Powerpoint, July 15, 2014

July 15, 2014

Carol Rogerson

Rollie Thompson

History

How the SSAG were created, current status

Appeal decisions

Current SSAG issues

SSAG successes, problems

Spousal guidelines internationally

Materials:

◦ Appeal Decisions 2010-14

◦ “Canada’s Experiment” 2011 FLQ article

◦ “Ideas of Spousal Support Entitlement”

(1) Early Research (2001-2002)

(2) Background Paper (December 2002)

(3) Sneak Preview (July 2004)

(4) Draft Proposal (January 2005)

Immediate use, software available

(5) Appeal Court Decisions: BCCA August 2005,

NBCA April 2006, ONCA January 2008

(6) Detailed Feedback in 2006-08

(7) Revised Final Version (July 2008)

(8) New and Improved User’s Guide (March 2010)

(9) Monitoring for New Developments by DOJ

Software updates taxes, etc.

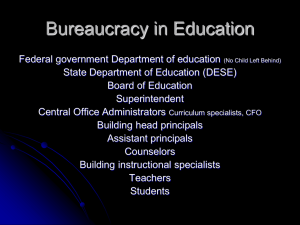

Not legislated, informal

National: divorce and other support claims

Ranges for amount and duration, threshold entitlement determined first

Formula ranges for “typical” cases, note exceptions and departures

Formulas reflect dominant patterns

Sophistication required, complex issues

Software necessary for most cases

Experience with Child Support Guidelines

◦ Widely viewed as success

◦ Familiarity with income-based guidelines

SCC in

Bracklow

(1999) confused us

◦ No guidance on amount, duration

◦ Rogerson, Thompson papers in 2001

Outcomes inconsistent, unpredictable

◦ Frustration of spouses, Bar, bench

◦ Desperate for guidance

Federal Justice commitment

◦ Advisory, professional

To reduce conflict, encourage settlement

To create consistency and fairness, more predictability, thus legitimacy

To reduce legal costs, improve efficiency of process

To provide a starting point for solutions in

CDR/CFL/mediation/settlement confs.

To provide basic structure for further judicial elaboration in decisions

Background Paper (December 2002)

SSAG Final Version (July 2008)

New & Improved User’s Guide (March 2010)

(2014 updated version forthcoming)

(2009), 28 Can.Fam.L.Q. 193 (SSAG issue)

(2011), 45 F.L.Q. 241 (materials)

Website: library.law.utoronto.ca/spousal-supportadvisory-guidelines

Final Version

(2008) still applies

Monitoring: no major changes since 2008

Software adjusts for tax, benefit changes

New User’s Guide (spring 2015) will reflect recent judicial decisions new patterns can emerge

Look to decisions, trends in other provinces

◦ Smaller provinces look to BC, ON for e.g.s

◦ Less-SSAGish provinces look to SSAG provinces

BC, NB, ON, PEI: appellate endorsement

NL, SK, MB: extensive use at trial

NS, AB: wide,erratic use, appellate confusion

QC: just beginning, 2011 QCCA decision

180+ CA decisions: BC 83, ON 32, AB 23,

NB 15, NS 9, MB 6, QC 8, MB 6, PEI 1, NL 1

2400+ trial decisions: BC 857, ON 801,

AB 157, NS 153, SK 133, NB 104, NL 68,

MB 56, QC 53, Terr. 16, PEI 7

No SCC decision: leave denied 7 times

Fewer interesting appeals since 2012

Older appeals cited, e.g.

ONCA:

NBCA:

, 10-year time limit struck, indefinite after 20-year marriage

MBCA:

Reisman

Kynoch

Fisher, Chutter

BCCA: 9 of19 appeals raised “imputing” issues

◦ E.g. PRM, Brandl, Kouznetsova, Shen, KD, Marquez amount increased, but still below range (?)

QCCA: similar to

Smith

, cautious re SSAG use,

Kynoch , 2011 QCCA 1554

(2011), no “error” not to use SSAG, but reasons required, then mid-SSAG ordered…

Focus today on SSAG, but not:

Threshold/no entitlement

Spousal support agreements,

Miglin

Variation, material change after

LMP v LS

Income determination mechanics

Retroactive spousal support

SSAG only AFTER entitlement established

Social assistance (incl. ODSP) is NOT income

Include any pre-marital cohabitation

Always consider s. 7 expenses BEFORE SSAG

Discount lump sum for non-deductibility

Know how outcomes calculated!

Be transparent about assumptions, esp. income

Fewer “ordinary” cases reported, more settlements

Twice as many as with child support without child support cases

, but demographics

Income determination now central issue

More attempts to “impute” income…

Default to mid-range on amount

Generally consistent on duration

Interprovincial differences re review orders

Reviews vs long time limits?

