VegeUSA - National Sustainable Sales

advertisement

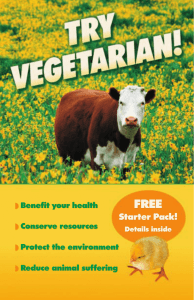

VegeUSA Vegetarian Brief Size of the Prize – 10% of US Adult Population Vegetarian Times Study Shows 7.3 Million Americans Are Vegetarians and an additional 22.8 Million Follow a VegetarianInclined Diet The 2008 “Vegetarianism in America” study, published by Vegetarian Times (vegetariantimes.com), shows that 3.2 percent of U.S. adults, or 7.3 million people, follow a vegetarian-based diet. Approximately 0.5 percent, or 1 million, of those are vegans, who consume no animal products at all. In addition, 10 percent of U.S., adults, or 22.8 million people, say they largely follow a vegetarian-inclined diet 59 percent are female; 41 percent are male. 42.0 percent are age 18 to 34 years old; 40.7 percent are 35 to 54; and 17.4 percent are over 55. 57.1 percent have followed a vegetarian diet for more than 10 years; 18 percent for 5 to 10 years; 10.8 percent for 2 to 5 years, 14.1 percent for less than 2 years. Age Group of the Vegetarian 45 40 Percentage of Age Group 35 30 25 20 15 10 5 0 % of Total 18-34 35-54 55+ 41 40.7 17.4 Why Vegetarian The Vegetarian Times 2008 study further indicated that: over half (53 percent) of current vegetarians eat a vegetarian diet to improve their overall health Environmental concerns were cited by 47 percent 39 percent cited “ natural approaches to wellness” 31 percent cited food-safety concerns; 54 percent cited animal welfare; 25 percent cited weight loss; and 24 percent weight maintenance. A 2012 Harvard study from Harvard School of Public Health (HSPH) researchers has found Daily serving of one hot dog or two slices of bacon associated with 20% increased risk of mortality Red meat consumption is associated with an increased risk of total, cardiovascular, and cancer mortality. The results also showed that substituting other healthy protein sources, such as fish, poultry, nuts, and legumes, was associated with a lower risk of mortality A vast number of people are seeking to reduce their meat intake Why Vegetarian A 2010 Harvard Study, the first systematic review and metaanalysis of worldwide evidence – nearly 1,600 studies - for how eating unprocessed red meat and processed meat relates to risk of cardiovascular diseases and diabetes, the researchers have found that eating processed meat, such as bacon, sausage or processed deli meats, was associated with a 42 percent higher risk of heart disease and a 19 percent higher risk of type 2 diabetes. The results showed that, on average, each 50 gram (1.8 oz) daily serving of processed meat (about 1-2 slices of deli meats or 1 hot dog) was associated with a 42 percent higher risk of developing heart disease and a 19 percent higher risk of developing diabetes. In contrast, eating unprocessed red meat was not associated with risk of developing heart disease or diabetes Marketing/Selling to Whom 18 to 24-year-olds eat out and drink alcohol outside the home more often than other age groups. Generation Y – those born since 1978 – tend to eat more often at quick-service and pizza restaurants. Generation X – those born between 1965 and 1977 – tend to prefer quick-service or casual establishments with comfort and a good perceived value. Smaller households eat out more often than bigger households. Empty nesters eat out more and spend more when they eat out. They typically spend 65% more on dining out than couples living with children. Empty nesters are generally more concerned about the quality of food and the elegance of the atmosphere than the price. People with more income tend to eat out more frequently. People who work long hours eat out more than people who have enough free time to cook their own meals. Traditionally, the older people get, the less frequently they eat out. However, this may change soon, since many baby boomers grew up eating out often. Seniors tend to eat early and slowly, and they look for good values with small portions. Wealthy, well-traveled consumers, particularly the wealthier baby boomers and the next generation, are more likely to look for ethnic or exotic food when they eat out. Exist in Targets World People between the ages of 18 and 24 eat out more often than other age groups. If you choose to target them, listen to their music and keep up with their technologies and fashions. This will help you determine the best way to promote yourself to them. You could try text message marketing or promoting yourself through online social networks, like Facebook® or MySpace®. Venues to find those in this age group that can afford demand selection: College & Universities Higher income areas Metropolitan Areas Coffee Shops Areas around College & Universities Panera Bread, Chipotle, Pizza Fusion Campaigns to attract attention of this and other groups The look The message The Identify/association with product consumption, what does it say when the eat it Associations and awareness, PETA, other animal welfare groups, vegetarian community Food for Thought Why Vegetarians Back Slide For most people, the draw of meat is powerful -often irresistible Hal Herzog is Professor of Psychology at Western Carolina University and the author of Some We Love, Some We Hate, Some We Eat: Why It's So Hard To Think Straight About Animals. Why VegeUSA because it tastes like meat but it is vegan Selling point then don’t back slide eat VegeUSA The Craving for meat creates a demand for VegeUSA Sales approach- attract those who want to move from meat to vegetarian and those who crave to move back. The Rise of the Carnivorous Vegetarian * Looking Ahead Food Culture 2012, Hartman Group Consider the heightened reverence for the season’s latest bounty as a balancing element to this, the decade of bacon and burgers. Vegetables are becoming increasingly fashionable. This new breed of vegetable fan isn’t motivated entirely by ethical, environmental or health reasons (for the most part), but by culinary ones. Consumers are realizing that vegetables are best celebrated with healthy doses of olive oil or butter, rather than the steamed and undressed version we’d sooner forget. From Meatless Monday and Eataly’s vegetable butcher, consumers are interpreting this era as vegetable-focused, rather than the days of vegetarianism defining one’s identity. Consumption of meat is increasingly showing up as more of a condiment than as center plate. An example includes a bit of crispy bacon accenting roasted Brussels sprouts. Today, it’s more tempting for vegetarians to be enticed by well-sourced and crafted artisan bacon and happily raised grass-fed burgers than the sole feedlot option available a decade ago. Takeaway In theory, vegetarianism may be “healthier” for body and planet, the reality is that consumers are not going to stop eating meat any time soon. As a result, we are seeing an increased reverence for plants and a more humane approach to the rearing and processing of our (tasty) animals. The Johns Hopkins Center For A Livable Future: Sodexo Meatless Monday Survey Results Conclusions As a whole, survey respondents, regardless of their level of participation, overwhelmingly reported that the Meatless Monday promotion demonstrated Sodexo’s commitment to health. Beyond this finding, providers also said that Sodexo has the potential to be a forerunner in the field of healthy eating campaigns. As one survey respondent stated, “I think Sodexo can be a leader in this area.” Despite difficulties in implementation for some sites, there is overall strong support for the promotion and desire to continue on the part of the food service providers. Sodexo’s network of more than 1,800 accounts, in the corporate, health care and government sectors, has the ability to reach large numbers of individual consumers. With their support, the Meatless Monday campaign has the potential to further greatly reduce environmental and health impacts. Challenges Distribution: The development of a base of customers sufficient to attract distribution UNFI redi model while available and needed is ineffective for sustainable growth on a broad bases National Accounts provide volume and distribution but do not necessarily will help expand beyond the National Account However, it can contribute to critical mass for minimums However, National account pricing can result in abuses by distributors Distribution: Every Supplier must pay to play with all broadliners as well as other distributors Pricing should include sufficient allocation of money to support distributor marketing programs, payment discounts and activities such as food shows which are current averaging $7000 for a one day event Forward spending is to be expected Ongoing oversight is necessary and the time required increases with distribution expansion and sales growth NSD minimizes or eliminate Challenges Go to NSD outline