A provider perspective, Peter Gianfranesco

advertisement

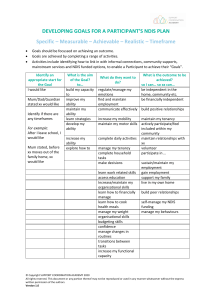

NDIS & LEARNING FROM THE UK EXPERIENCE OF PERSONALISATION: A PROVIDER PERSPECTIVE Peter Gianfrancesco galeru@btinternet.com www.galeruconsultancy.com © P. Gianfrancesco 2014 OVERVIEW About me The UK & ‘Personalisation’ What we did well (and what we did wrong) Insights arising from our experience Lessons for NDIS providers My emphasis is on the longer term view of market engagement A provider emphasis and focus GENERAL NDIS concept exists elsewhere Implementation plans & progress are impressive Not much written about ‘provider experience’ Most critical part of model is provider response Observations about MH NFP sector in Oz Getting ‘fit’ for the NDIS will improve you NDIS ‘fitness’ will result in a stronger NFP sector England is a good place to learn from Phase 1: Implementation EASY Phase 2: Consolidation Regulator Provider Consumer Helpful Lots of Regulation Stimulates & Supports Providers Separation of Funding Learning Anxious Short Term Focus Products emerge from existing capability / structures Confused & Anxious Wants more of same Provider familiarity Market De-regulation Integration of Funding Less inclusive Internal Cultural Change Increasing competition Emerging product innovation More provision across disability types New Partnerships Emerging new providers Emerging new workforce Confident Exercise influence Provider swapping Buys traditional care Less Helpful Relaxes Regulation Market Driven Model has shaped provider culture Increasingly innovative products Competitive Market Non MH providers Providers compete on added value New workforce Discerning Expects more May not choose MH HARDER Phase 3: Market Maturation HARDES T Gianfrancesco 2013 Time THE EVOLUTION OF A MODEL Over time………(if all goes well) Regulators (the NDIA) relax control over market conditions (rules) Consumers (customers) exercise more authority and discernment in relation to purchasing Providers adapt, innovate and extend their markets UK EXPERIENCE AS A PROVIDER PERSONALISATION – THE ENGLISH EXPERIENCE A national policy approach with strong political support Implementation devolved to 250+ Unitary Authorities Introduced on a national scale 5 years ago Tariffs and products (regulation) determined locally (with some exceptions) or by provider Consumers ‘hold’ the budget (reality is different) or get a ‘notional’ budget Brilliant when it is allowed to be used creatively (the Lathe example) It has not worked that well in mental health because of the chaotic implementation and existing care planning biases Being used to drive price down and eligibility up in some places Implemented at a time of great financial austerity, loss of contracted care and regulatory capacity Smaller providers demonstrated faster market entry, greater innovation and better quality but were often outlasted in the market (by larger providers) because of their more fragile infrastructure capacity, cash flow and (typically) higher supply costs We should seek to counter this trend because quality, localism and innovation are critical to the success of the model WHAT WOULD HAVE HELPED US CLEAR NATIONAL TARRIFFS SUPPORT FOR PROVIDERS SUPPORT FOR CUSTOMERS INDEPENDENT CARE PLANNING BETTER TRANSITION FROM CONTRACTS BETTER PLANNING AND LESS MARKET CHAOS MORE STRATEGIC AND LESS REACTIVE SUPPLY TIME TO UNDERSTAND WHAT WE WERE DOING WE SURVIVED AND THRIVED! SO WHAT DID WE DO? WHY US? THE 5 C’S Cultural confidence and readiness Customer service and focus Capability was understood Capacity was identified Costs were known (eventually!) CULTURAL CONFIDENCE & READINESS Who are we here for? Who could we be here for? What are the cultural barriers? What values must we preserve? What can we move on from? CUSTOMER SERVICE & FOCUS Who are our customers? How do we reach them? How can we provide GREAT customer experience? What do our customers tell us they want? What more can we do to add value? CAPABILITY What is it we ACTUALLY do? What is it that makes a difference? What else are we good at? Who else might benefit? How willing are we to focus our development on the things that REALLY matter to customers? CAPACITY How much can we provide? How productive do we need to be? How can we be more efficient? What new partnerships emerge? What are the markets we are seeking to appeal to? What else do we need and how will we pay for it? COSTS How much does it cost us to supply? Can we supply within the market tolerances? Do we ‘loss lead’? Do we subsidise care? What assumptions do we make about our supply model? What are our ‘lines in the sand’ KEY QUESTIONS WE CONTINUALLY ASKED…. Why are we considering entering this market? What are our ambitions as a provider? Do we have a duty to supply? What happens if we choose not to? How does it fit with our organisational purpose? Can we afford to do it? Do our values limit our market? What hidden capability is there? What would we do with the profit? How would we manage revenue loss? OUR CONTEXT IN NORFOLK, ENGLAND… Population