Exceptions still under-used

Mid is not “norm”, factors to consider:

Strength of compensatory claim

Recipient’s needs

Age, number, needs of children

Needs, ability to pay of payor

Work incentives for payor

Property division, debts

Self-sufficiency incentives for recipient

Good e.g.s: Reid v Carnduff (ONSC 2014); Mayer

(ONSC 2013);

2013); Jardine

Brown (NBQB 2013);

(NSSC 2013); Hari

Cochrane (BCSC

(ONSC 2013);

Bastarache (NBQB 2012); SD v JD (NBQB 2012)

Beyond threshold, identifying entitlement still important; compensatory vs non-compensatory

Location in ranges

Exceptions, variation issues

Duration: end of entitlement

Compensatory issues:

◦ “She was a secretary before, so no loss”…

◦ “She worked throughout the marriage, so no loss” …

◦ “He received no career advantage because she stayed home with the kids” …

◦ good compensatory analysis: Hartshorne

Abernethy v Peacock (ONSC 2013)

(2010 BCCA),

Non-compensatory issues:

◦ “need” as a ceiling vs. marital standard of living in long marriages

◦ post-separation need?: Tscherner v. Farrell

Jubinville (BCSC 2013)

(ONSC 2014),

Divorce Act, s. 15.2(6)(a) and (b)

Economic disadvantage/advantage, roles

Markers:

◦ home with children full or part-time

◦ primary care of children after separation

◦ secondary earner

◦ moves for payor’s career

◦ support for payor’s education/training

◦ work in family business

Implications:

◦ strong compensatory claim, higher in the range

◦ more likely to share post-separation income increases

◦ less impact of repartnering

Divorce Act , s. 15.2(6)(a), (c)

Needs-based, “merger over time”

Need relative to marital standard

Markers:

◦ length of marriage/cohabitation

◦ drop in standard of living

◦ economic hardship

All to assess “interdependence”

Implications:

◦ assess usually on separation date incomes

◦ lower in range, but disability/extreme need often pushes higher

◦ more impact to repartnering

Many reported decisions

SSAG often used, “ideal setting”

But remember: exception for compelling financial circumstances in interim

◦ SSAG amount may be too high; eg payor responsible for debts, mortgage, etc:

2011); Carrier v. Poon

Fyfe v. Jouppien

(NBQB 2013)

(ONSC

◦ SSAG may be too low, hardship, eg. short marriage, no kids: Singh (ONSC 2013)

Complex incomes, lack of accuracy: choose a number, can correct at trial

Include interim in calculating duration

One third of reported cases, except half in NB, NS

Wide range of cases, mix of compensatory and noncompensatory entitlement

◦ short, medium, long, no kids

◦ long with grown children

◦ medium length, wcs at time of separation, cross-over when cs ends

Exceptions more relevant in these cases

Court cases within formula range for amount 60% ON to 70% BC (90% in NB)

◦ but many fall within exceptions (noted or not noted)

◦ unusual facts

Duration often involves time-limits

◦ think about restructuring, lump sums

◦ indefinite with variation/review vs. long time-limits

20 yrs or more

Majority of

without child support

ct. cases

Spousal support mixed with property issues, complex incomes

Duration generally indefinite in initial orders, not even many reviews (except BC)

Main issues on variation/review

◦ changing incomes, self-sufficiency

◦ repartnering, retirement

0-9 yrs (similar issues for custodial payor )

Formula: low amount, short duration

Most settle: interim enough, time limit, lump sum

Few reported cases: atypical, formula result seems unfair (too low, too short)

Remember relevant exceptions!

◦ Compensatory exception in short marriages

◦ Compelling financial circumstances in interim

◦ Hardship in short marriages

◦ Immigration sponsorship

Good examples: RMS (BCCA 2011), Stergios v. Kim

(ONCA 2011), Singh (ONSC 2013)

10-19 yrs

◦ medium length, no kids (non-compensatory)

◦ medium length with kids, cross-over to wocs when child support ends (compensatory & non-compensatory)

Issue is duration: formula generates time-limits; how to implement?

