2015 Budget Presentation - Kitsap County Government

advertisement

Kitsap County

2015 Budget

{

December 1, 2014

Kitsap County

Proposed 2015 Budget

$339 Million

Internal

Service

7%

Enterprise

24%

Capital

Projects

1%

Debt Service

3%

General Fund

25%

Special

Revenue

40%

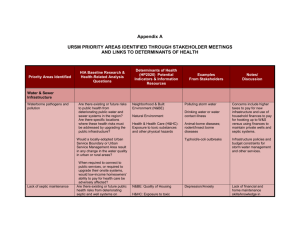

Fund Structure – 2015 Preliminary

# of Funds

Type of Fund

2015 Total

Example

1

General Fund

$ 85,113,280

Law & Justice, Parks, Admin

56

Special

Revenue

$134,771,769

Roads, Mental Health, Cencom,

Community Development

6

Debt Service

$ 10,207,611

Repayment of Debt

3

Capital Projects

$ 3,359,398

Parks, Facilities

13

Enterprise

$ 80,202,802

Solid Waste, Sewer, Stormwater

5

Internal Service

$ 25,383,753

Fleet & Equipment, Risk Mgmt,

Technology, Benefits

Total = 82

$339,038,613

Most Funds are legally restricted for very specific purposes

What is the General Fund?

The County’s largest individual fund and the center of County

budget challenges

The one fund outside of Public Works that citizens think about

when considering County services and functions

Finances the majority of the traditional services associated with

County government

Most of the budget deliberations center around this fund since it

allows for resource allocation flexibility

Primary sources of revenue = Property and Sales Taxes

Millions

General Fund Revenues vs. Expenditures

95

90

85

80

Revenues

Expenditures

75

70

General Fund Expenditures – 2015

(By Function)

Courts =

Facilities

Maint.

2%

Misc. Admin.

21%

Courts

24%

Superior

District

Prosecutor

Clerk

Public Defense

Coroner

1%

Parks

5%

Juvenile

9%

Jail

16%

Sheriff

22%

Misc. Admin =

Auditor

Assessor

Treasurer

Commissioners

Admin Services

Human Resources

General Fund Expenditures – 2015

(By Category)

Internal

Service

Charges

10%

Supplies

3%

Misc.

7%

Services

12%

Salaries &

Benefits

68%

General Fund Revenue - 2015

Law & Justice

Fines

3%

Grants &

Intergov

10%

Other

5%

Charges for

Service

11%

Property Tax

36%

Licenses &

Permits

1%

Other Taxes

9%

Sales Tax

25%

Millions

Property and Sales Tax Receipts

32

30

28

26

24

22

20

18

16

14

Property Tax

Sales Tax

Your Property Tax Dollar - 2014

County

9.7%

Roads

8.2%

State

Education

19.9%

Local

Schools

34.6%

Fire

Districts

13.7%

Cities

6.4%

Other*

7.5%

*Other = Conservation Futures, Ports, Utility

Districts, Park Districts, Libraries

New Construction Tax Dollars

$900,000

$800,000

$700,000

$600,000

$500,000

$400,000

$300,000

$200,000

$100,000

$-

Other Major Funds – 2015 Budget

Fund

2015 Prelim

Funding Source

Road Maintenance

$ 27,294,079

Property Tax (Road Levy)

Road Construction

$ 14,730,000

Fuel Tax

Solid Waste Operations

$

3,867,922

Charges for Service

Transfer Station Operations

$ 11,230,375

Charges for Service

Sewer Utility Operations

$ 17,334,729

Sewer Rates

Sewer Utility Construction

$ 20,713,227

Sewer Rates, Bonds

Central Communications (911) $ 10,288,970

Sales Tax, Phone Excise

Tax, Agency Charges

Community Development

General Fund, Permit Fees,

Engineering Fees

$

7,856,148

Major Changes – 2015 Budget

6 New Corrections Officer Positions

3 New Deputy Sheriff Positions

3 New Parks Maintenance Positions

1 New Fire Inspector Position

½ Time New Plans Examiner Position

Additional Funds for Treasurer’s Office Staff to Restore Staff

Hours to Full Time (open all day on Friday)

Additional Funding for the Comprehensive Plan Update

Additional Funding for Addressing Project

Additional Training Dollars

Additional Funding for Sheriff & Jail Uniforms and Supplies

Additional Funding for Parks Maintenance Projects

Special Thanks To…

Board of County Commissioners & County Administrator

Elected Officials, Department Heads and Department

Budget Coordinators

Budget Office Staff

Stephanie Hettema, Lisa Fryer, Jackie Cutlip, Kris

Carlson

Citizen Volunteers – Budget Review Committee

Jim Carmichael, Jim Sommerhauser, Steve Maxim,

Chad Enright