Community Services - the Township of Lanark Highlands

advertisement

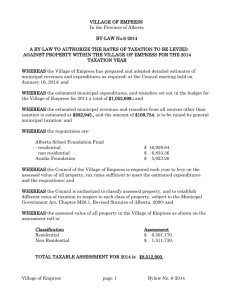

2014 BUDGET PRESENTATION Tuesday January 28, 2014 • The complete budget document can be located on the Lanark Highland’s web site at www. lanarkhighlands.ca /Services/Budget.php • The assessment in Lanark Highlands for 2014 taxation increased on average 5.53%. Of this, 1.65% relates to real growth, 3.88% relates to assessment phase-in increase. • The 2014 budget includes a municipal tax levy increase of 2%. This approximates about $ 84,000 of additional revenue for Municipal operations. • 2014 is the forth consecutive year the tax rate increase has been maintained at 2%. • Policing Cost has increased $ 43,544 for 2014. This equates to about 1% of the tax levy. Policing Cost represents about 8.5% of the Township’s total gross expenses. • The Ontario Municipal Partnership Fund Grant ( OMPF ) increased by $114,800. Since 2009, this grant had been steadily decreasing . The increase for 2014 is a welcome reprieve. • At this time, a $ 150,000 surplus is forecast for 2013. The 2013 year end must still be completed as well as the 2013 audit. Therefore, this forecast is subject to change. • This surplus is attributable to actual expenses being approximately $ 60,000 less than budgeted but also tax revenue being $ 90,000 higher than budgeted. Most of the tax increase was created by additional tax supplementaries based on reassessments by the Municipal Property Assessment Corporation ( MPAC ) The 2014 budget includes $ 2,000,500 to be spent on capital items and projects. $ 236,865 of this amount will be funded through the tax levy. The remainder will be funded from reserves, development charges and a $ 1,099,088 grant from OMAFRA - MIII Building & Protective Services: Fire Services: Scott SCBA Regulators Rapid Intervention Team Equipment Hoses, nozzles, fittings, gated valves ¾ ton 4X4 crew cab Emergency Lighting $ 14,000 5,500 26,000 30,000 15,000 Total $ 90,500 ( continued ) Community Services: Youth Centre capital work Community Halls capital improvements Property Acquisition – survey & legal – Clyde Forks Cemetery Total Public Works – Environmental Services: Middleville waste site Land Purchase Costs – Robertson’s Lake / White Lake Total ( continued ) $ 12,000 13,000 5,000 30,000 250,000 45,000 $ 295,000 2014 BUDGET EXPENDITURES ( CONTINUED ) Public Works – Transportation: Resurface .6km on Paul Drive Acquire Property & Realign Coon Hill Design & Engineering – Sheridan Rapids & Galbraith Rd. Bridges Design / Engineering & Construction – French Line Bridge ½ Ton Truck Asphalt Conveyor for Village Truck Repair Salt Shed at Joe’s Lake Total $ 25,000 80,000 120,000 1,290,000 30,000 10,000 30,000 $ 1,585,000 2014 BUDGET SUMMARY 2013 2013 2014 BUDGET FORECAST BUDGET BUDGET NOTES EXPENSES Departments $ Conservation Authority Levy $ 5,273,201 $ 5,212,987 28,996 $ 28,996 $ 5,518,853 $ 30,000 Increase Allowance for Doubtful Accounts $ 5,302,197 $ 5,241,983 $ 5,548,853 Payments in Lieu $ 53,000 $ 56,000 $ Interest & Penalties on Taxes $ 165,000 $ 173,000 $ Ontario Municipal Partnership Fund (OMPF) $ 1,319,700 Interest Income $ Aggregate Producers Grant TOTAL EXPENSES REVENUES 57,000 LCBO, Post Office, County Forest, Hydro 170,000 1.25%/month as per Municipal Act $ 1,319,700 $ 1,434,500 35,000 $ 26,000 $ 26,000 on operating bank accounts $ 60,000 $ 61,636 $ 60,000 Reflects anticipated aggregate producers Provincial Offences Act Income $ 55,000 $ 55,000 $ 55,000 output Taxes $ 4,158,800 $ 4,245,000 $ 4,334,200 as confirmed by Ministry of Finance incl. 2% rate increase + estimated 2014 supplementries TOTAL REVENUES $ 5,846,500 $ 5,936,336 $ 6,136,700 SURPLUS / ( DEFICIT ) BEFORE POLICING $ 544,303 $ 694,353 $ 587,847 OPP POLICING CONTRACT $ 544,303 $ 544,303 $ 587,847 TOTAL SURPLUS / ( DEFICIT ) $ - $ 150,050 $ - Estimate - 8.5% Salary related increase