◦ many indefinite to begin, then short time limits/termination imposed on variation/review: over, terminate16 yrs after 16 yr marriage)

◦ but some longer time limits in advance,

2012), Zimmaro (BCSC 2013)

Domirti (BCCA 2010, cross-

Maher (NBQB

Most cases within ranges for duration: SSAG bringing structure to duration in medium length marriages

◦ high end of duration range in compensatory cases (crossovers); lower end of duration range (half length of marriage) in many non-compensatory cases

◦ disability may be an exception, no time limit:

(NBCA 2013), Van Rythoven

Leblanc

(2010 Ont.Div.Ct. 2010)

◦

Remember, when child support ends, need to switch to

without child

formula for spousal support; retro calculations as well as ongoing support

Maher (NBQB 2012), Purgavie (ONSC 2012)

Duration: may now be time limits

Remember s.15.3 exception, inadequate compensation, priority to child support

◦ Beck v. Beckett (ONCA 2011), Abernethy v. Peacock

(ONSC 2013)

Leading case on when to use:

(ONCA 2011)

Davis v. Crawford

Lump sums based on SSAG, need time limits for duration; most often short, medium length marriages without children

If converting periodic to lump sum remember to discount for tax

Issue: additional 20% contingency discount in BC?

Marsh (BCSC 2012), Walker v. Brown (BCSC 2013)

In many cases, multiple purposes, no calculations

Fewer “basic” formula cases, 45-55% more complex custody cases now shared custody, esp. in BC (30% of cases) custodial payor, esp. in Ont (20%)

90% fall within range for amount mid-range for 60% of outcomes

Duration generally consistent with SSAG, except short marriages, young children

More homogenous than

without child

cases

Problem of duration, not amount

Compensatory claims :

◦ Young children, disproportionate care

◦ More future disadvantage, than past

◦ Judges, lawyers underestimate loss

Do NOT tie duration to length of marriage

◦ Persistent pattern across provinces

E.g. MacKenzie v Perestrelo (BCCA 2014)

◦ Age of children test more important

◦ Reviews rather than short time limits

Large income disparities common (!)

Most fix child support at set-off

◦ Spousal support used to adjust living standards

Trend to equalise NDIs in Ontario, not BC

◦ E.g. Rankin (ONSC 2014); McMahon

◦ BC most mid or low-end SSAG?

(BCSC 2012)

Thompson (2013), 32 CanFLQ 315

Similar household living standards as guide

◦ Using child support, spousal support

SSAG range always includes 50/50 NDI split

◦ In bi-nuclear cases, starting point…

◦ In complex families, can use Schedule II adjusted

Duration can be important in these cases

◦ Reduced disadvantage going forward

Hybrid, i.e. at least 1 child shared

◦

◦ Child support at set-off, spousal to adjust

With child support formula, mostly mid-range

Split custody

◦ Not equalise NDIs: Greig (ONSC 2014)

Step-children:

◦ With child formula, often hybrid custody

◦ Trade-off vs child support, Stadig (ONSC 2013)

◦ If only step-child, length of marriage re duration

More frequent: NB 23%, ON 20%, BC 10%

Leading case:

Cassidy v McNeil

(ONCA 2010)

Compensatory vs non-compensatory?

When? older children, disability, guys

Papasodaro

(ONSC 2014): formula “harsh”?

◦ But reflects cost of children, length of marriage

Generous time limits, also indefinite

◦ Medium-to-long marriages

Note: is child support being paid or not?

Exceptions? disability, parenting?

Used more frequently, but still missed:

Read Chapter 12!

Most common?

debt, interim, disability, hardship prior support, s. 15.3

Used more in

without children

Driven by entitlement analysis, also practical adjustments cases

11 exceptions in all, not exhaustive

Unusual facts mean departures

◦

Compelling financial circumstances at the interim stage (SSAG 12.1)

Singh (ONSC 2013); Tasman v. Henderson (ONSC

2013); Fyfe v. Jouppien

(NBQB 2013)

(ONSC 2011); Carrier v. Ponn

◦

Debt payments (SSAG 12.2)

Dunn (ONSC 2011); Goodine (NSSC 2013)

◦

Illness and disability (SSAG 12.4)

Powell v. Levesque (BCCA 2014); Shen v. Tong (BCCA

2013); Leblanc (NBCA 2013);

(Ont.Div.Ct. 2010);

Van Rythoven

Knapp (ONSC 2014)

Tscherner v. Farrell (ONSC 2014);

◦

Prior support obligations (SSAG 12.3)

Newcombe (ONSC 2014)

◦

Compensatory exception in short marriages without children (SSAG 12.5)

R.M.S. v. F.P.C.S.

(BCCA 2011); Stergios v. Kim (ONCA

2011); Singh (ONSC 2013); Sidhu (ONSC 2014); Bhandal v.

Mann (BCSC 2012)

◦

Basic needs/hardship (SSAG 12.7)

Singh (ONSC 2013)

◦

Non-primary parent to fulfil parenting role (SSAG

12.9)

R.M.S. v. F.P.C.S.