of 1 million people In any given year:* 120,000 people experience a mental health problem requiring help 45,000 see a GP ONLY 15,000 use public or NGO mental health services Less than 5,000 eligible for a personal budget 60,000 people may need help, get nothing or have no eligibility but many have a capacity and desire to purchase The market opportunities here are pretty obvious? WHAT WE DID…. WE…. Sought to engage with the larges market possible CONSISTENT with our values and purpose For us this meant everyone? (Universality) We developed a broad product range We tested this with existing and potential customers We packaged the offer differently for different markets? People with personal budget, employers, general public We developed a safe but less qualified workforce? We went to market before we understood everything? We learnt about supply on the go and reviewed our offer continually THE OFFER Psychological Therapies Individual Recovery Support Complementary Therapies Learning & Personal Development Residential Care Wellness Retreats Befriending Personal Assistants Carer Support Condition Specific Packages (eg: Depression) Community Engagement Fitness & Nutrition Giving Back Packaged and delivered through three distinct sub-brands LIFEHELP Part of Norwich Mind (A$5M) New brand and product range developed Psychosocial support, packages, psychological treatments, complementary therapies, training courses, nutrition, fitness, general wellbeing Offered universally 600+ customers first two years 25% clients hold a personal budgets 40% have care purchased for them (notional budget) 25% self fund 10% free Profit is used to provide free care to 10% of the clients who would otherwise receive nothing ADVANTAGES OF UNIVERSAL SUPPLY Larger Market Less Stigma Less Regulation Greater Public Benefit & Impact & Reach Customer Expectations Higher Better Organisational Profile Fewer people excluded from available care Larger profit, greater potential to subsidise The key things we learned Staff are much more productive Staff are more flexible and multi-skilled Staff have become innovators and promoters The workforce is more diverse and more casualised Volume matters as does a broad customer base Mixed economy of purchasers is critical MAXIMISING market size is key Financial planning and management is very complex Client retention is good Clients say the service works and they welcome the choice Staff are satisfied 11 insights Mental Health NGOs often ‘punching below their weight’ Our offer will always be 90% relational and 10% technical There is very little product delineation amongst mental health providers - the key difference, the real value is in the person you supply to assist the customer Market the ‘relational promise’ Celebrate and share success through story telling…real people, real lives Keep your values and history at the heart of your message and as the key driver for your business model Add ‘delight’ and value at every opportunity Remember that customer experience is at least as important as efficacy for most customers Continually innovate and evolve your offer and expect others to copy you Listen carefully to what customers tell you before deciding what a ‘qualified workforce’ is Make part of your offer the opportunity for the customer to ‘pay it forward’, to give back, to be involved Supply Challenges – What we learned in the UK Our workforce had to increase productivity by 20% ‘Standing’ liability needs to be minimised Customers demand different qualities to those that organisations often hold dear….eg: Less qualified but experienced in life (not necessarily ‘lived experience) Flexible and responsive Relationally competent A new paradigm of staff deployment Move away from traditional structural model (teams) Multi-skilled staff covering full range of client needs are more efficient Big increase in infrastructure demands Requires a different understanding of outcome Workforce has become more casual and/or self employed and generally operating at a lower level of qualification but with new sought after attributes Organisational complexity increases Creativity needed to continually add value Greater reliance on technology to support distant delivery Very hard to supply remotely unless additional investment (by sponsor, provider, regulator or co-purchasing) SUMMARY OF KEY POINTS It’s bloody hard! NDIS offers great opportunity BUT it should not be your only market The implementation approach seems sound Providers need to think differently In terms of who they supply to In terms of brand and marketing In terms of supply and productivity Early to market is important Competition is inevitable and GOOD (particularly in urban settings) Funding will be more complex and chaotic Customers will benefit if suppliers adapt Preparing for supply will improve your organisation FURTHER INFORMATION www.norwichmind.org.uk www.personalhealthbudgets.england.nhs.uk www.mind.org.uk www.scie.org.uk/topic/keyissues/personalisation www.thinklocalactpersonal.org.uk www.whitecoat.com.au www.patientopinion.org.uk