Open

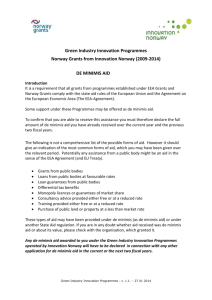

advertisement

HOW TO SUCCESSFULLY GAIN COMMISSION APPROVAL 3 June 2014 Overview 1. When does State aid have to be notified? 2. Block Exemption Regulations 3. Full notification 4. How to avoid State Aid 5. State aid and infrastructure - Leipzig Halle decision 6. Implications of not notifying 7. Roles and responsibilities 8. NI Regional Stadia case What is State Aid? Treaty on the Functioning of the European Union Article 107 (1) “Save as otherwise provided in the Treaties, any aid granted by a Member State or through State resources in any form whatsoever which distorts or threatens to distort competition by favouring certain undertakings or production of certain goods shall, in so far as it affects trade between Member States, be incompatible with the internal market.” Obvious State Aid • Grants • Loans below ‘market’ rate of interest • Equity injections on less than ‘market’ terms • Guarantees • Derogations from a Tax Less Obvious State Aid • Sale of land below market prices • Rents at less than market rates • Secondment of Civil Servants • Services provided by State resources at a reduced or zero cost Why have State Aid rules? • Level playing field for commercial competition • Smooth functioning of the internal market • Avoid a subsidy race to the bottom How to identify State Aid Basic 4 Point Test – there is an intervention by the State or through State resources; – the intervention gives the recipient a selective economic advantage; – competition will be or may be distorted; – there is a potential effect on trade between Member States. • Only the European Commission and National Courts are competent to conclude whether State Aid is present. • UK takes a risk based approach to State Aid • No obligation to notify if assessment is no State aid is present What is an undertaking? • State aid rules only apply to ‘undertakings’ • Undertakings are private and public organisations involved in activities that are economic. • Undertakings do not have to be profit-making. • Activities are probably economic if there are commercial companies providing the same product or service. • Public and voluntary sector organisations, including universities and charities, can be classified as undertakings. How to obtain EC approval • Seek cover within an existing scheme • Block Exemption Regulations (GBER, SGEI Decision) • De Minimis Regulation • Full Notification Block Exemptions • Fast (20 working days) and simple procedure for obtaining State Aid approval • Schemes that a MS say comply with the block exemption regulations are not assessed by the EC • Main block exemption regulation is the General Block Exemption Regulation • 13 different types of state aid in the 2014 -2020 GBER • SGEI Decision also an option in certain cases Block Exemptions • Big advantage – reduction in administrative costs for the beneficiary, the Member State and the Commission. • It also allows the Commission to focus its attention on the most distortive types of aid. • Disadvantage – responsibility for ensuring compliance rests with the Member State • Commission Monitoring – SFA (MX9/2008) De Minimis • Industrial de minimis ceiling - €200,000 per undertaking during current and last 2 financial years • De minimis must be cumulated with other de minimis • Recipient must declare what other de minimis aid it is receiving • Grant provider must check recipient will not exceed the €200k ceiling • No Commission monitoring • SGEI de minimis (up to €500k) also a possibility in some cases • Agricultural de minimis up to €15k Full notification • Start early – consider State Aid issues during policy development • Allow at least 12 months for a full notification • Study carefully relevant Commission frameworks, guidelines and previous decisions • Seek specialist State Aids advice – including considering pre-notification discussions with the Commission • Legal advice may be needed in innovative or difficult cases Implications of not notifying • Notifiable aid granted without approval is illegal • EC may investigate even if there isn’t a complaint • If a negative decision – Aid (plus interest) must be repaid by the beneficiary. – No further aid to beneficiary until aid repaid. – No further aid may be granted by the Scheme / Programme, until it is notified and approved – Government may have to pay damages to competitors of beneficiary How to avoid State aid • Aid repaid at market rates – 2008 EC method for setting reference and discount rates – 2011 Sachsen-Anhalt subordinated loans decision • Pari Passu investment • Market Economy Investor Principle – Applicable to ‘public undertakings’ – When a public authority invests in an enterprise on terms and in conditions which would be acceptable to a private investor operating under normal market economy conditions, the investment is not a state aid. State aid and Infrastructure • Leipzig/Halle decision - General Court finds that the construction of infrastructure linked to its later operation constitutes an economic activity. • March 2011 DG Comp writes to DG Regio... “after the Leipzig/Halle ruling, it cannot be denied anymore that the financing of any type of infrastructure (excluding infrastructure related to security, safety, etc.) that is later commercially exploited is State aid relevant.” • April 2014 DG Comp decision in relation to the NI Stadia (Windsor, Casement park and Ravenhill)... “the funding of the necessary infrastructure, which will be used in part for commercial activities, could constitute aid, according to the Leipzig/Halle airport judgement of the Court of Justice, if all the requirements of 107(1) are fulfilled.” Roles and Responsibilities • DETI – Provide advice & raise awareness (NI Depts & NDPBs) – Monitor & report (to DBIS) • DBIS – Provide advice & raise awareness (UK wide) – ‘Sign up’ / ‘approve GBER’ notifications (via UKREP) • NI Public Sector Bodies – Assess & manage compliance risks – Prepare notification & provide info to Commission – Maintain records Regional Stadia Development in Northern Ireland SA.37342 (2013/NN) Windsor Park Casement Park Ravenhill Park NI Regional Stadia notification (1) • Outline Business Case prepared in 2010 • 14 December 2012 – first contact with DCAL • January 2013 – DCAL starts work on pre-notification • 15 February 2013 – Senior legal counsel opinion received • 20 March 2013 – Crusaders Football Club submit JR papers • 1 May 2013 – Crusaders lawyer contacts DG Comp • 22 May 2013 – JR leave granted on grounds of State aid NI Regional Stadia notification (2) • 12 June 2013 – DG Comp not prepared to discuss matters that are before the National Courts (i.e. Windsor Park). Happy to discuss Casement and Ravenhill. • 10 July 2013 – Non-meeting with DG Comp • 14 Aug 2013 – High Court dismisses JR request • 11 Sept 2013 – Pre-notification • 15 Nov 2013 – Formal notification • 24 Jan 2014 – Further information provided • 9 Apr 2014 – No objection decision Further Information • DETI State Aid Unit – Stephen Moore • Tel: 028 9052 9415 • email: stephen.moore@detini.gov.uk