Medicare Advantage Plans - American Academy of Home Care

advertisement

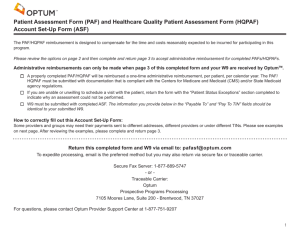

Ronald J Shumacher, MD FACP CMD Chief Medical Officer, Optum Complex Population Management ©AAHCM Ronald J Shumacher MD has the following financial relationship to disclose: Employee of: Optum Services, Inc. ©AAHCM ©AAHCM Exhibit 4 Distribution of Medicare Advantage Plans by Plan Type, 2007-2014 2,830 2,623 107 51 118 43 696 2,098 104 42 801 452 335 2,314 102 59 2,011 116 413 220 525 522 412 1,165 1,249 2007 2008 1,451 2009 2,074 1,974 59 101 201 100 54 180 2,014 51 93 48 120 548 511 512 504 1,218 1,104 1,114 1,195 1,242 2010 2011 2012 2013 2014 NOTE: Excludes SNPs, employer-sponsored (i.e., group) plans, demonstrations, HCPPs, PACE plans, and plans for special populations (e.g., Mennonites). Other category includes cost plans and Medicare MSAs. SOURCE: MPR/KFF analysis of CMS’s Landscape Files for 2007 – 2014. Other Regional PPOs PFFS Local PPOs HMO Clinical quality and STARs Care coordination and management • Greater focus on quality performance and outcomes evaluation • HEDIS measures tied to revenue • Financial incentives and brand identity critical to business • Shifts from fee for service to pay for performance and accountability • Member outreach and engagement • Integrated clinical data at point of care • Improved coordination of services and accountability Plan Health Performance • MA Plans face margin pressures and revenue management needs • Convergence of closing gaps in care at point of service • Compliance: EDPS and RADV Risk adjustment • • • Admission and Re-admission prevention • Post-acute and end-of life care SNF LOS management Network/Contracting Medical expense management ©AAHCM The most expensive members offer the biggest opportunity for savings; however, these patients require a home-based care program. %5% of the population drives 50% of the medical spend The high cost 5% of the population are generally on an erratic course These patients take more medications, see their provider more and utilize the ER three times per year on average Members do not regularly engage with or look to payer for health support or management Stanton MW. The High Concentration of U.S. Health Care Expenditures. Research in Action, Issue 19. AHRQ Publication No. 06-0060, June 2006. Agency for Healthcare Research and Quality, Rockville, MD. http://www.ahrq.gov/research/findings/factsheets/costs/expriach/index.html ©AAHCM Consider the unique demographics of MA plan populations — 10% of the population averages at least one hospital visit per year and accounts for 30% of the spend 4,000 % of Population Hospital ER Visits/Yr Visits/Yr # Chronic Diseases $PMPM % of Cost <0.70 50% .164 .252 0.3 $330 21% .71 to 1.45 30% .373 .429 1.3 $710 33% 1.46 to 2.05 10% .660 .632 2.3 $1,190 15% 2.06 to 2.75 5% .915 .766 3.0 $1,640 11% >2.75 5% 1.477 .992 3.7 $2,740 20% Risk Score 3,500 Hospital Admits 2,500 2,000 ER Visits 1,500 1,000 500 0 0. 17 0. 35 0. 55 0. 75 0. 95 1. 15 1. 35 1. 55 1. 75 1. 95 2. 15 2. 35 2. 55 2. 75 2. 95 3. 15 3. 35 3. 55 3. 75 3. 95 4. 15 4. 35 4. 68 5. 73 6. 73 7. 73 8. 73 9. 72 Rate per 1000 per year 3,000 Source: Nationwide Medicare 5% Sample HCC Risk Score ©AAHCM Tompkins et. al. Population Health Management in Medicare Advantage; Health Affairs Blog, April 2013 Needs Assessment Value Story Implementation Plan • Identify the problem being solved • Determine how it is applicable to MA plans • Understand the environment in which you’ll provide care (geography, etc.) • Develop a proven ROI (e.g., executive summary, affordability analysis, ROI & quality metrics) • Provide a MA Health Plan health care economics analysis • Determine if there is a need to take on risk • Have a willingness to contract and get credentialed with the health plan • Propose a clinical program/model • Review of contract by legal • Develop a road to deployment (e.g., staffing, certification, filing, delegation agreements, credentialing, etc.) • Identify/align on early indicators and analytics • Determine program monitoring ©AAHCM Identification of members and risk stratification Member outreach and engagement Demonstrate value / ROI Capture of quality and encounter data Develop clinical care model (e.g., visit types, how to manage the most challenging patients) ©AAHCM Reimbursement Structure • Case rate (PEMPM) • Capitated payment (PMPM) • Gain sharing with quality metric goal(s) • Full risk/percent of premium Profitability Management • Low health care utilization (e.g., admissions, readmission, emergency department, etc.) • Manage quality measures, including STARs, HEDIS • Accurate documentation/coding • Simple way to share data ©AAHCM Challenge Risk mitigation strategies Identification and stratification Algorithms that accurately reflect implications of regression of the mean Member outreach and engagement Specialized outreach teams to manage engagement Member compliance with care plans Partner home care medicine providers with telephonic case management support Collaboration with MA Health Plan case Establish clear criteria, communication management and other programs and handoffs Navigating MA Health Plan networks Emphasize communication with network providers and provide documentation Managing operational metrics Rigorous management oversight and tracking tools Data capture and tracking Robust EHR and reporting/analytics ©AAHCM Ronald J Shumacher, MD FACP CMD Chief Medical Officer, Optum Complex Population Management rshumacher@optum.com ©AAHCM