An Introduction to Behavioural Finance

advertisement

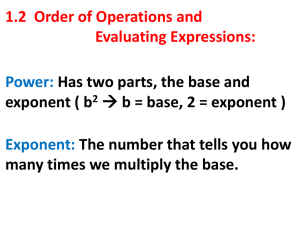

AN INTRODUCTION TO BEHAVIORAL FINANCE Definition: Behavioral Finance is an approach that attempts to explain anomalous behaviour of security prices (i.e. deviations from efficient markets theory and asset pricing models) by the psychological biases and/or behavioral regularities of market participants. A Reminder of Theory Finance Theory basically suggests that the return of a financial asset in period t should be the sum of expected return (i.e. the compensation for holding the asset) and a random error term (reflecting information surprises and any temporary deviations). Rt = E(Rt) + et E(Rt) is practically the sum of the protection against inflation, reward for postponing consumption, and reward for taking the risk associated with the asset A sufficiently long term average of Rt (realized returns) should converge to E(Rt), such that E(RABN)=0. Further, efficient markets theory predicts that abnormal returns (ei’s) should be unpredictable (follow a random walk), so that it is impossible to persistently earn positive abnormal returns. RABNt ~ iid(0,σi) These examples do not constitute a violation of the theory, although abnormal returns are not compensation for risk. But, they do suggest that unexpected returns can be much larger than expected returns. 1.Chart: short period, unpredictable, should rather be assigned to the error term. (manipulation in a small-cap stock in Turkish stock market). 2.Chart: The process of incorporation of new fundamental information into price may seem like an anomaly, but does not necessarily violate theory. (the rise of Crude Oil since 2002). It is possible to obtain positive abnormal returns by exploiting superior private information (theory should allow for the effect of information surprises). Maybe, the theory is to be revised as such: Rt = E(Rt) + It + et (Elton, 1999) A true violation needs to be predictable cases of statistically and economically significantly positive or negative average abnormal returns over sufficiently long periods such that E(It)=0. VIOLATIONS OF THE THEORY THAT GIVE RISE TO BEHAVIOURAL APPROACHES * Momentum Rules (Short-lag Positive Autocorrelation in Returns): Create zero-cost arbitrage portfolios by buying most winners and selling (short) most losers of the past 3-12 months, hold them for the next 3-12 months. Jegadeesh and Titman (1993) and Rauwenhorst (1998) report around 1% monthly average excess returns to this strategy. * Contrarian Rules (Long-lag Negative Autocorrelation in Returns): Buy most losers and sell most winners of the past 3-5 years, hold the portfolio for the next 3-5 years. DeBondt and Thaler (1985) report significantly positive returns to this strategy, however more recent studies suggest less profitability (while profitability of momentum rules turns out to be more robust over time). * Excessive Volatility: Shiller (1981) finds that stocks are more volatile than fundamentals require. Lo and MacKinlay (1990) find that excessive volatility violates random walk. So, there may be a human element adding to volatility. * Trends, Trend Reversals and The Profitability of Technical Analysis: It may be possible to make money by following trends • In sum, short-lag positive and long-lag negative autocorrelation in Rt series, which is a violation of weak form of efficiency. * Sentiment Anomalies, Calendar Effects, etc. MAJOR BEHAVIOURAL THEORIES • Underreaction due to Conservatism Bias: Human tend to be slow in adapting to new information. Consequently, new information is priced-in gradually (stepwise) rather than at a single step. This spurs positive autocorrelation in returns and renders momentum rules profitable. However, some of the profitability of momentum rules may result from gradual diffusion of private information, and it’s difficult to distinguish (semi-strong form of efficiency). Earnings momentum. * Overreaction due to Representativeness Bias: A tendency to overemphasize the most recent and the most salient may cause overreaction, creating excessive volatility (continuing trends, then reversals). * Overconfidence with Self-Attribution: Daniel et al. (1998) suggest it may cause overreaction and subsequent reversals. • Interaction between informed and momentum traders (Hong and Stein, 1999): One of the most promising theories: The insufficient number of informed traders results in underreaction, which creates room for profitability for momentum traders, the existence of which creates the potential for an overreaction and subsequent reversal. • Herd Behaviour: Herding is an instinctual defence mechanism against unknown external danger. It may be rational as it ensures to be not far worse than average. There is evidence that some fund managers, analysts and even CEO’s mimic each other. This may enhance existing trends. • Disposition Effect: Tendency to hold losing stocks too long and sell gaining stocks too early; may harm individual traders; has little impact on market prices as informed traders dominate the pricing. DEBATE BETWEEN EFFICIENT MARKETS AND BEHAVIOURAL APPROACHES Statistical and economic significance of reported abnormal returns are not robust to methodological issues (Fama, 1998). Behaviourists: Especially momentum rules are robust. Behavioural Factors are difficult to identify ex ante, and backward evaluations do not constitute robust evidence against efficient markets (one may attach one of a large number of behavioural theories to any anomaly). Behaviourists: produced testable predictions and general models. Real-time tests may overcome this problem. Sophisticated market participants can learn not to commit behavioural biases. As markets will be dominated by sophisticated traders as a result of “natural selection”, markets may evolve toward efficient market conditions. Hence, behavioural factors, even if they exist today, will be a temporary phenomenon. Behaviourists: The causes of behavioural biases are instinctual, they are inherent in human psychology, likely to repeat over next generations.