SUMMARY - DEPARTMENT 2014 BUDGET DEPARTMENT 2013 2013 2014 BUDGET FORECAST BUDGET Corporate $ 1,009,387 $ 957,526 $ 1,060,619 19% Building, Planning & Protective Services $ 786,841 $ 775,757 $ 827,802 15% Community Services $ 227,686 $ 244,934 $ 262,625 5% Public Works & Waste Management $ 3,249,287 $ 3,234,770 $ 3,367,807 61% TOTAL $ 5,273,201 $ 5,212,987 $ 5,518,853 100% PENALTIES & INTEREST ON TAXES 3% AGGREGATE GRANT & OTHER 3% OMPF GRANT 23% 26% in 2010 25% in 2011 24% in 2012 23% in 2013 TAXES 71% 71% in 2010, 2011,2012 & 2013 CORPORATE 7 RESERVES 7% ADMINISTRATION 9% COUNCIL 3% COMMUNITY SERVICES 5% BUILDING – PLANNING & PROTECTIVE SERVICES 15% PUBLIC WORKS & WASTE MANAGEMENT 61 Gross Road Expenditures by Function Communication / Office Costs Supervisory / Technical Equipment Depots Empl. Benefits & Other Debt Repayment Winter Maintenance Road - Safety Roadside Maint. Road - Loosetop Maint. Road - Hardtop Maint. Drainage & Structures $- $200,000 $400,000 $600,000 $800,000 PROPERTY TAXES HOW THEY ARE CALCULATED Education Tax Rate Property Taxes = Assessed Property Value X Municipal Tax Rate County Tax Rate Note : Assessed Property Values provided by the Municipal Property Assessment Corporation ( MPAC ) WHERE YOUR TAXES GO RETAINED BY THE TOWNSHIP TO SCHOOL BOARDS 17 % 50 % 33 % TO THE COUNTY OF LANARK 2014MUNICIPAL PROPERTY TAX OBLIGATION 2 % LEVY INCREASE Example: 2013 Property assessed at $182,900 Rising by average assessment increase 3.88% 2014 Property assessed at $190,000 2014 MUNICIPAL PROPERTY TAX OBLIGATION Does not included County & School Taxes 2.0 % LEVY INCREASE Municipal Tax Obligation Residential Property assessed @ $ 182,900 in 2013 $ 1,141.76 Average Residential Assessment Increase @ 3.88 % = Residential Property assessed @ $ 190,000 in 2014 $ 1,164.61 Increase in Annual Taxation $ 22.85 Budgeted Reserve Balances Jan 1, 2014 $ Transfer In $ Transfer Out $ Dec 31, 2014 $ TI = Transfer In TO= Transfer Out Operating funds 502,627 59,321 20,000 541,948 TO = Wage/Benefit Adjust. Capital Funds 404,506 50,000 45,000 409,506 TO = Waste Site Capital Administration Building 104,500 25,000 129,500 TI= Per Budget Election Expense 33,859 Computer Replac. 18,000 Emerg. Generator Bidg. 15,000 15,000 CBO Vehicle 13,679 13,679 Road Mntce. Equip 34,874 Policing Reserve 14,024 6,000 282,500 29,000 4,859 TO= 2014 Election 15,000 9,000 TO= Capital Asset Software 40,000 277,374 TI = Surplus on Equip Rental TO = ½ Ton Pickup / Asphalt Conveyor 14,024 Budgeted Reserve Balances ( cont.) Jan 1, 2014 $ Transfer In $ Transfer Out $ Gas Tax Funding 195,691 148,483 299,912 Special Reserve – Crain’s Constr. 24,000 6,000 30,000 Recreation 34,612 2,000 36,612 TI= Sale of Lottery Lic. Vincent Hall 5,116 Lanark Arena 54,401 Lanark Village Museum 7,801 Fire Capital Fire – PPEquip & Radio Licencing TOTAL Dec 31, 2014 $ TI = Transfer In TO= Transfer Out 44,262 TI= Gas Tax Funding TO= French Line Bridge TI= Per Crain’s Agreement 5,116 25,000 79,401 TI= Per Budget 7,801 304,499 84,300 61,500 327,299 TI = Per Budget 30,000 10,000 29,000 11,000 TI = Per Budget 1,797,189 698,604 539,412 1,956,381 Development Charges / Cash in Lieu of Parklands ( Estimates ) JAN. 1 2014 $ TRANSFER IN $ Development Charges. 330,000 50,000 Cash in Lieu of Parklands 101,100 4,500 431,100 54,500 TRANSFER OUT Scott SCBA Regulators 3,500 Hoses, nozzles, fittings 6,500 Library Services 2,500 TOTAL 12,500 TRANSFER OUT $ 12,500 DEC. 31 2014 $ 367,500 99,300 12,500 466,800 2013 LONG TERM DEBT PURPOSE LENDER BAL. INTEREST YEAR DEC. 31.13 RATE PAID OFF Road Reconstr. Infrastructure Ont. $ 458,356 4.73 % 2017 Road Reconstr. Infrastructure Ont. $ 32,362 2.51 % 2014 Road Reconstr. Township of Lanark Highlands ( Water & Sewer ) $ 805,606 3.73 % 2021 Arena Ice Plant Infrastructure Ont. $ 804,000 TBD 2019 $ 1,296,324 Total annual repayment obligation combined principal & interest = $ 307,513