(BCCA 2011); Kelly ( BCCA 2011); Osanlo v.

Onghaei (ONSC 2012)

◦

Special needs of child (SSAG 12.10)

Jans (Alta.Prov.Ct. 2013); Metzger (ONSC 2011)

◦

Section 15.3: inadequate compensation (SSAG

12.11)

Beck v. Beckett (ONCA 2011); Abernethy v. Peacock (ONCJ

2012)

NOT a “cap”, just “ceiling” on formulas

Discretion once beyond $350,000

◦ ON, BC more likely to follow formula than MB, SK

Incomes closer to $350,000: often low to mid formula range incomes up to $500,000

Incomes above $500,000: “pure discretion”

Shorter marriages, more modest amounts

Large child support: moderate spousal?

Run various incomes, from $350,000 on up

To vary, proof of “material change” required

Review: court can make term of order, reconsider after date/event, if uncertainty

SSAG formulas apply on variation, review

But hard entitlement issues creep in…

Post-separation income increase

Remarriage/repartnering of recipient spouse

Self-sufficiency of recipient

Retirement of payor

So greater discretion in use of SSAG

Entitlement issue: share all, some or none of increase

Test: loose connection of increase to marriage:

◦ length of marriage

◦ roles during marriage (compensatory/non-comp)

◦ time elapsed since separation

◦ reason for increase

◦ together/support while education/training

AB more demanding, less so ON, BC

Run alternative incomes, different sharing

Most likely to be shared:

◦ with child support cases

◦ compensatory claims generally

◦ medium and longer marriages

Delayed support claims:

◦ “SSAG don’t apply”: wrong

◦ E.g. Quackenbush (ONSC 2013)

◦ real issue incomes to be used, living standards

Flip side: post-separation reduction of recipient’s income, e.g. job/pay loss

Issue of entitlement: its end

Initial time limits:

◦ without child support, custodial payor formulas

Time limits over time: both formulas

Self-sufficiency: common reason

Other reasons for ending entitlement: repartnering of recipient retirement

No formulaic adjustment

◦ No automatic termination

◦ Entitlement compensatory or non-compensatory?

◦ Support continues longer, bigger if former

Alternatives to adjust :

◦ None (if compensatory, or partner low-income)

◦ Low end SSAG range

◦ Step-down order

◦ Below formula range

◦ Nominal support (in case)

◦ Termination/no entitlement

Need for “more guidance”:

See K.A.M. v P.K.M.

Colley (ONSC Quinn J)

, 2010 BCSC 93

Relative concept, to marital standard

No “deeming”, realism needed:

A factor, not determinative:

Methods of encouraging:

Moge

Leskun

◦ Impute income to recipient: most common

◦ Increase support: education/retraining

◦ Review, or another review

◦ Reduce support/step-down: need to earn more

◦ Terminating review order

◦ Time limit

Dangers of double-counting

◦ e.g. impute and low end, or impute and step down

Retirement usually a “material change”

Early retirement: may not be “change”

Reduced income, SSAG to reduce support

Division of property/pension important

Boston

(SCC 2001):

◦ no double-dipping of divided pension

◦ but broad exception for need

◦ both spouses to use assets to generate income

Entitlement often ends…

SSAG formulas are gender-blind

Less bias: NB, ON, BC…

E.g.

Walker v Brown,

More cases

2013 BCSC 204

Still unspoken “exception”?

No entitlement, lower amount, shorter duration

Higher expectations of self-sufficiency

Firth v. Allerton

(ONSC 2013): bad arguments, low

and

short!

Shaping client expectations

Framing negotiations

More settlements, less litigation

Simplifying resolution of typical cases

◦ Smaller claims resolved, basic without child formula

Access to justice, esp. unrepresented

More structure for duration

Calculating lump sums

Isolating outlier decisions/patterns

Gender neutrality

Fewer “bad” agreements

Establishing a standard for appellate review

Providing structure for support analysis

Skipping over entitlement

Defaulting to the mid-range on amount

Duration too short where young children

Failing to consider exceptions

Unsophisticated use generally

◦ Attempts to impute income

Seeking rules where SSAG leave discretion

◦ Defaulting to formulas for high incomes

More frequent claims for retroactive support

Unrepresented litigants:

◦ But now MySupportCalculator.ca

Local guidelines, mostly temporary

◦ E.g. Santa Clara, Fairfax, Penn, Kansas

American Law Institute (2002)

Am. Ass’n of Mat. Lawyers (2007)

Mass (2011), NY (2010, temporary,…)

Other states

UK Law Commission Report (February 2014)

“Matrimonial Property, Needs, Agreements” recommends working group re formulas