual percentage rate (APR) less than 3.5 percentage points above the average prime offer rate (APOR) • Other QM loans with higher APRs meeting the small creditor exception will only receive a legal Presumption of Compliance, which is a lesser legal protection for the lender Qualified Mortgage – Balloon Payment Loan Lender Underwriting Requirements Loans are considered QM loans if ALL of the following conditions are satisfied • Originated and held in portfolio for at least 3 years • Originated by a lender with under $2 billion in assets • Originated by a lender who, together with its affiliates, originates no more than 500 first-lien covered mortgages per calendar year • Originated by a lender providing more than 50 percent of its first-lien mortgages in areas considered rural or underserved as defined by the CFPB o “Small creditors “ that do not operate predominantly in rural or underserved areas can offer balloon-payment QM loans until January 10, 2016, if all other requirements are satisfied • Lender must follow all other QM basic underwriting requirements detailed on page 2 • Debt-to-income ratio must be considered but is not subject to the 43 percent debt-to-income requirement 4 Mortgage Loan Requirements Balloon mortgage loans must • Have a term of at least 5 years • Have a fixed interest rate and periodic payments (other than the balloon payment) that would amortize the loan over 30 years or less • Be held in portfolio for at least 3 years Legal Protection • Lenders receive Safe Harbor legal protection for loans with an annual percentage rate (APR) less than 3.5 percentage points above the average prime offer rate (APOR) • Other QM balloon loans with higher APRs will only receive a legal Presumption of Compliance, which is a lesser legal protection for the lender Exemption from Ability-to-Repay Requirements for Refinancing NonStandard Mortgages into Standard Mortgages Lender Underwriting Requirements Following conditions must be met • Lender is current holder of the nonstandard mortgage • The payments under the refinance will not cause the principal balance to increase • Standard mortgage monthly payment will be materially lower than the nonstandard mortgage payment (i.e., at least 10 percent) • Lender receives written application no later than 2 months after the nonstandard mortgage has recast • Consumer did not make more than one payment more than 30 days late during the 12 months preceding application receipt and no late payments within 6 months • If the non-standard mortgage was consummated on or after January 10, 2014, it must be in accordance with the ability-to-repay requirements 5 Mortgage Loan Requirements Exemption applies to the following “nonstandard” mortgage loans being refinanced into a “standard mortgage” • ARM with an intro fixed interest rate for 1 year or longer • Interest only loans • Negative amortization loans Standard mortgage means a covered transaction with all of the following • That has regular periodic payments • For which the total points and fees do not exceed 3 percent for loans greater than $100,000 (the points and fees caps are higher for smaller loans) • That does not have a term greater than 40 years • That has a fixed interest rate for at least the first 5 years after consummation • For which the proceeds from the loan are used solely to pay off the outstanding balance on the nonstandard mortgage and closing or settlement charges Legal Protection N/A