Disrupting Canadas Low-Innovation Equilibrium

advertisement

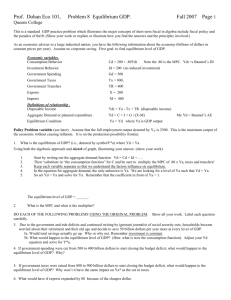

DISRUPTING CANADA’S LOW-INNOVATION EQUILIBRIUM Presentation to Research Money Conference by Peter J Nicholson Ottawa, 17 May, 2012 CANADA’S INNOVATION PARADOX Conventional wisdom: Business innovation is the principal driver of firm competitiveness and long-run economic prosperity The Canadian business sector is an innovation laggard—e.g. Feeble MFP growth Low R&D spending Middling up-grading Few tech-based MNEs …but Canada’s economy continues to produce one of the world’s highest standards of living; and Canada’s business profitability, in aggregate, matches that of the US. This benign state of affairs has persisted for decades… through good times and bad. Canada’s “low-innovation” business behaviour has delivered GDP PER CAPITA: CANADA AS % US 1870-2005 WHAT CREATED THE LOW-INNOVATION EQUILIBRIUM? I. Canada’s small and fragmented domestic market is: (a) less attractive to foreign competitors who go first where opportunities are greatest; (b) less likely to reward the risk of investment in major innovation. …but what about Finland, Sweden, Taiwan, Switzerland? II. Canada’s Upstream Role in North American Value Chains U.S.: Full-spectrum, end-user-focused innovation strategies Canada: Truncated, branchplant innovation strategies Resource extraction Processing Assembly Sophisticated End Products Profitable linkages with the US have powerfully shaped business strategy and culture CANADA LACKS A “SERIOUS” INNOVATION POLICY Federal governments, of both parties, have never sustained the commitment needed to encourage Canadian business out of its low-innovation equilibrium Innovation policy largely an R&D policy with academic intermediaries Innovation file always assigned to a junior Minister PM’s Science Advisor never gained traction—compare Korea, Japan, US Revolving door of S&T agencies and advisory bodies Government S&T establishment largely ignored as an economic asset SR & ED tax credit is innovation policy on auto-pilot The low-innovation equilibrium has been working—so why really try to “fix” it ? LONG-RUN PERSPECTIVE ON GROWTH GDP PER CAPITA: 1870-2005 (US $ 000 at PPP) 35 30 The Canadian and the US economies have been “joined at the hip” … Will the future mimic the past? 25 20 USA Canada 15 10 China 5 0 1870 1885 1900 1915 1930 1945 1960 1975 1990 2005 DISRUPTING THE LOW-INNOVATION EQUILIBRIUM Commodity-Driven $C Soars Jobs & Productivity Diverge (Canada as % US) 120 110 1.10 Employment to Population Ratio 1.00 100 PAR 0.90 90 0.80 80 Labour Productivity 70 0.70 60 0.60 50 0.50 1976 1981 1986 1991 1996 2001 2006 2011 Min US 63.7 cents 1982 1987 1992 1997 2002 2007 Unit Labour Cost Surges, Eroding Competitiveness of Many Canadian Businesses 140 Index in $US at PPP: 2005=100 130 120 US 110 100 90 80 CANADA 70 60 50 Source: OECD 40 1994 1996 1998 2000 2002 2004 2006 2008 2010 FUNDAMENTAL STRUCTURE-DISRUPTING FORCES GLOBAL ECONOMIC REBALANCING Emerging markets opportunities versus continued US focus RESOURCES DEMAND AND SUPPLY AGEING POPULATIONS Continued strong $C for now but intensifying global R&D for substitutes Tightening labour supply implies rising labour cost—productivity imperative TRANSFORMATIONAL ICT Profound and continuing disruption of markets and business models These forces are already making Canada’s low-innovation equilibrium untenable WHAT ROLE FOR PUBLIC POLICY? The structure-disrupting forces will (eventually) force Canadian business to be much more innovative. Wise and potent policies can make the transformation faster, more efficient and of greater overall benefit for Canadians. ADDRESS TRANSFORMATIVE FORCES For example: *Major push into emerging markets (and not only China) *Hypercharge the “Digital Economy Strategy” (remember that?) *Strengthen the “innovation intermediaries” between ideas and markets MAKE INNOVATION A REAL PRIORITY For example: *Upgrade the “file” and go beyond the R&D ghetto *Rebuild internal capacity to engage with business *Work co-operatively with Provinces and cities. Make it a truly national endeavour …but the old habits of both business and governments will not easily be changed ANNEX SLIDES CONVERTING “RESEARCH” INTO “INNOVATION” Trained People; Promising Ideas Research Problem Identification Priority setting Universities & Colleges • Tech Transfer Offices Commercial Businesses Degree of Focus Degree of Focus Problem Solving, Mentoring, Financing… • Public Research Institutions & Programs • Incubators • Angels & VCs Basic Research Knowledge Translation & Mobilization (Innovation Intermediaries) Development & Marketing Need more business ‘demand-pull’ to complement ‘research-push’ THE CHALLENGE OF MULTI-INSTITUTIONAL COLLABORATION UNIVERSITIES Research Motivation Create and share knowledge TRANSLATION & MOBILIZATION Ideas to Innovation BUSINESSES Use and control knowledge Time Horizon Mid-to-Long Variable Short-to-Mid Individual Rewards/ Incentives Tenure, promotion and professional recognition Variable (Major challenge for organizational design) Money and authority in the firm Institutional Temperament Institutional continuity, organizationally-loose Ranges from bureaucratic to entrepreneurial Goal-focused, organizationallytight Organizational innovation needed to meld cultures and incentives BUSINESS INNOVATION SUPPORT IN BUDGET 2012 IRAP R&D Internships Business-led NCEs 2012-13 2013-14 2014-15 2015-16 110 7 12 110 7 12 25 37 110 ? 12 35 37 110 ? 12 35 37 110 ? 12 40 37 ? ? ? 550 14 60 135 185 67 60 ? 241 194 194 199 1071 -35 -315 -480 -500 -1330 206 -121 -286 -301 -259 Procurement Business-Academic Collaboration Re-focussing NRC Genomics Research 37 67 10 50 Western Innovation Program TOTAL NEW TARGETED SPENDING 243 Reduction in SRED NET INCREASE (DECREASE) IN SUPPORT 243 2016-17 5-Year Total Source: Estimates from text and tables in Budget Plan INNOVATION POLICIES VS. STRUCTURAL CONDITIONS Business R&D as Percent of GDP 1.4 BERD as % of GDP 1.2 1.0 Tech Boom Collapse 0.8 Prosperity Initiative Canada-U.S. Free Trade Agreement 0.6 Strategic Aerospace & Defence Initiative Technology Partnerships Canada 0.4 “Modern” version of R&D Tax Credit Canada’s Innovation Strategy Creation of NABST 0.2 NAFTA 0 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 Data Source: OECD, 2008c Only the tech boom and collapse have had any major impact on BERD ratio